On the GST portal, an updated feature called IMS (Invoice Management System) has been introduced. As it isn’t feasible to approve every invoice or take action after reconciliation with the records on the portal, SAG Infotech has implemented the new IMS dashboard feature in Gen GST Software for registered taxpayers to ease compliance.

The receiver through this feature can accept, reject, or keep the purchase invoice pending. Thereafter, they are allowed to generate the information via GSTR 2B and claim the true ITC in GSTR-3B. This feature enables users to use it with ease and save time.

New Video of IMS Inward Supply Part 2-Summarized ITC Claimed Report

Why Gen GST Software Always Take Care of Its Clients by Implementing New Features?

The clients of the Gen GST Online software would feel secure because of its updated feature that improves the user experience and facilitates tax compliance. The software would get updated regularly from the GST portal which ensures that the businesses would remain aligned with the emerging norms.

The software with its updated features like reporting tools, automated reconciliation, or enhanced dashboard functionality eases the GST filing’s complex procedure. By responding to user requirements and integrating state-of-the-art solutions, the software enables clients to handle their taxes efficiently, thereby facilitating improved decision-making and compliance.

SAG Infotech has incorporated the newly introduced features on the GST portal, such as the IMS functionality, into its popular Gen GST software, which is widely favoured by professionals in India.

What is the Use of the Invoice Management Systems(IMS) Under Gen GST Software?

After the introduction of Invoice Management System (IMS) features by the GST portal, Gen GST software adopted these systems to improve GST compliance for businesses. The IMS dashboard under the software consolidates GST-related data, furnishing a real-time overview of your invoices, payments, and tax liabilities.

The dashboard provides a user-friendly interface that allows users to check the status of GST invoices, keep track of pending and filed returns, and view a summary of input tax credits and liabilities. The same combines with the GST portal, automating the data sync between the portal and the software, ensuring accuracy, and reducing manual errors.

This execution facilitates tax filing, reconciliation, and reporting, improving business efficiency and ensuring better compliance with GST regulations.

Step-by-Step Guide to Use IMS Dashboard Features in Gen GST Software

Here in the below section, we have discussed the process of IMS Dashboard Features in Gen GST Software:-

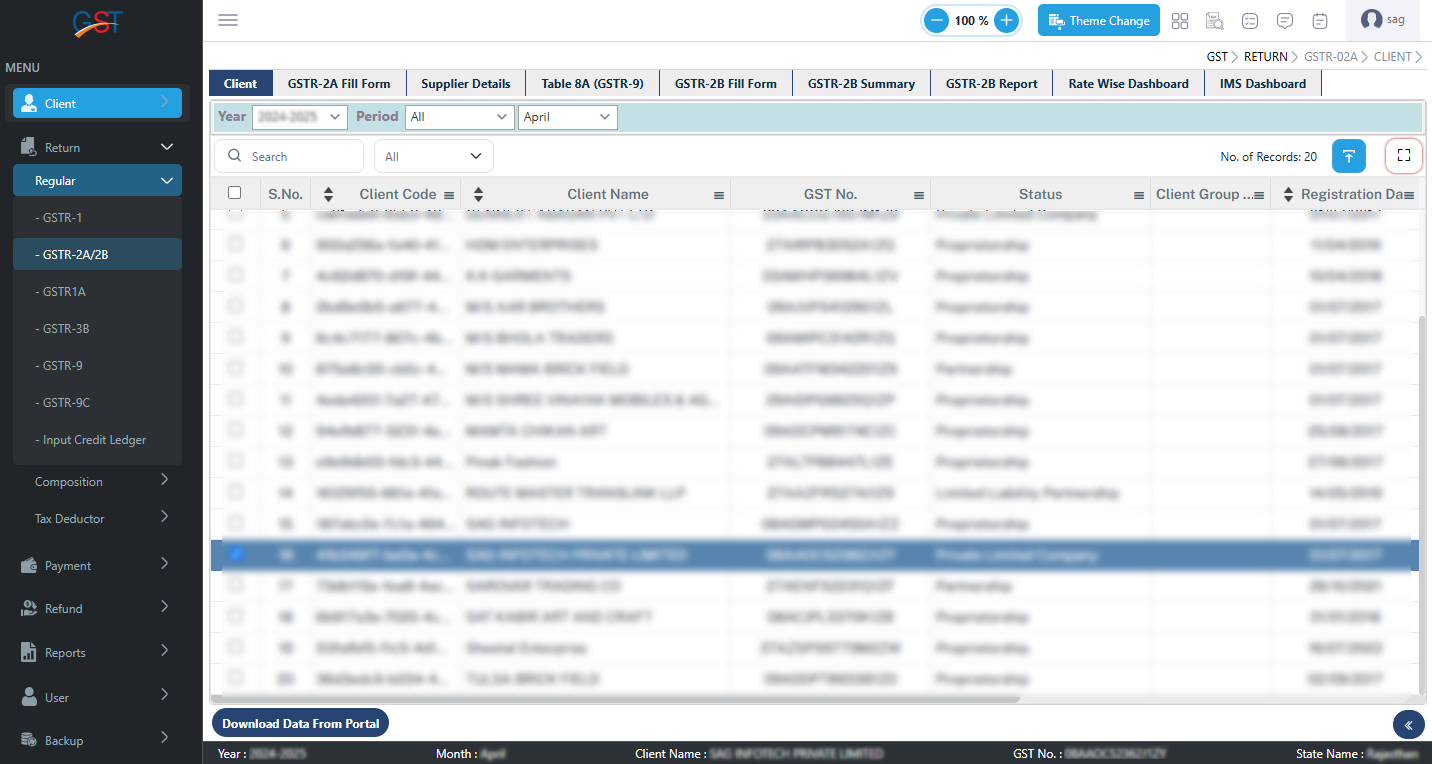

Step 1:- To use this, Kindly select client first, Then Goto Return -> Regular -> GSTR-2A/2B -> IMS Dashboard

