Gen TDS is a leading TDS filing software from SAG Infotech and has been giving complete TDS filing solutions to taxpayers and companies for more than a decade. The Gen TDS is also authorized by the government department on the TDS official portal and it has ranked top TDS filing solution in the FY 2012-13 also with its class ahead features.

What is Form 26Q (Furnish TDS Return for Non-Salary Deductions)

During the payment towards the payee, the payer needs to cut TDS on specific events. This payment excludes the salary and the payer needs to furnish the TDS return in Form 26Q. 26Q is required to be furnished on quarterly grounds.

The total amount furnished in the quarter and the TDS amount cut down upon these payments is to be described in 26Q. In this, we give the details on the method to file form 26Q by Gen TDS return software step by step including all the original screenshots.

- What is Form 26Q

- Last Date of Filing Form 26Q

- Rate of Interest on Form 26Q

- Late Filing Fees for 26Q Form

- Process to Filing Form 26Q by Gen TDS software

- View Form 26Q in PDF Format

Information Needed Inside Form 26Q Under TDS

Towards The 24Q that consists of 2 annexures, Form 26Q contains only one annexure. Challan details (BSR code, date of payment, total amount, etc.), information of deductor, and deductees are to be mentioned. Along with that if the deductor has not either deducted the TDS or deducted it at a smaller rate then the causes are to be mentioned inside the form.

Last Date of TDS Filing Form 26Q

| Quarter | Last date |

|---|---|

| April to June | 31st July | 30th Sep. Only for 26Q and 27Q |

| July to September | 31st Oct |

| October to December | 31st Jan |

| January to March | 31st May |

Rate of Interest on TDS Form 26Q

If the TDS has not been deducted at 1% per month from the last date of deduction to the real date of deduction.

If the TDS is not deposited for 1.5% per month then from the actual date of deduction to the actual payment date. There is an interest rate of 0.75% if the last date comes between 20/03/2020 and 29/06/2020. If the sum is left out to be an unpaid post to 30th June then the ordinary interest rate will be 1.5% chargeable.

Late Filing Fees for TDS 26Q Form

Fee for late fines: Beneath section 234E one needs to pay the fine of Rs 200 per day until the return is to be furnished. The amount is furnished for every day until the total fine becomes relevant to the TDS amount.

Read Also: Generate Challan-cum Statement Form 26QB by Gen TDS Software

The Penalty Beneath 271H – In addition to fees to be furnished beneath 234E, AO might charge a penalty of a minimum of Rs. 10,000 and a maximum of Rs. 1,00,000.

No Penalty Will be Charged Below 271H If:

- TDS is deposited to the Indian government

- Late filing fees & interest (if any) are also deposited,

- Return gets furnished prior to the expiry of 1 year from the last date

Know these points

- Verification of all the PAN numbers,

- Verification of the challans, & try to match them through OLTAS or NSDL portal

- Signed Form-27A is to be filed with the return of TDS

Filing Steps of Form 26Q Through Gen TDS software

The mentioned is the process of furnishing the Form 26Q Non-Salary Deductions through Gen TDS software. SAG Infotech offers a free trial of Gen TDS Software full version for 5 active hours.

