What is the Income Tax Form 10EE for Pensioners?

The income tax portal has updated the system towards Form 10EE pensioners form (‘Taxation of income through retirement benefits account maintained in a reported country’) to get furnished in following the rule 21AAA for Financial Year 2023-24 would be available to file upon the portal of income tax. If you come beneath the same then you should file the 10-EE form within the mentioned due date.

Submit Query for Income Tax Compliance Software

Income Tax Exemption Under Section 10(10C)

Under the voluntary retirement scheme, any money obtained as per the mentioned rules would get exempted up to a maximum limit of Rs 5 lakhs beneath section 10(10C).

NRI Details Required Under Form 10EE

In the income tax return, the assessee would be required to select the pensioner’s option for the ‘Nature of Employment’ under the salary schedule. The pension income taxable as ‘salary’ would need to be reported by mentioning the name, address, and tax collection account number (TAN) of the employer and the Tax Deducted at Source (TDS) afterwards.

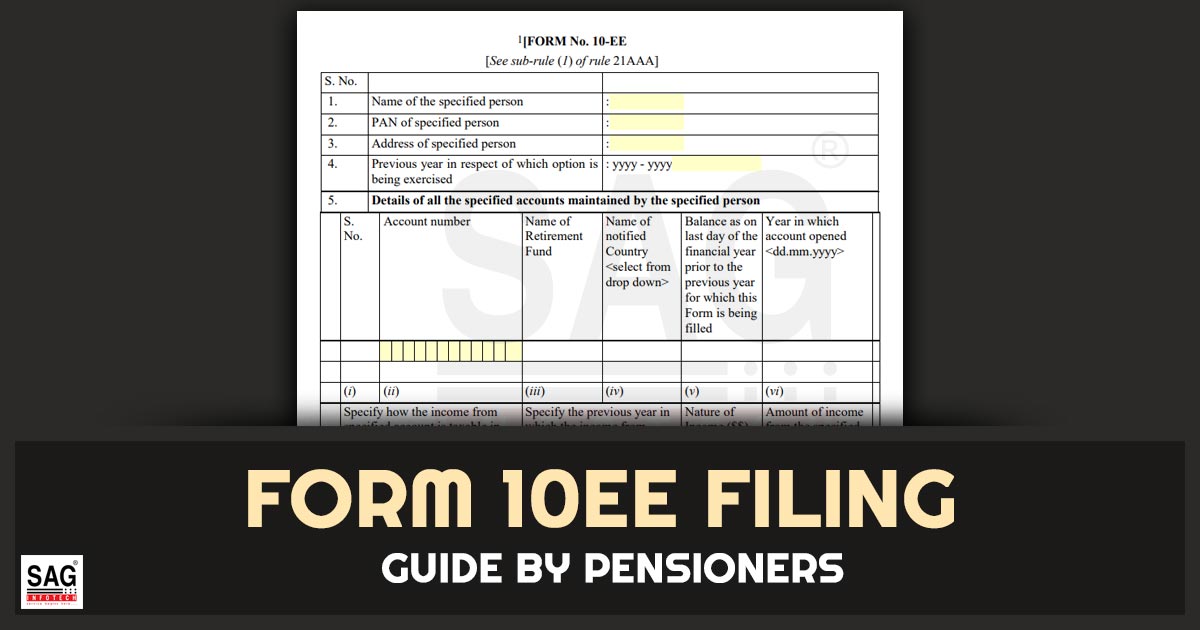

Rule 21AAA & Form 10-EE CBDT Notification No. 24/2022

CBDT Notifies Rule 21AAA and Form 10-EE to Provide Relief to NRI from Double Tax on Foreign Retirement Funds

CBDT vide Notification No. 24/2022 dated 4th April 2022 in G.S.R. 256(E) via Income-tax (6th Amendment), Rules, 2022 reports Rule 21AAA to furnish the relief via taxation of income through retirement advantages account maintained in a reported country as per the provisions of section 89A of the Income-tax Act, 1961 (‘Act’). Additionally, the relief is needed to be claimed in Form 10-EE.

With effect from the assessment year 2022-23, the same Rule 21AAA and Form 10EE will be inserted in the Income-tax Rules, 1962 (‘Rules’).

What is Income Tax Section 89A?

Finance Act, 2021 introduced section 89A to furnish relief via double taxation to non-resident Indians (NRIs) on money received in foreign retirement accounts that are maintained in an informed country.

Section 89A specified that the income of an individual through a specified account would be taxed in such way along with such year as might be specified via complaints and also expresses the expressions “specified person”, “specified account” and “notified country”.

According to IT section 89A, the government would notify rule 21AAA and Form 10EE to furnish relief to NRIs on income received in foreign retirement accounts held in a reported country.

Read Also: Easy Process of Filing 10E Form U/S 89(1) on New ITR Portal

According to the rule, if any income is received upon the foreign retirement accounts maintained in a reported country in the year 2023-24 (AY 2024-25) then the assessee would have the choice to postpone and consists of the income in the subsequent year where the income via foreign retirement accounts shall be taxed during the time of withdrawal or redemption.

The rule is, that income via foreign retirement accounts that are currently included in the total income and taxed in any subsequent year, would not be engaged in the total income of the assessee for any further duration and no credit for the foreign tax could be claimed.

When no tax is applied on the income in India considering the non-resident status of the taxpayer or due to the application of DTAA, if any foreign tax is paid after that, no credit upon the foreign tax paid on such types of income can be claimed in India.

An assessee would be needed to practice the option to all the foreign retirement accounts.

Electronic Filing of Form 10EE by Pensioners

The option to practice according to rule 21AAA(1) towards suspension of the income upon foreign retirement funds to the year of withdrawal/redemption via assessee, for any year related to the start of the assessment year, on or post to 1st day of April 2020, would be in Form No. 10-EE and the same would be filed through the electronic way beneath the digital signature or electronic verification code (EVC).

The option in Form 10E would need to be furnished on or before the last date for filing the income return mentioned beneath section 139(1) of the act.

The option once practised in form 10EE can not be withdrawn and would be applied to all subsequent previous years.

Towards the case, the same must be noted that CBDT vides Notification No. 25/2022 on 4th April 2022 has reported the following countries for the objective of claiming relief beneath section 89A read with Rule 21AAA:

| Si. no | Country name |

| 1 | Canada |

| 2 | United Kingdom of Great Britain and Northern Ireland |

| 3 | United States of America |

Read the full text of notification no 24/2022 dated 4th April 2022 on Rule 21AAA to furnish the relief to NRIs from Double Tax on Foreign Retirement Funds.