What is the ITR 2 Form?

The ITR-2 is filed by individuals or HUFs not having income from profit or gains of business or profession and to whom ITR-1 is not applicable. It includes income from capital gains, foreign income, or any agricultural income more than Rs 5,000.

- What is ITR 2 Form

- Eligibility File ITR 2 Online AY 2020-21

- File ITR 2 Via Gen IT Software

- ITR 2 Due Date for AY 2024-25

- Structure of ITR 2 Filing

- ITR 2 Form Filing Online and Offline Mode

ITR 2 Filing Start Date for Taxpayers

The Income Tax Department launched an online filing for the ITR-2 form on July 18, 2025.

Eligible Taxpayers for Filing ITR 2 Online AY 2025-26

The taxpayers who are eligible for filing the ITR-2 form are the persons whose source of income is as mentioned below:

- A resident having any asset located outside India or signing authority in any account.

- A non-resident or not-ordinary resident.

- Taxpayers who earn agriculture income above Rs. 5000/-.

- Income from winnings of a lottery, horse race, gambling, etc. under the head of other sources.

- Both short and long-term capital gains/losses from the sale of property/investments/securities. (if there is only long term capital gain exempt u/s 10(38) then ITR-1 can be filed)

The taxpayers who do not require to file the ITR-2 form are as follows:

- Taxpayers who earn from business or profession

- Taxpayers who are eligible to file Income Tax Return 1.

Latest Update

- ITR-2 Excel-based utility and JSON schema (V1.1) are now available for filing on the e-filing portal. Download Now

- An Excel-based ITR-1 and ITR-2 utility for Assessment Years 2021-22 and 2022-23 has been launched on the Income Tax Department portal. Check here

File ITR 2 Via Gen IT Software, Get Demo!

Due Date for Filing ITR 2 Online FY 2024-25

- FY 2024-25 (AY 2025-26) – 31st July 2025 | 16th September 2025 (Revised)

- FY 2023-24 (AY 2024-25) – 31st July 2024

- FY 2022-23 (AY 2023-24) – 31st July 2023

- FY 2021-22 (AY 2022-23) – 31st July 2022

- Every year on or before 31st July is termed as the last date for filing ITR 2.

