The Government has released the Anti-Profiteering Complaint Form for the consumers who want to lodge grievances against businesses for not giving the benefits of reduced taxes under GST regime. The consumer needs to file the complaint in the pre-decided format of the application form before Standing Committee on anti-profiteering or State level Screening Committee in terms of Rule 128 of CGST Rules, 2017, in case of the conduct of the profiteering is local. The application form is required to furnish with the details of the price of the product and the implied tax rates before the pre and post GST implementation. Also, you can view or download the anti-profiteering complaint form in PDF format.

The anti-profiteering rules in India are released by the GST council and committee formed for the supervision of illegal profiteering of business units after the lower GST rates decided for them.

General Instruction Before Filing Anti-Profiteering Complaint Form:

- Application Form requires to fill in BLOCK LETTERS only with READABLE WORDS

- Know the interpretation of common terms

- SAC- Services Accounting Code

- HSN-Harmonized System Nomenclature

- GSTIN-Goods and Services Tax Identification Number

- SGST-State Goods and Services Tax

- CGST-Central Goods and Services Tax

- UTGST-Union Territory Goods and Services Tax

- IGST-Integrated Goods and Services Tax

- This Application form is formulated to lodge A SINGLE COMPLAINT only about any good and service. In case of multiple complaints about Goods/Services, you are required to furnish separate form accordingly for each one.

- After Accepting the application form successfully, for further detailing and any required information the applicant is liable to furnish any further information as per the requirement of the government.

- The application without prescribed necessary document attachment and working sheets will be treated as an invalid application.

- Attaching all the required information, sheets and document are important.

- Furnished application form with prescribed format should be sent to State level Screening Committee (if the problem is of local nature) or to Standing Committee.

- Sent the application to the mentioned address:

- Contact details of State Screening Committee on Anti-profiteering:

Details Of Anti-profiteering Screening Committee In States / UT is available at goo.gl/eYJXnK - Contact details of Central Standing Committee on Anti-profiteering:

2nd Floor, Bhai Vir Singh Sahitya Sadan, Bhai Vir Singh Marg, Gole Market, New Delhi-110 001. Tel No.: 011-23741537

Fax. No.: 23741542, E-mail: anti-profiteering@gov.in

- Contact details of State Screening Committee on Anti-profiteering:

- The field with asterisk (*) are mandatory fields to be furnished

Step-by-step Procedure To Fill Anti-Profiteering Complaint Form:

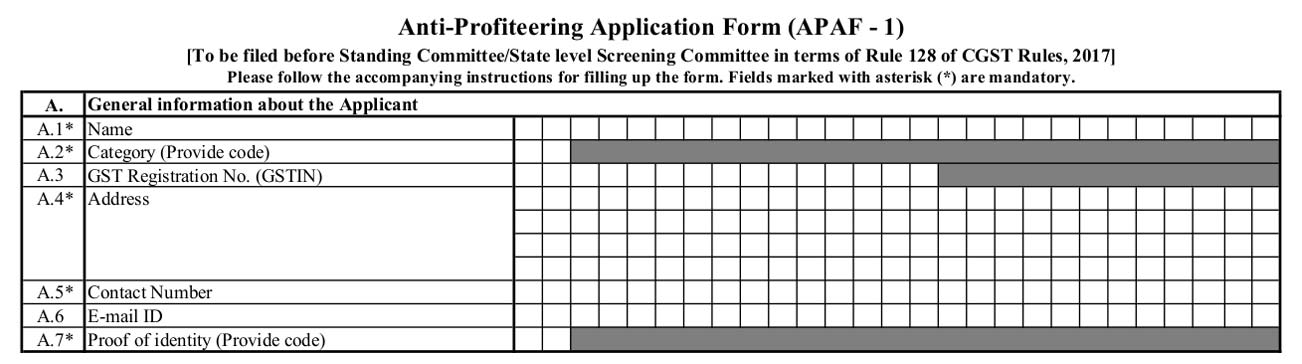

Part A: General Information About The Applicant: This head is fractionated into seven subparts which initiate from A1 to A7. This portion is all about the general information of the complainant.

- A1*- Name: The Name of the applicant must be as written on proof of identity which is attached to the application form.

- A2*- Category (Provide code): This title is required to fill with CODE of an applicant. The details about what code you need to furnish are here:

- 01: Fill code ‘01’ in case of ‘INTERESTED PARTY’ which includes suppliers or recipients of goods/services in relation to this application

- 02: Fill code ‘02’ in case of ‘COMMISSIONER’ at a reputed post

- 03: Fill code ‘03’ in case of ‘ANY OTHER PERSON’ than aforementioned category

- A3- GST Registration No. (GSTIN): It takes the GSTIN number of complainant or applicant. The GSTIN no. is a 15 digit alphanumeric number which is allocated to the registered taxpayer under GST regime.

