It is the moral duty of every organisation and taxpayer to file an income tax return and pay the taxes. The budget 2020 income tax amendments have stated that the ITR is important to be filed in case the electricity bill is more than 1 lakh and more than 2 lakh for foreign travel expenses.

The income tax return form 7 is to be filed by all the Charitable /Religious trusts u/s 139 (4A), Political party u/s 139 (4B), Scientific research institutions u/s 139 (4C), University or Colleges or Institutions or Khadi and Village industries u/s 139 (4D). These organisations have to file the form for claiming the exemptions.

Latest Update

- The updated versions of the ITR-7 Excel-based utility (V1.3) have been released on the official e-filing portal. Download now

Gen IT Software Free Demo for Filing ITR-7

What is ITR 7 Form?

The Firms, Companies, Local authority, Association of Person (AOP) and Artificial Judiciary Person are eligible for filing Income Tax Return through ITR-7 Form if they are claiming exemption as one of the following categories:

- Under Section 139 (4A)- if they earn from a charitable /religious trust

- Under Section 139 (4B)- if they earn from a political party

- Under Section 139 (4C)- if they earn from scientific research institutions

- Under Section 139 (4D)- if they earn from universities or colleges or institutions or khadi and village industries

Who are Not Eligible to File ITR 7 Form Online?

Taxpayers who are not claiming exemption under Section 139 (4A), Section 139 (4B), Section 139 (4C) or Section 139 (4D) are not liable to file ITR 7 Form for Income Tax Return.

Who is Eligible to File the ITR-7 Form?

- Return under section 139 (4A), filing. Every person in receipt of income derived from property held under trust or other legal obligation wholly for charitable or religious purposes or in part only for such purposes, or of income being voluntary contributions, if the total income in respect of which he is assessable as a representative assessee exceeds the maximum amount which is not chargeable to income-tax

- Return under section 139 (4B), a political party is required to fill out the form in case the income exceeds the maximum amount not chargeable to tax.

- Return under section 139 (4C) is filled by some organisations such as :

- Scientific Research Association ;

- Hospital, Fund, Any Educational Institution or University;

- Association or Institution Referred to in Section 10 (23A);

- News Agency ;

- Institution Referred to in Section 10 (23B);

- Return under section 139(4D), every college or University that is not required to furnish the return of income or loss

- Return under section 139(4D), every college or University is required to fill which who is unable not required to furnish the income tax return or loss under any other provision of this section

- Return under section 139 (4E), Every business trust, which is not required to furnish a return of income or loss under any other provisions of this section, shall furnish the return of its income in respect of its income or loss in every previous year and all the provisions of this Act shall, so far as may be, apply *_ if it were a return required to be furnished

under sub-section (1). - Return under section 139 (4F), Every investment fund referred to in section 115UB, which is not required to furnish a return of income or loss under any other provisions of this section, shall furnish the return of income in respect of its income or loss in every previous year and all the provisions of this Act shall, so far as may be, apply as if it were a return required to be furnished under sub-section (1).

Any taxpayer can use the ITR-7 Form for filing Income Tax Returns if they file as a Trust, Company, Firm, Local authority, Association of Person (AOP) or Artificial Judicial Person and claims exemption under Section 139 (4A), Section 139 (4B), Section 139 (4C)or Section 139 (4D).

What is the Last Date for Filing ITR 7 Form?

The due date for filing the ITR-7 form varies depending on the audit of the accounts. Tax assesses whose accounts are not required to be audited can file till 31st July 2025 for AY 2025-26, while for audit cases, the due date is 31st October 2025 10th December 2025 (Revised).