Structure of ITR 2 Filing for AY 2025-26 Online

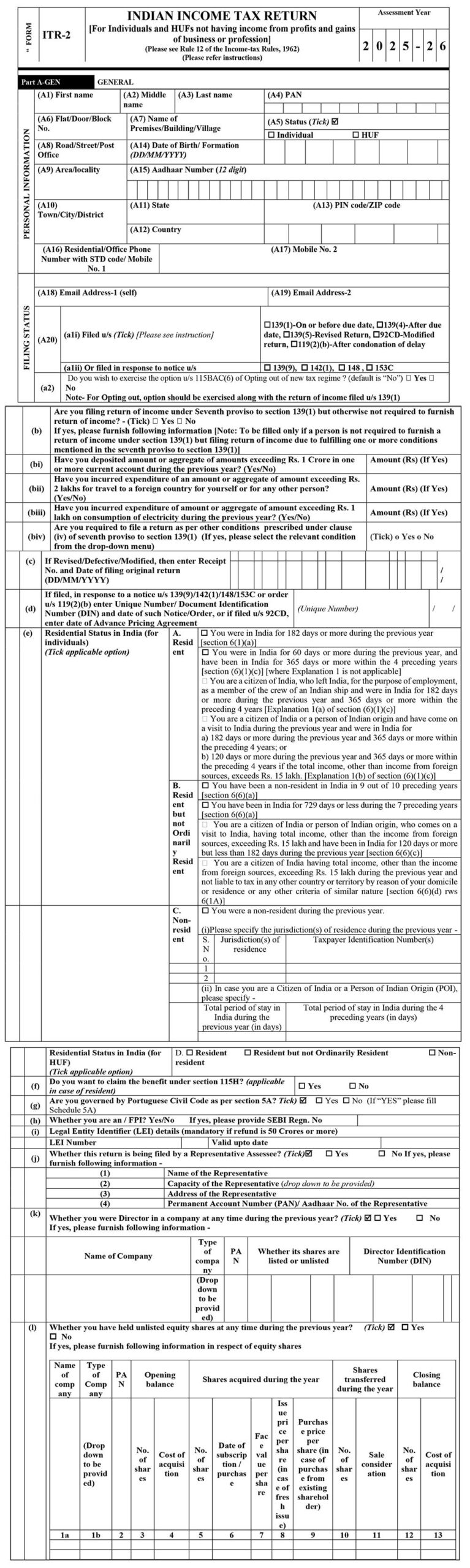

Part A: General Information

The general information is enclosed with the following details of the taxpayer to furnish with:

- Name

- PAN number

- Status: Individual or HUF

- Flat/Door/Block No

- Name of Premises/Building/Village

- Road/Street/Post Office

- Area/Locality

- Aadhar number

- Town/City

- State

- Country

- PIN Code/ZIP Code

- Residential/Office Phone Number with STD code/ Mobile No. 1

- Mobile No. 2

- Email Address 1 (Self)

- Email Address 2

Filing Status

- A20 – Filed u/s

- (a1i) Filed u/s (Tick) [Please see instruction]

- 139(1)-On or Before Due Date

- 139(4)-After Due Date

- 139(5)-Revised Return

- 92CD-Modified Return

- 119(2)(b)-After Condonation of Delay

- (a1ii) Or filed in response to notice u/s

- 139(9)

- 142(1)

- 148

- 153C

- (a1i) Filed u/s (Tick) [Please see instruction]

(a2) Do you wish to exercise the option u/s 115BAC(6) of Opting out of new tax regime ? (default is “No”)

Note: For Opting out, option should be exercised along with the return of income filed u/s 139(1)

B – Are you filing a return of income under the Seventh proviso to section 139(1) but otherwise not required to furnish a return of income? Yes or No

If yes, please furnish following information [Note: To be filled only if a person is not required to furnish a return of income under section 139(1) but filing return of income due to fulfilling one or more conditions mentioned in the seventh proviso to section 139(1)]

- B.i- Have you deposited an amount or aggregate of amounts exceeding Rs. 1 Crore in one or more current accounts during the previous year? (Yes/No)

- B.ii- Have you incurred expenditure of an amount or aggregate of the amount exceeding Rs. 2 lakhs for travel to a foreign country for yourself or for any other person? (Yes/No)

- B.iii- Have you incurred expenditure of amount or aggregate of amount exceeding Rs. 1 lakh on the consumption of electricity during the previous year? (Yes/No)

- B.iv- Are you required to file a return as per other conditions prescribed under clause (iv) of the seventh proviso to section 139(1) (If yes, please select the relevant condition from the drop-down menu? (Yes/No)

C – If Revised/Defective/Modified, then enter Receipt No. and Date of filing original return (DD/MM/YYYY)

D – If filed, in response to a notice u/s 139(9)/142(1)/148/153A/153C or order u/s 119(2)(b) enter Unique Number/ Document Identification Number (DIN) and date of such Notice/Order, or if filed u/s 92CD, enter the date of Advance Pricing Agreement

E – Residential Status in India (for individuals)

- Resident

- Resident but not Ordinarily Resident

- Non-resident

(II) Residential Status in India (for HUF)

- Resident

- Resident but not Ordinarily Resident

- Non-resident

F – Do you want to claim the benefit under section 115H? (Yes/No)

G- Are you governed by Portuguese Civil Code as per section 5A?

H- Whether you are an FII / FPI? Yes/No (If yes, please provide SEBI Regn. No)

I- Legal Entity Identifier (LEI) details (mandatory if refund is 50 Crores or more)

- LEI Number

- Valid upto date

J – Whether this return is being filed by a Representative Assesse?