- A4*- Address: Furnish the ADDRESS details of the APPLICANT in this field.

- A5*- Contact Number: Furnish the CONTACT NUMBER details of the APPLICANT in this field

- A6- E-mail ID: Fill the E-mail ID of the APPLICANT in this heading.

- A7*- Proof of identity (Provide code): This field requires a code of any attachment identity proof mentioned below:

- Write Code ‘01’ if the proof of identity is ‘Aadhaar Card issued by the Unique Identification Authority of India’

- Write Code ‘02’ if the proof of identity is ‘Voter ID’

- Write Code ‘03’ if the proof of identity is ‘Permanent Account Number (PAN) card’

- Write Code ‘04’ if the proof of identity is ‘Driving Licence’

- Write Code ‘05’ if the proof of identity is ‘Passport’

- Write Code ‘06’ if the proof of identity is ‘Ration card having photograph of the applicant’

- Write Code ‘07’ if the proof of identity is ‘Any other proof of Identity (Specify)’

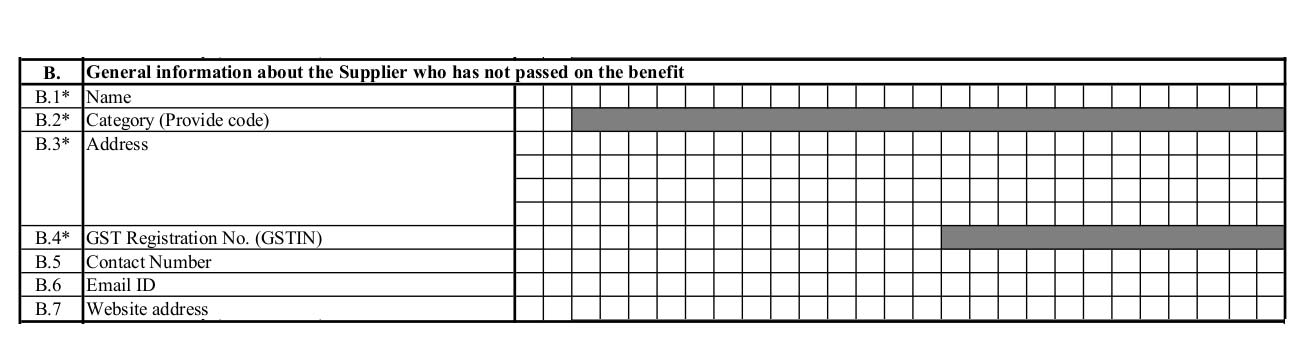

Part B: General information about the Supplier who has not passed on the benefit: This field takes the information about the business/entity/supplier who did not pass the benefit of reduced GST rates to end users. Part B is divided into seven subparts.

- B1*-Name: Enter the name of supplier/Manufacturer/Trader as mentioned in the supporting documents like Invoice etc.

- B2*-Category (Provide code): This title is required to fill with Supplier CODE. The details about what code you need to furnish are here:

- 01: Fill code ‘01’ in case of ‘MANUFACTURER’

- 02: Fill code ‘01’ in case of ‘SERVICE PROVIDER’

- 03: Fill code ‘01’ in case of ‘TRADER’

- 04: Fill code ‘01’ in case of ‘Others (Specify)’

- B3*-Address: Furnish the ADDRESS details of the SUPPLIER in this field.

- B4*-GST Registration No. (GSTIN): It takes the GSTIN number of the SUPPLIER. The GSTIN no. is a 15 digit alphanumeric number which is allocated to the registered taxpayer under GST regime.

- B5-Contact Number: Furnish the CONTACT NUMBER details of the APPLICANT in this field

- B6-Email ID: Fill the E-mail ID of the APPLICANT in this heading.

- B7-Website address: if the website address of SUPPLIER is available, then you can fill in this field.

