ITR 7 can be filed by any person, including companies who are required to furnish a return under section 139(4A) or section 139(4B) or section 139(4C) or section 139(4D)

Important Points to Know While Furnishing the ITR-7

- No additional documents, paperwork, or TDS certificates are needed to be submitted or affixed to the return form

- When the documents are affixed with the return form, then they will be sent back to the applicant who has furnished the same return

- The same is to be noted that the assessee matches the taxes deducted, collected or paid through them, including their tax credit statement Form 26AS

Why So Difficult to File the ITR 7 Form?

The ITR 7 is much more different than the general ITR i.e. 1,2,3,4 etc as its schedule is not similar to these general IT forms. This ITR 7 return form is particularly filed by the trusts and institutions which is generally not filed on a common basis, therefore, making it hard to understand its filing requirements.

The department brings multiple variances in the ITR 7 compared to other general ITR forms, as it has been non-standard for the assessee in its filing.

How to Make Easy Filing of ITR 7 by Gen IT Software?

View here the easy steps of filing the income tax return form 7 through Gen IT Software. The income tax software makes it simpler for Indian chartered accountants and tax professionals

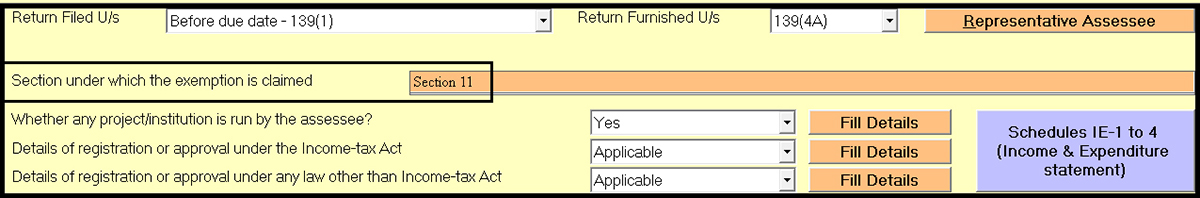

When the Taxpayer Claims the Exemption Under Section 11

The section under which the exemption is claimed must be chosen as section 11 inside the Schedule Part A, General

Step 1: Go to General Information – Select the section under which the exemption is claimed

The registration information under section 12A/12AA must be furnished in the Schedule Part-A General.

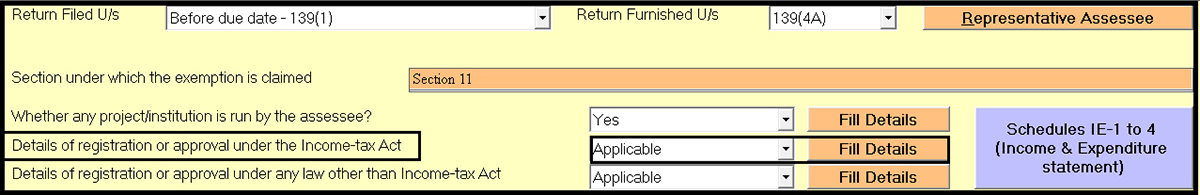

Step 2: Go to General Information – Fill Details of “Details of registration or approval under Income Tax Act”

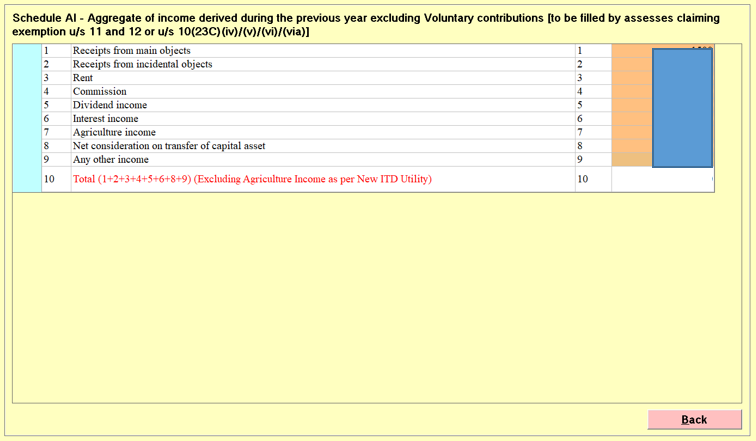

Taxpayers’ income must be reported in the Schedule-AI and/or Schedule-VC

Step 3: Go to Application of Fund – Aggregate of Income Referred – Click on the 3 dots, then fill in the details

Note: The donation income must be reported in schedule-VC (Voluntary contribution), and income excluding the donation must be furnished in schedule AI.