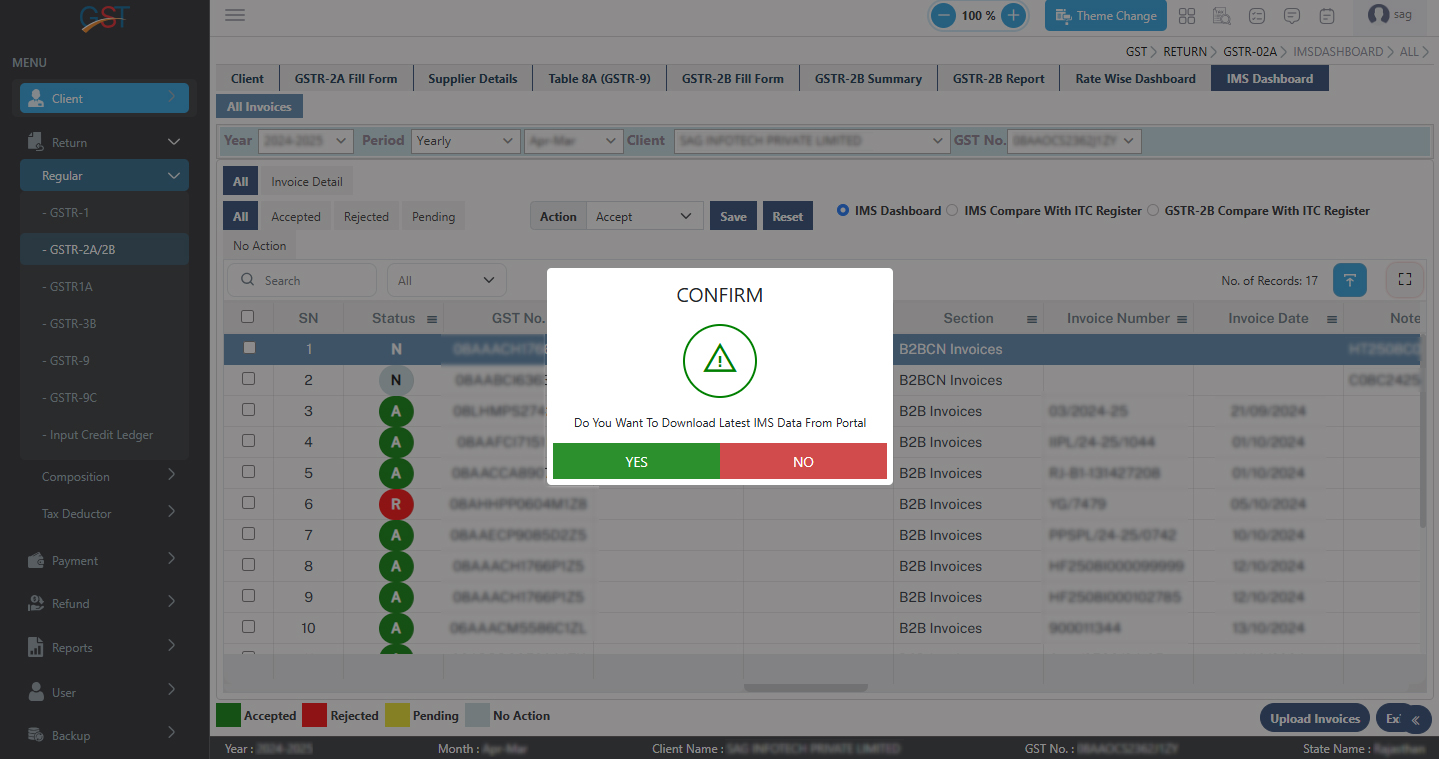

Step 2:- After clicking on IMS Dashboard, it will ask you to Download the Latest IMS data from the portal

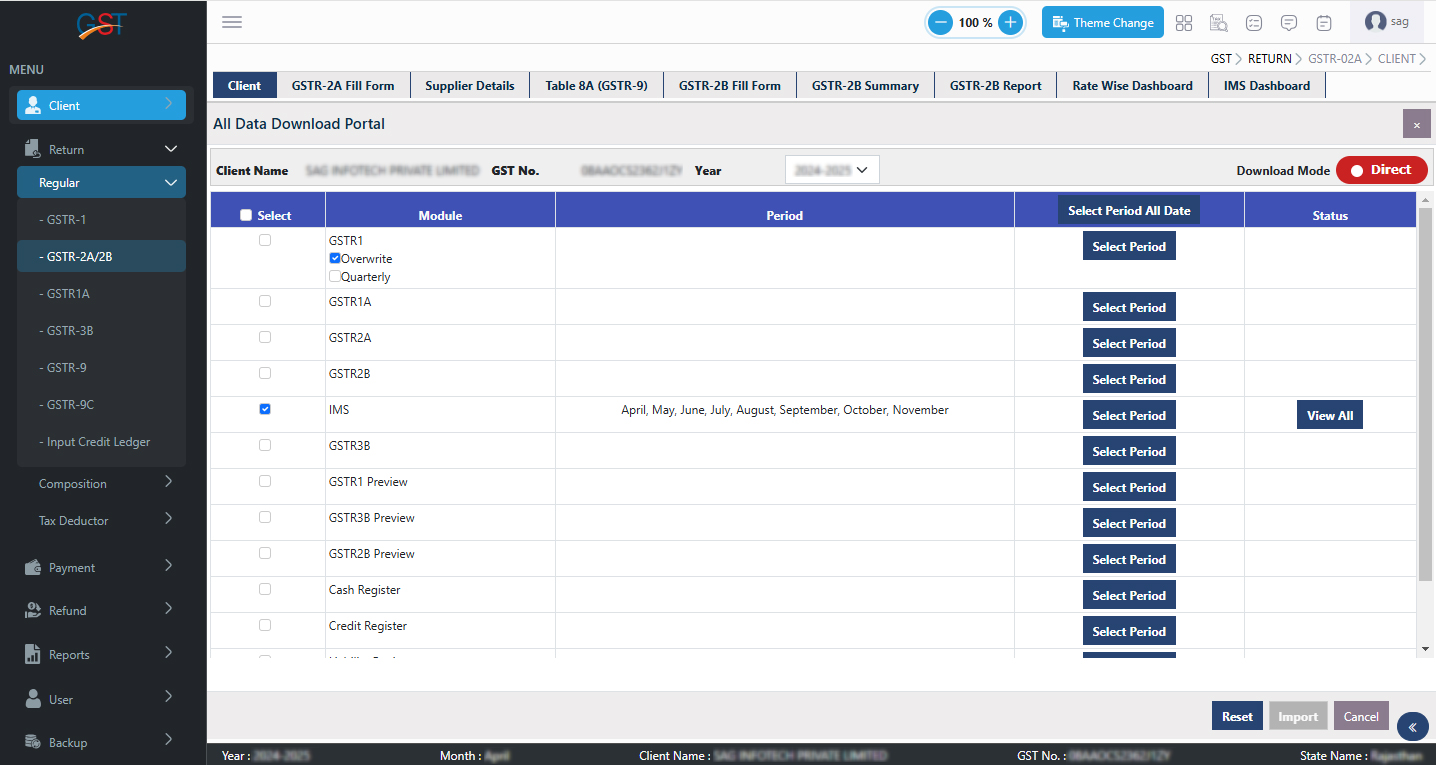

Step 3:- After Clicking on the Yes button it will show on the ALL Data Download portal Page, there you can select IMS Module and select the required period for download

