To avail of the advantages beneath section 89(1), filing a 10E Form is an essential part. Upon the income tax e-filing portal one can furnish this form online. An individual can log in to your account to access the form.

Income Tax Notice Concerning Non-filing of 10E Form

Within the fiscal year, 2014-15 in the assessment year 2015-16 the income tax department has proceeded with the importance of furnishing the Form 10E if one needs to avail advantage beneath section 89(1). The Assessee claiming for the relief beneath salary arrears section 89(1) however did not have furnished Form 10E possess received the income tax notice via the tax department under the mentioned criteria.

Submit Query of Tax Software for Filing Form 10E

Step by Step to File 10E Form

One can furnish Form-10E via the online system. Below is the mentioned procedure to furnish Form 10E online:

Step 1: Go to https://www.incometax.gov.in/iec/foportal/ with your User ID and password.

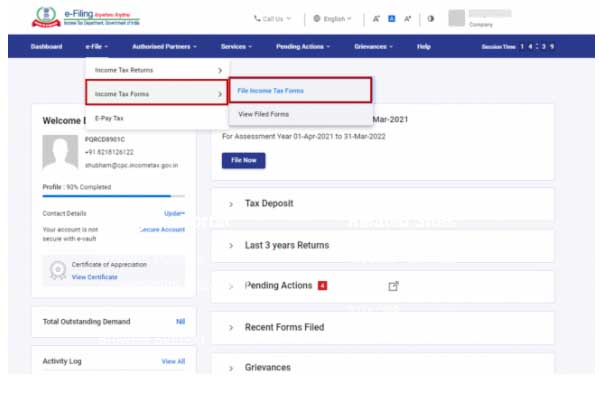

Step 2: Post logging in, tap e-File > Income tax forms > File Income Tax Forms.

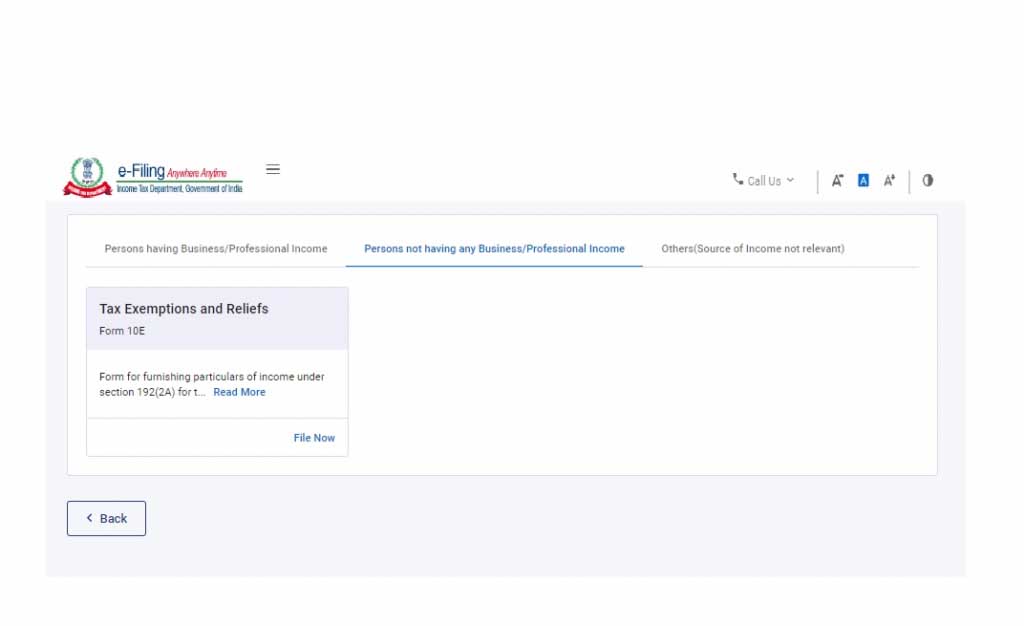

Step 3: The following screen will prompt. Tap on the ‘Persons who do not pose any business/professional income’ tab and then choose Form 10E.

