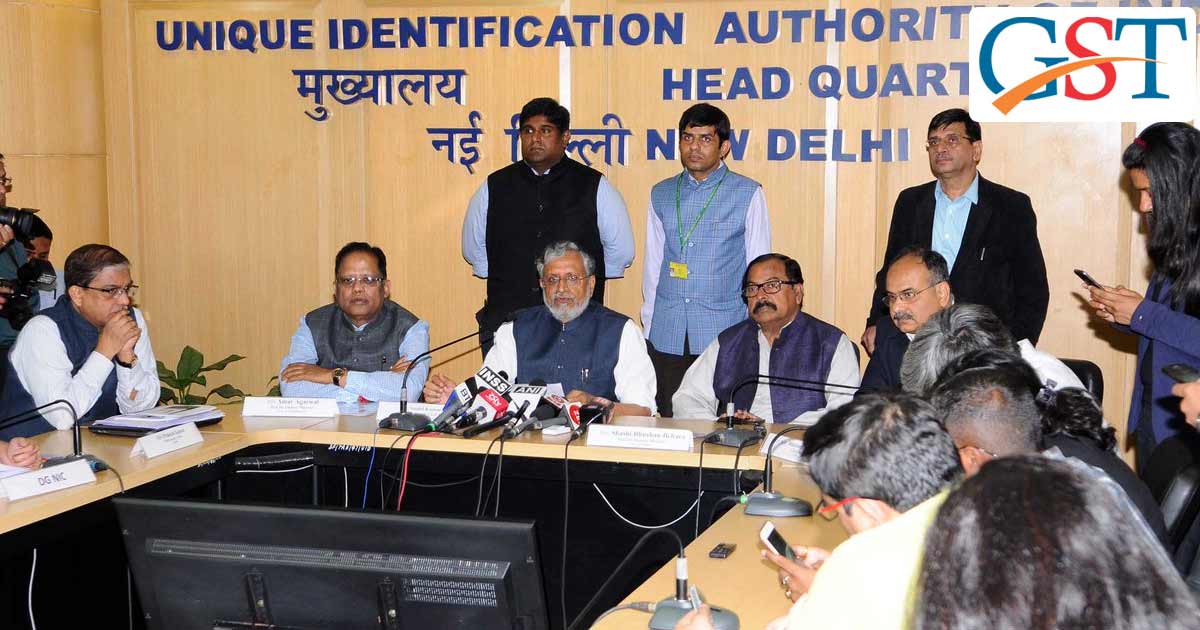

The GoM with chairperson Bihar Deputy Chief Minister Sushil Modi scheduled a meeting with the industry representatives and experts to solve out the remaining issues over return simplification under GST. More than 40 industry and trade representatives joined the meeting along with tax experts to discuss the provision on simple tax return filing. Also, chamber of commerce, FICCI and CII in the presence of revenue secretary Hansmukh Adhia were there to analyze the overall meeting discussion.

Here we are providing all the details of the meeting and the discussion carried out within the meeting:

- GoM chairperson hinted for a new design layout for GSTR 3B and other return forms soon

- GoM meeting is again scheduled to meet on 1st May to discuss RCM provision

- The discussion held was analyzed whether the provision credit should be given or not

- Also, the credit should be linked to the tax payment or not

Recommended: Major GSTN Issues That Need Immediate Solutions

Proper guidelines issued for verification and checking of e waybill. Guidelines are as follows:

- Commissioner will designate a proper officer to check out the vehicles

- The officer can demand GST e waybill from the in charge of a conveyance

- In case, the goods are not according to the e waybill, the officer can penalize the conveyance in charge

- The taxes and penalty must be deposited within the 7 days of demand

- If the penalty is not deposited, the goods may be confiscated and auctioned

The guidelines and decision will be drafted and presented at the GST council meeting whenever it may happen within the coming 10 to 20 days or so.

Read Also: Easy to Understand 21 Offences, Penalties & Appeals Under GST

The group of ministers are trying to finalise the return form into a single page which will be done after the detailed discussion with the experts and industry representatives.

The said structure of return filings conceived by the centre and state officials will be having zero tax liability for around 6 consecutive months which implies that they need to file return twice a year only.

Thus the returns date will be adjusted accordingly so that the taxpayers with 1.5 crore turnover will be filing returns by 10th of next month while other taxpayers will be doing return filing by 20th of the month.

While in another case, the normal taxpayers can file returns whole year i.e. 12 times in a year for both small and large taxpayers. The meeting also includes discussion over the provision of reverse charge mechanism.

Great