Step 1: First install a complete setup of a Gen TDS e-filing Software

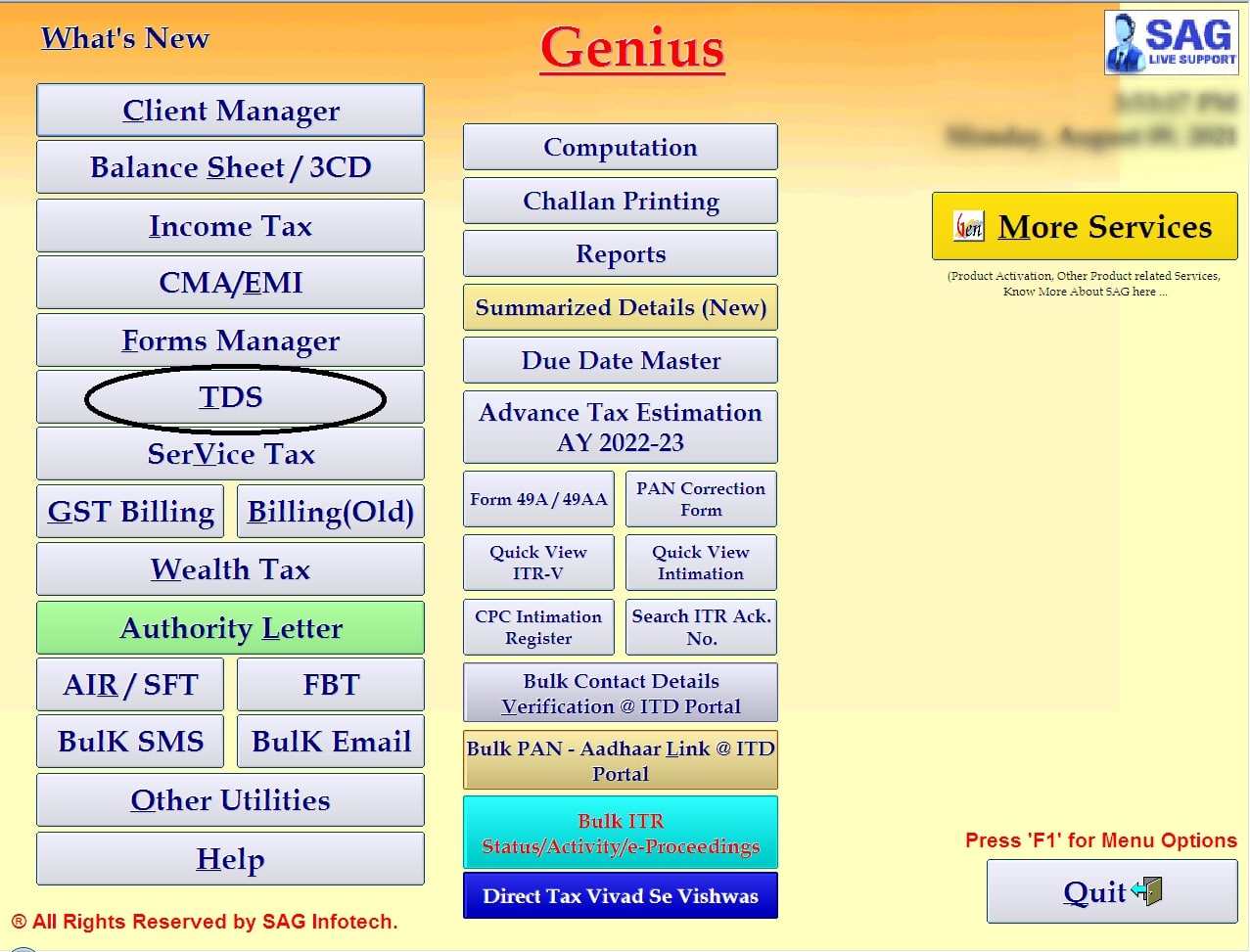

Step 2: After installing the software, open the dashboard

