What is the MCA LLP Form 8

MCA form LLP 8 or statement of account and solvency composes a filing which should be furnished every year by all Limited Liability Partnerships (LLPs) enrolled in India. No matter what the turnover of the LLP is, Form 8 must be filed with the Ministry of Corporate.

LLP Form 8 Due Date Under MCA

30th October of each financial year would be the last date to furnish the LLP. If an individual would not be able to furnish the MCA LLP Form 8, heavy penalties can be imposed as stated below. Moreover, to file LLP Form 8, all LLPs should furnish LLP Form 11 before 30th May of each fiscal year.

Download a Free Trial of V3 LLP 8 Filing Software

MCA LLP Compliance Chart

All LLPs enrolled in India should furnish the mentioned forms in each fiscal year, whatever be the profits or turnover of the business.

- Filing of MCA LLP Form 11 – Annual Return – Due on 30th May

- Filing of LLP Form 8 under MCA- Statement of Account and Solvency – Due on 30th October

- ITR-5 – Income Tax Return for LLP – Due on 31st July if Tax Audit not needed. Due on 30th September, if a Tax Audit is needed.

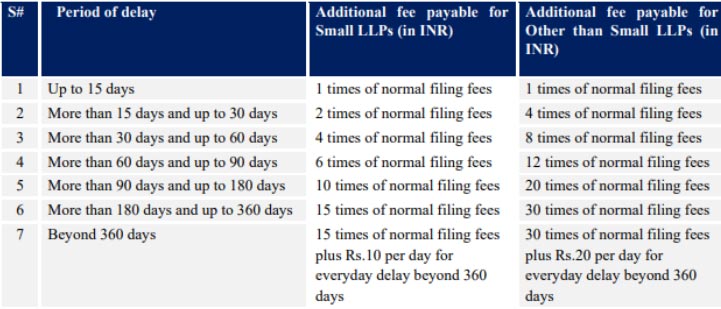

Penalty for Non-filing of MCA LLP Form 8

When the LLP is unable to furnish Form 8 within a specified time period, then a penalty of an additional fee would be applicable as per the table given below, subject to pay from the last date of filing of Form 8 till the actual filing of the Form.

Essential Points:

- Every LLP enrolled on or before 30th September is required to furnish a statement in MCA LLP Form 8 towards the fiscal year ending on 31st March.

- The due date to furnish LLP Form 8 for the Financial Year ending on 31st March 2026 would be 30th October 2026.

- Filing fees for Form 8 are mentioned below:

| LLP Form 8 Contribution | Penalty |

|---|---|

| Up to INR 1 Lakhs | INR 50 |

| More than INR 1 Lakhs up to INR 5 Lakhs | INR 100 |

| More than INR 5 Lakhs up to INR 10 Lakhs | INR 150 |

| More than INR 10 Lakhs up to 2,500,000 | INR 200 |

| More than 2,500,000 up to 100,00,000 | INR 400 |

| More than 100,00,000 | INR 600 |

The same must be known that, for the foreign limited liability partnership, the filing fee of Form 8 is Rs 1000.

Account and Solvency Statement

MCA Form 8 is also called Statement of Account & Solvency. In Form 8, the LLP should furnish information on the financial transactions within the fiscal year and the position to finish the fiscal year. Moreover, in the fiscal part, the LLP should mention the:

- Show that the turnover exceeds or less than Rs 40 lakhs.

- Show that the LLP has previously furnished a statement showing the creation of charges or modification, or satisfaction till the current fiscal year.

- Show that the partners or authorised representatives have opted for effective handling and responsibility to maintain enough accounting records and preparation of accounts.

Attachments with LLP Form 8

The below-mentioned documents should be attached to Form 8:

- Mandatory: Disclosure under Micro, Small and Medium Enterprises Development Act, 2006.

- Towards the emergency liabilities, a statement of contingent liabilities needs to be attached.

- Any additional details will be given as an optional attachment.

Chartered Accountant and Partners Signature

Form 8 needs to be digitally signed by a minimum of two Designated Partners of the LLP or Authorised Representatives of a Foreign LLP. Moreover, when the total turnover of the LLP is more than Rs 40 lakhs or partners’ responsibility for the contribution of more than Rs 25 lakh, then Form 8 must be certified by the auditor of the LLP/ FLLP. or, the digital signature of a minimum of two Designated Partners would be enough.

Step-by-Step to Produce MCA LLP 8 Form

Step 1: Open the MCA V3 homepage

Step 2: Log in to the MCA portal with genuine credentials

Step 3: Click MCA services and then choose LLP E-Filing

Step 4: Select Form 8 – Statement of Account & Solvency

Step 5: Checkmark the option Statement of Account & Solvency

Step 6: Input LLP Information

Step 7: Complete the application

Step 8: Click on submit form after successful save at each step.

Step 9: SRN is generated after submitting the form. (The SRN can be operated by the user for any forthcoming resemblance with MCA.)

Step 10: Download the webform and affix the DSC.

Step 11: Upload the DSC affixed pdf document to MCA V3 portal

Step 12: Pay Fees (In point the user does not modify or successfully upload the DSC affixed PDF within 15 days of SRN generation and complete the payment within 7 days of successful upload of DSC affixed document or due date of filing of the form + 2 days, whichever is earlier, the SRN will be revoked/ cancelled.)

Step 13: Download the paid Challan/ Acknowledgement.

FAQs on LLP Form 8 Under MCA

Q.1 – What do you mean by MCA LLP Form 8?

LLP Form 8 is an Annual Filing Form that is needed to file along with ROC every year. The same is a statement of accounts and solvency. The same Form poses a declaration on the basis of the solvency of the LLP by the designated partners and indeed the data concerned to the statement of assets and liabilities and statement of the income and expenditure of LLP. the same forms need to be furnished via LLP on a yearly grounds.

Q.2 – Who must furnish LLP Form 8?

Every LLP existing or started on or before 30th September will need to furnish Form 8 before 30th October.

Q.3 – Who is privileged from filing Form 8 LLP?

LLPs started on or after 1st October 2018 are privileged from furnishing Form 8 for the fiscal year ended 31st March. but, they may voluntarily file Form 8.

Q.4 – What are the requirements for filing the statement of accounts and solvency and what will be the Form 8 attachment?

- 1) Requirement:

- Digital Signature of Both Designated Partners and knowledge of basic details of the LLP. When the turnover of LLP is more than Rs 40 lakhs or partners’ contribution is more than Rs 25 lakh, then the certification by the auditor of the LLP/FLLP is essential.

- 2) Attachment:

- Copy of Balance Sheet and Profit & Loss Account of the LLP, Disclosure under MSME, 2006, and Statement of Contingent Liabilities not given for, if exists.

Q.5 – Could Form 8 of LLP be amended once it has been furnished?

No. there is no choice but to amend Form 8 once it gets furnished. Thus, much more care should have opted during the filing of LLP Form 8.