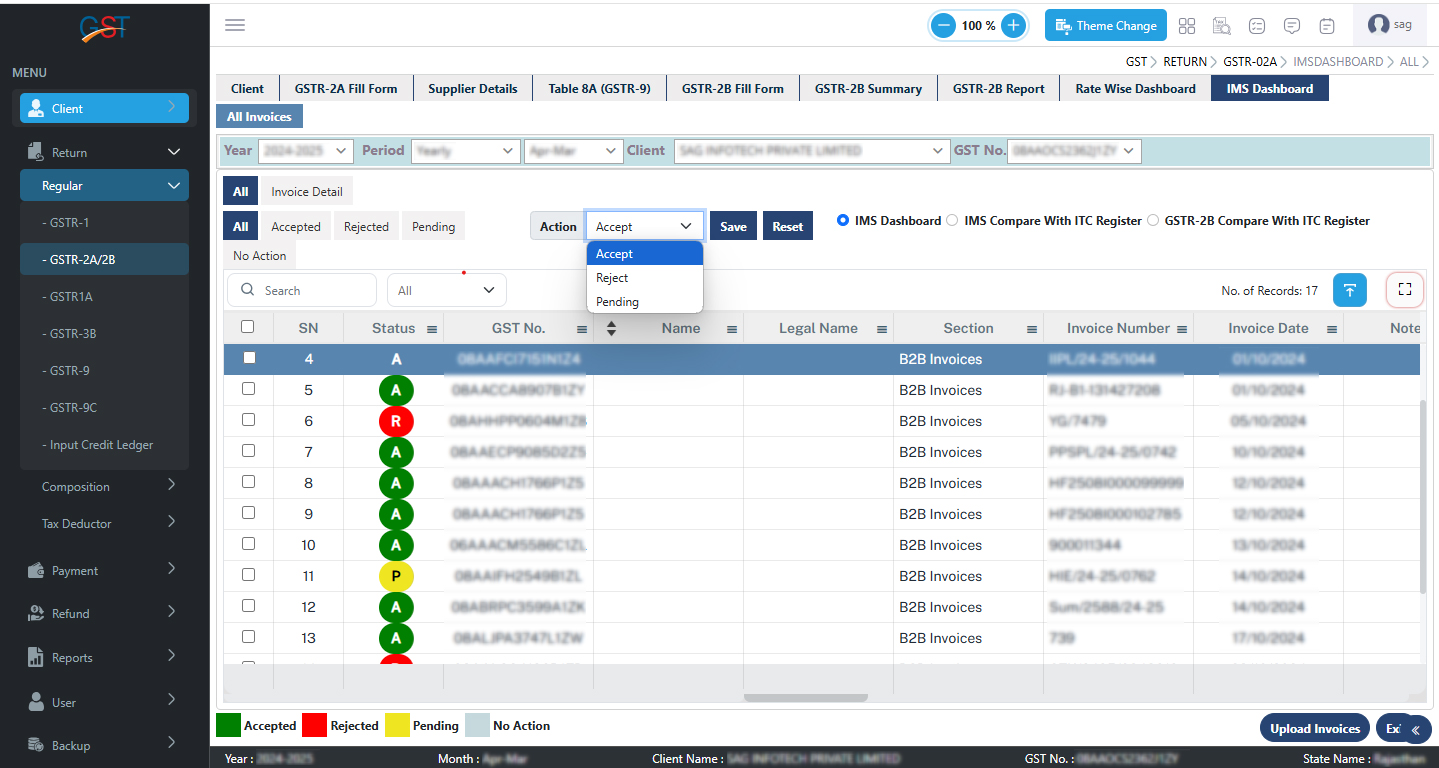

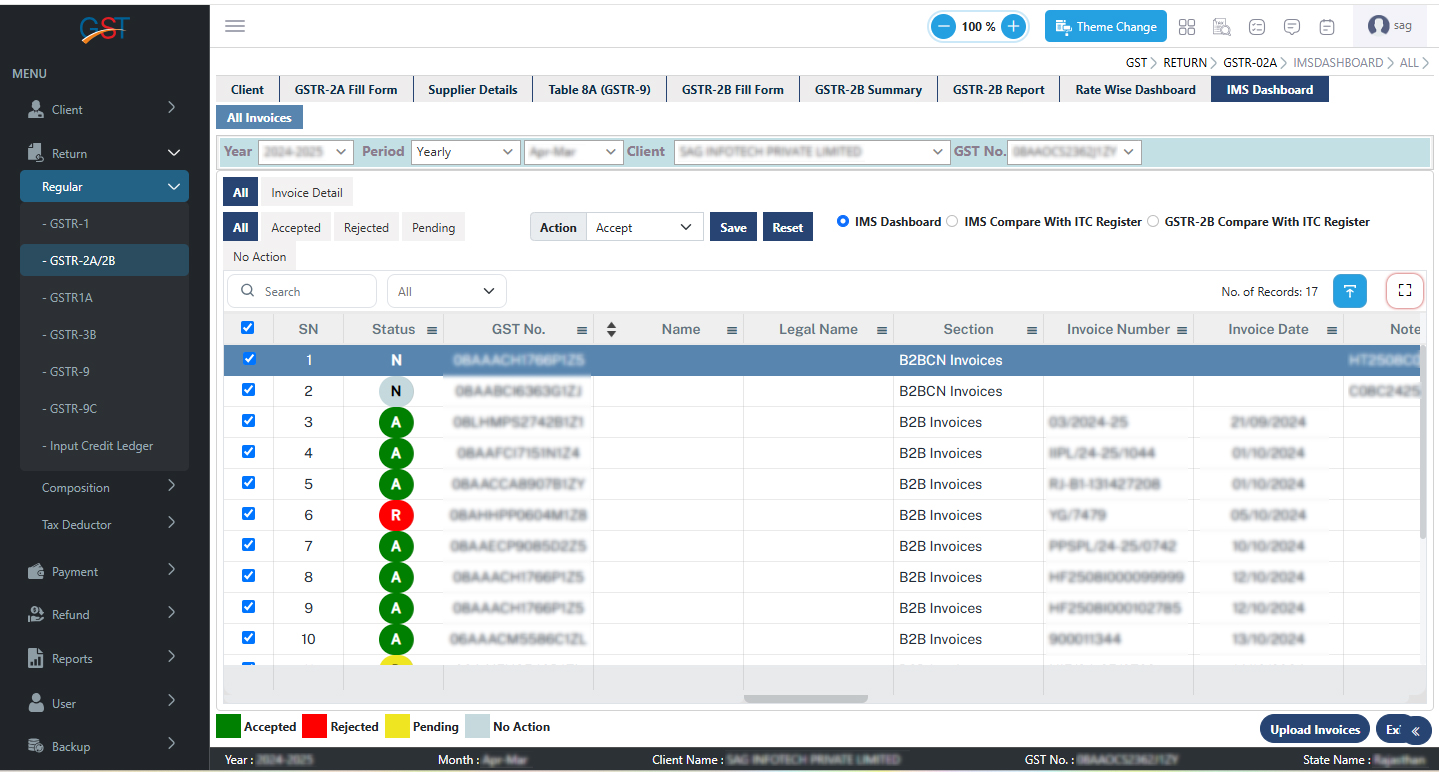

Step 4:- After updating the latest data from the portal into the software, One can check all entries of IMS and can select Accept/Reject/Pending as shown in given below image and click on the save button to update the entry into the software as well as on GST portal

