In Today’s taxation world, People are so confused about getting online e-filing. They do not complete the preparation of the papers and many accounting works. As we know, there are several taxes applied by the Indian Government as well as income, service, TDS, wealth, etc. So we have to need software, which can e-file several taxes at once. SAG Infotech researched the solution and developed Genius tax return filing software for CA and professionals.

The Genius TDS and income tax return filing software is developed with several facilities such as backup, restore and Password Settings, etc. Here is a Help option for you with any problem. It has another facility, as the client can import master details from the XML Files. The Genius pack provides an easy way to e-file, and without any errors, you can upload the return forms. Installation charges of the Genius are INR 15000/-, and Updation charges are INR 7000/-.

Introducing Genius software, designed to make tax filing simpler and less stressful for both individuals and businesses. With errorless and strict compliance with the most recent tax laws and regulations, our software is made to save your time and money. It has a user-friendly interface, error-checking, and computations for tax filing.

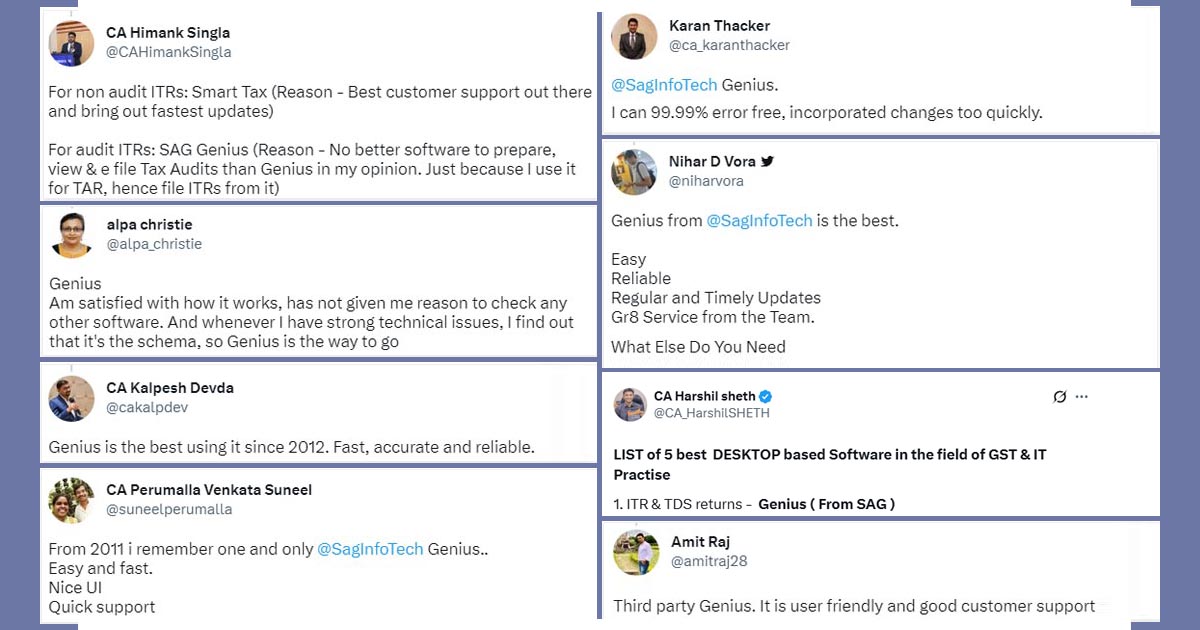