Read Also: Penalties for Late Income Tax Return Filing in India

Know the Steps to File ITR 7 Online

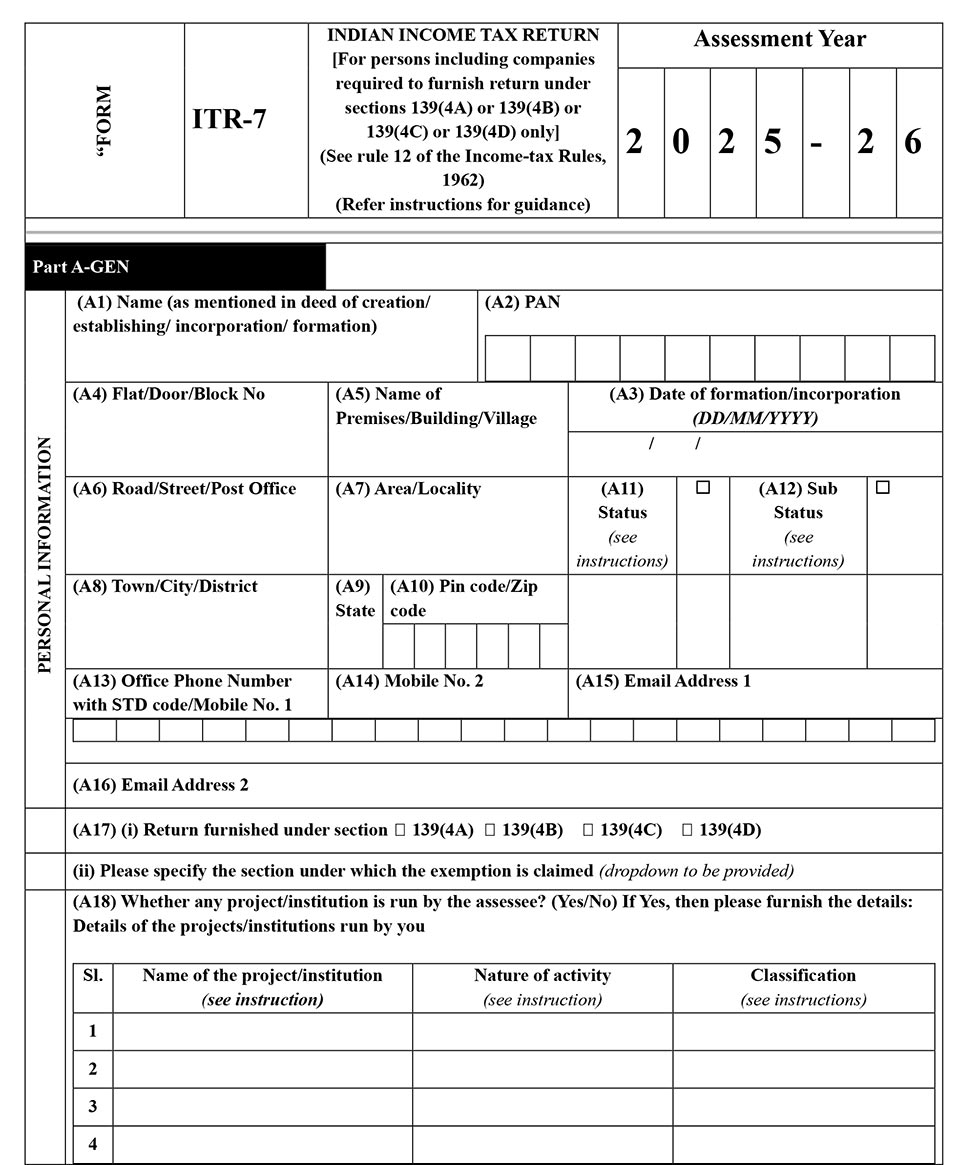

Part A-GEN

- Name (as mentioned in deed of creation/ establishing/ incorporation/ formation)

- PAN

- Flat/Door/Block No

- Name Of Premises/Building/Village

- Date of formation/incorporation

- Road/Street/Post Office

- Area/Locality

- Status

- Sub-Status

- Town/City/District

- State

- Pin code/Zip code

- Office Phone Number with STD code/Mobile No. 1

- Fax Number/Mobile No. 2

- Email Address 1

- Email Address 2

- Return furnished under section

- 139(4A)

- 139(4B)

- 139(4C)

- 139(4D)

- Please specify the section under which the exemption is claimed

- Whether any project/institution is run by the assessee? (Yes/No) If Yes, then please furnish the details: Details of the projects/institutions run by you

- Name of the project/institution

- Nature of activity

- Classification

- Details of registration/provisional registration or approval under the Income-tax Act (Mandatory, if required to be registered). Where regular registration/approval has been granted, details of provisional registration/ approval are not required)

- Details of registration/provisional registration or approval under any law other than Income-tax Act (including the registration under Foreign Contribution (Regulation) Act, 2010, registration on DARPAN portal of Niti Aayog and registration with SEBI)

Filing Status

- Return filed u/s (Tick)

- 139(1)-On or before due date

- 139(4)-After due date

- 139(5)-Revised Return

- 92 CD Modified return

- 119 (2)(b) After Condonation of delay

- Or filed in response to notice u/s

- 139(9)

- 142(1)

- 148

- 153C

- If revised/ defective/Modified, then enter Receipt No.and Date of filing original return (DD/MM/YYYY)

- If filed, in response to a notice u/s 139(9)/142(1)/148/153A/153C or order u/s 119(2)(b), enter unique number/ Document Identification Number (DIN) and date of such notice/order, or if filed u/s 92CD enter date of advance pricing agreement

- Residential status?

- Resident

- Non-resident

- Whether any income is included in total income for which claim under section 90/90A/91 has been made? (Yes/No)

- Whether this return is being filed by a representative assessee?

- Whether you are a Partner in a firm? (Yes/No)

- Legal Entity Identifier (LEI) details (mandatory if refund is 50 crores or more)

- Whether you have held unlisted equity shares at any time during the previous year? If yes, please furnish the following information in respect of equity shares

Other Features

- A2 Where, in any of the projects/institutions run by you, one of the charitable purposes is advancement of any other object of general public utility then:

- a

- (i) Whether there is any activity in the nature of trade, commerce or business referred to in proviso to section 2(15)?