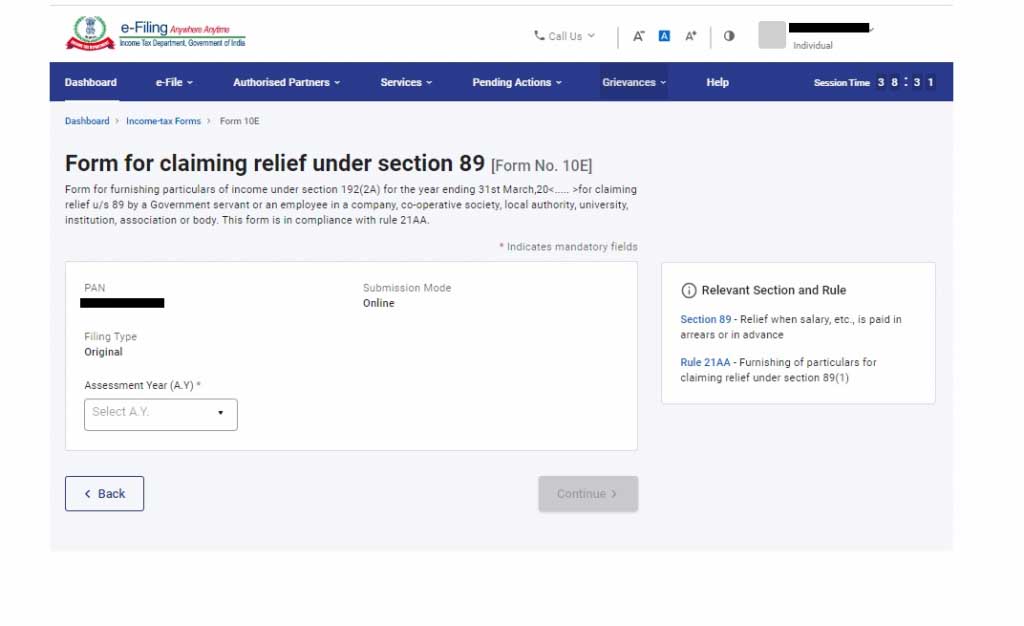

Step 4: The following screen prompts. Choose the assessment year and tap on the ‘Continue’ button.

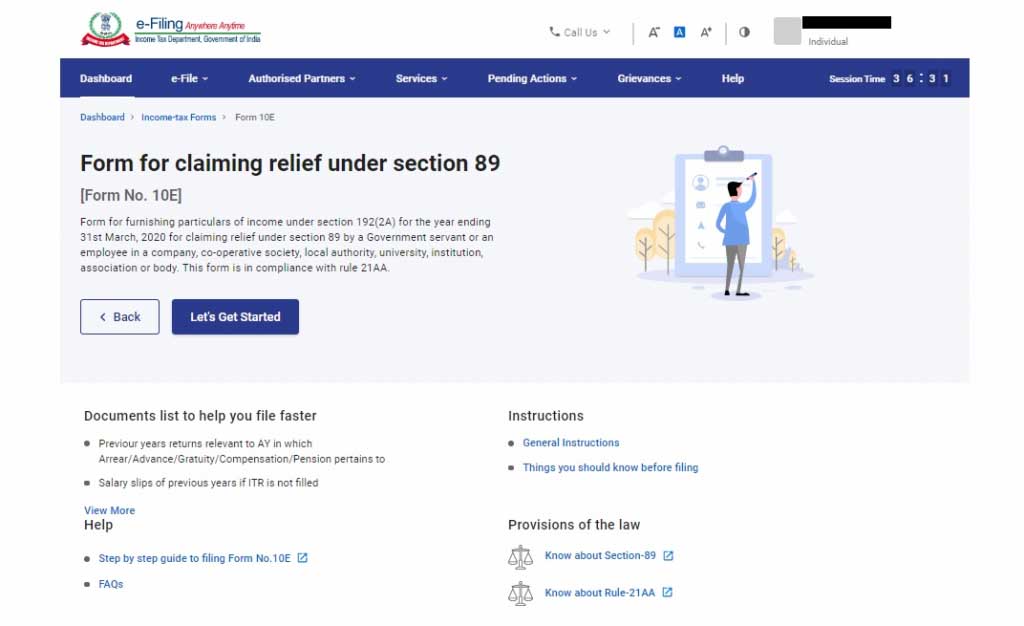

Step 5: The mentioned screen will resemble. Tap on the ‘Let’s Get Started’ button to begin filling out the form.

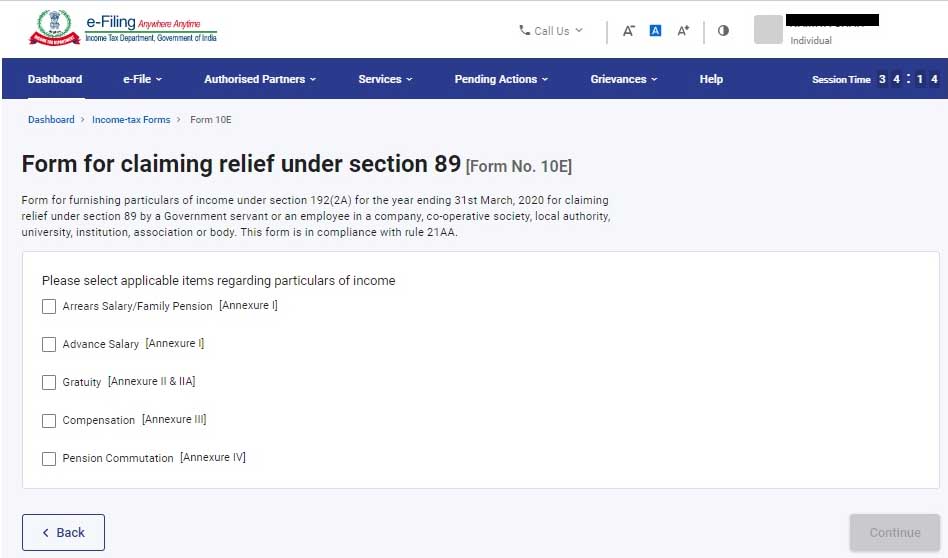

Step 6: After the above steps choose the related items relevant to the particulars of the income and then tap on the continue button.