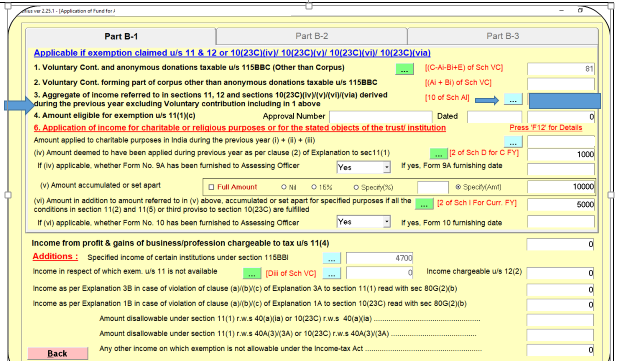

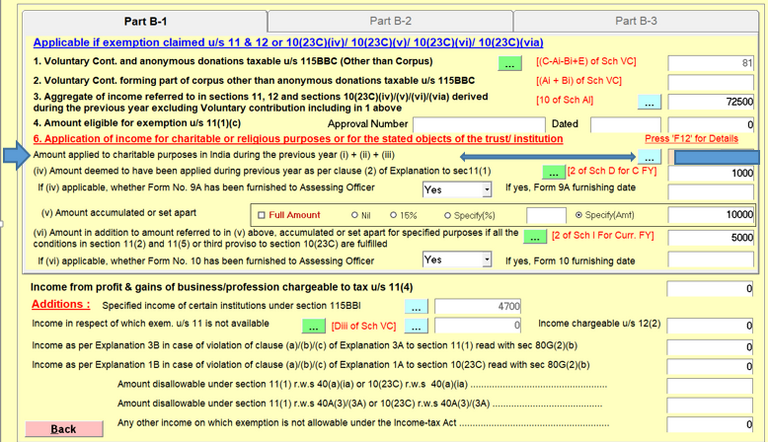

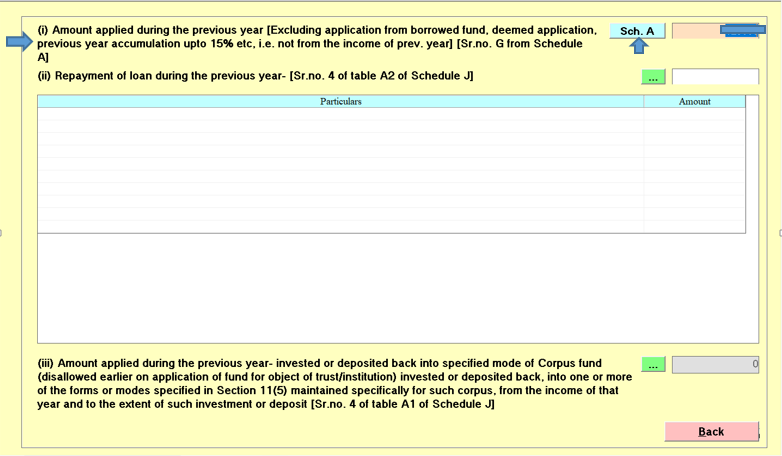

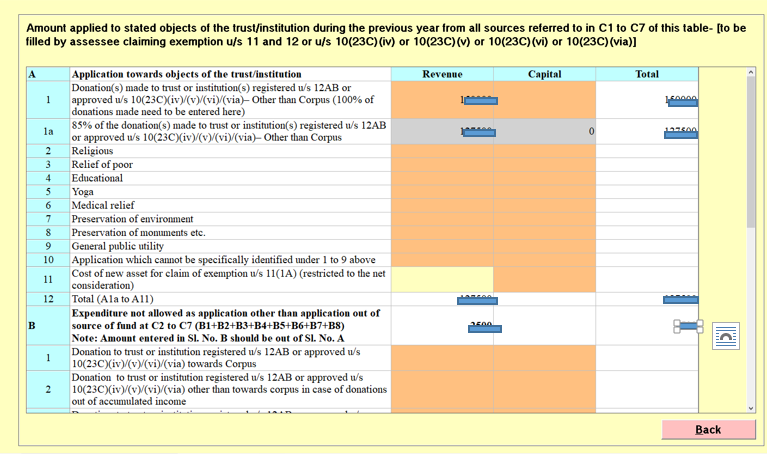

Step 4: Go to Application of Fund -> then Part B-1 Point No. 6, click on 3dots -> Where Schedule A is given in Point (I), click on Sch. A

-> Fill here the Amount of

Expenditure(Revenue/ Capital Expenditure)

Schedule A

Accordingly, point no. (ii) Repayment of loan during the previous year and point no. (iii) The amount applied during the previous year can be filled.