- (ii) If yes, then percentage of receipt from such activity vis-à-vis total receipts

- b

- Whether there is any activity of rendering any service in relation to any trade, commerce or business for any consideration as referred to in proviso to section 2(15)?

- If yes, then percentage of receipt from such activity vis-à-vis total receipts

- a

- If ‘a’ or ‘b’ is YES, the aggregate annual receipts from such activities in respect of that institution

- B

- (i) Is there any change in the objects/activities during the Year on the basis of which approval/registration was granted?

- (ii) If yes, please furnish following information:-

- a date of such change (DD/MM/YYYY)

- b Whether an application for fresh registration/provisional registration has been made in the prescribed form and manner within the stipulated period of thirty days as per Clause (ab) of sub-section (1) of section 12A / Sub-clause (v) of Clause (ac) of sub-section (1) of section 12A

- c Whether fresh registration/provisional registration has been granted under section 12AB

- d date of such fresh registration (DD/MM/YYYY)

- C Is this your first return?

- D Whether provisions of the twenty-second proviso to section 10(23C) or section 13(10) are applicable?

- If “Yes”, please furnish below information, whether:

- Provisions of proviso to clause (15) of section 2 are applicable

- Conditions specified in clause (a) of tenth proviso to 10 (23C) / sub-clause (i) of clause (b) of sub-section (1) of section 12A have been violated

- Conditions specified in clause (b) of tenth proviso to 10 (23C)/ sub-clause (ii) of clause (b) of sub-section (1) of section 12A have been violated

- Conditions specified in twentieth proviso to 10(23C)/ clause (ba) of sub-section (1) of section 12A have been violated Yes

- If “Yes”, please furnish below information, whether:

Audit Information

- Are you liable for audit under the Income-tax Act?

- Section under which you are liable for audit (specify section). Please mention date of audit report. (DD/MM/YY)

- If liable to audit under any Act other than the Income-tax Act, mention the Act, section and date of furnishing the audit report?

Members Information

- Particulars of persons who were members in the AOP on 31st day of March, 2025 (to be filled by venture capital fund/ investment fund)

- Particulars regarding the Author(s) / Founder(s) / Trustee(s) / Manager(s), etc., of the Trust or Institution

- A. Details of all the Author (s)/ Founder (s)/ Settlor (s)/Trustee (s)/ Members of society/Members of the Governing Council/Director (s)/ shareholders holding 5% or more of shareholding / Office Bearer (s) as on the date of applications

- B. In case if any of the persons (as mentioned in row A above) is not an individual then provide the following details of the natural persons who are beneficial owners (5% or more) of such person as on the date of application

- C Name(s) of the person(s) who has/have made substantial contribution to the trust/institution in terms of section 13(3)(b)

- D Name(s) of relative(s) of author(s), founder(s), trustee(s), manager(s), and substantial contributor(s) and where any such author, founder, trustee, manager or substantial contributor is a Hindu undivided family, also the names of the members of the family and their relatives

Schedules To The Return Form (Fill As Applicable)

- Schedule I: Details of amounts accumulated/set apart within the meaning of section 11(2) or in terms of the third proviso to section 10(23C)/10(21) read with section 35(1).

- Schedule IA: Details of accumulated income taxed in earlier assessment years as per section 11(3)

- Schedule D: Details of deemed application of income under clause (2) of Explanation 1 to sub-section (1) of section 11.

- Schedule DA: Details of accumulated income taxed in earlier assessment years as per section 11 (1B). Assessment year in which the amount referred at Col 5 of Schedule D was taxed (Figures in Rs)

- Schedule J: Statement showing the funds and investments as on the last day of the previous year [to be filled if registered under section 12A/12AA/12AB or approved under section 10(23C)(iv)/10(23C)(v)/ 10(23C)(vi)/10(23C)(via)/10(21)]

- A1 Details of corpus

- A2 Details of loan and borrowing

- B Details of investment/deposits made under section 11(5) as on 31.03.2025 (Note to Systems: validation notes not to be part of the final notified ITR form, but only to serve as instructions to develop utility)

- C Investment held at any time during the previous year (s) in concern (s) in which persons referred to in section

- 13(3) have a substantial interest

- D Other investments as on the last day of the previous year

- E Voluntary contributions/donations received in kind but not converted into investments in the specified modes u/s 11(5) within the time provided

Part A-BS: Consolidated Balance Sheet as on 31st Day of March, 2025

- Sources of Funds

- Application of funds

Schedule R: Reconciliation of Corpus of Schedule J and Balance Sheet

- Particulars

- Corpus out of the donations received for renovation or repair of places notified u/s 80G(2)(b) on or after 01.04.2020

- Other corpus received on or after 01.04.2021

- Corpus other than (a) and (b)

Schedule LA: Political Party

- Whether registered under section 29A of Representation of People Act, 1951

- Whether books of account were maintained?