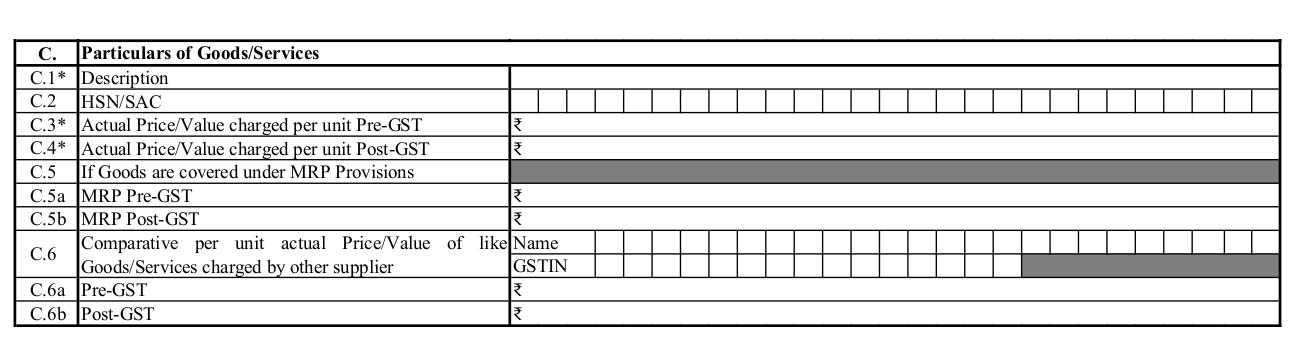

Part C: Particulars of Goods/Services: This field requires information about goods and services which profiteered by the supplier.

- C1*-Description: Mention the conduct of goods/services as described in invoice/price list etc.

- C2-HSN/SAC: Mention HSN/SAC of goods/services as described in invoice/price list/GST rate list etc.

- C3*-Actual Price/Value charged per unit Pre-GST: Mention Pre-GST actual price/value charged per unit of the goods/service (of the same quantity) regarding any discount/rebate provided by the supplier.

- C4*- Actual Price/Value charged per unit Post-GST: Mention Post-GST (current) actual price/value charged per unit of the goods/service (of the same quantity) regarding any discount/rebate provided by the supplier.

- C5- If Goods are covered under MRP Provisions: Provide the details in below subcategories of C5

- C5a- Mention Pre-GST MRP of the goods printed on the pack of the goods of the same quantity.

- C5b- Mention Post-GST (current) MRP of the goods printed on the pack of the goods of the same quantity.

- C6- Comparative per unit actual Price/Value of like Goods/Services charged by other suppliers: Provide the name and GSTIN of other suppliers.

- C6a- Pre-GST: Mention Pre-GST actual price/value charged per unit of the like goods/service after regarding any discount/rebate provided by other suppliers.

- C7b- Post-GST: Mention Post-GST (current) actual price/value charged per unit of the like goods/service regarding any discount/rebate provided by other suppliers.