Step 3: Now select the ‘TDS option from the dashboard

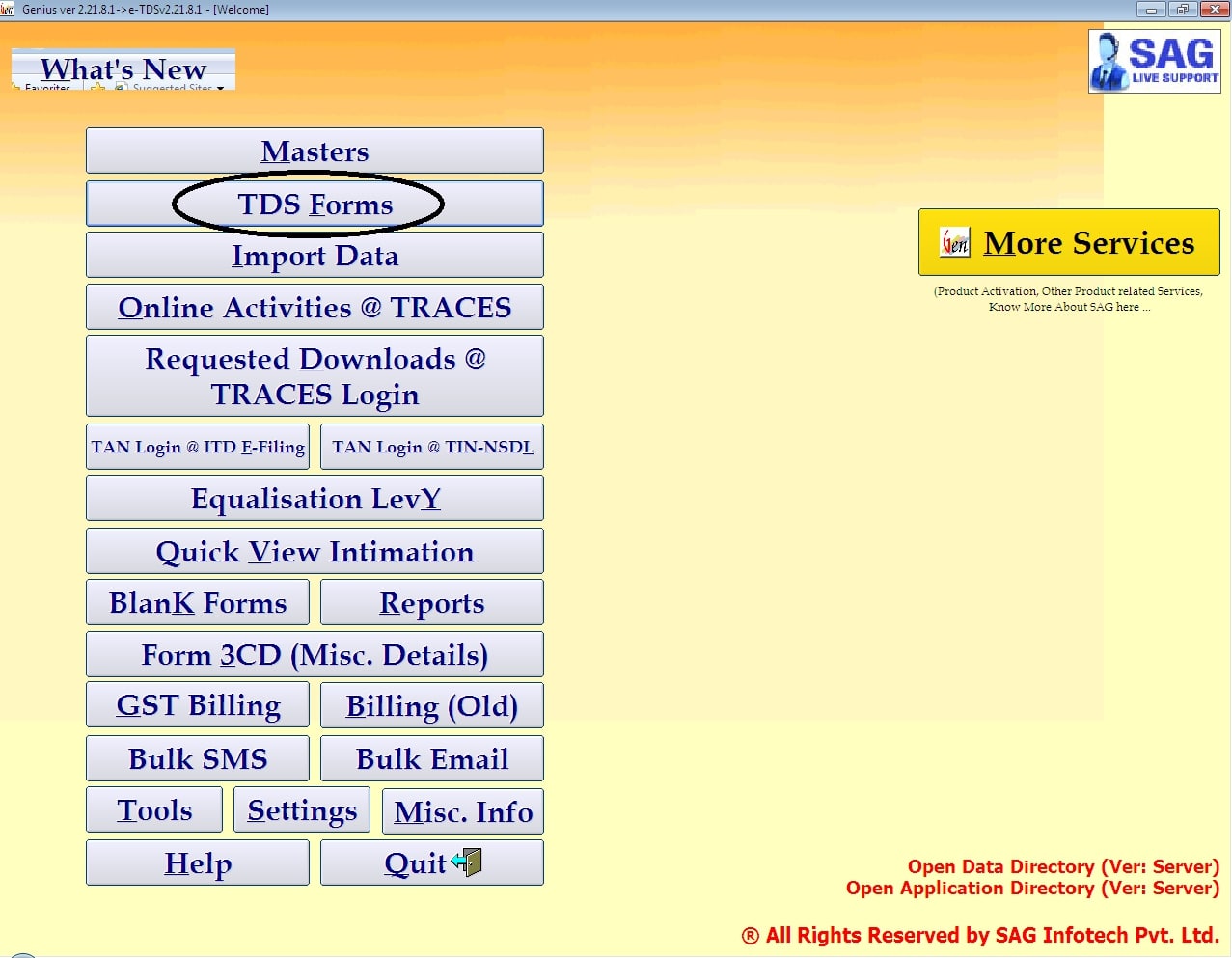

Step 4: After selecting the ‘TDS’ option click on the ‘TDS form’ from the dashboard.