- Whether the accounts have been audited?

- Whether the report under sub-section (3) of section 29C of the Representation of the People Act, 1951 for the financial year has been submitted?

- 5a Whether any voluntary contribution from any person in excess of twenty thousand rupees was received during the year ?

- 5 b If yes, whether record of each voluntary contribution (other than contributions by way of electoral bonds) in excess of twenty thousand rupees (including name and address of the person who has made such contribution) were maintained?

- Whether any donation exceeding two thousand rupees was received otherwise than by an account payee cheque or account payee bank draft or use of electronic clearing system through a bank account or through electoral bond?

- Please furnish the following information:-

- a. Total voluntary contributions received by the party during the F.Y. (b+d)

- b. Aggregate value of all the voluntary contributions received upto Rs. 20,000 during the F.Y.

- ci. Aggregate value of all the voluntary contributions received upto Rs. 2,000 in cash during the F.Y.

- cii. Aggregate value of all the voluntary contributions received upto Rs. 2,000 other than in cash during the F.Y.

- d. Aggregate value of all the voluntary contributions received more than Rs. 20,000/- during the F.Y

Schedule ET: Electoral Trust

- Whether books of account were maintained?

- Whether a record of each voluntary contribution (including name, address and PAN of the person who has made such contribution along with the mode of contribution) were maintained?

- Whether record of each eligible political party to whom the distributable contributions have been distributed (including name, address, PAN and registration number of eligible political party) was maintained?

- Whether the accounts have been audited as per rule 17CA(12)? (tick as applicable)

- Whether the report as per rule 17CA(14) furnished to the Commissioner of Income-tax or Director of Income-tax?

- Details of voluntary contributions received and amounts distributed during the year

Schedule VC: Voluntary Contributions [to be mandatorily filled in by all persons filing ITR-7]

- Domestic Contribution

- Foreign contribution

- Total Contributions (Aiii + Biii)

- Anonymous donations, chargeable u/s 115BBC [Applicable to assessee claiming exemption u/s 11 or 10(23C)(iv) or 10(23C)(v) or 10(23C)(vi) or 10(23C)(via) or 10(23C)(iiiad) or 10(23C)(iiiae)]

- Anonymous donations other than those included at Sl. No. Diii (Di-Diii of Schedule VC)

Schedule AI: Aggregate of income derived during the previous year excluding Voluntary contributions [to be filled by assessees claiming exemption u/s 11 and 12 or u/s 10(23C)(iv) or 10(23C)(v) or 10(23C)(vi) or 10(23C)(via)]

- Receipts from main objects

- Receipts from incidental objects

- Rent

- Commission

- Dividend income

- Interest income

- Agriculture income

- Net consideration on transfer of capital asset

- Any other income (specify nature and amount)

- Total (1 + 2 + 3 + 4 + 5 + 6 + 7 + 8 + 9)

Schedule A: Amount applied to stated objects of the trust/institution during the previous year from all sources referred to in C1 to C7 of this table- [to be filled by assessee claiming exemption u/s 11 and 12 or u/s 10(23C)(iv) or 10(23C)(v) or 10(23C)(vi) or 10(23C)(via)]

- Application towards the expenditure of the trust/institution

- Expenditure not allowed as application other than application out of source of fund at C2 to C7 (B1 + B2 + B3 + B4 + B5 + B6 + B7 + B8)

- Source of funds to meet revenue and capital application in Row A

- Total Amount applied during the previous year [A12-B-C2-C3-C4-C5-C6-C7]

- Amount which was not actually paid during the previous year out of D

- Amount actually paid during the previous year which accrued during any earlier previous year but not claimed as application of income in earlier previous year

- Total amount to be allowed as application (G=D-E+F)

Schedule IE1: Income & Expenditure statement [Applicable for assessees claiming exemption under sections 10(21), 10(22B), 10(23AAA), 10(23B), 10(23D), 10(23DA), 10(23EC), 10(23ED), 10(23EE), 10(23FB), 10(29A), 10(46), 10(47) and other clauses of section 10 where income is unconditionally exempt]

- Total receipts including any voluntary contribution

- Application of income towards object of the institution

- Accumulation of income

Schedule IE2 Income & Expenditure statement [Applicable for assessee claiming exemption under sections 10(23A), 10(24)]

- A

- Total receipts including any voluntary contribution

- Application of income towards object of the institution

- Accumulation of income

- B Do you have any income which is taxable? If Yes Please provide details

- Income from House Property? (If yes, Please fill Schedule HP)

- Income from Business or Profession (If yes, Please fill Schedule BP)

- Income from Capital gains (If yes, Please fill Schedule CG

- Income from other Sources (If yes, Please fill Schedule OS)

Schedule IE- 3 Income & Expenditure statement [applicable for assessee claiming exemption under sections 10(23C)(iiiab) or 10(23C)(iiiac)] (please fill up address for each institution seperately)

