The union finance minister in its latest talks cleared the air regarding the implementation schedule of upcoming goods and services tax in India. In an interview, the minister said that the GST is a very simplified tax scheme and there is no reason to postpone it further than the pre-decided date of 1st July 2017.

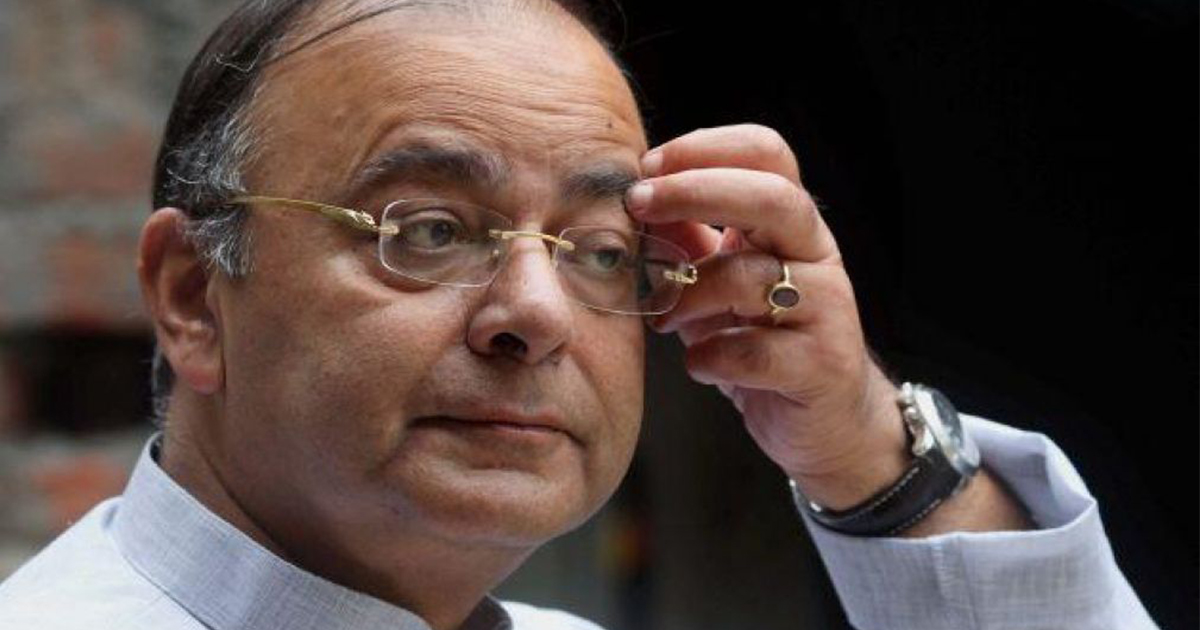

The minister in an interview to an imminent media house mentioned that, “With all the procedural matters decided, registrations are taking place at a fast pace. Today I see no reason why we can’t target July 1.” The comment was directly targeted towards the West Bengal finance minister Amit Mitra who had raised concerns and issues regarding the feasibility and preparedness of the tax scheme.

He doubted that the GST network is in initial phase currently and cannot process all those large volumes of invoices and forms which will be received as soon as the GST comes into effect. But the union finance minister Jaitley informed that almost all the states had greater confidence on GST except West Bengal’s minister.

The union finance minister also assured that despite initial small issues, there will be the larger positive impact of GST on the economy and will also increase the taxpaying base which will ultimately garner better revenue for development. He said that “There may be teething troubles initially…I don’t think there would be any adverse impact on growth. Disruption will be there because we are switching to a new system. But I foresee assessee base and taxpayer base expanding.”

The GST Council has summed up with the tax rates and now a meeting has been scheduled for 11 June to discuss over the representations on tax rate changes, pleaded by various industries and states. For this, he mentioned that “The June 11 meeting is intended to be for undecided matters. Council is an accountable body. A lot of representations have come, which will also be discussed. But merely using the media for propaganda and putting pressure will not be entertained.”

On the matter of one tax one nation, he cleared that all the items cannot be taxed at a single rate as their usability are different. He said that “It is a real system. It is not a complex system. You have a whole legacy of different products being taxed at different rates. If you had fixed one single rate and let us say the single rate had come to 14-15 percent — that seems to be the normal common sense — then from tobacco to luxury cars to other sin products would all be 15 per cent and flour and rice would also be 15 per cent. It would be disastrous if we did that.”

Recommended: Updated: GST Slab Rates in India as Finalized by the GST Council

“So we have taken all the food products which the common man uses, put them into zero, nil category. Similarly, in areas like clothing and footwear, which are again essential, we have seen the existing rate, allowed the equivalence principle to prevail, but for the more vulnerable sections — a footwear below Rs 500 and an apparel below Rs 1,000, we have given a concessional rate, and for the others, we have all fitted them into one bracket instead of multiple brackets, which existed earlier,” he added

He stated it clearly, that the tax rates are considered on the basis of social and economic conditions of the nation and not just by the tax paying abilities of any certain section. He was very positive towards the upcoming GST implementation and said in a confident tone that it will remove many issues and problems from the economy rather than creating any disruptive scenario.