- Name of the representative

- Capacity of the Representative (drop down to be provided)

- Address of the Representative

- Permanent Account Number (PAN) of the representative

K – Whether you were Director in a company at any time during the previous year? (Tick) þ o Yes o No If yes, please furnish following information

- Name of Company

- Type of Company

- PAN

- Whether its shares are listed or unlisted

- Director Identification Number (DIN)

L – Whether you have held unlisted equity shares at any time during the previous year?

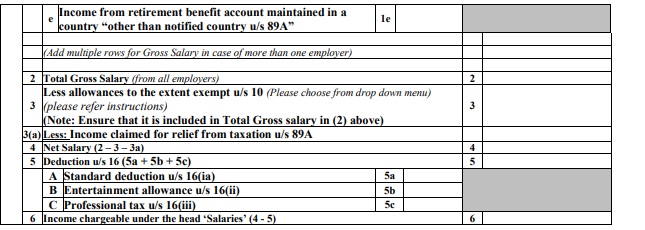

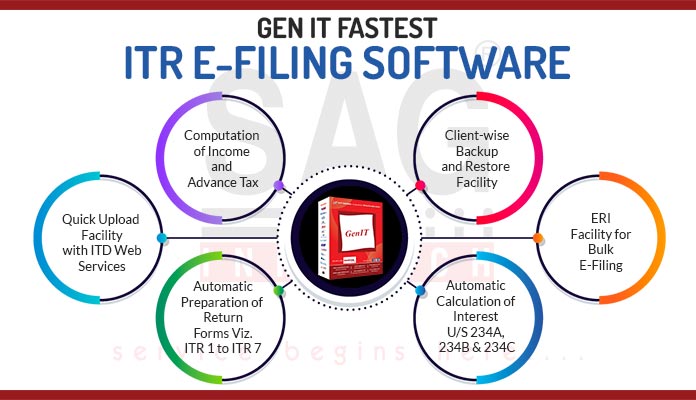

Schedule S: Details of Income from Salary

The information regarding Details of Income from Salary is enclosed with the following details of the taxpayer to furnish:

- Name of Employer

- Nature of Employer

- TAN of Employer

- Address of employer

- Town/City, State, PIN Code

- Gross Salary ((1a + 1b + 1c + 1d + 1e + 1f)

- Total Gross Salary

- Less allowances to the extent exempt u/s 10 (drop down to be provided in e-filing utility) (please refer instructions) (Note: Ensure that it is included in Total Gross salary in (2) above )

- Less: Income claimed for relief from taxation u/s 89A

- Net Salary (2 – 3 – 3a)

- Deduction u/s 16 (5a + 5b + 5c)

- Income chargeable under the head ‘Salaries’ (4 – 5)

Schedule HP: Details of Income from House Property

The information regarding Details of Income from House Property is enclosed with the following details of the taxpayer to furnish:

- Address of property 1

- Town/ City

- State

- PIN Code/ ZIP Code

- Is the property co-owned? (Yes/No)

- Your percentage of share in the property (%)

- Name of Co-owner(s)

- PAN/Aadhaar No. of Co-owner(s)

- Percentage Share in Property

- [Tick the applicable option]

- Let out

- Self-occupied

- Deemed let out

- Name(s) of Tenant(s) (if let out)

- PAN/ Aadhaar No. of Tenant(s)

- PAN/TAN/ Aadhaar No. of Tenant(s) (if TDS credit is claimed)

- a – Gross rent received or receivable or letable value

- b – The amount of rent which cannot be realized

- c – Tax paid to local authorities

- d – Total (1b + 1c)

- e – Annual value (1a – 1d)

- f – Annual value of the property owned (own percentage share x 1e)

- g – 30% of 1f

- h – Interest payable on borrowed capital

- i – Total (1g + 1h)

- j – Arrears/Unrealised rent received during the year less 30%

- k – Income from house property 1 (1f – 1i + 1j)

- Pass through income/loss if any *

- Income under the head “Income from House Property” (1k + 2)

Note:

- Please include the income of the specified persons referred to in Schedule SPI and Pass through income referred to in schedul e PTI while computing the income under this head

- Furnishing of PAN/ Aadhaar No. of tenant is mandatory, if tax is deducted under section 194 -IB

- Furnishing of TAN of tenant is mandatory, if tax is deducted under section 194 -I

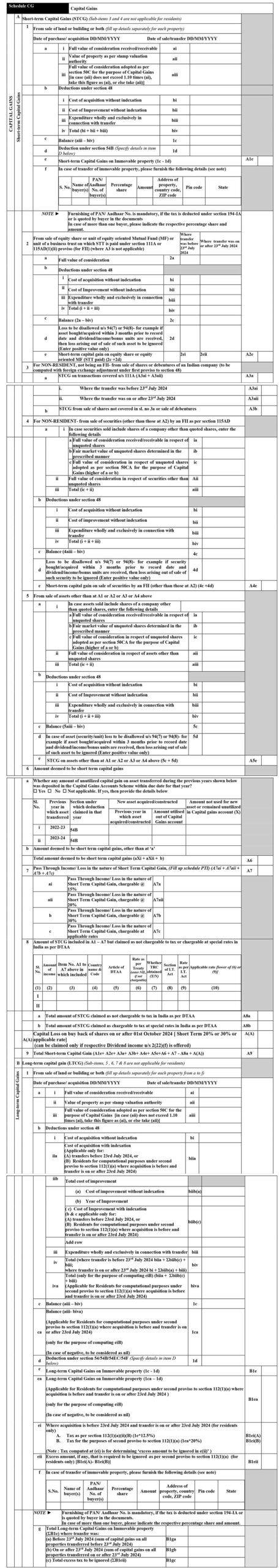

Schedule CG: Capital Gains

The information regarding Capital gains is enclosed with the following details of the taxpayer to furnish with:

A. Short-term Capital Gains (STCG)

1. From the sale of land or building or both

- a

- I Full value of the consideration received/receivable

- II Value of property as per stamp valuation authority

- III Full value of consideration adopted as per section 50C for the purpose of Capital Gains [in case (aii) does not exceed 1.10 times (ai), take this figure as (ai), or else take (aii)]

- b – Deductions under section 48

- I Cost of acquisition without indexation

- II Cost of Improvement without indexation

- III Expenditure wholly and exclusively in connection with transfer

- IV Total (bi + bii + biii)

- c – Balance (a-iii – b-iv)

- d – Deduction under section 54B (Specify details in item D below)

- e – Short-term Capital Gains on Immovable property (1c – 1d)

- f – In case of transfer of immovable property, please furnish the following details (see note)

Note: Furnishing of PAN/ Aadhaar No. is mandatory, if the tax is deducted under section 194-IA or is quoted by buyer in the documents In case of more than one buyer, please indicate the respective percentage share and amount.

2. From the sale of equity share or unit of an equity-oriented Mutual Fund (MF) or unit of a business trust on which STT is paid under section 111A or 115AD(1)(ii) proviso (for FII). (where A3 is not applicable) Data should be entered considering the specific date of 23rd July, 2024.

3. For NON-RESIDENT not being an FII- from sale of shares or debentures of an Indian company (to be computed with foreign exchange adjustment under first proviso to section 48)

- STCG on transactions covered u/s 111A (A3ai + A3aii)