- Objective of the institution (drop down to be provided Educational / Medical)

- Addresses where activity is carrying out

- Total receipts including any voluntary contribution

- Government Grants out of Sl. No. 3 above

- Amount applied for objective

- Balance accumulated

Schedule IE- 4 Income & Expenditure statement [applicable for assessee claiming exemption under sections 10(23C)(iiiad) or 10(23C)(iiiae)] (please fill up address for each institution seperately)

- Objective of the institution (drop down to be provided Educational / Medical)

- Addresses where activity is carrying out

- Total receipts including any voluntary contribution

- Government Grants out of Sl. No. 3 above

- Amount applied for objective

- Balance accumulated

Schedule HP Details of Income from House Property (Please refer to instructions) (Drop down to be provided indicating ownership of property)

- Address of property 1

- Pass through income/Loss if any

- Income under the head “Income from house property” (1j + 2j + 3) (if negative take the figure to 2i of schedule CYLA)

Note:

- Furnishing of PAN/Aadhaar No. of tenant is mandatory, if tax is deducted under section 194-IB.

- Furnishing of TAN of tenant is mandatory, if tax is deducted under section 194-I

Schedule CG: Capital Gain

- Short-term Capital Gains (STCG) (Sub-items 4 & 5 are not applicable for residents)

- Long-term capital gain (LTCG) (Sub-items 6, 7& 8 are not applicable for residents)

- Income chargeable under the head “CAPITAL GAINS” (C1 + C2)

- Information about the deduction claimed against Capital Gains

- Set-off of current year capital losses with current year capital gains (excluding amounts included in A9a & B12a, which is NOT chargeable under DTAA)

- Information about accrual/receipt of capital gain

Schedule VDA: Income from transfer of virtual digital assets u/s 115BBH

- Sl. No

- Date of Acquisition

- Date of Transfer

- Head under which income to be taxed (Business/Capital Gain)

- Cost of Acquisition In case of gift:

- A. Enter the amount on which tax is paid u/s 56(2)(x) if any

- B. In any other case cost to previous owner

- Consideration Received

- Income from transfer of Virtual Digital Assets (enter nil in case of loss) (Col. 6 Col. 5)

Schedule OS: Income from other sources

- Gross income chargeable to tax at normal applicable rates (1a+ 1b+ 1c+ 1d + 1e)

- Income chargeable at special rates (2ai + 2aii + 2b+ 2c+ 2d + 2e elements related to Sl. No. 1)

- Deductions under section 57(other than those relating to income chargeable at special rates under 2a, 2b,2c, 2d & 2e)

- Amounts not deductible u/s 58

- Profits chargeable to tax u/s 59

- Net income from other sources chargeable at normal applicable rates (1 (after reducing income related to DTAA portion) – 3 + 4 + 5)

- Income from other sources (other than from owning race horses) (2+6)

- Income from the activity of owning and maintaining race horses

- Income under the head “Income from other sources” (7 + 8e)

- Information about accrual/receipt of income from Other Sources

Schedule OA: General

Do you have any income under the head business and profession?

- Nature of Business or Profession (refer to the instructions)

- Number of branches

- Method of accounting employed in the previous year

- Is there any change in method of accounting

- Effect on the profit because of deviation, if any, in the method of accounting employed in the previous year from accounting standards prescribed under section 145A

- Method of valuation of closing stock employed in the previous year:

- Raw Material (if at cost or market rates whichever is less write 1, if at cost write 2, if at market rate write 3)

- Finished goods (if at cost or market rates whichever is less write 1, if at cost write 2, if at market rate write 3)

- Is there any change in stock valuation method

- Effect on the profit or loss because of deviation, if any, from the method of valuation prescribed under section 145A

Schedule BP: Computation of income from business or profession

- A From business or profession other than speculative business and specified business

- B Computation of income from speculative business

- C Computation of income from specified business under section 35AD

- D48 Income chargeable under the head ‘Profits and gains from business or profession’ (A36+B40+C46+A3d)

- E Intra head set off of business loss of current year

Schedule CYLA Details of Income after set-off of current years losses

- Sl. No.

- Head/ Source of Income

- Income Income of current year (Fill this column only if income is zero or positive)

- House property loss of the current year set off

- Business Loss (other than speculation or specified business loss) of the current year set off

- Other sources loss (other than loss from race horses) of the current year set off

- Current year’s Income remaining after set off

Schedule PTI: Pass Through Income details from business trust or investment fund as per section 115UA, 115UB

- Sl. No

- Investment entity covered by section 115UA/115UB

- Name of business trust/ investment fund

- PAN of the business trust/investment fund

- Sl.No

- Head of income

- Current year income

- Share of current year loss distributed by Investment fund

- Net Income/Loss 9=7-8

- TDS on such amount, if any

Schedule SI: Income chargeable to tax at special rates [Please see instruction]

- 111A (STCG on shares where STT paid) [where transfer was before 23rd July 2024 as applicable]

- 115AD (STCG for FIIs on securities where STT not paid) [where transfer was before 23rd July 2024 as applicable]

- 112 proviso (LTCG on listed securities/ units without indexation [where transfer was before 23rd July 2024 as applicable and tax thereon after taking into account Sl. no. B4(f) of Schedule CG, if any.]