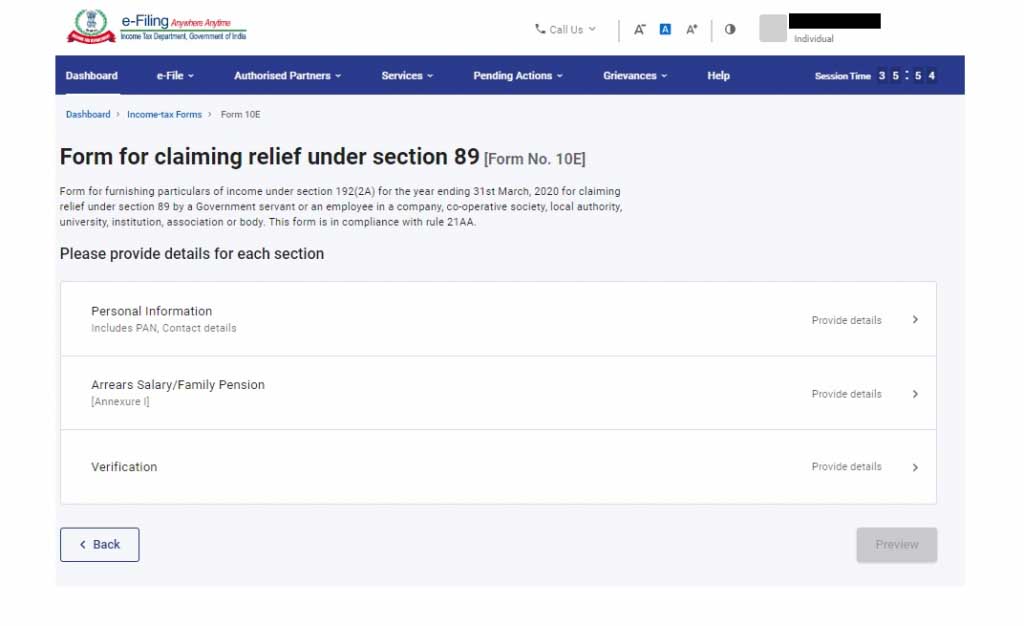

Step 7: On the subsequent screen tap on the links and then furnish the information for every section.

Step 8: Post the filing of the information inside the Form-10E, Just tap on the ‘Preview’ button.

Step 9: On the preview page, move to e-verify.

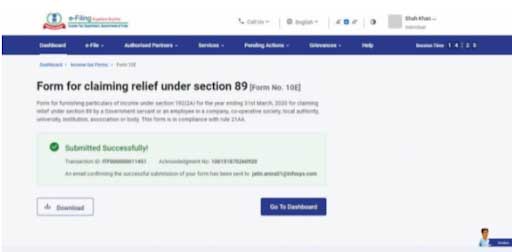

A message shall be shown on the completed submission of the form which displays the transaction ID as well as the acknowledgement receipt number. You can simply file the 10e form via Gen Income tax software as the software follows all the rules and guidelines of the government.

FAQs on Filing Form 10E

Q.1 – What does the term Form 10E Defines?

Beginning the Fiscal year 2014-15 i.e the assessment year 2015-16 the income tax department performed it important to furnish Form 10E when you are intended to avail the relief beneath section 89(1).

Q.2 – At Which Place Could I Furnish Form 10E?

Form 10E can be furnished online on the website https://www.incometax.gov.in/iec/foportal.

Q.3 – Which year of assessment assessee should prefer when filing Form 10E?

Opt the assessment year where the arrears are obtained by an individual. For instance, if the arrears are obtained in the fiscal year 2018-19 then opt for the assessment year 2019-20.

Q.4 – Did the taxpayer urge to submit Form 10E prior to the furnishing of the return or it needs to be submitted after furnishing of the ITR?

One should furnish Form 10E prior to furnishing the ITR. While if the person has submitted the return but not furnished Form 10E and availed for the relief beneath section 89(1) then there is a majority of chance that he shall receive a notice from the tax department urging him to furnish Form 10E.

Q.5 – Is there is a need for the assessee to attach a copy of Form 10E to my tax return?

Form 10E needs to be furnished online and no copy is needed to be attached to your tax return. If you have furnished Form 10E online then there is no document that is needed to be submitted to clear tax or the income tax department. There is no annexure return on ITR. But you need to make your credentials in a safe manner in your records in the case AO urges for the future.

Q.6 – Does the taxpayer require to submit Form 10E to my employer?

Your employer might urge for the confirmation of submission of Form 10E prior to managing the taxes and permitting the tax benefits. It is not important to furnish the same Form to the employer.