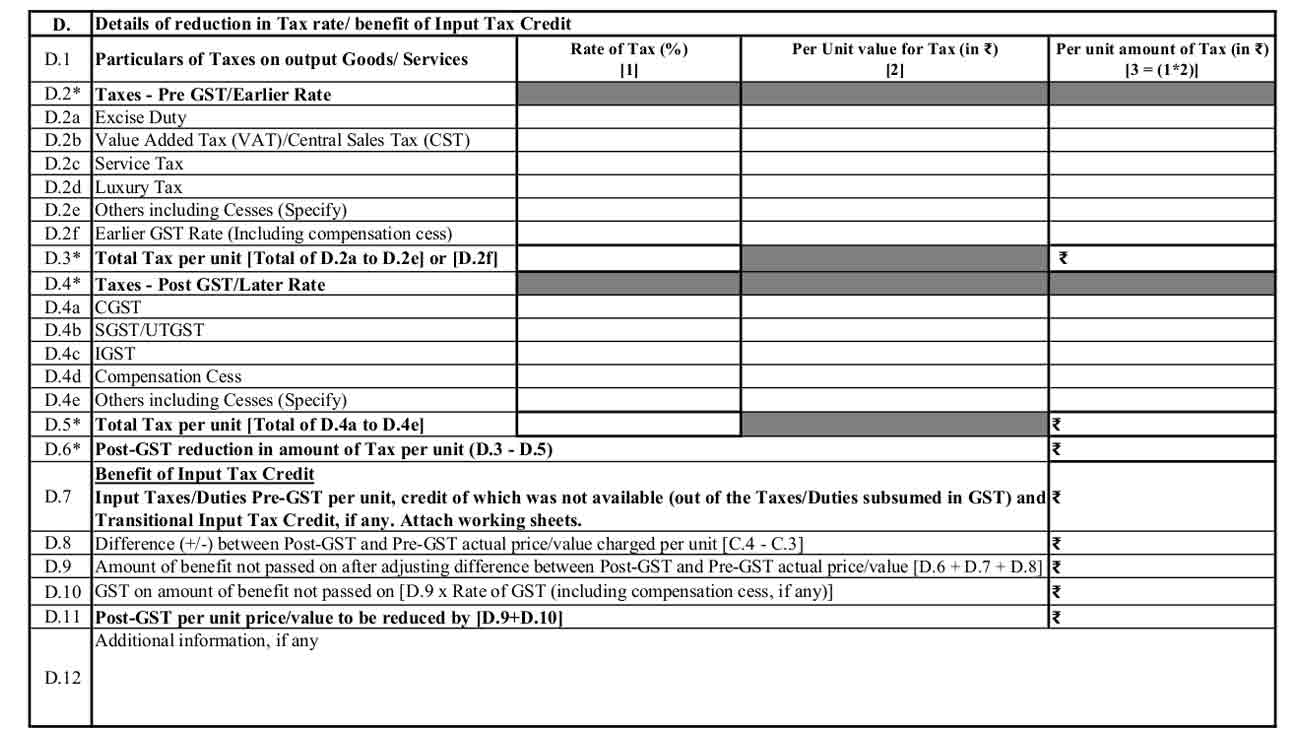

Part D: Details of reduction in Tax rate/ benefit of Input Tax Credit

- D1- Particulars of Taxes on output Goods/ Services: This field just shows the heading of the below-mentioned category.

- D2*- Taxes – Pre GST/Earlier Rate: Mention the Rate of Pre-GST Indirect Taxes (For example Value Added Tax, Excise Duty, Service Tax, Central Sales Tax, Luxury Tax etc.) or previous Goods & Service Tax (Including compensation cess) levied on the goods/services and the assessable/taxable/base amount per unit to the extent possible on which such rate of Indirect Taxes was imposed in arriving at effective Pre-GST amount of Tax per unit or previous GST (Including compensation cess) amount of Tax per unit.

- D2a- Excise Duty- Fill the information about Rate of tax(%), Per Unit value for Tax (in Rs.), and Per unit amount of Tax (in Rs.)

- D2b- Value Added Tax (VAT)/Central Sales Tax (CST)- Fill the information about Rate of tax(%), Per Unit value for Tax (in Rs.), and Per unit amount of Tax (in Rs.)

- D2c- Service Tax: Fill the information about Rate of tax(%), Per Unit value for Tax (in Rs.), and Per unit amount of Tax (in Rs.)

- D2d- Luxury Tax: Fill the information about Rate of tax(%), Per Unit value for Tax (in Rs.), and Per unit amount of Tax (in Rs.)

- D2e- Others including Cesses (Specify): Fill the information about Rate of tax(%), Per Unit value for Tax (in Rs.), and Per unit amount of Tax (in Rs.)

- D2f- Earlier GST Rate (Including compensation cess): Fill the information about Rate of tax(%), Per Unit value for Tax (in Rs.), and Per unit amount of Tax (in Rs.)

- D3*- Total Tax per unit [Total of D.2a to D.2e] or [D.2f]: Fill the information about Rate of tax(%) and Per unit amount of Tax (in Rs.)

- D4*- Taxes – Post GST/Later Rate: Mention the GST Rates under IGST, CGST, SGST/UTGST, Compensation Cess and other indirect taxes applicable after tweaks in GST Rates, if any by Central Government on recommendation of Goods & Services Tax Council after GST rollout applicable on the goods/services and the assessable/taxable/base amount per unit on which such rate of Indirect Taxes are imposed in arriving effective Post-GST/later GST amount of Tax per unit.

- D4a- CGST: Fill the information about Rate of tax(%), Per Unit value for Tax (in Rs.), and Per unit amount of Tax (in Rs.)

- D4b- SGST/UTGST: Fill the information about Rate of tax(%), Per Unit value for Tax (in Rs.), and Per unit amount of Tax (in Rs.)

- D4c- IGST: Fill the information about Rate of tax(%), Per Unit value for Tax (in Rs.), and Per unit amount of Tax (in Rs.)

- D4d- Compensation Cess: Fill the information about Rate of tax(%), Per Unit value for Tax (in Rs.), and Per unit amount of Tax (in Rs.)

- D4e- Others including Cesses (Specify): Fill the information about Rate of tax(%), Per Unit value for Tax (in Rs.), and Per unit amount of Tax (in Rs.)

- D5*- Total Tax per unit [Total of D.4a to D.4e]: Fill the information about Rate of tax(%) and Per unit amount of Tax (in Rs.)

- D6*- Post-GST reduction in the amount of Tax per unit (D.3 – D.5): Provide the Post GST reduction in Tax per unit by reducing Post-GST tax amount per unit from Pre-GST tax amount per unit as computed above.