- 115AC (LTCG for non-resident on bonds/GDR)

- 115AD (LTCG for FII on securities)

- 112 (LTCG on others)

- 112A(LTCG on equity shares/units of equity oriented fund/units of business trust on which STT is paid)

- STCG chargeable at special rates in India as per DTAA

- LTCG Chargeable at special rates in India as per DTAA

- 115AC (Income by way interest received by non-resident from bonds or GDR purchased in foreign currency)

- 115AC (Income by way of Dividend received by non-resident from bonds or GDR purchased in foreign currency

- 115BB (Winnings from lotteries, puzzles, races, games etc.)

- 115BBE (Income under sections 68, 69, 69A, 69B, 69C or 69D)

- Any other income chargeable at special rate

- Income from other sources chargeable at special rates in India as per DTAA

- Income in the nature of Short Term Capital Gain chargeable @ 15%

- Pass through Income in the nature of Short Term Capital Gain chargeable @ 30%

- Pass Through Income in the nature of Long Term Capital Gain chargeable @ 10%

- Pass Through Income in the nature of Long Term Capital Gain chargeable @ 20%

- Pass through Income in the nature of Long Term Capital Gain chargeable @ 10% other than section 112A

- Pass through income in the nature of income from other source chargeable at special rates

Schedule 115TD: Accreted income under section 115TD (Applicable if exemption claimed u/s 11 and 12 or 10(23C)(iv)/10(23C)(v)/ 10(23C)(vi)/10(23C)(via)

- Aggregate Fair Market Value (FMV) of total assets of trust/institution

- Less: Total liability of trust/institution

- Net value of assets (1 – 2)

- 4

- FMV of assets directly acquired out of income referred to in section 10(1)

- FMV of assets acquired during the period from the date of creation or establishment to the effective date of registration/provisional registration u/s 12AA/12AB, if benefit u/s 11 and 12 not claimed during the said period

- FMV of assets transferred in accordance with third proviso to section 115TD(2)

- Total (4i + 4ii + 4iii)

- Liability in respect of assets at 4 above

- Accreted income as per section 115TD [3 – (4iv – 5)]

- Additional income-tax payable u/s 115TD at the maximum marginal rate

- Interest payable u/s 115TE

- Specified date u/s 115TD

- Additional income-tax and interest payable

- Tax and interest paid

- Net payable/refundable (10 – 11)

- Date(s) of deposit of tax on accreted income

- Name of Bank and Branch

- BSR Code

- Serial number of challan

- Amount deposited

Schedule 115BBI: Specified income of certain institutions under section 115BBI

- Deemed income referred in Explanation 4 to the third proviso to section 10(23C) or section 11(3)

- Deemed income referred under section 11(1B)

- Income which is deemed to be income under the twenty-first proviso to section 10(23C) or which is excluded from the total income as per section 13(1)(c)

- Income which is not exempt under section 10(23C) on account of violation of clause (b) of the third proviso of section 10(23C) or which is excluded from the total income as per section 13(1)(d)

- Income which is not excluded from the total income as per section 11(1)(c)

- Income accumulated or set apart in excess of fifteen per cent of the income where such accumulation is not allowed under any specific provision of this Act;

- Total (total of Sl. No. 1 to 6)

Schedule FSI: Details of Income from outside India and tax relief (available only in case of resident)

- Sl.

- Country Code

- Taxpayer Identification Number

- Sl.

- Head of income

- Income from outside India (included in PART B-TI)

- Tax paid outside India

- Tax payable on such income under normal provisions in India

- Tax relief available in India (e)= (c) or (d) whichever is lower

- Relevant article of DTAA if relief claimed u/s 90 or 90A

Schedule TR: Summary of tax relief claimed for taxes paid outside India (available only in case of resident)

- Details of Tax relief claimed

- Total Tax relief available in respect of country where DTAA is applicable (sections 90/90A)

- Total Tax relief available in respect of country where DTAA is not applicable (section 91)

- Whether any tax paid outside India, on which tax relief was allowed in India, has been refunded/credited by the foreign tax authority during the year? If yes, provide the details below

- Amount of tax refunded

- Assessment year in which tax relief allowed in India

Schedule FA: Details of Foreign Assets and Income from any source outside India

- A1. Details of Foreign Depository Accounts held (including any beneficial interest) at any time during the relevant calendar year ending as on 31st December, 2024

- A2. Details of Foreign Custodial Accounts held (including any beneficial interest) at any time during the relevant calendar year ending as on 31st December, 2024

- A3. Details of Foreign Equity and Debt Interest held (including any beneficial interest) in any entity at any time during the relevant calendar year ending as on 31st December, 2024

- A4. Details of Foreign Cash Value Insurance Contract or Annuity Contract held (including any beneficial interest) at any time during the relevant calendar year ending as on 31st December, 2024

- B. Details of Financial Interest in any Entity held (including any beneficial interest) at any time during the relevant calendar year ending as on 31st December, 2024

- C. Details of Immovable Property held (including any beneficial interest) at any time during the relevant calendar period

- D. Details of any other Capital Asset held (including any beneficial interest) at any time during the relevant calendar year ending as on 31st December, 2024

- E. Details of account(s) in which you have signing authority held (including any beneficial interest) at any time during the relevant calendar period and which has not been included in A to D above.

