Form 26QB (Challan-cum Statement) Under TDS

To begin with, Form 26QB (Challan-cum Statement) has a twin-fold objective that is synonymous with the two blades of a single scissor – It is both a return as well as challan form for the deductions that have been made u/s 194 of the Income Tax Act, 1961 for paying Tax Deducted at Source (TDS) that is added to the state exchequer.

Furthermore, the aforesaid section of the I-T Act, 1961, specifically deals with those transactions that involve the selling of immovable property and the consequent applicable TDS along with Form 26QB. This form ought to be submitted in 30 days that are counted from the end date of the month in which the TDS has been deducted. For instance, if a transaction has occurred on the date of 14th March then from a legal perspective, Form 26QB ought to be submitted by 30th April.

- What is Form 26QB

- Penalties to Section 194-IA Form 26QB

- Why Gen TDS Software for Form 26QB?

- How to File Form 26QB by Gen TDS Software

Key Attributes of Form 26QB Under TDS Section 194-IA

In the Income Tax Act, 1961 few key rules have been framed that are related to the purchase and sale of immovable property. In the aforesaid transactions that come within the domain of Section 194-IA, the buyer (who is also called the deductor) has to deduct the TDS if the value of the transaction exceeds Rs 50 lakhs.

Thereafter, the deductor ought to issue Form 16B to the deductee (i.e.seller). All the requirements that are to have adhered to Form 26QB have been mentioned under Section 194-IA. They are as follows:

- As per Section 194-IA, the buyer ought to deduct the Tax Deducted at Source at the rate of 1% of the entire value of sales that is determined at the time of settlement of the transaction

- Tax Deducted at Source u/s 194-IA does not apply to the transactions that involve the buying and selling of agricultural land

- ‘TDS does not apply to the transactions involving the sale of immovable property that is of value less than Rs. 50 lakhs. For transactions beyond the aforesaid limit, the TDS has to be deducted from the entire value of the transaction. For example, if the property costs Rs. 52 lakhs then you ought to pay TDS on the sum of Rs. 52 lakhs and not the sum of Rs 2 lakhs ( 52 lakhs – 50 lakhs)

- And If the payment has been made in instalments then the TDS is proportionately deducted from each individual instalment

- The buyer doesn’t need to obtain the Tax Deduction Account Number (TAN) for deducting and depositing TDS. Nevertheless, the PAN is the mandatory requirement for both the buyer and the seller in case the TDS deduction occurs using Form 26QB

- The buyer ought to deposit TDS and submit the form 26QB via Gen TDS Software within 30 days calculated from the end date of the month in which TDS has been deducted

- In case multiple sellers and buyers are involved in the transaction, the deductor shall be required to submit multiple forms i.e. Form 26QB

- Then after deducting and depositing the TDS, the buyer shall furnish the TDS certificate to the seller within the cap of 15 days of the transaction instead of deducting the tax and depositing it to the government

- Thereafter The buyer ought to obtain Form 16B and submit it to the seller

Penalties Associated with Section 194-IA and Form 26QB

It is worthwhile mentioning here that

- The act of not deducting the TDS,

- Issuing the Form 16B or

- Not filing Form 26QB attracts both interest and penalty. The applicable penalties are as follows:

| Condition | Penalty |

|---|---|

| In the case of Non-deduction of TDS | The Penalty of 1% interest on the amount not deducted for the TDS |

| In case of Non-remittance of the TDS to the government | The Penalty of 1.5% of the total deducted amount that is calculated per month |

| Delay in the TDS returns Filing | The Penalty of a sum of Rs. 200 per day for every day of the default |

Why Gen TDS Software for Challan-cum Statement Form 26QB?

Gen TDS is one of the Value additive, genuine, user-friendly, and consequently well-recognized software in the corporate world across the length and breadth of the country. It is a brand and Due to massive response from across the country, we are also planning to venture overseas. Gen TDS is a multitasking software that is specifically designed for filing the TDS and TCS returns. The Gen TDS Return Filing Software has been designed considering the guidelines, norms, and regulations of TRACES and CPC India. Our software assists in

- Predetermining the sum of TDS

- Preparing TDS returns

- Calculating interest and penalty in case of late filing

- And so on

Most importantly, Gen TDS software is an authorized software that is listed on the government of India’s official tax information network website. Lastly and importantly is the fact that during the financial year 2012-13, it secured the highest rank in the Government of India’s authorized TDS filing software list. Below is the step-by-step procedure for creating a payment Challan-cum Statement form 26QB via Gen TDS Software. SAG Infotech provides a free trial of Gen TDS Software full version for 5 active hours.