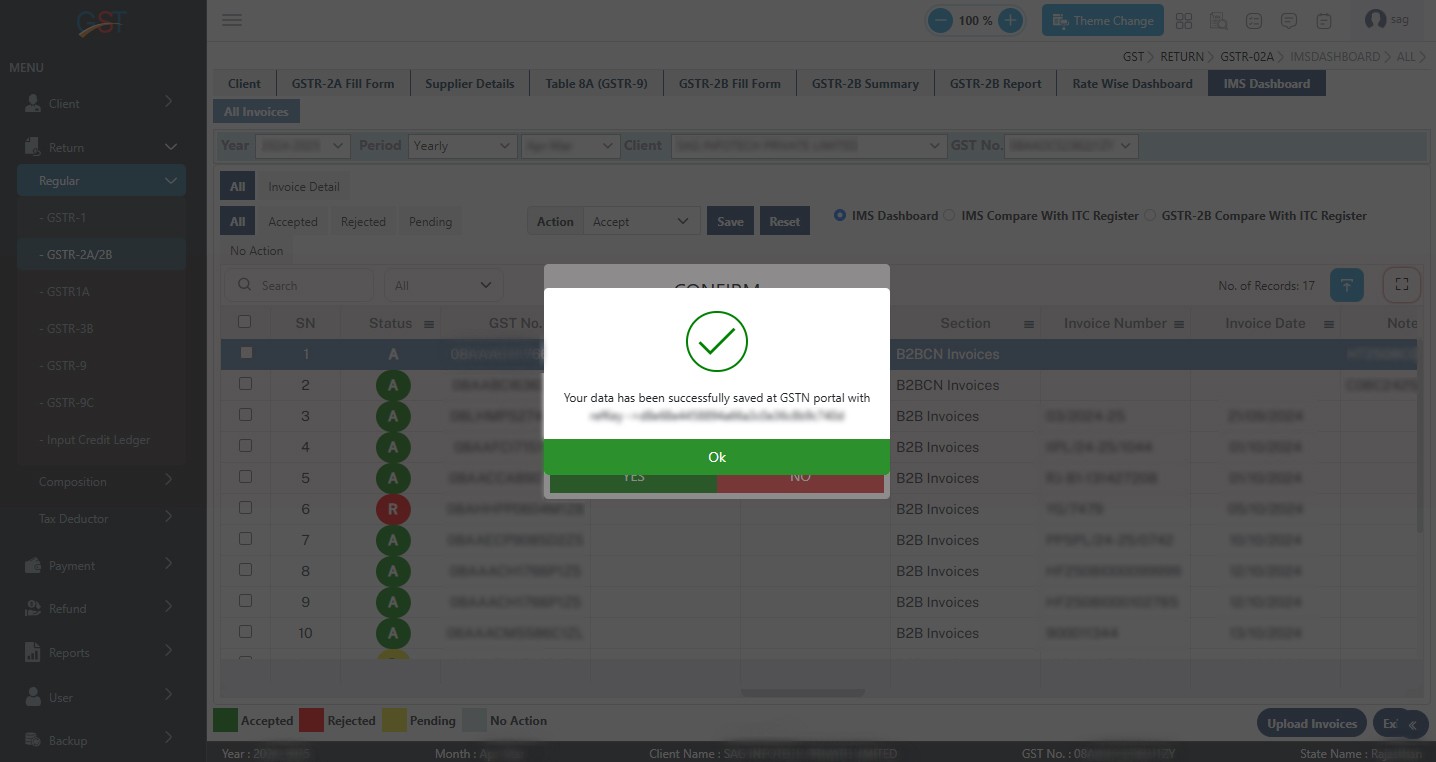

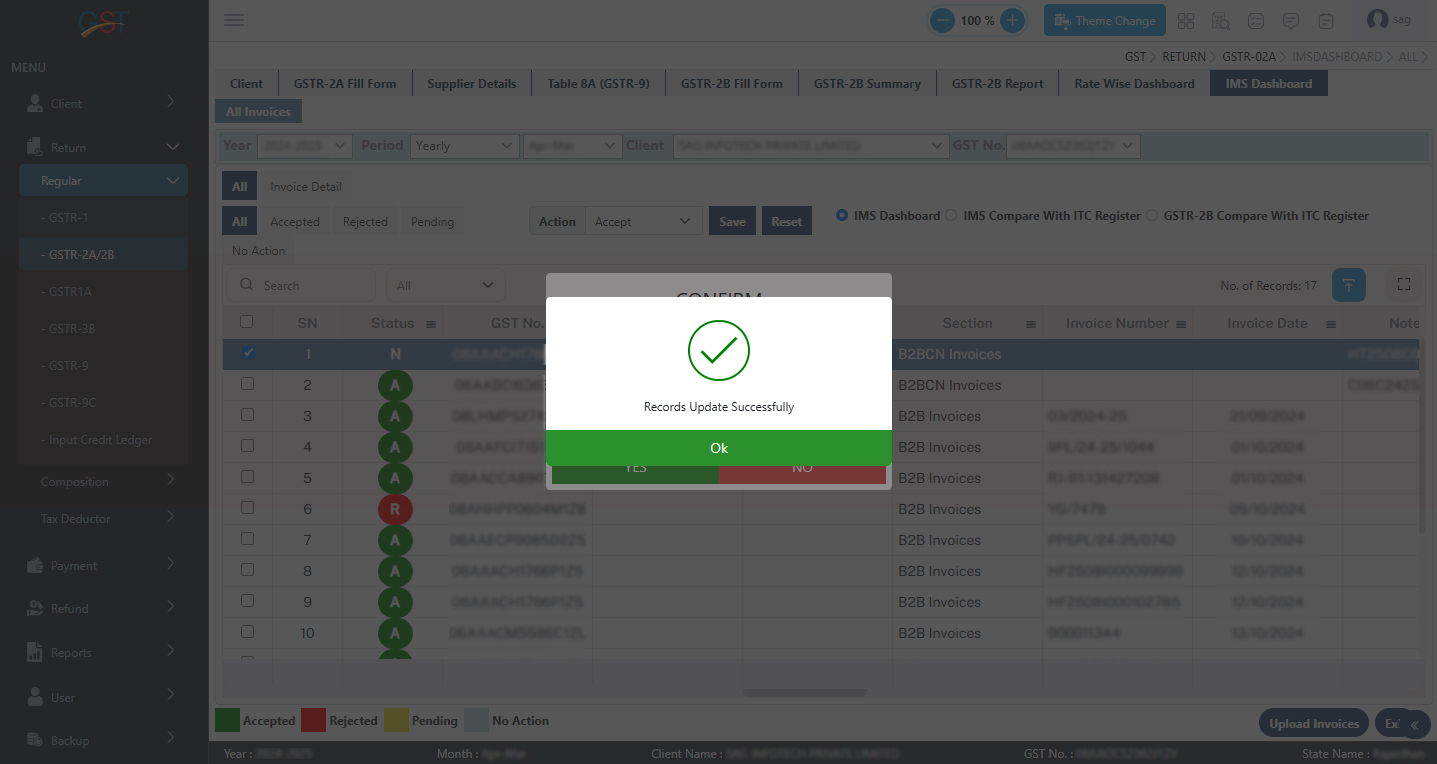

Step 5:- After selecting the required action and clicking on the save button following message will be displayed “Record Update successfully” as shown in given below image

