SAG Infotech once again comes up with the latest features in the Genius tax management software package, including extra reporting tools.

Summarised Consolidated Reports

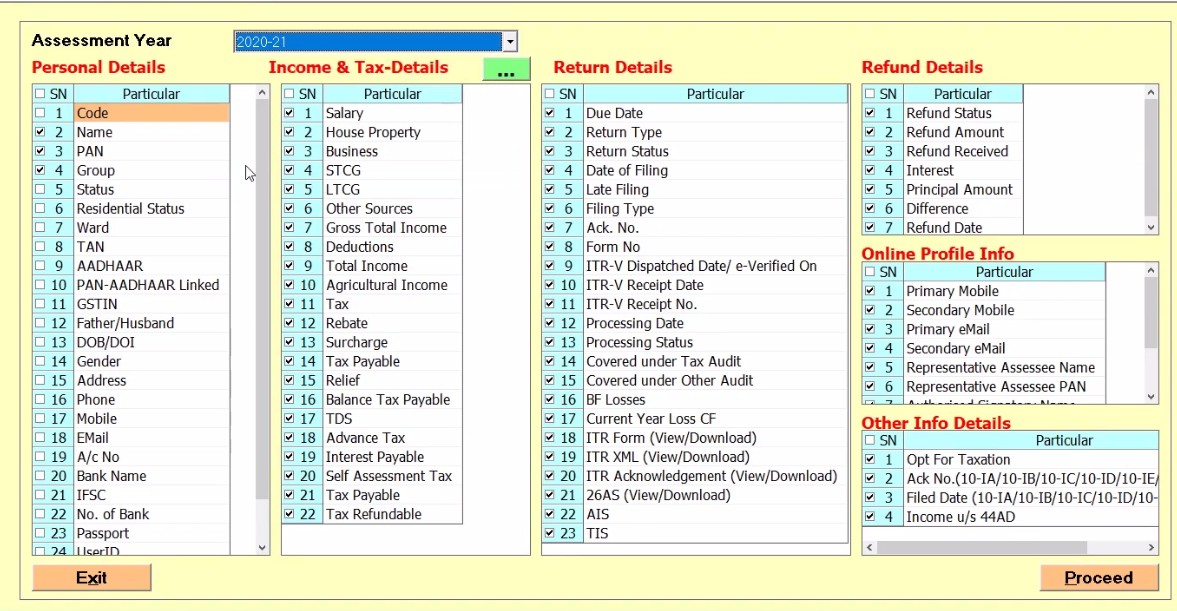

The first and the latest features one would find when opening the Genius tax filing software dashboard and clicking on the main ‘Gen Income tax’ tab, after which there will be a summarised detail tab on the right.

One can access comprehensive details, including the assessment year, by clicking on the summarised detail tab and selecting from the drop-down box.

What is the Summarised Detail?

A summarised detail is a basically consolidated report which includes client details such as income, income tax, return details, also refund details on a single window. There are also personal details readily available to the user, such as code, name, PAN and many more, along with income tax details, including a salary, house property, business, STCG and other details saved.

In the return details, there are due dates, return type, etc, with added refund details like status, amount date, etc.

Consolidated Report

The software allows users to save various details for future reference. These details can be accessed through a check-uncheck option. Users can view or save each detail, and a consolidated report can be generated based on these saved details.

After checking the required details, one can click the Proceed tab. After clicking the proceed button, there is a list of clients which will appear on the screen. Therefore, the individual can select the client and further proceed to the ‘Auto pick e-return filing details from ITD login’ tab.

Once you select the required detail, a pop-up box will appear with the options to import ITR-V and 26AS details. The software will automatically pick the information from the report.

The software will display the import status to provide reassurance. Additionally, the user can update the status by clicking the update button.

The software has the capability to provide clients’ details for any assessment year. This feature is most useful for keeping track of clients, and the details can be exported to an Excel sheet with just a single click. Additionally, the feature allows for editing of client details, such as name and basic information.

So, this was the brief introduction of the latest summarised details within the income tax e-filing software of the Genius package.

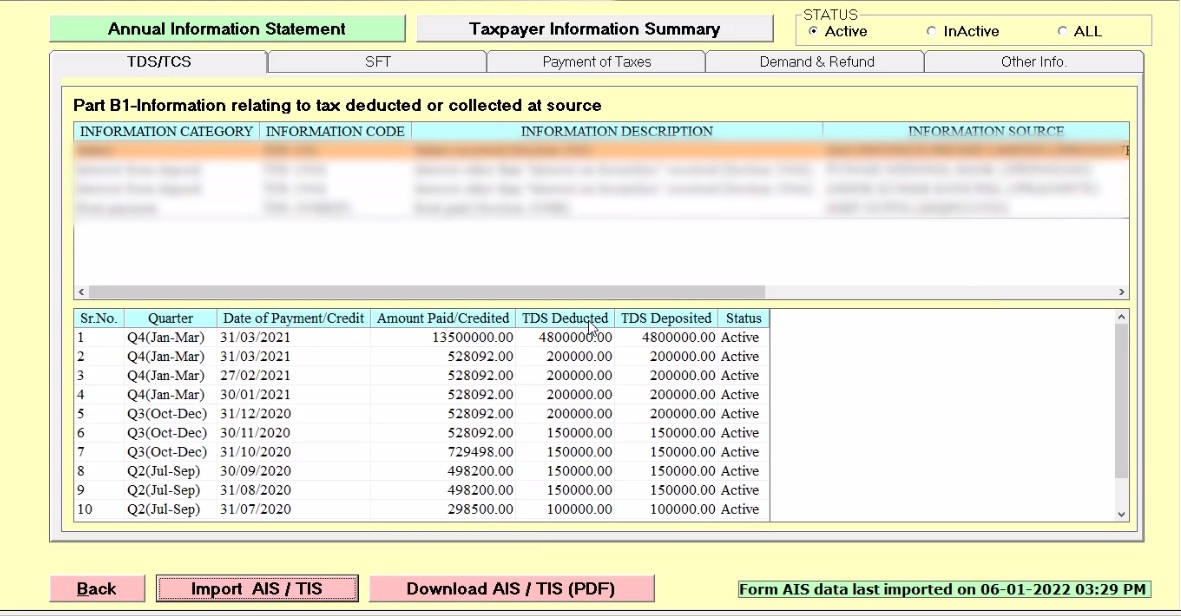

New Annual Information Statement (AIS) and Taxpayer Information Summary (TIS)

Genius return software package now includes a new feature where a client can be selected from the list on the ‘Gen Income tax’ tab and the computation tab.

A new feature added within the software is AIS/TIS, i.e. Annual information statement and taxpayer information summary. Anyone can import AIS/TIS from where the person would get the option to update information, and the software will be updated with the latest information on the client details.

You can easily access all the necessary information related to TDS/TCS and SFT with detailed insights. The payment of taxes tab will also be available, providing you with the details of any particular year, along with the information on demand and refund. Another tab will allow you to download the AIS/TIS PDF in the appropriate format.

Afterwards, an individual can view their taxpayer information summary in one place and have the option to download it in PDF format. Additionally, the date and time of checking and downloading the information are displayed in the same location.

The Genius tax filing software package has introduced two new features to provide better and more reliable services to its clients. Additionally, clients can expect to receive more updated features in the future. For more information, one can always connect with the tech support team.

Videos of the Latest Features in Gen IT Software