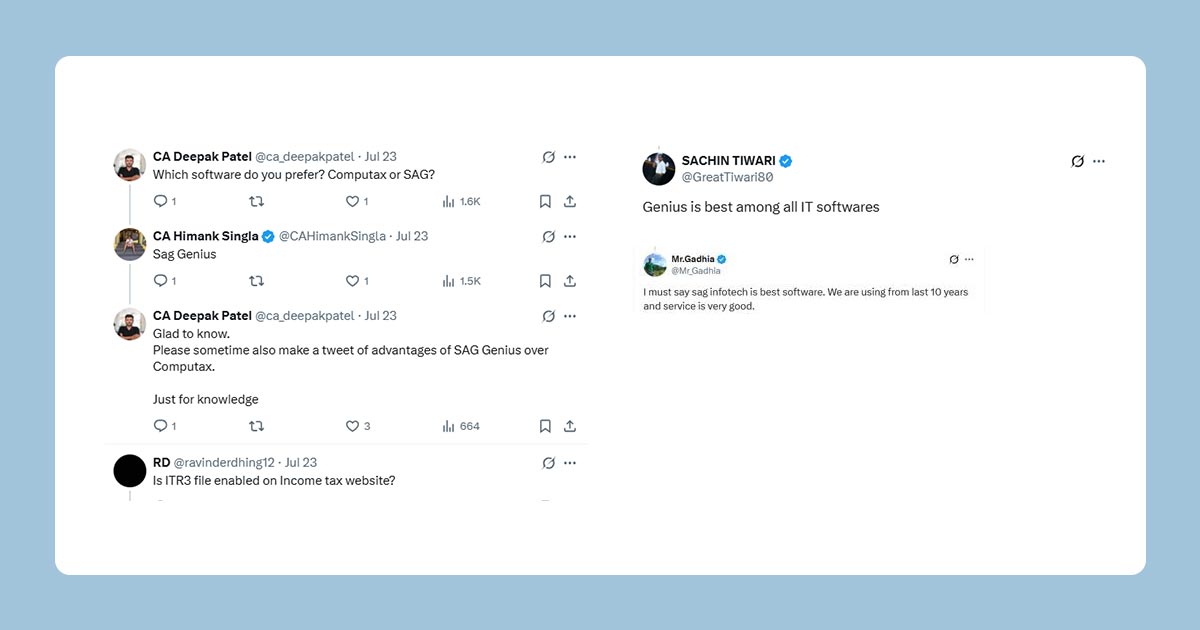

But don’t just believe what we say. Here are some social media testimonials from genuine customers who have availed of our software packages and got the benefits:

These are only a few of the numerous clients that have benefited from our Genius tax software. We are assured that our software, whether you are a small company owner, independent contractor, or individual taxpayer, can help make your tax filing process more effective, less stressful, and more accurate than ever before.

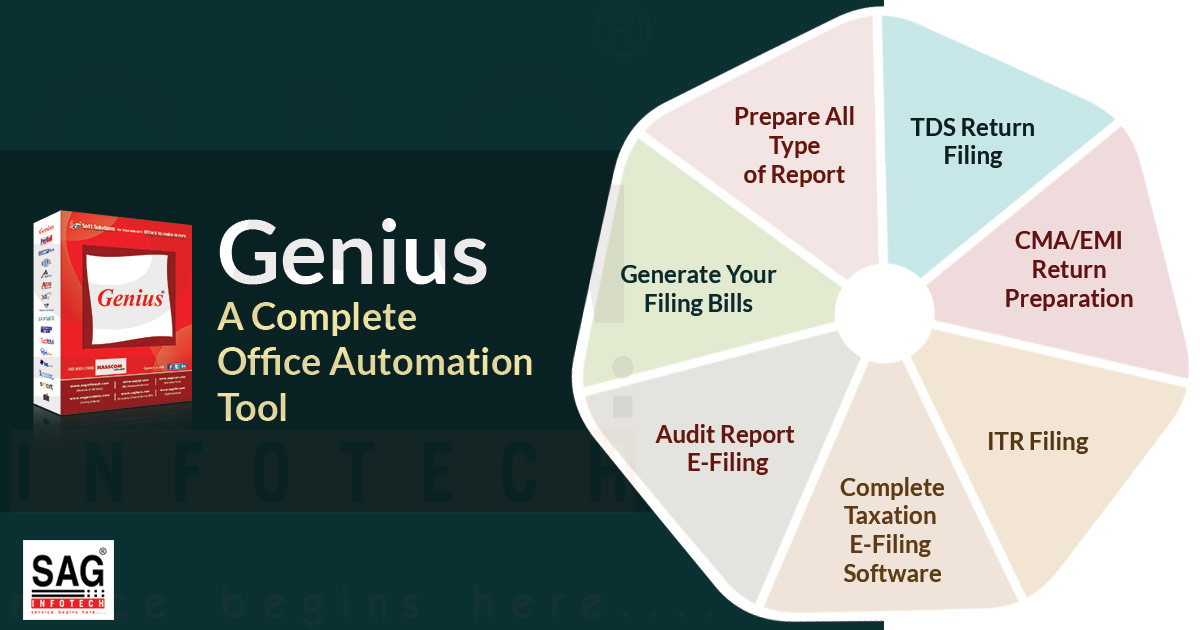

Below is the List of Genius Tax Software Modules

Genius is a complete model that includes GEN BAL, GEN IT, GEN CMA, GEN FORM MANAGER, GEN e-TDS and AIR. It also holds a complete database of clients that maintains their address and telephone directory, partners’ details and signatory details. By using Genius, you can also do billing through this software.

Gen Income Tax Software

Gen IT is known as the fastest Income Tax e-filing tool. It is developed on a success mantra “For those who can’t afford to make errors” that meets your requirements of e-filing of Income Tax, Self Tax, and Advance Tax, and the income tax software gives a facility for returns of Income Tax to be directly uploaded.