- D7- Input Taxes/Duties Pre-GST per unit, the credit of which was not available (out of the Taxes/Duties subsumed in GST). Attach working sheets: Mention and enclose working sheets for calculation of the Input Taxes/Duties Pre-GST per unit, the credit of which was not available to the supplier before GST rollout (out of the Taxes/Duties subsumed in GST, the list is given below):

- Central Excise duty

- Duties of Excise (Medicinal and Toilet Preparations)

- Additional Duties of Excise (Goods of Special Importance)

- Additional Duties of Excise (Textiles and Textile Products)

- Additional Duties of Customs (commonly known as CVD)

- Special Additional Duty of Customs (SAD)

- Service Tax

- Central Surcharges and Cesses so far as they relate to supply of goods and services

- State VAT

- Central Sales Tax

- Luxury Tax

- Entry Tax (all forms)

- Entertainment and Amusement Tax (except when levied by the local bodies)

- Taxes on advertisements

- Purchase Tax

- Taxes on lotteries, etc.

- State Surcharges and Cesses so far as they relate to supply of goods and services.

- Note:

- Do not attach information of Taxes/Duties, the credit of which was available prior to GST and mention the details only regarding Input Taxes/Duties, the credit of which was not available to the supplier before GST rollout.

- Also, mention Transitional Input Tax Credit accepted in terms of Section 140(3) of CGST Act, 2017 read with Rule 117 of CGST Rules, 2017 which is not given to the recipient.

- D8- Difference (+/-) between Post-GST and Pre-GST actual price/value charged per unit [C.4 – C.3]: Mention the tweaks in actual price/value charged per unit by reducing Actual price/value charged per unit Pre-GST (C.3) from Actual price/value charged per unit Post-GST (C.4).

- D9- Amount of benefit not passed on after adjusting difference between Post-GST and Pre-GST actual price/value [D.6 + D.7 + D.8]: Mention the total amount of profits not given on by adding Post-GST price decrease in amount of Tax per unit (D.6) plus Post-GST profit of Input Tax Credit per unit on inputs (D.7) + Difference (+/-) between Post-GST and Pre-GST actual price/value charged per unit (D.8).

- D10- GST on amount of benefit not passed on [D.9 x Rate of GST (including compensation cess, if any)]: Mention the ‘GST on amount of benefit not passed on’ by multiplying amount of Profit not given on as computed in D.9 and total GST rate (in %) computed in D.5.

- D11- Post-GST per unit price/value to be reduced by [D.9+D.10]: Mention the Post-GST per unit price/value to be decreased from actual price/value charged per unit Post-GST

by adding D.9 & D.10 as computed above. - D12- Additional information, if any: If there is any additional information regarding the tax rate and Input Tax Credit, the applicant can mention them here.

After furnishing the details in the Anti-Profiteering Complaint Form, the applicant needs to attach Self-attested copies of all documentary shreds of evidence like an invoice, proof of identity, detailed working sheet, Price List, etc. At the end of the application form, the applicant is required to sign the declaration with mentioning place and date of the present event.

First Anti profiteering Notices Released to Companies

In a recent drive to find out the entities which are illegally mining profits out of tax rates after GST, the finance ministry and the standing committee has issues Anti profiteering notices to 5 business units in concern with the complaints which have stated that these entities has made illegal profits even after the tax rates have been slashed.

DG safeguards have released notices against Hardcastle restaurants, Mcdonalds, Lifestyle retailer, Jaipur based Sharma trading and Pyramid Infratech in the issues raised by the customers of their which have alleged that the said units have charged higher taxes even when in the recent notification released by the government made some tax benefits to the consumers.

The standing committee has decided to take strict actions against these entities and may apply applicable penalty regarded in the provision of Anti profiteering committee.

Government to Introduce Standard Operating Procedure

Under the Goods and Services Tax (GST) scheme, there are a growing number of anti-profiteering complaints and in wake of this, the Finance Ministry is in the process of obtaining a ‘standard operating procedure’ which is said to soon deal with such complaints. The government has created dual committees including a screening committee to register complaints of the consumers against the businessmen who have illegally benefited from the reduction of tax but have not passed the same to the consumer in the form of price reduction.

So far, 170 complaints have come in front of the committee out of which 50 of the complaints received have been sent to the Directorate General of Defense (DGS) for further investigation and the investigation of 5 of them has already been started. According to sources, the Ministry of Finance is preparing a standard operating procedure (SOP) to deal with this situation. There will be some guidelines for dealing with grievances of consumers for the Standing Committee and the Screening Committee.