Process of How to File TDS Form 26QB by Gen TDS Software

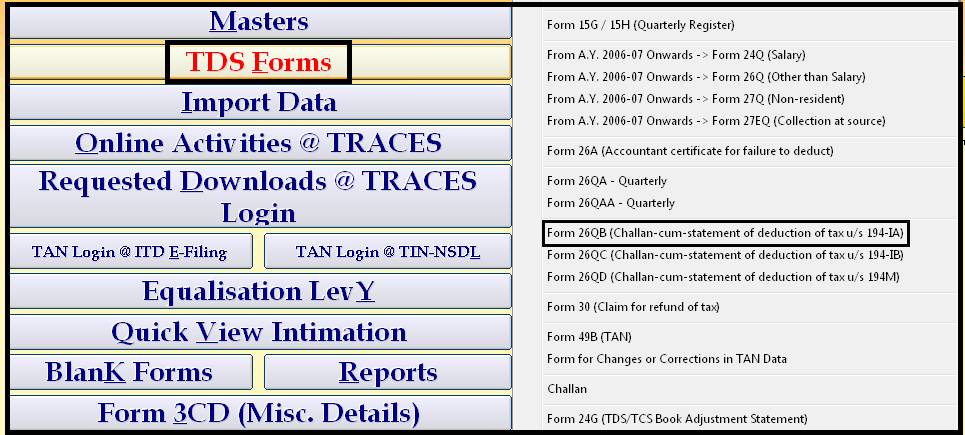

Step 1: Go to TDS Forms – Select Form 26QB

Step 2: Select Financial Year

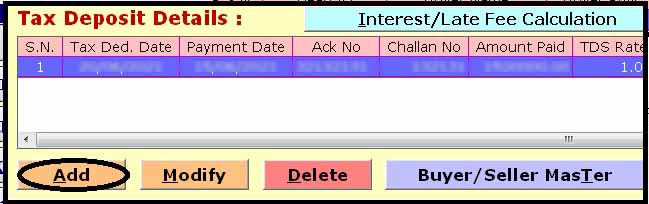

Step 3: Add Challan

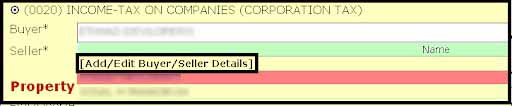

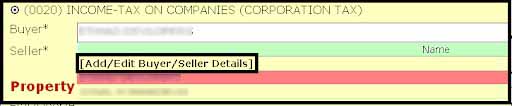

Step 4: Add Buyer – Add/Edit Buyer Details

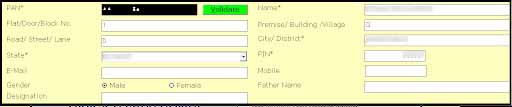

Step 5: Add – Fill All Required Details – Select Buyer

Step 6: Add Buyer – Add/Edit Seller Details

Step 7: Add – Fill All Required Details – Select Buyer

Step 8: Add Property Details

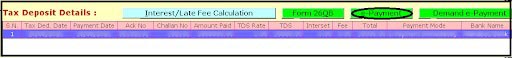

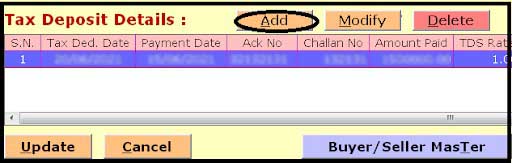

Step 9: Add Tax Deposit Details

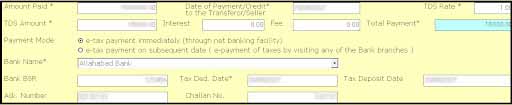

Step 10: Fill in All Required Details, I.E., Amount Paid, Date of Payment, TDS Amount, etc

Step 11: Go to E-Payment and Make Payment