Union FM Nirmala Sitharaman has shown the list of items, no GST would be drawn on them on loose selling and not prepacked or prelabeled.

In between the protests by the opposition members on the GST levy on some new items and on the increase in the cost.

Opposing the 5% GST on the food items like cereals, rice, flour, and curd which are pre-packaged and labelled, Finance Minister Sitharaman specified that “it was a unanimous decision of the GST Council last month in which even non-BJP ruled states were present.”

Latest Update in GST on Food Items

22nd August 2022

- Ashok Gehlot Ji chief minister of Rajasthan has appealed to Nirmala Sitharaman Ji Indian finance minister for reconsidering the move to GST levy on unbranded and pre-packaged food items, in a letter sent earlier this month, asserting that the state had “vehemently” opposed the move. Read more

FM articulated that the council has suggested acknowledging the approach towards the GST levy on the mentioned food items such as pulses, cereals flour, and others.

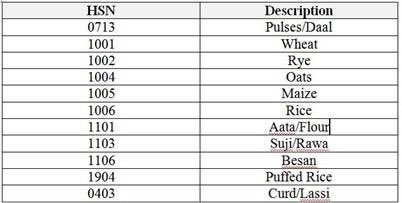

There will be no GST incurred on some of the items like pulses/daal, wheat, rye, oats, maize, rice, atta/flour, suji/Rawa, besan, puffed rice, curd/lassi when sold loose and non-pre-packed or pre-labelled, Sitharaman spoke.

FM tweeted that “Recently, the GST Council in its 47th meeting recommended to reconsider the approach for the imposition of GST on specified food items like pulses, cereals, flour, etc. There have been a lot of misconceptions about this that have been spread. Here is a thread to lay the facts.”

It is not the first time that the food items tax is being levied. The states were collecting the revenue through the foodgrain in the pre-GST regime. The state of Punjab itself has collected more than Rs 2000 cr on the food grain through the tax purchase. Uttar Pradesh has collected Rs 700 cr.

“Taking this into account, when GST was rolled out, a GST rate of 5% was made applicable on BRANDED cereals, pulses, and flour. Later this was amended to tax only such items which were sold under REGISTERED brand or brand on which enforceable right was not foregone by the supplier.”

But the provision was misused by the reputed manufacturers and brand owners and slowly GST revenue from these items fell significantly.

“This was RESENTED by suppliers and industry associations who were paying taxes on branded goods. They wrote to the Govt to impose GST uniformly on all packaged commodities to stop such misuse. This rampant evasion in tax was also observed by States.”

The Fitment Committee includes the officers from Rajasthan, West Bengal, Tamil Nadu, Bihar, Uttar Pradesh, Karnataka, Maharashtra, Haryana & Gujarat would have investigated the same problem in various meetings and incurred its suggestions for amending the modalities to restrict the misuse.

“It is in this context that the GST Council in its 47th meeting took the decision. With effect from July 18, 2022, only the modalities of imposition of GST on these goods was changed with no change in coverage of GST except 2-3 items.”

GST on these kinds of items would be applied when these items get supplied in pre-packaged and labelled commodities drawing the law of the legal metrology act.

“For example, items like pulses, cereals like rice, wheat, flour, etc, earlier attracted GST @ 5% when branded and packed in unit container. From 18.7.2022, these items would attract GST when pre-packaged and labeled.

No GST Will be Levied on Loose Sold Items & Pre-packed/Pre-labeled

The same decision is the decision of all of the members of the GST council. All the states were present in the GST official when the problem was shown by the GOM upon GST rate rationalization in the 47th meet held in Chandigarh dated Jun 28, 2022.

“All States, including non-BJP States (Punjab, Chhattisgarh, Rajasthan, Tamil Nadu, West Bengal, Andhra Pradesh, Telangana, Kerala) agreed with the decision. This decision of the GST Council is yet again by consensus.”

The Group of members suggested these amendments be taken, the members who had approached the decision belonged from West Bengal, Rajasthan, Kerala, Uttar Pradesh, Goa & Bihar, and were headed by the CM of Karnataka. This is done for restricting tax leakage.

“To conclude: this decision was a much-needed one to curb tax leakage. It was considered at various levels including by officers, the Group of Ministers, and was finally recommended by the GST Council with the complete consensus of all members,” she added.