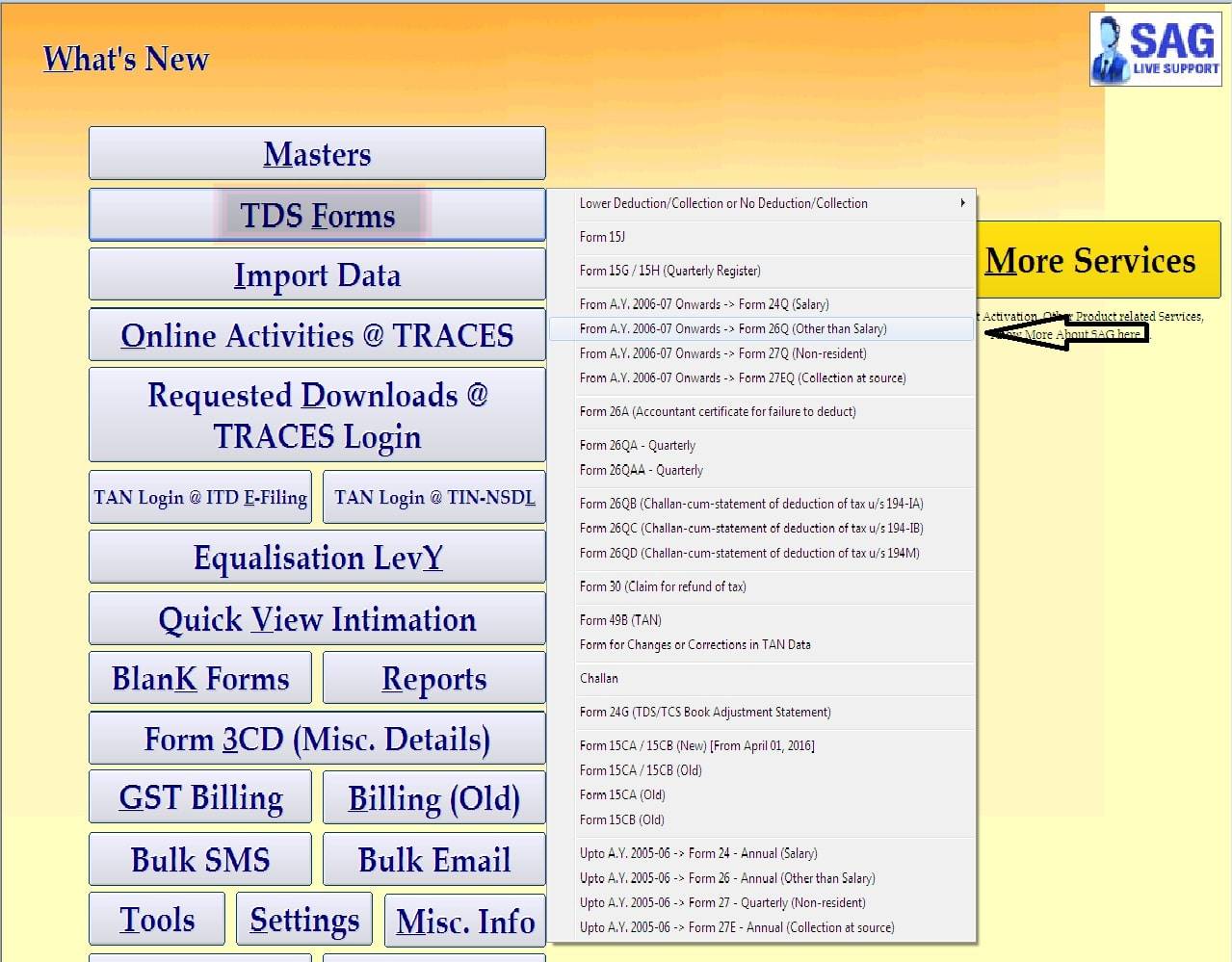

Step 5: Then, select the ‘Form 26Q’ from the dashboard

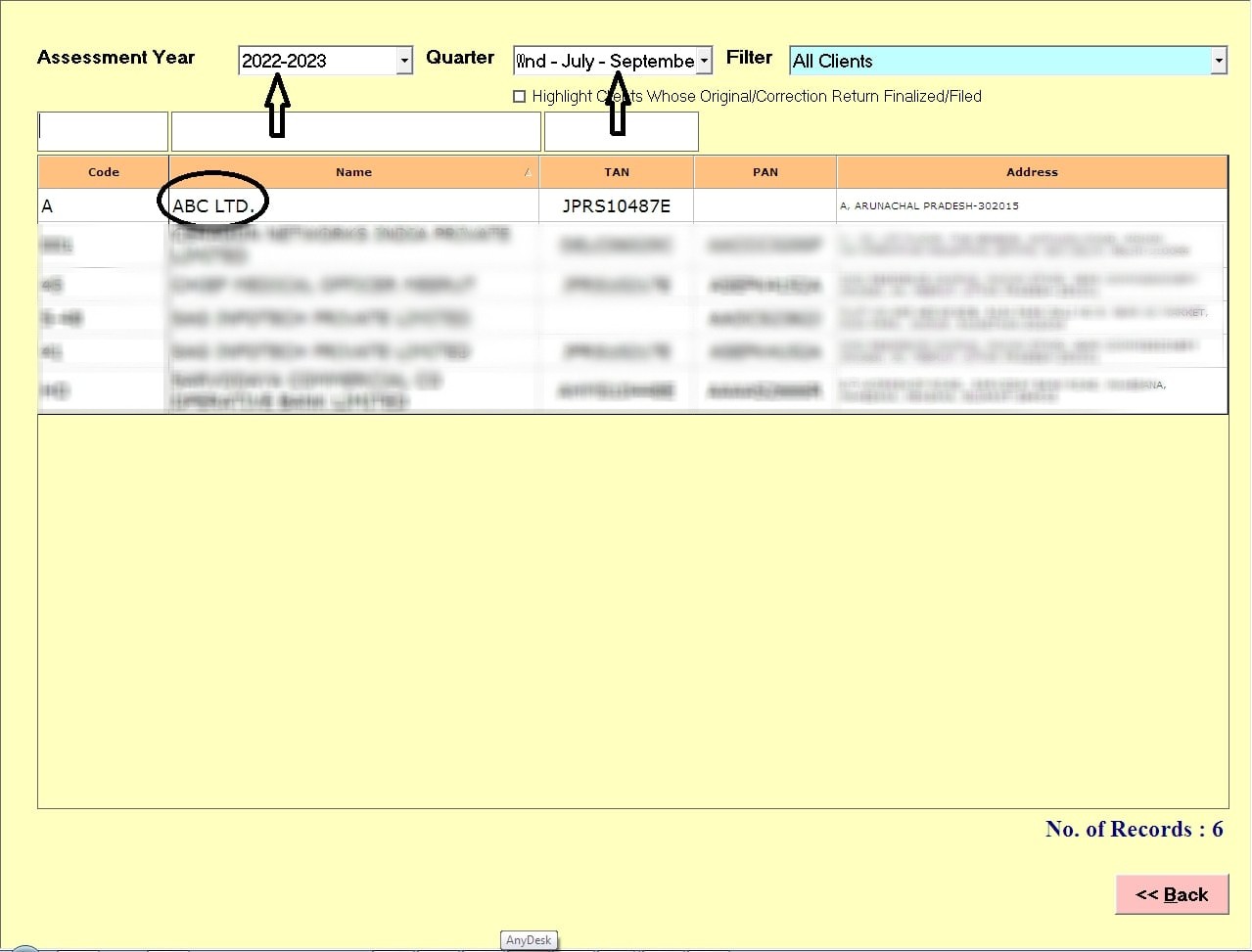

Step 6: On the next page you have to select the Assessment Year, Quarter and Client for which you are filing the TDS Return.

