The Finance Ministry has issued regulations outlining the procedures for appointing the president and members of GST appellate tribunals (GSTAT) in Tripura and six other northeastern states.

Alongside Tripura, separate benches are set for establishment in Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, and Nagaland, as per a notification from the Finance Ministry.

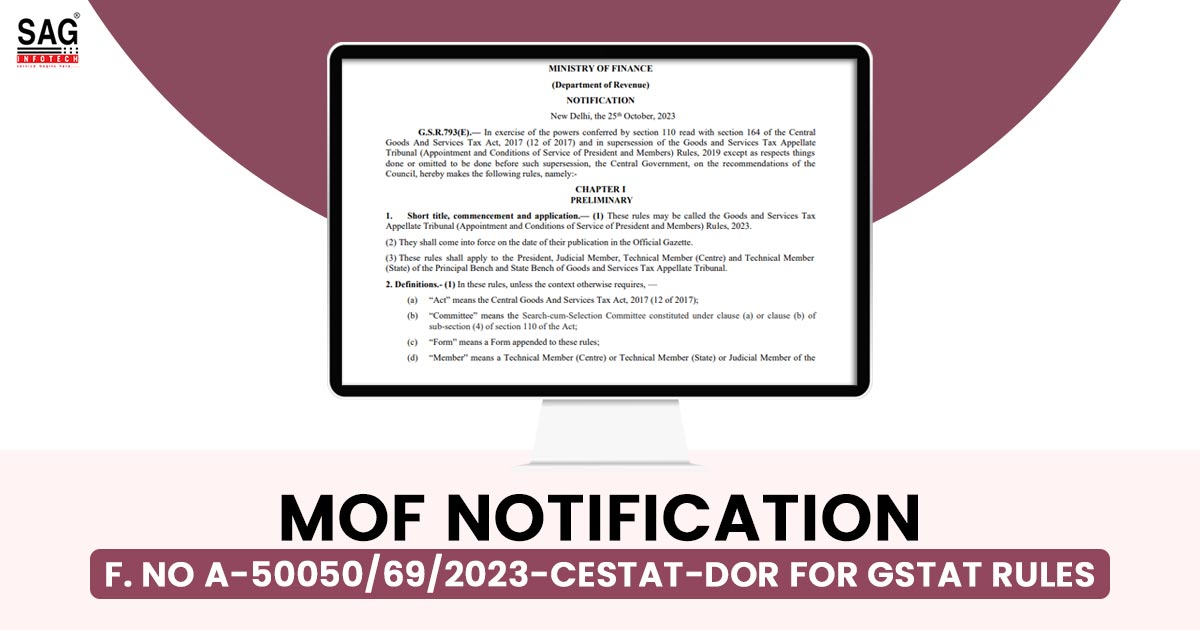

The Goods and Services Tax Appellate Tribunal (Appointment and Conditions of Service of President and Members) Rules, 2023, lay down the guidelines for the selection, dismissal, remuneration, benefits, and leave entitlements of the president and members of these appellate tribunals.

During the 52nd meeting on October 7, the GST council meeting, led by the Union Finance Minister along with state representatives, decided that the maximum age limit for the president and members of the GST Appellate Tribunal (GSTAT) would be 70 years and 67 years, respectively.

Earlier in September, the Finance Ministry had announced the establishment of 31 GSTAT benches across 28 states and 8 Union Territories.

Establishing 31 benches of the GST Appellate Tribunal (GSTAT) across all states and Union Territories is expected to expedite the resolution of more than 14,000 cases involving disputed tax claims.

Presently, taxpayers dissatisfied with the decisions made by tax authorities must approach the respective High Courts. However, the resolution process tends to be prolonged as High Courts are already overwhelmed with a backlog of cases and lack specialized benches to address GST-related matters.

According to data presented by Minister of State for Finance Pankaj Chaudhary in the Lok Sabha last month, the number of appeals against tax demands raised by Central GST authorities had escalated to 14,227 by the end of June, up from 5,499 as of March 2021.

The establishment of state-level GSTAT benches is balanced to administer businesses by providing swifter dispute resolution mechanisms.

As outlined in the notification, Gujarat and the Union Territories of Dadra and Nagar Haveli and Daman and Diu are set to have two GSTAT benches, while Goa and Maharashtra combined will accommodate three benches.

Important: TPA Indore Files a Petition in HC Due to GSTAT Establishment in Bhopal

Karnataka and Rajasthan are scheduled to accommodate two benches each, while Uttar Pradesh is set to have three benches.

The grouping of West Bengal, Sikkim, and the Andaman and Nicobar Islands, along with Tamil Nadu and Puducherry, will collectively host two GSTAT benches each, whereas Kerala and Lakshadweep will house one bench.

The remaining states are allocated one bench each of the GSTAT.

Recommended: FM: The Northeastern States Have Received Significant Advantages After GST

GST tribunals are pivotal in resolving tax-related issues, providing an impartial, expert, and efficient platform for addressing tax disputes. Their role is fundamental in upholding fairness, accountability, and the rule of law within tax administration.

In its initial phase, the government has announced the formation of 31 tribunals to be established across major cities in the country.