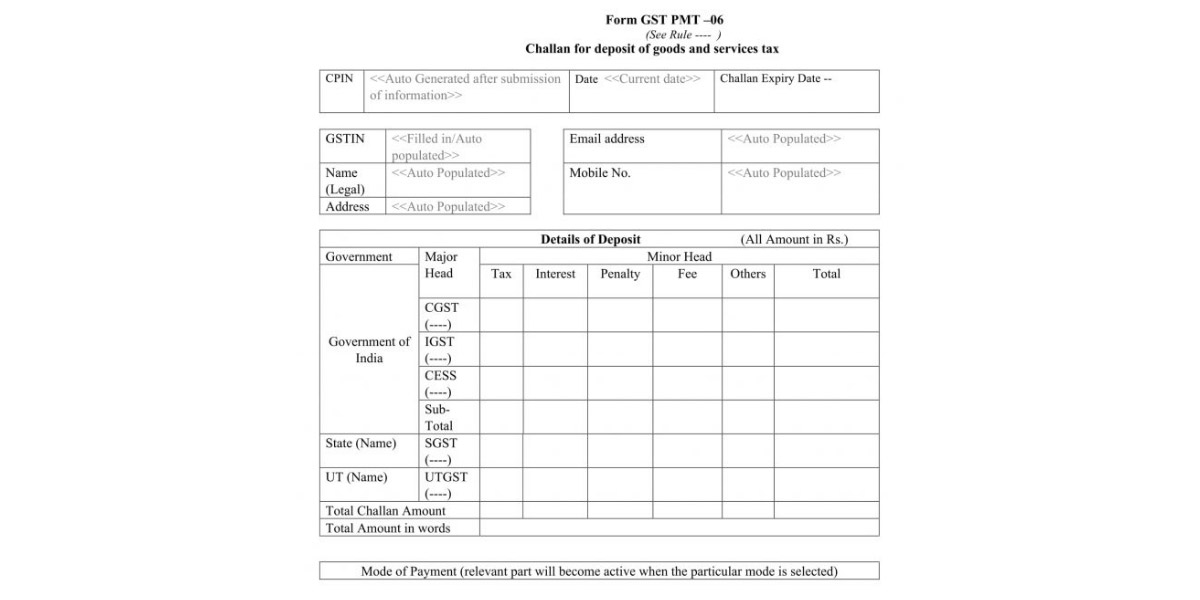

Here, we are going to provide you with the format of GST PMT-06 (payment form), and it is necessary to generate the challan after making the payments of tax under GST. Any of the tax payments made via net banking/OTC without using the facility of ITC. In this case, an individual has to generate a challan under Form GST PMT-06.

GST PMT 06 Due Date

| Period | Last Date of Filing |

|---|---|

| February 2026 | 25th March 2026 |

| January 2026 | 25th February 2026 |

| December 2025 | 25th January 2026 |

| November 2025 | 25th December 2025 |

| October 2025 | 25th November 2025 |

| September 2025 | 25th October 2025 |

| August 2025 | 25th September 2025 |

| July 2025 | 25th August 2025 |

| June 2025 | 25th July 2025 |

| May 2025 | 25th June 2025 |

| April 2025 | 25th May 2025 |

| March 2025 | 25th April 2025 |

| February 2025 | 25th March 2025 |

| January 2025 | 25th February 2025 |

| December 2024 | 25th January 2025 |

Also, have a look at the Indian government-sourced GST PMT 06 Challan:

Once the payment of tax is made by the registered person, they must generate the challan. After making a payment, the Bank would share a CIN (challan ID number) at the time of online payments or over-the-counter payments. The registered must mention a CIN (challan ID number) in the form GST PMT-06 (challan). Once the challan is generated, it is valid only for 15 days.

Read Also: GST Forms in PDF Format: Returns, Rule, Registration, Challan, Refund, Invoice, Transition

A registered person has to submit the challan application on the GST portal within 24 hours of tax payments. If the challan ID number (CIN) is not shared by the concerned bank, then the bank will receive the complaint from the common portal, and the notification will be sent to the registered person.

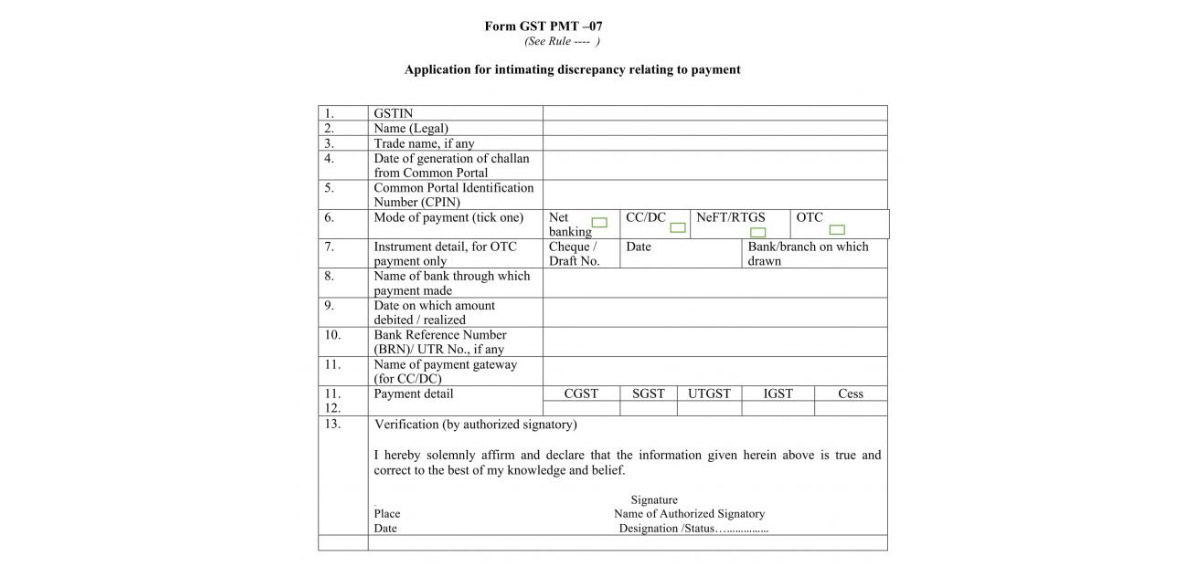

The total tax amount that has been paid by the registered person would be displayed as a debit entry in the electronic cash ledger (Form GST PMT-05). In case of any mishappening, the tax paid amount and the debited entry as shown in the electronic cash ledger, the registered person has to file the application by availing the form GST PMT-07.

The structure of the GST PMT 07 application form is mentioned below:-

All the registered persons under GST have to file the above application by providing the details of tax paid under CGST, SGST, UTGST, IGST and cess along with. And on which date the challan was generated by the registered person by availing the form of GST PMT-06. In the form of GST PMT-07, the registered person must provide their digital signature at the common portal.

Some Important Points to Be Considered:

- The application is for the taxpayer where the amount that is to be paid is deducted from the account, but CIN is not further communicated to the common portal by the bank, or the CIN is being generated but not reported to the relevant bank.

- If CIN is not shared by the concerned bank within 24 hours of the tax payment, the registered person must file the application

- The common portal would send the complaint to the concerned bank and inform the registered person as well

- ‘CGST’ is an acronym of for Central Goods and Services Tax, SGST is an acronym of State Goods and Services Tax, ‘UTGST’ is an acronym of Union Territory Goods and Services Tax, ‘IGST’ is acronym of Integrated Goods and Services Tax and ‘Cess’ is known for Goods and Services Tax (compensation to states).