- F. Details of trusts, created under the laws of a country outside India, in which you are a trustee, beneficiary or settlor

- G. Details of any other income derived from any source outside India which is not included in,- (i) items A to F above and, (ii) income under the head business or profession

Schedule SH: Shareholding of Unlisted Company

- If you are an unlisted company, please furnish the following details;-

- Details of shareholding at the end of the previous year

- Details of equity share application money pending allotment at the end of the previous year

- Details of shareholders who is not a shareholder at the end of the previous year but was a shareholder at any time during the previous year

Part B TI– Statement Of Income For The Period Ended On 31St March, 2025

Part B1: Part B1 Applicable if exemption is being claimed u/s 11 and 12 or 10(23C)(iv)/10(23C)(v)/ 10(23C)(vi)/10(23C)(via) and where Part B3 is not applicable.

- Voluntary Contributions other than Corpus and anonymous donations taxable u/s 115BBC

- Voluntary contribution forming part of corpus other than anonymous donations taxable u/s 115BBC [(A + B) of schedule Part B-TI -Part B1]

- Note: If conditions specified in Section 11 and 12 are violated, this field will be considered for adjustment under section 143(1)

- .Corpus representing donations received for the renovation or repair of places notified u/s 80G(2)(b) [Aia +Bia of Schedule VC]

- Corpus other than above [Aib +Bib of Schedule VC]

- Note: If conditions specified in Section 11 and 12 are violated, this field will be considered for adjustment under section 143(1)

- Aggregate of income referred to in sections 11, 12 and sections 10(23C)(iv), 10(23C)(v), 10(23C)(vi) and 10(23C)(via) derived during the previous year excluding Voluntary contribution included in 1 above (10 of Schedule AI)

- Amount eligible for exemption under section 11(1)(c)

- Approval number given by the Board

- Date of approval by board

- Income to be applied [1+3-4-(A1-A1a of Schedule A)]

- Application of income for charitable or religious purposes or for the stated objects of the trust/institution:-

- Additions

- Income chargeable u/s 11(4)

- Gross income after Exemption u/s 11/10(23C)(iv)/10(23C)(v)/ 10(23C)(vi)/10(23C)(via)[(5-6vii)+7ix+8]

- 10.1 Short term

- Short-term chargeable @ 15%

- Short-term chargeable @ 20%

- Short-term chargeable @ 30%

- Short-term chargeable at applicable rate

- Short-term chargeable at special rates in India as per DTAA (9v of item E of Schedule CG

- Total Short-term (Aia+ Aib + Aii + Aiii+ Aiv)

- Long term

- Long-term chargeable @ 10%

- Long-term chargeable @ 12.5%

- Long-term chargeable @ 20%

- Long-term chargeable at special rates in India as per DTAA

- Total Long-term (Bia + Bib + Bii + Biii)

- Sum of Short-term/Long-term capital gains (Av+Biv)

- Capital gain chargeable @ 30% u/s 115BBH (C2 of schedule CG)

- Total capital gains (C + D)

- Income from other sources

- Total (10i + 10ii + 10iiiE + 10iv)

- Gross income (9+10)

- Losses of current year to be set off against 10v

- Total Income (11-12)

- Income which is included in 13 and chargeable to tax at special rates (total of col. (i) of schedule SI)

- Anonymous donations, included in 15, to be taxed under section 115BBC @ 30% (Diii of Schedule VC)

- Income chargeable u/s 115BBI , included in 13, to be taxed @ 30%

- Aggregate Income to be taxed at normal rates (13-14-15-16)

Part B2: Applicable if exemption is being claimed under section 13A/13B and under sections 10(21), 10(22B), 10(23A), 10(23AAA), 10(23B), 10(23EC), 10(23ED), 10(23EE), 10(29A), 10(23C)(iiiab), 10(23C)(iiiac), 10(23C)(iiiad), 10(23C)(iiiae), 10(23D), 10(23DA), 10(23FB), 10(24), 10(46), 10(47)

- Amount eligible for exemption under sections 10(21), 10(23AAA), 10(23B), 10(23D),10(23DA), 10(23EC), 10(23ED), 10(23EE), 10(23FB), 10(29A), 10(46), 10(46A), 10(46B), 10(47)