- STCG from sale of shares not covered in sl. no 3a or sale of debentures

4. For NON-RESIDENT- from the sale of securities (other than those at A2) by an FII as per section 115AD

5. From the sale of assets other than at A1 or A2 or A3 or A4 above

6. Amount deemed to be short-term capital gains

7. Pass Through Income/ Loss in the nature of Short Term Capital Gain, (Fill up schedule PTI) (A7ai + A7aii + A7b + A7c)

8. Amount of STCG included in A1 – A7 but not chargeable to tax or chargeable at special rates in India as per DTAA

- a Total amount of STCG not chargeable to tax in India as per DTAA

- b Total amount of STCG chargeable to tax at special rates in India as per DTAA

9. Total Short-term Capital Gain (A1e+ A2e+ A3a+ A3b+ A4e+ A5e+A6 + A7 – A8a + A(A))

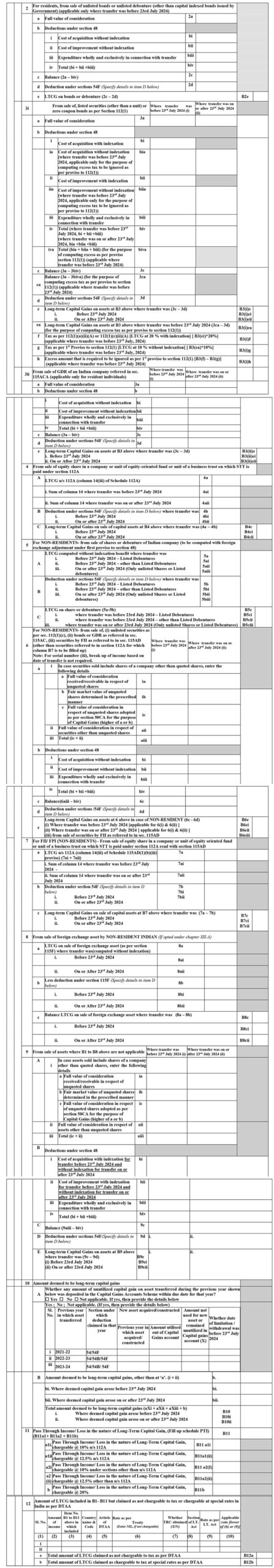

B. Long-term capital gain (LTCG) (Sub-items, 5, 6, 7 & 8 are not applicable for residents)

- From the sale of land or building or both

- From the sale of bonds or debentures

- From the sale of listed securities or zero-coupon bonds where proviso u/s 112 is applicable or from the sale of GDR referred to in section 115ACA

- From the sale of equity share in a company or unit of equity oriented fund or unit of a business trust on which STT is paid under section 112A

- For NON-RESIDENTS- from the sale of shares or debenture of an Indian company (to be computed with foreign exchange adjustment under first proviso to section 48)

- For NON-RESIDENTS- from sale of, (i) unlisted securities as per sec. 112(1)(c), (ii) bonds or GDR as referred in sec. 115AC, (iii) securities by FII as referred to in sec. 115AD (other than securities referred to in section 112A for which column B7 is to be filled up)

- For NON-RESIDENTS – From the sale of equity share in a company or unit of equity-oriented fund or unit of a business trust on which STT is paid under section 112A

- From the sale of foreign exchange assets by NRI

- From the sale of assets where B1 to B8 above are not applicable

- The amount deemed to be long-term capital gains

- Pass Through Income/ Loss in the nature of Long-Term Capital Gain, (Fill up schedule PTI) (B11a1+ B11a2 + B11b)

- Amount of LTCG included in B1- B11 but claimed as not chargeable to tax or chargeable at special rates in India as per DTAA

- a. Total amount of LTCG not chargeable to tax as per DTAA

- b Total amount of LTCG chargeable to tax at special rates as per DTAA

- Total long term capital gain chargeable under I.T. Act (B1e+B2e+B3ie+B3iie+B4c+B5c+B6e+B7c+B8c+B9e+B10 + B11 – B12a+B(A))

C1. Sum of Capital Gain Incomes (11ii +11iii + 11iv +11v + 11vi + 11vii + 11viii + 11ix +11x of table E below)

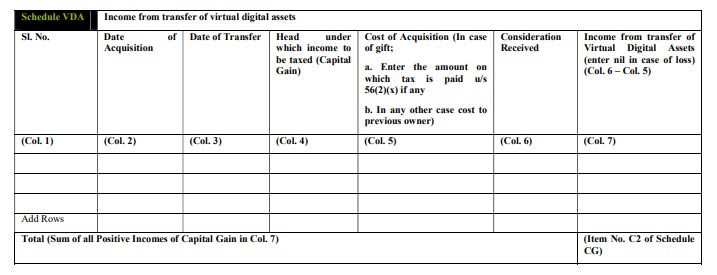

C2. Income from transfer of virtual digital assets (Col. 7 of Schedule VDA)