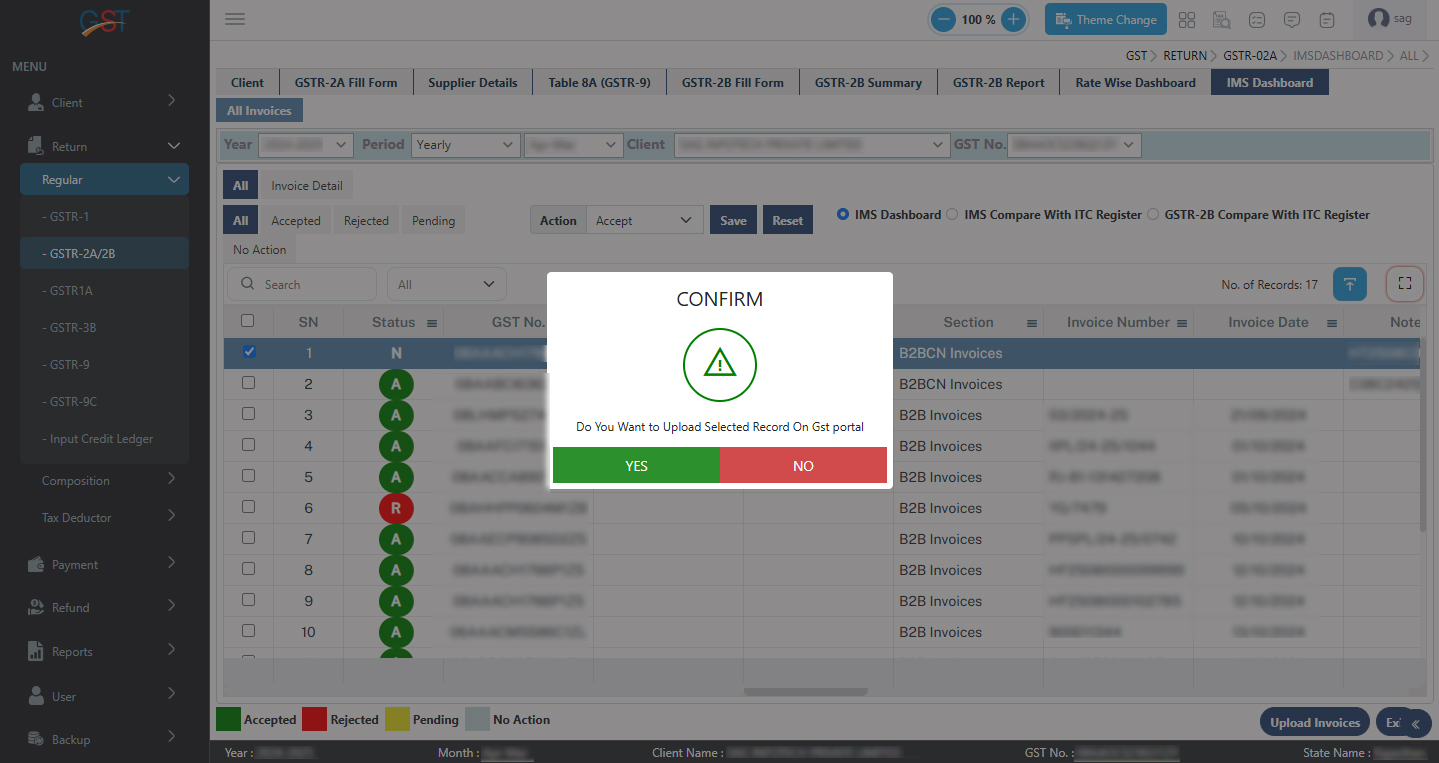

Step 6:- After selecting the action software will ask promptly to upload the selected record on the GST portal as shown in given below image