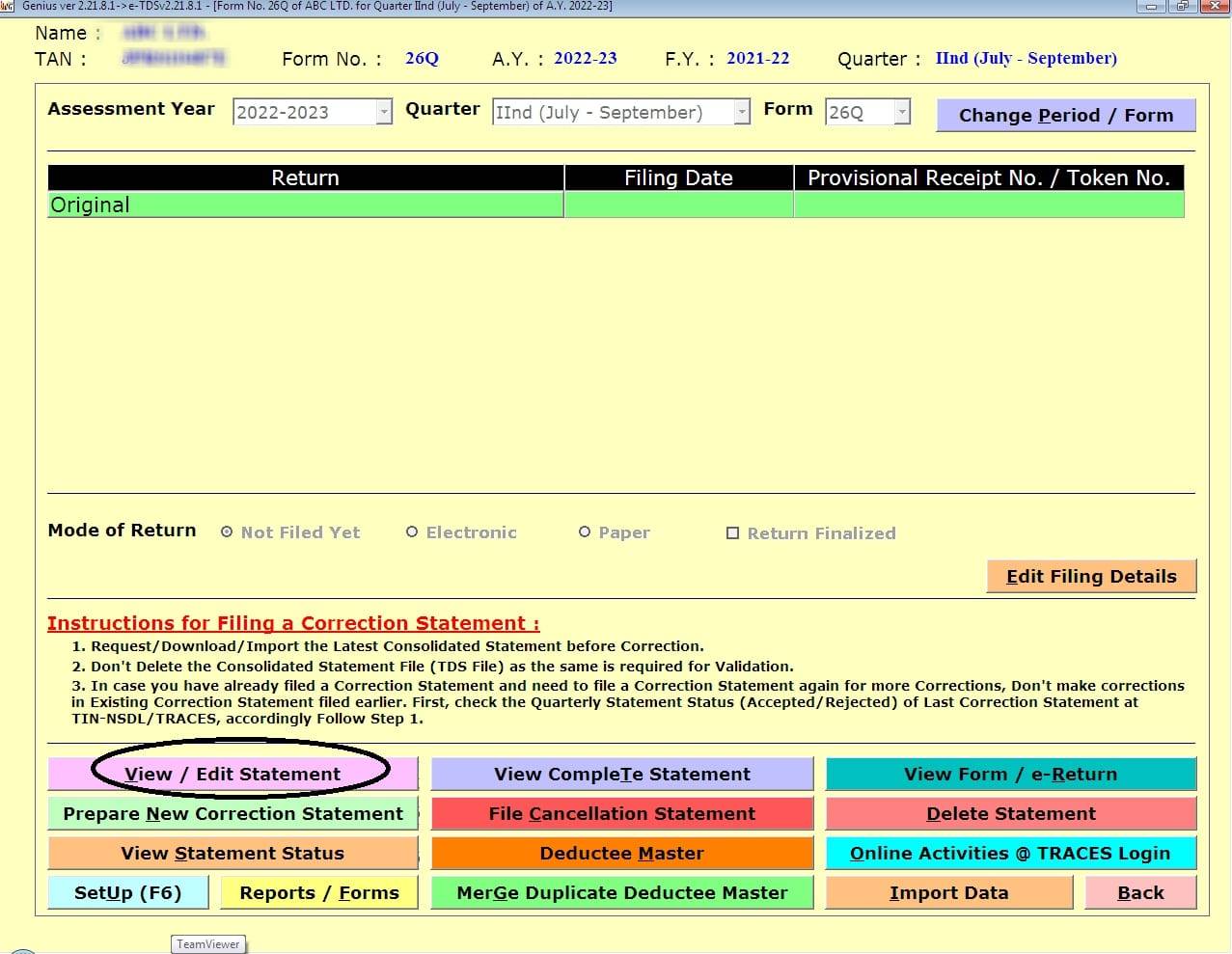

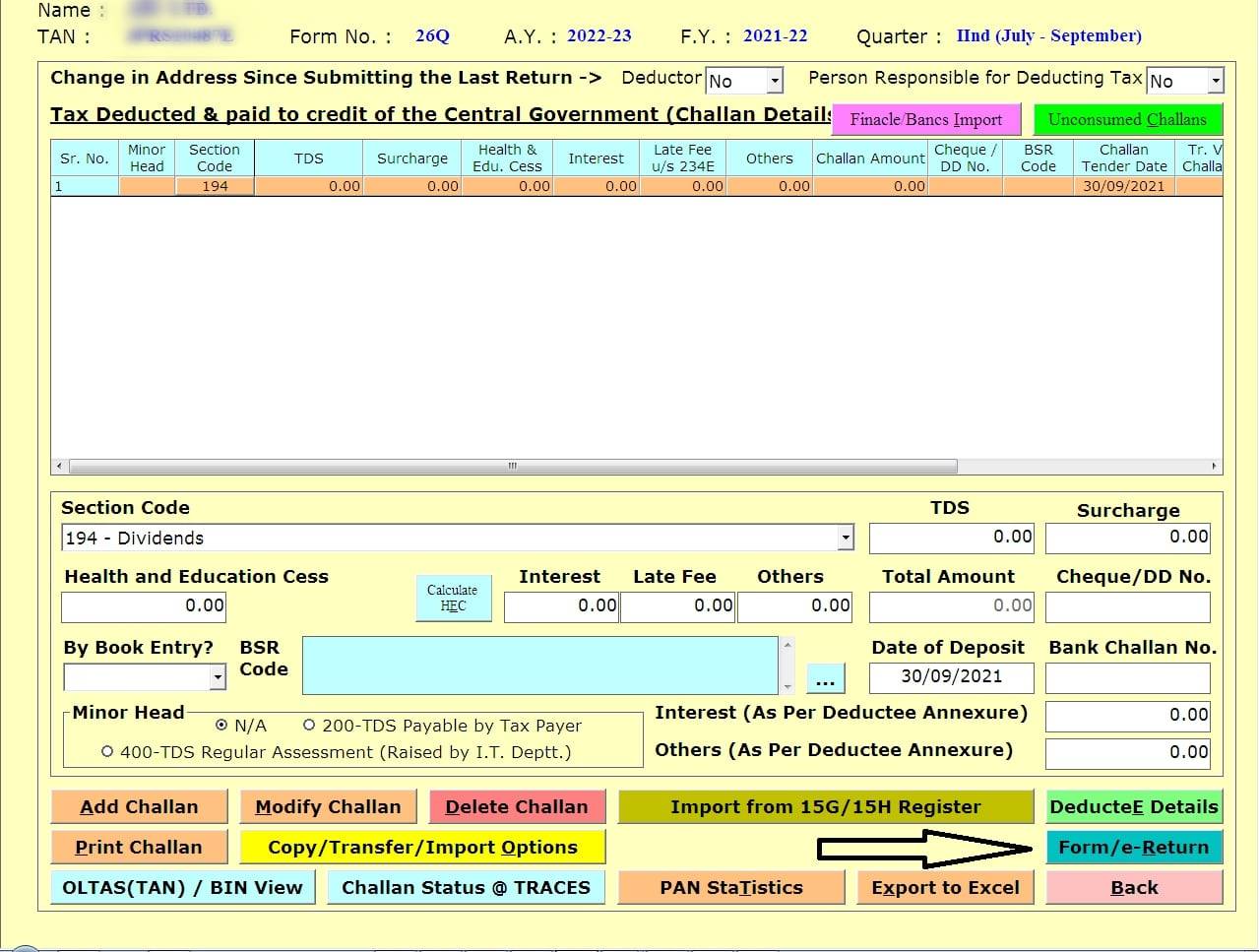

Step 7: Go to View/Edit Statement in order to add challan

