Simple Meaning of Revised ITR for Assessees

The purpose of a revised return is to correct any omissions or errors made when filing your original ITR. When you file a revised return, you simply file it again with the correct information. You must include details of the original return when filing a revised return.

Who is Eligible to File a Revised Income Tax Return?

A taxpayer who has filed an income tax return has the right to revise it under section 139(5) to provide the tax department with the correct information. It is possible to file a revised return even if you file a belated ITR, i.e. after the deadline has passed. In the past, taxpayers could only revise their ITR if they filed it before the deadline.

Last Date for Filing the Revised ITR

A revised ITR must be filed by December 31 of the relevant assessment year. The deadline for filing a revised ITR for FY 2025-26 (AY 2026-27) is 31st December, 2026.

What is the Maximum Number of Times to File a Revised Return?

You can file a revised return as many times as you like. Every time you file a revised return, you must provide details of your original ITR. It is possible to correct your mistake by revising your tax return, but this facility should not be misused, and utmost care should be taken when filing the original return.

Things to Consider When Filing Revised ITR

If you have filed a revised ITR, make sure that it has been verified. If your revised tax return is not verified, it will not be accepted by the income tax department. If you need to verify your revised income tax return, you have 6 different options available, i.e., e-verification through electronic methods, such as Aadhaar, OTP and EVC through net banking, or physical verification by mailing CPC, Bangalore, a signed copy of ITR-V.

Why Choose Gen IT Software for Revised ITR Filing?

Gen Income Tax Filing Software is an excellent solution for calculating Income Tax, Advance Tax, Self Assessment Tax, and Interest under sections 234B, 234A, and 234C. With Gen ITR e-filing software, you can quickly prepare and file income tax returns with accuracy, and it has the option of e-filing directly from the software.

There are all the industry-compulsory features available in the software for filing income tax returns, including the automatic selection of return forms, the XML or JSON generation of tax forms, the import of master data and income details, calculation of arrear relief and e-payment of challans with verification. Taxpayers and clients can find many other useful features included in the ITD (Income Tax Department) web services, including MAT/AMT calculation, income deductions summarisation, and quick ITR uploading.

Procedure to File Revised ITR Via Gen IT Software:

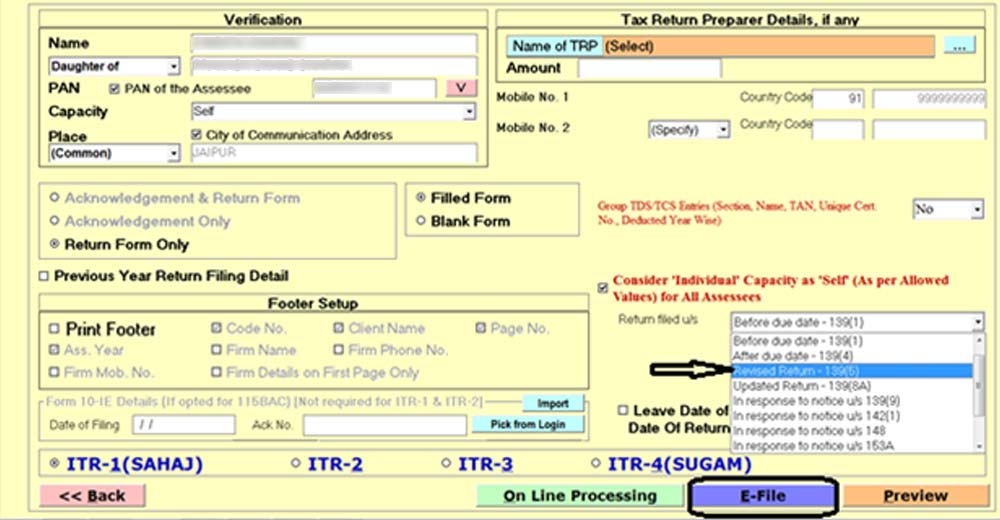

A revised ITR can be filed in the same way as an original one. You must file a revised ITR under section 139(5) of the Income-tax Act when filing a revised ITR. The option ‘Revised u/s 139(5)’ must be selected in the ‘return filed under’ column. ITR forms will also ask for details about the original ITR, such as the receipt number and date of filing.

