Finance minister Nirmala Sitharaman told on Monday that the suggestions to cut down personal income tax rates, by lawmakers to encourage demand, has been presented to the board and she also assured that the Government of India (GOI) will “take action at an appropriate time”.

FM also added that the rate cut would though-out for its benefits & not to create disharmony with GOI’s decision to drop off corporate income tax rates. She also underlined the regular assurance of tax benefits for individuals.

Her views on personal income tax rates were a reply to a question from Saugata Roy, who is a TMC member when a debate on Taxation Laws (Amendment Bill) was taking place in Lok Sabha where FM was passing the bill to cut corporate tax rates

“It is very different to compare developed countries and developing countries and emerging economies and then say they have income tax reduction and therefore you should give,” FM said. After the discussion, the bill was passed by the House, ousting the law by voice vote.

When questioned about abbreviation in the corporate rate tax, she pressed that it will attract new investments and create job opportunities. “People are approaching the government for fresh investment which will help to generate more jobs as well as make India a manufacturing hub in the future,” she said.

On the 3rd of this month, Sitharam notified the exposure of GOI for more improvements to make India an enticing investment haven.

For the current economic downturn, she sewed up that a “pro-active” government was working towards resolving different challenges an Indian economy faces & is facing. She also clarified that rate cut in corporate tax rate will benefit entire and not a few companies. The reduction in corporate tax will affect the revenue collection by approx Rs 1.45 lakh crore but this will let India attract more funds within a year, she stated so in a Lok Sabha discussion.

“Yes, we are conscious of it and we are conscious that if not today, in a matter of a year you will have a lot of investment coming into this country. I can see the initial green shoots,” the minister replied when questioned by Members of Parliament about revenue loss due to the tax cut.

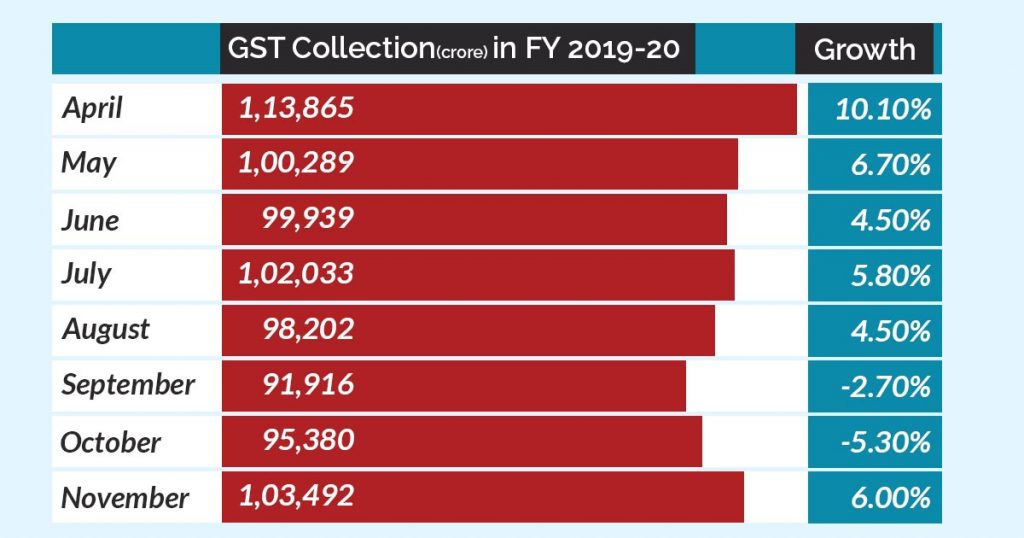

According to the finance minister, no decline in the direct tax collection has been observed and the gross mop-up ascended by 5% till November this financial year. She emphasized the statistic that the highest direct tax collection happens in the last quarter of the fiscal year.

In November, the Goods & Service Tax (GST) collection rose by 6%

In September, the GOI curtailed the corporate tax rates by up to 10% which is the biggest cut in the last 28 years. The government did so to get the Indian economy out of the dismal phase which started 6 years ago. For this, the government is ready to relinquish revenue of approx Rs 1.45 lakh crore.

The base corporate tax rate for the fresh manufacturing companies established after October 1, 2019, and commencing transactions before March 31, 2023, will now be 15% instead of 25% and that for the existing companies will be 22% instead of 30%. However, the companies opting to pay lower tax rates will become ineligible to claim rebates or deductions.

Only the companies registered under the company act will be able to enjoy the reduced tax rate, and the reduced corporate tax rates are inapplicable to Limited Liability Partnership (LLP) firms & the issues related to them will be handled separately.

She assuaged the pain of economic downturn, highlighting the GDP record of sub-5% growth in FY 2012-13 and saying that slowdown in the growth rate of GDP (Growth Domestic Product)

To back up her statement, FM told about her meetings with the two former finance ministers, Manmohan Singh and Pranab Mukherjee before the presentation of the initial July Budget. She also told about her meetings with industrialists, economists, and other stakeholders to reap propositions and feedback.

Congress leader Adhir Ranjan Chowdhury recommended the BJP leadership to solicit guidance from former PM Manmohan Singh on methods to combat the current economic falloff.

He underlined the actualization of Manmohan Singh’s alert that demonetization would curtail India’s Gross Domestic Product (GDP) by 2%.