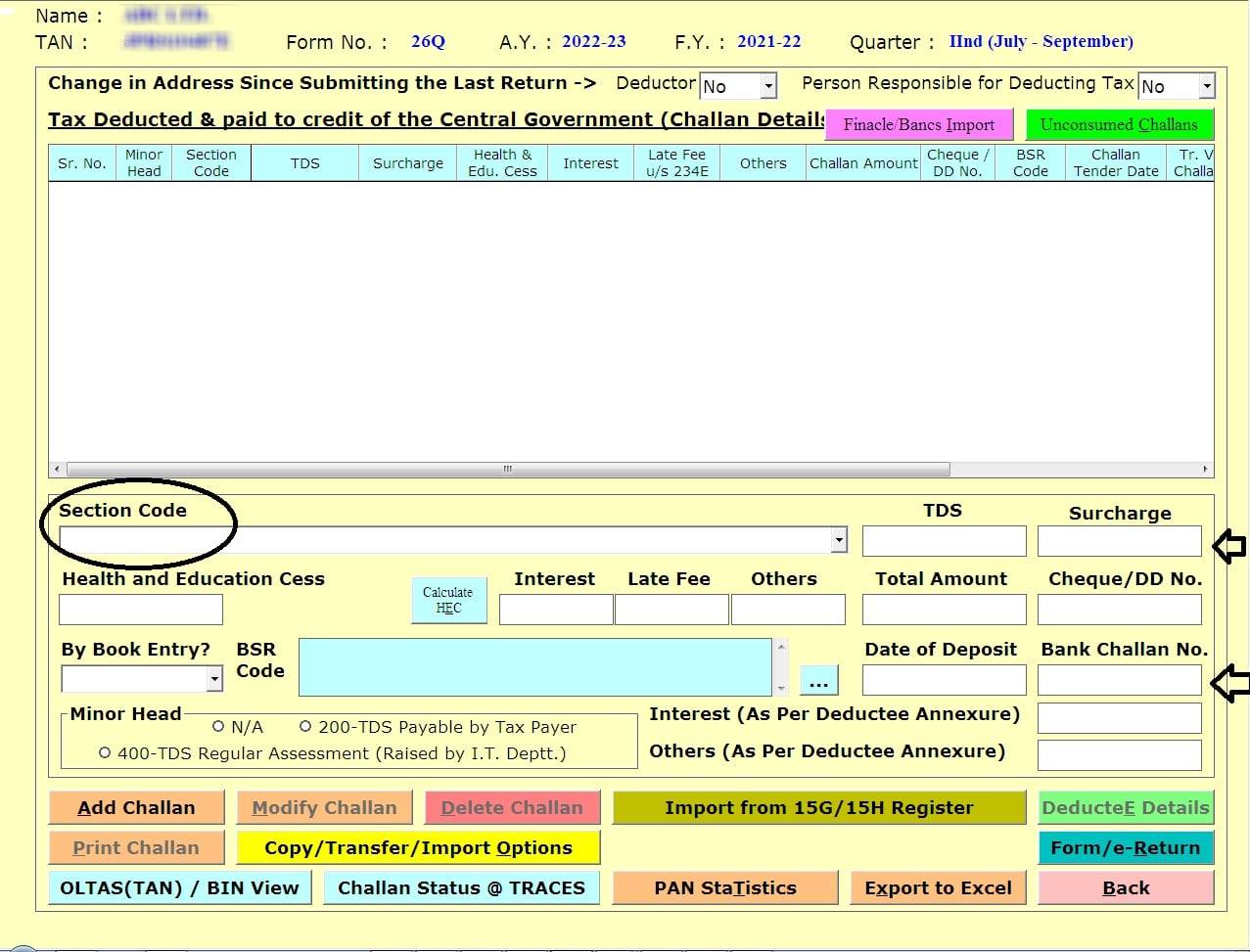

Step 8: Select the Section Code for which you are paying the challan and enter the TDS Amount, Surcharge and other details as required.