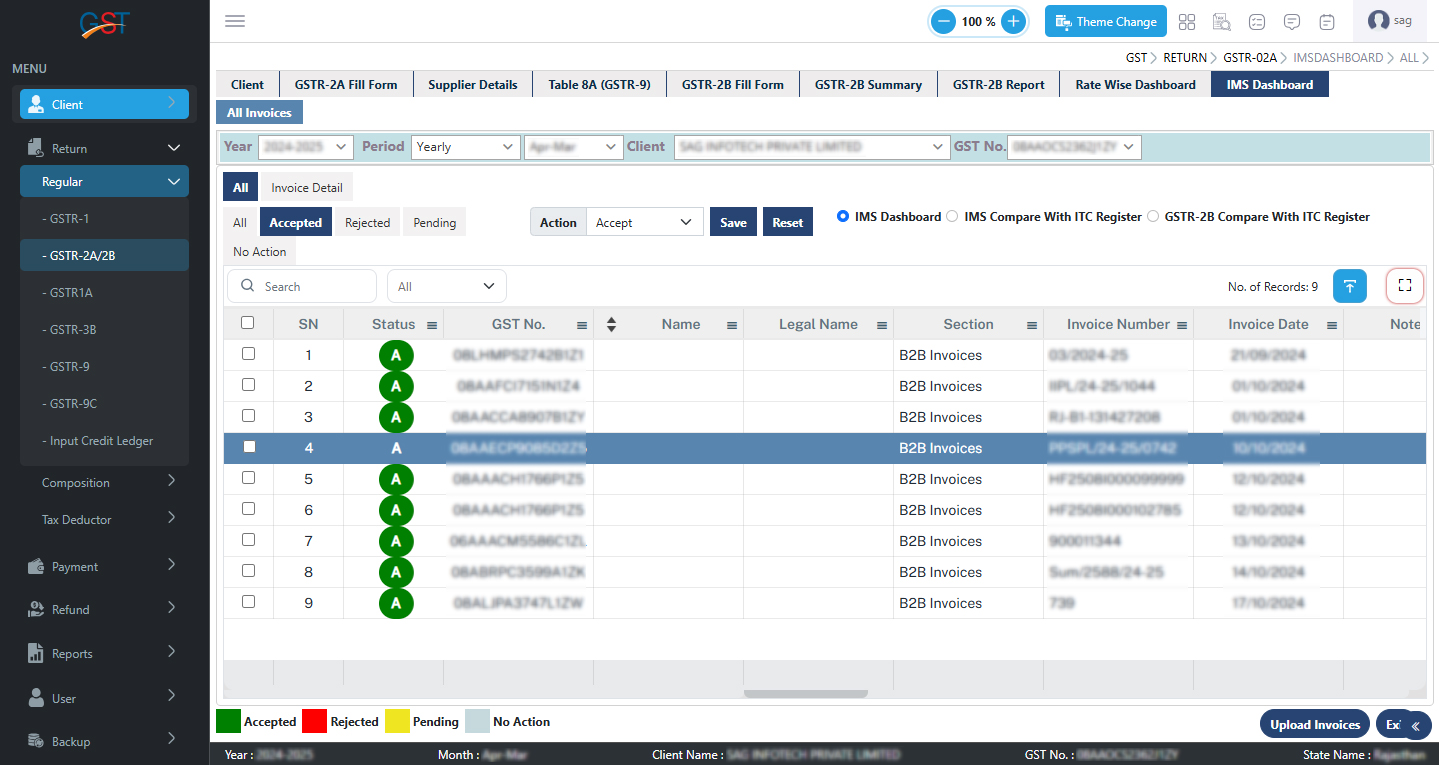

Step 7:- After accepting entries, one can check all accepted entries in the Accept Tab

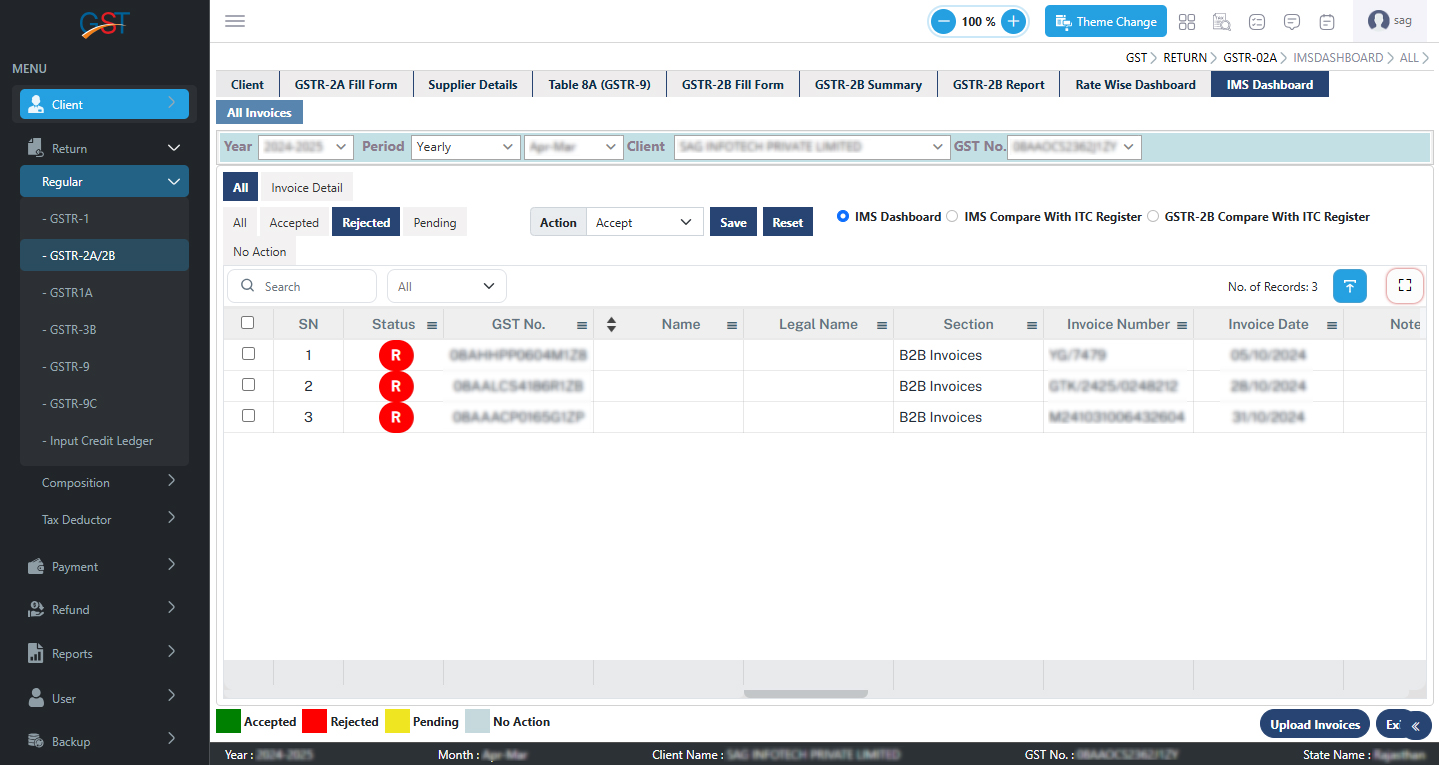

Step 8:- After Rejecting entries one can check all Rejected entries in Rejected Tab