Salient Features of Gen IT Software:

- A new feature to import data of Capital Gains from the Excel Sheets

- It is used for the computation of Income from the assessment year 2000-01

- It gives many facilities, such as ERI for bulk e-filing, quick upload with ITD web services

- It holds return forms and various MIS reports

- It provides an e-filing facility for the ITR forms 1, 2, 3, 4, 5, 6, and 7, which are available in XML format

- By using this tool, you can directly e-file the return and pay the online challan

- It provides a facility to generate and submit an online PAN correction form

- It also gives convenience in the verification of PAN online

- Automatic preparation of schedules and lists

- Bulk contact details verification by the ITD portal

- You can view all intimations of the department from your mail ID by using the CPC intimation register

- You can now send any Doc and PDF file through WhatsApp and e-mail functionality

- Aadhaar OTP or DSC for e-Verification of ITR is available

- e-filing of forms 10B, 29B, 29C, 10CCBBA, 10CCBC, 10CCBD, 10CCC, and 56FF

- Facility for importing and sending return forms, 26AS, acknowledgements, computations, AIS, and TIS.

- Comparison of 26AS, TIS, and Computation

- A summary report showing the pre-validation status of the bank account selected for refunds

- In the XML/JSON Import Facility, you can directly download XML/JSON files from the ITD Portal

Gen E-TDS Return Software

TDS stands for Tax Deducted At Source, used for online e-filing of TDS returns. It offers convenience for TDS returns that meet all the requirements of the Income Tax Department. By using this software, you can online e-file TDS online and it provides a quick acknowledgement efficiently. The Gen TDS software holds all India Pin codes, STD codes, Tan/Pan AO codes, TIN FCs, MICR codes, IFSC codes, Service Tax ranges and Bank BSR codes, which are used in e-filing of TDS.

Salient Features:

- It is used for bulk contact verification.

- By using this tool, online e-filing TDS return preparation and maintaining its correction statement.

- It calculates the salary

- It holds various forms as Forms 24, 26, 27, 27E, 24Q, 26Q, 26QA, 26QB, 27Q, 27EQ, 16, 16A, 16AA, 22, 27D, 12B, 12BB, 15G, 15H, 15CA and 15CB.

- This software gives a facility to import and export data from MS Excel files.

- You can also generate TDS certificates in PDF format.

- It comes with online PAN and TAN verification.

- Gen TDS software offers the convenience of uploading online TDS e-return.

- By tracing the login, you can download online requests.

- Section 194P, 194A and 194Q validation for changes and additions.

- Section 206AB and 206CCA Feature Compliance Checking in Deductee Master.

GEN Balance Sheet Software

This software is a spanking tool that saves you time. The trial balance can be imported from various accounting software such as Tally and Busy. It automatically prepares the profit account, loss account and balance sheet. This software helps to calculate depreciation as per the IT Act, Companies Act and Fixed Assets.

Salient Features: This model has many characteristics that are mentioned below:

- Available Depreciation Chart as per Schedule II of the Companies Act 2013

- There are import and export facilities in the Depreciation Chart

- Gen BAL makes a new audit report as per the ICAI guidelines

- In the Gen BAL software, you can directly import master data from Tally

- It is known for its quick report generator

- You can update the Tax audit report according to the assessment year

- Prepare a company auditor report, notes on the account, CARO, director’s report, representation letter, etc.

- Printing features for Balance Sheet/P & L of General Information

- Facility to Import 3CD Items in the Business Head Section

Gen CMA/EMI

The CMA stands for Credit Monitoring Arrangements. It is an analysis report prepared by the borrower to submit to the banks for availing the loan. By using this software, you can prepare a CMA report as per the Tandon and Nair Committee on the following basis:

- Percentage basis

- Ratio basis

EMI stands for Equated Monthly Instalment is a fixed amount that the borrower gives to the lender on a fixed date of each month. Gen EMI software calculates EMI in a very easy way.

Salient Features:

- This software gives a facility to prepare CMA data and MPBF calculations on a percentage basis and ratio basis as per the Tandon and Nayar Committee.

- You can also calculate EMI and the rate of Interest by using this tool.

Gen Form Manager

Gen Form Manager is the most successful software that holds various forms, agreements and other related stuff. It is developed with one thousand forms.

Salient Features:

- Gen Form Manager Tool holds and maintains one thousand forms, including agreements, company law, gifts, company minutes, resolutions and partnerships.

- This software offers a facility to create new forms and make updates to existing forms.

See the Genius Tax Filing Software Demo in English Language

You can download the free demo of Genius software or you can generate inquiries for buying purposes here: saginfotech.com/Order.aspx?proid=Genius