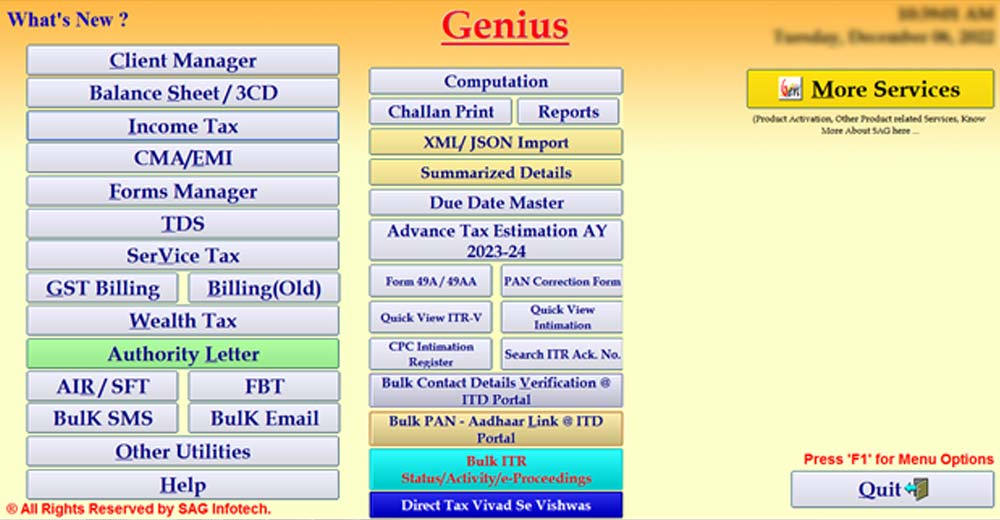

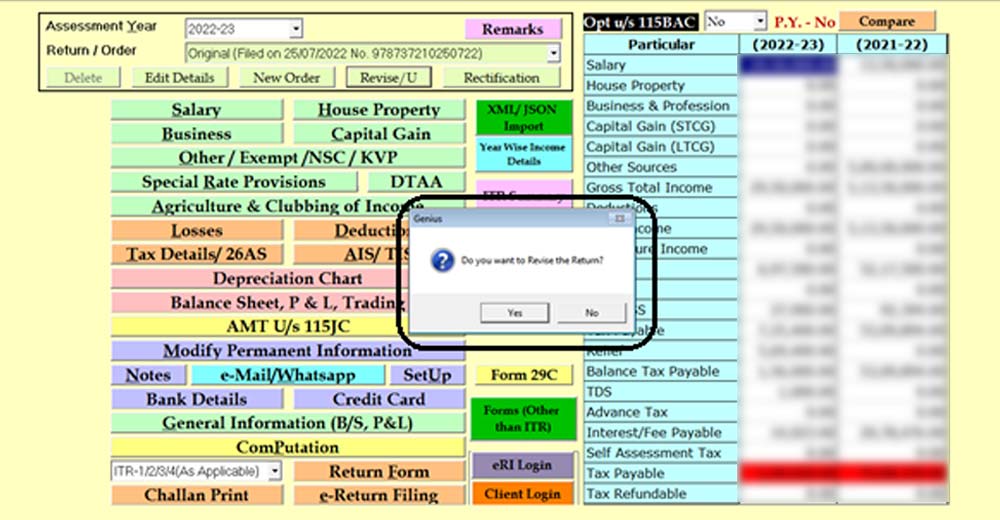

Step 1: First Install the Gen Income Tax Return Filing Software on your laptop and pc after that Go to ⏩ the ‘Income Tax->Computation’ Option as shown in the screenshot below.

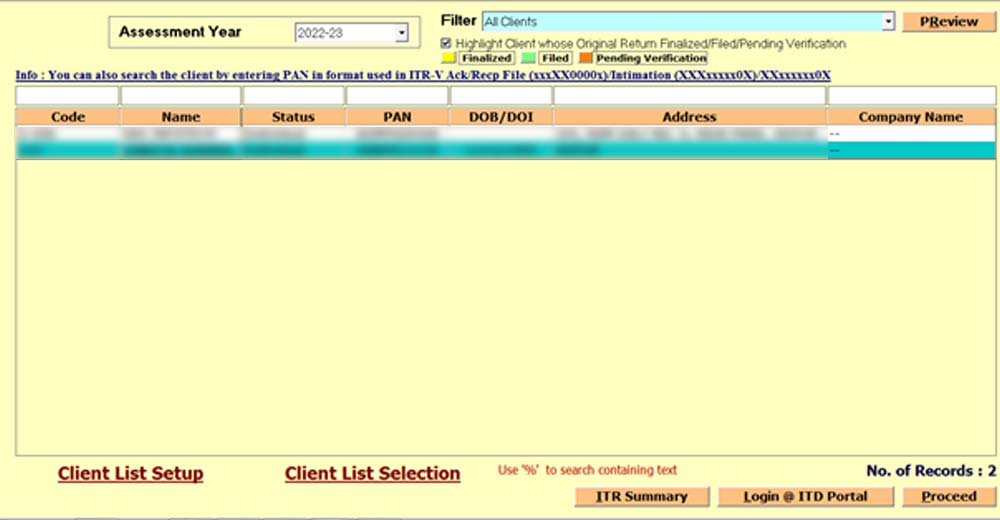

Step 2: Now select the client whose return you want to revise.