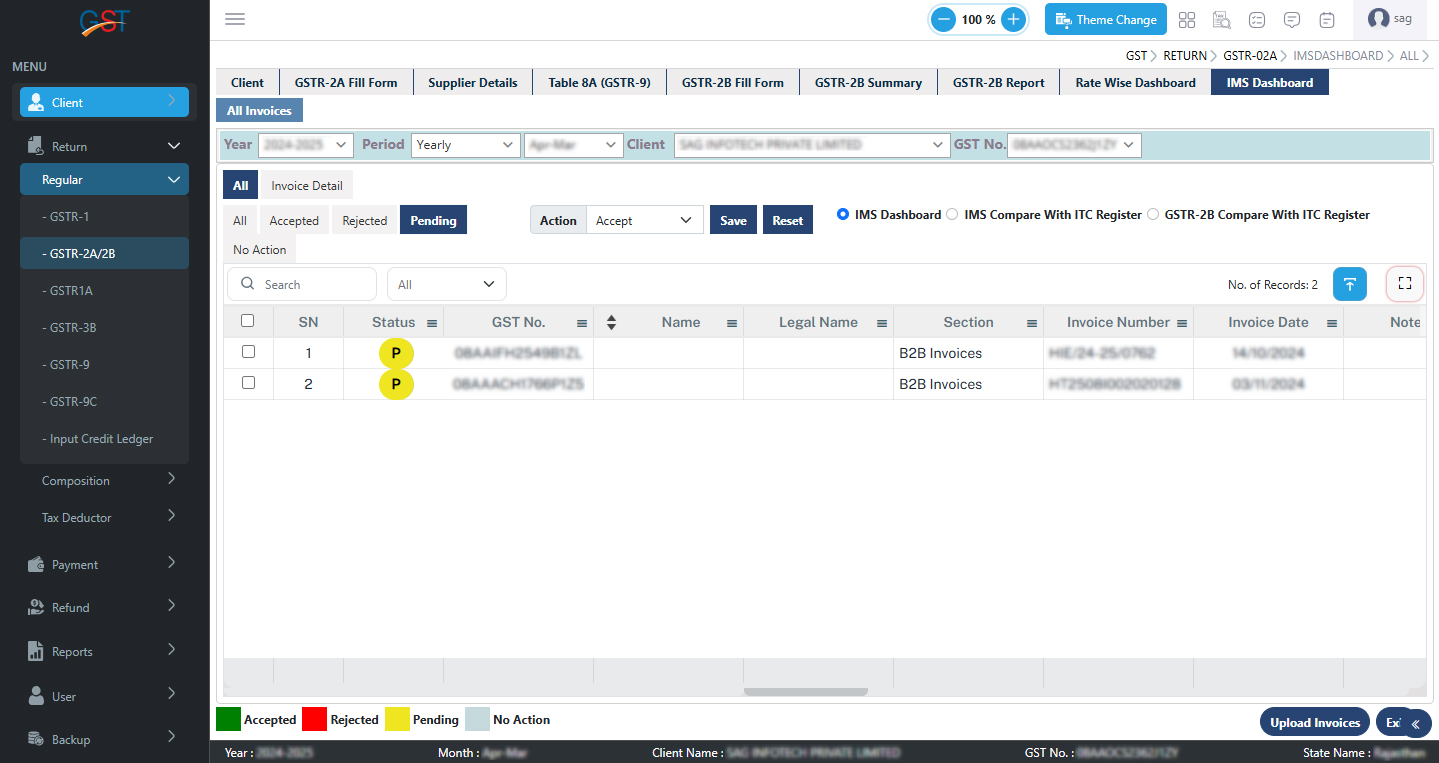

Step 9:- After Selecting Pending entries one can check all Pending entries in Pending Tab

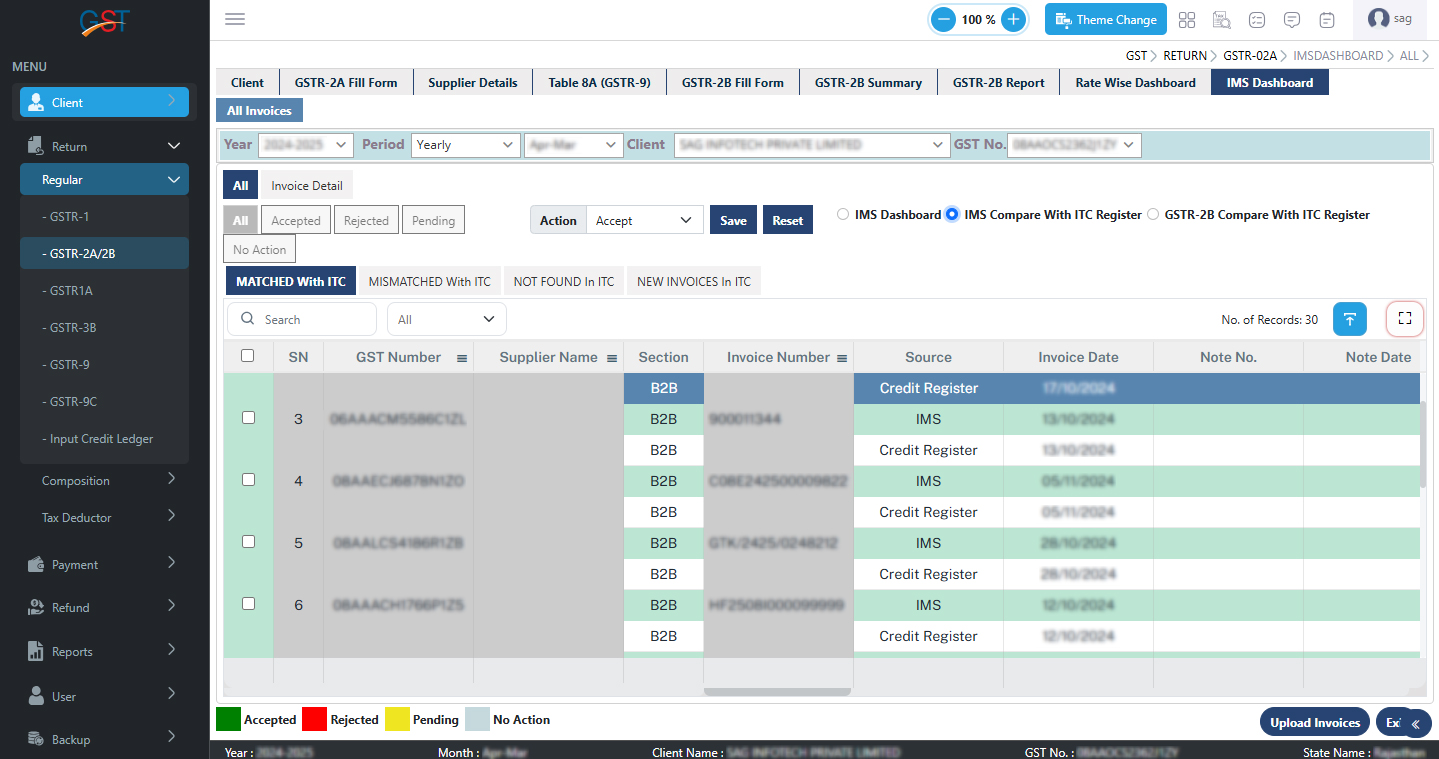

Step 10:- We have also provided the feature of Comparing IMS entries with the ITC Register (BooksITC). So that one can accept Matched Entries at one click. We have also provided Mismatched with ITC where IMS entry differs from Book ITC, Not found in ITC in which extra new entry is found in IMS Dashboard, and New Invoice in ITC in which Book ITC is not available in IMS Dashboard. Users can take action accordingly as per the required tab