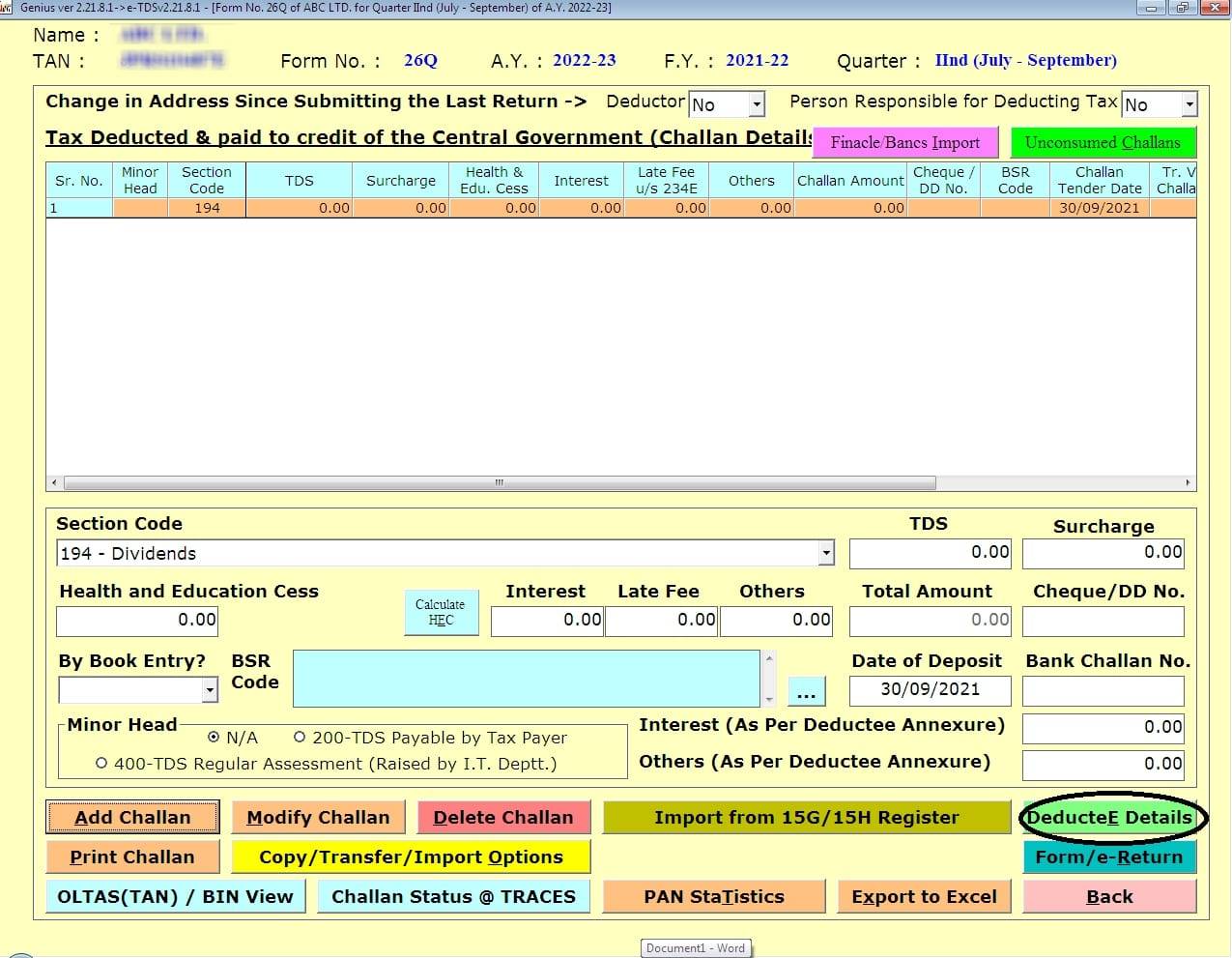

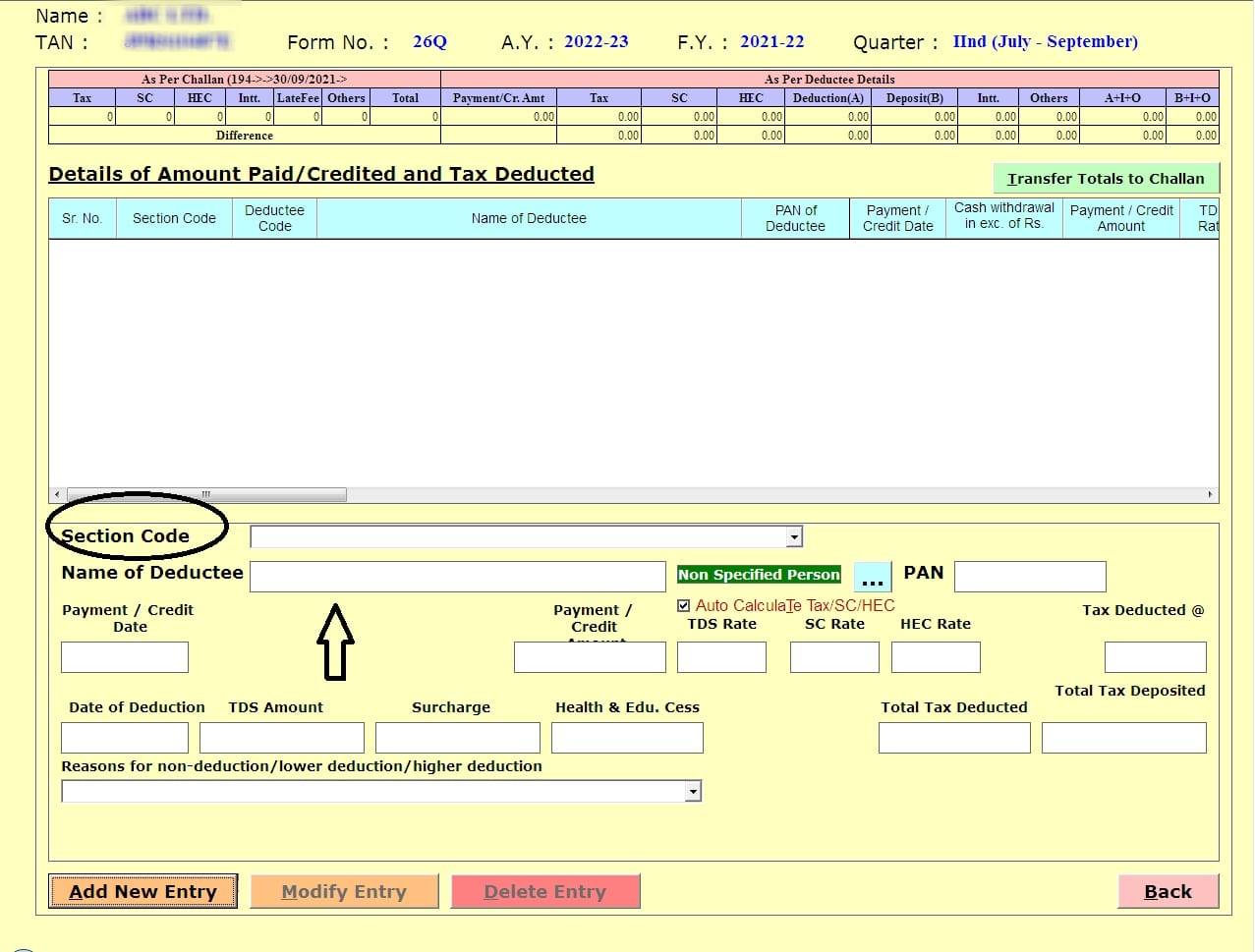

Step 9: Once you enter the details of the challan, the Deductee details will get enabled.

Step 10: In Deductee details add the name of deductee payment/ Credit Date, Section Code and other details as required.