Note: The trust cannot claim the Total Application of income for Charitable or religious purposes or for the stated object of the trust/institution to exceed the Aggregate of income.

- The section under which the return is furnished must be selected as 139(4A)

- When the total income of the trust or institution (without giving effect to the provisions of section 11 and section 12) exceeds the Basic Slabs Limit, then the audit report in Form 10B under income tax is to be furnished 1 month before the due date given u/s 139(1) as per Section 44AB

- When the taxpayer claims for TDS credit and the respective income has been reported in Schedule-AI, then in Schedule TDS, Schedule-AI should be selected as Income Head

- When the exemption under explanation 11(1)-Deemed Application is claimed – Form 9A must be furnished within the due date as provided u/s 139(1)

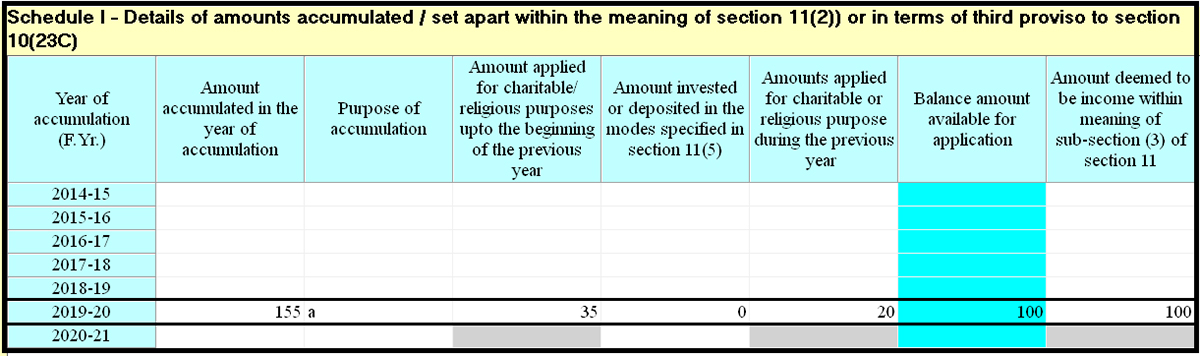

- Under section 11(2), when the exemption for the accumulation is claimed, Form 10 and income return must be furnished within the due date as provided u/s 139(1)

- When there is any amendment in the objects or activities in the year, the taxpayer needs to make the application for the newer enrollment within 30 days under section 12A(1)(ab). The same details must be given in the schedule Part A General(2)

- But when the percentage of the receipts of these activities exceeds 20% of the total receipts of the trust or institutions, then there would be no permit for the exemption u/s 11 under section 13(8)

Major Points Need to be Recognised

- In ITR 7, there is no concept for furnishing the Balance Sheet and P&L A/c

- In ITR 7, Schedule HP, Schedule BP, Schedule OS, and Schedule CG must be furnished only when the taxpayer has taxable income

- Selection of the section under which the exemption is claimed is essential

Significant Errors During ITR Filing

- The taxpayer is claiming the exemption; however could not furnish the registration or the approval details in the scheduled part-A General.

- Assessee registered under section 12A/12AA; however, he does not file the Audit Report in Form 10B within the given time.

- The wrong report was furnished by the taxpayer the taxpayer is registered u/s 12A/12AA but the Audit Report is filed in Form 10BB instead of Form 10B.

- The taxpayer is subjected to furnish the Form 9A however he does not file the Form 9A on the due date u/s 139(1) – Exemption claimed does not permit.

- The exemption under section 11(2) for accumulation is claimed, however, Form 10 and the income return were not furnished within the due date as provided u/s 139(1)

Audit Report E-filing Form 10B Under IT

Under section 12A(1)(b) of the Income Tax Act (up to the assessment year 2019-20) when the sum of income of the trust or the institutions is more than the basic slab and these trusts or institutions are subjected to the audit and to file the Form 10B including the return. (from the assessment year 2020-21) The Act gets revised from the Assessment year 2020-21.

Under section 12A(1)(b) r.w.s. 44AB audit report in Form 10B would be furnished one month before the last date of filing the return of the income under sub-section 1 of section 139.