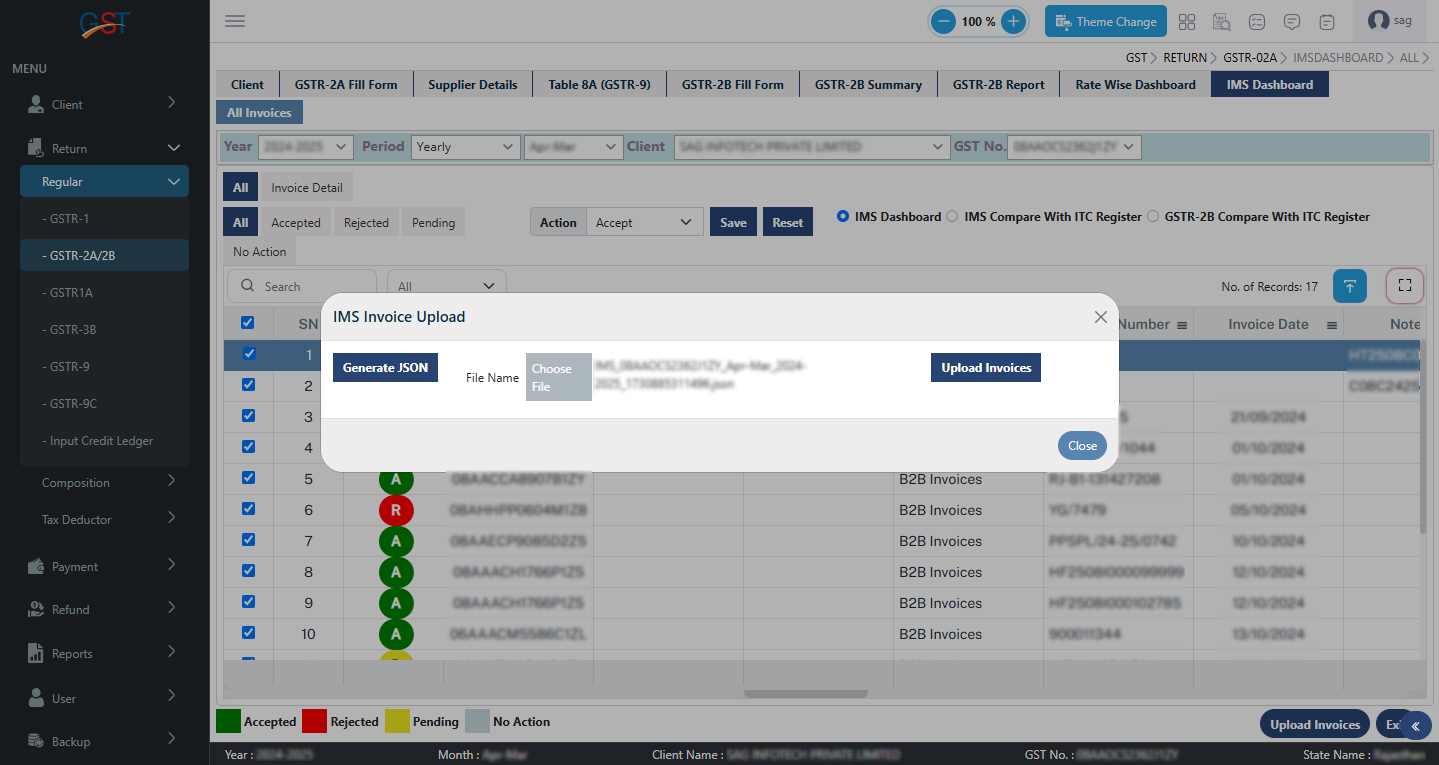

Step 11:- After selecting Required action one can select all records and click on the Upload invoice button

Step 12:- After that Generate JSON window will be opened where the user needs to click on the Generate JSON button

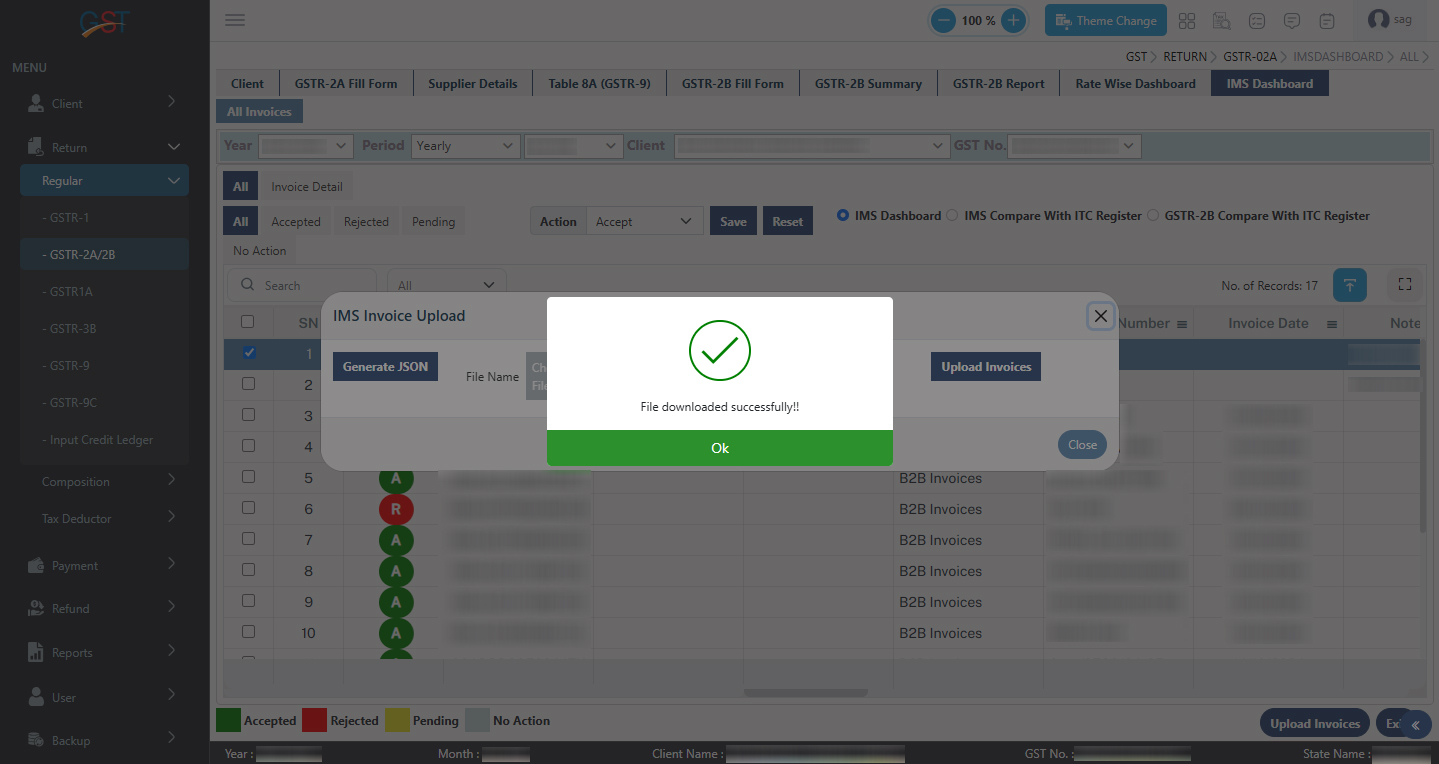

Step 13:- After generating the Latest JSON following message will be displayed “File Download Successfully” as shown below

Step 14:- After that, the user needs to click on the Upload Invoice button to upload the latest JSON file to the GST portal. The following message will then be displayed: ‘Your data has been successfully saved on the GSTN portal,’ as shown below.