Step 11: Then go to Form E-Return.

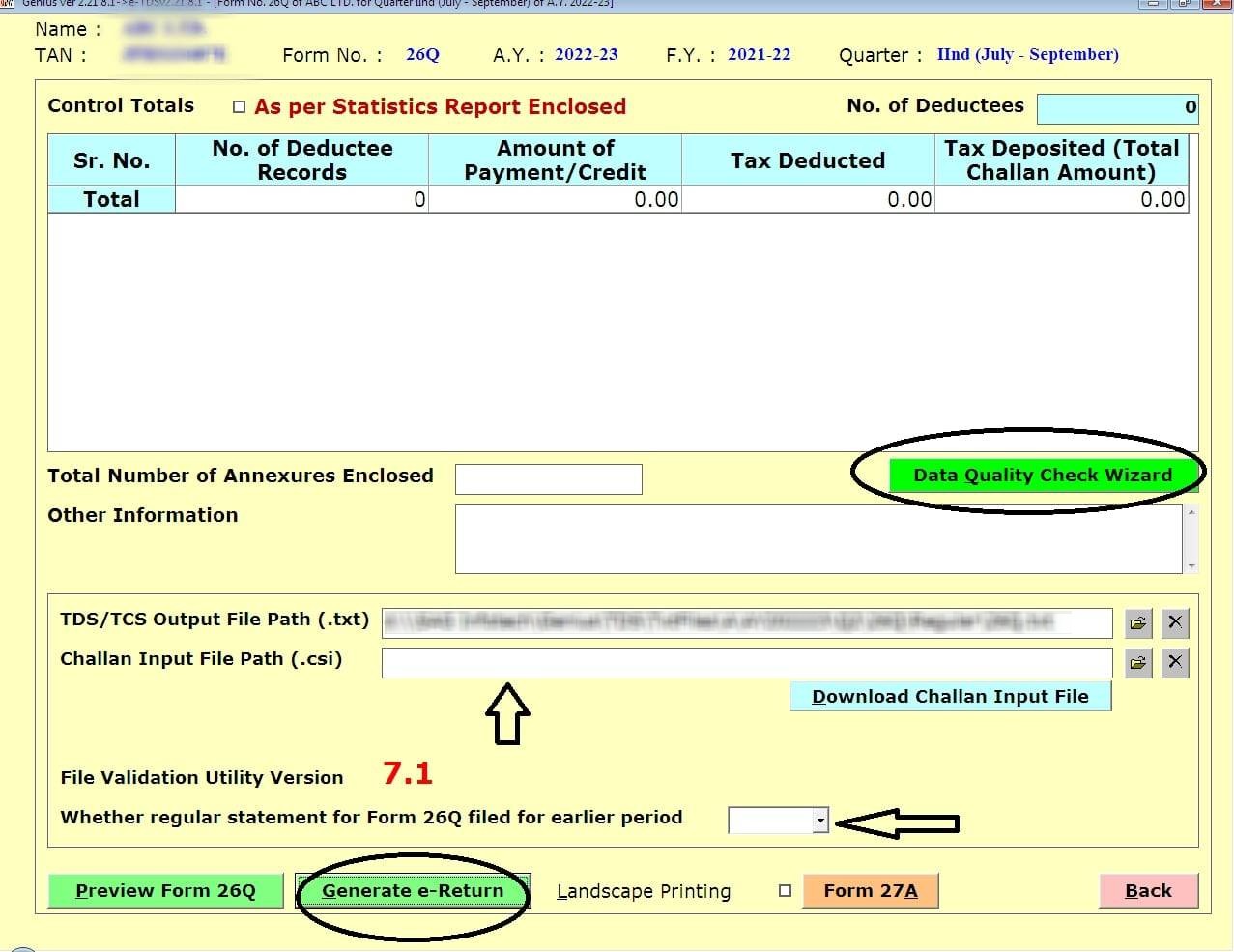

Step 12: Then go to Data Quality Check Wizard download the Challan Input File Path select whether a regular statement for Form 26Q was filed for an earlier period and then Generate an e-return.