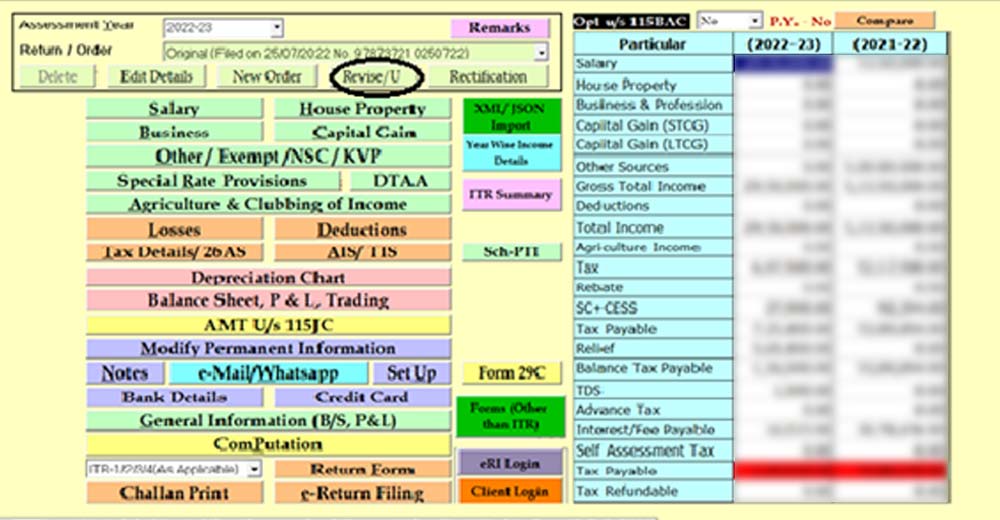

Step 3: After that Click on ⏩ the ‘Revise Return Tab’ in that Particular Client as shown below.

Step 4: A pop-up message will appear as shown below, asking whether you want to revise the Return. Click on ⏩ ‘Yes’ if you want to revise the Return.

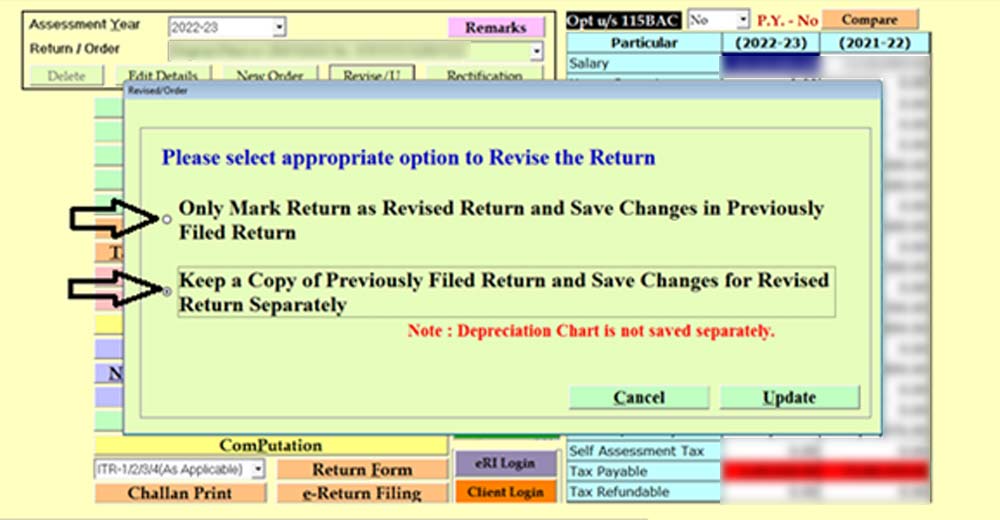

Step 5: Now select the 1st Option if you don’t want to save changes in the previously Filed Return, and the 2nd Option if you want to keep a Copy of the Previously Filed Return and save changes for the Revised Return Separately.