- Amount eligible for exemption under section 10(23A), 10(23C)(iiiab), 10(23C)(iiiac), 10(23C)(iiiad), 10(23C)(iiiae), 10(24)

- Income chargeable under section 11(3) read with section 10(21)

- Income claimed as exempt under section 13A in case of a Political Party

- Income claimed as exempt under section 13B in case of an Electoral Trust

- Voluntary Contribution received during the year

- Heads of Income

- Income from house property [ 4 of Schedule HP]

- Profits and gains of a business or profession

- Income under the head Capital Gains

- A. Short term

- Short-term chargeable @ 15%

- Short-term chargeable @ 20%

- Short-term chargeable @ 30%

- Short-term chargeable at the applicable rate

- Short-term chargeable at special rates in India as per DTAA (9v of item E of Schedule CG)

- Total Short-term (Aia + Aib + Aii + Aiii +Aiv)

- B. Long term

- Long-term chargeable @ 10%

- Long-term chargeable @ 12.5%

- Long-term chargeable @ 20%

- Long-term chargeable at special rates in India as per DTAA

- Total Long-term (Bia + Bib + Bii + Bi)

- Sum of Short-term/Long-term capital gains (Av+Biv)

- Income from other sources [as per item No. 9 of Schedule OS]

- Total (7i + 7ii + 7iiiE + 7iv)

- Gross income [6+7v-4-5] +3

- Losses of the current year to be set off against 7v

- Gross Total Income (8-9)

- Income which is included in 10 and chargeable to tax at special rates (total of col. (i) of schedule SI)

- Net Agricultural income for rate purposes

- Aggregate Income (10-11+12) [applicable if (10-11) exceeds the maximum amount not chargeable to tax]

- Income chargeable at maximum marginal rates

Part B3: Applicable if total income chargeable to tax u/s twenty-second proviso to section 10(23C) or section 13(10)

- Total Income for the previous year other than Sl. No. 7

- Total Expenditure incurred in India, for the objects of the assessee

- Expenditure to be disallowed

- Additions

- Income chargeable u/s 11(4)

- Sum total [(1-2+3x)+4vii+5)]

- Income not forming part of item No. 6 above

- Losses of current year to be set off against 7v (total of 2xiv, 3xiv and 4xiv of Schedule CYLA)

- Total Income (6+7-8)

- Income which is included in 9 and chargeable to tax at special rates (total of col. (i) of schedule SI)

- Anonymous donations, included in 9, to be taxed under section 115BBC @ 30% (Diii of Schedule VC)

- Income chargeable u/s 115BBI, included in 9, to be taxed @ 30% (Sl. No 7 of Schedule 115BBI)

- Income chargeable to tax u/s twenty-second proviso to clause (23C) of section 10 or sub-section (10) of section 13 (9-10-11-12)

Part B – TTI Computation of tax liability on total income

- Tax payable on total income

- Surcharge

- Health and Education cess @ 4% on (1g+ 2iii)

- Gross tax liability (1g+ 2iii + 3)

- Tax relief

- Net tax liability (4 – 5c)

- Interest and fee payable

- Aggregate liability) (6 + 7e)

- Taxes Paid

- Amount payable (Enter if 8 is greater than 9e, else enter 0)

- Refund (If 9e is greater than 8) (refund, if any, will be directly credited into the bank account)

- Net tax payable on 115TD income including interest u/s 115TE (Sr.no. 12 of Schedule 115TD)

- Do you have a bank account in India (Non- Residents claiming refund with no bank account in India may select No)

- Do you at any time during the previous year

15 Tax Payments

- Details of payments of Advance Tax and Self-Assessment Tax

- Details of Tax Deducted at Source (TDS) on Income [As per Form 16 A issued or Form 16B/16C/16D/16E furnished by Deductor(s)]

- Details of Tax Collected at Source (TCS) [As per Form 27D issued by the Collector(s)]

Verification

I, son/ daughter of, solemnly declare that to the best of my knowledge and belief, the information is given in the return and the schedules, statements, etc. accompanying it is correct and complete is in accordance with the provisions of the Income-tax Act, 1961. I further declare that I am making this return in my capacity as _________________ and I am also competent to make this return and verify it. I am holding permanent account number (if allotted) (Please see instructions). I further declare that the critical assumptions specified in the agreement have been satisfied and all the terms and conditions of the agreement have been complied with. (Applicable, in a case where the return is furnished under section 92CD)

Place……. Date…… Sign

here……

Filling the Verification Document

Fill in the information required in the verification document. Make sure that the document has been signed. Do mention the designation of the person who is signing the return. Any false statement or claim while filing the return may lead to prosecution under section 277 of the Income-tax Act, 1961 and the convict shall be punished with a fine and imprisonment as per the law.

Where can i fill additions of Fixed Asset in ITR 7 ?

ITR filing assessment year 2020-21 trust issue the registration section for with exemption we claimed the return

Thank you