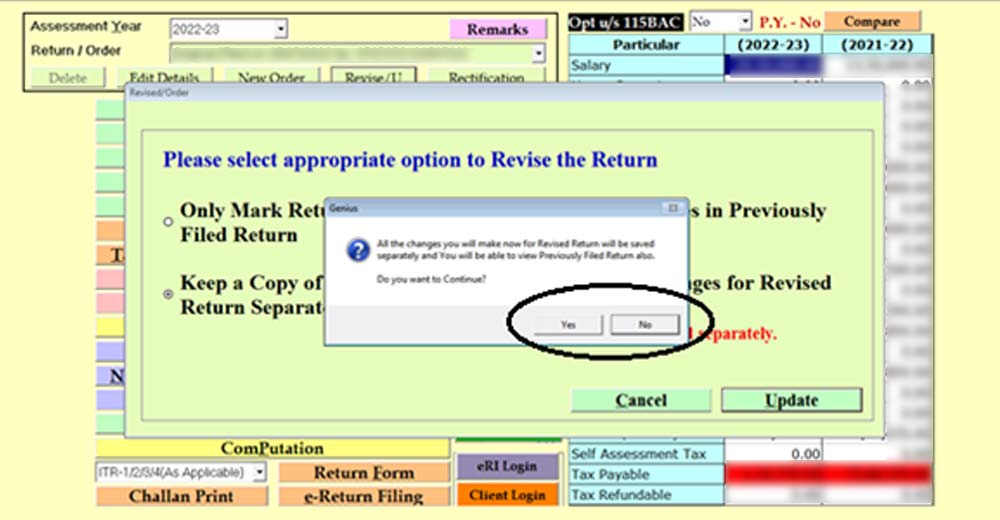

Step 6: Select the option in the message window appearing on the Screen.

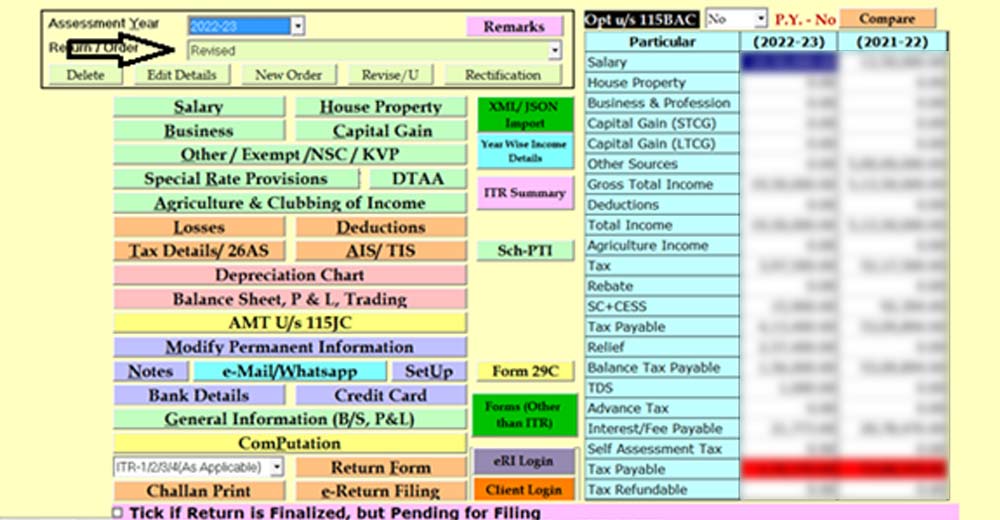

Step 7: A copy of the Return will be created in the software as shown in the image below.

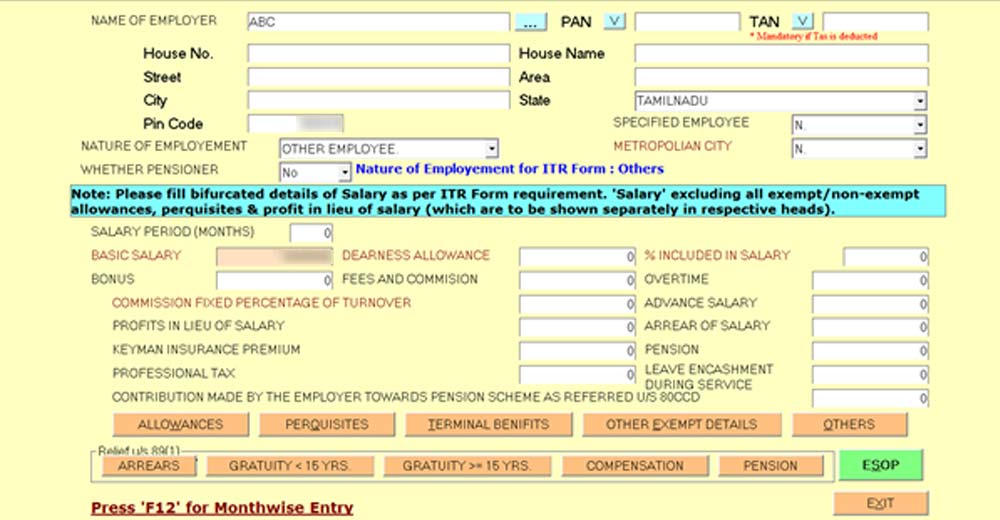

Step 8: Afterwards, you can make the changes as required by you in the ‘Income Tax Return Form’.

Step 9: After making the changes while filing the Revised Return, select Option 139(5) and click on ⏩ the ‘E-File’ button to file your Revised Return.

Government/CBDT is not generous, on the other hand very Harsh , they have cut Time to everify from 120 days to 30 days. What Government will achieve by this measure. And what is the sanctity of July end last date for filing, when Forms 16/ 16A are available only in June.