C3. Income chargeable under the head “CAPITAL GAINS” (C1 + C2)

D. Information about deduction claimed against Capital Gains

E. Set-off of current year capital losses with current year capital gains (excluding amounts included in A8a & B12a which is not chargeable under DTAA)

F. Information about accrual/receipt of capital gain

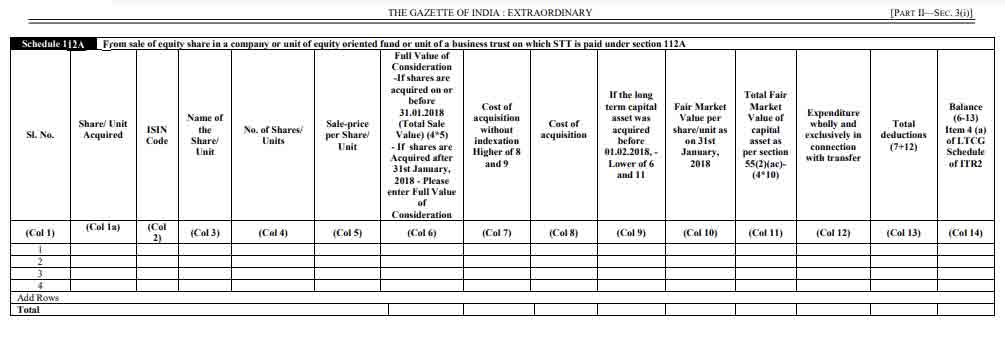

Schedule 112A:

From the sale of equity shares in a company or unit of an equity-oriented fund or unit of a business trust on which STT is paid under section 112A.

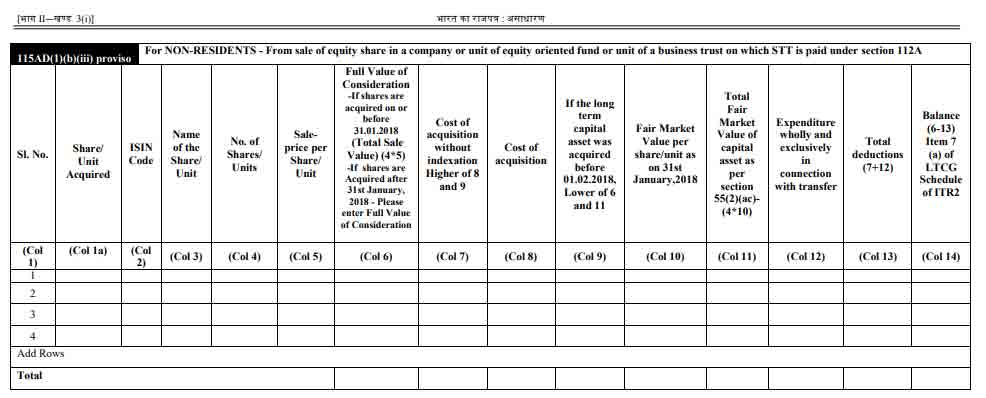

115AD(1)(b)(iii) proviso

For NON-RESIDENTS – From sale of equity share in a company or unit of equity-oriented fund or unit of a business trust on which STT is paid under section 112A.

Schedule VDA: Income from transfer of virtual digital assets

- Sl. No

- Date of Acquisition

- Date of Transfer

- Head under which income to be taxed (Capital Gain)

- Cost of Acquisition (In case of gift;)

- a. Enter the amount on which tax is paid u/s 56(2)(x) if any

- b. In any other case cost to the previous owner

- Consideration Received

- Income from transfer of Virtual Digital Assets (enter nil in case of loss) (Col. 6 – Col. 5)

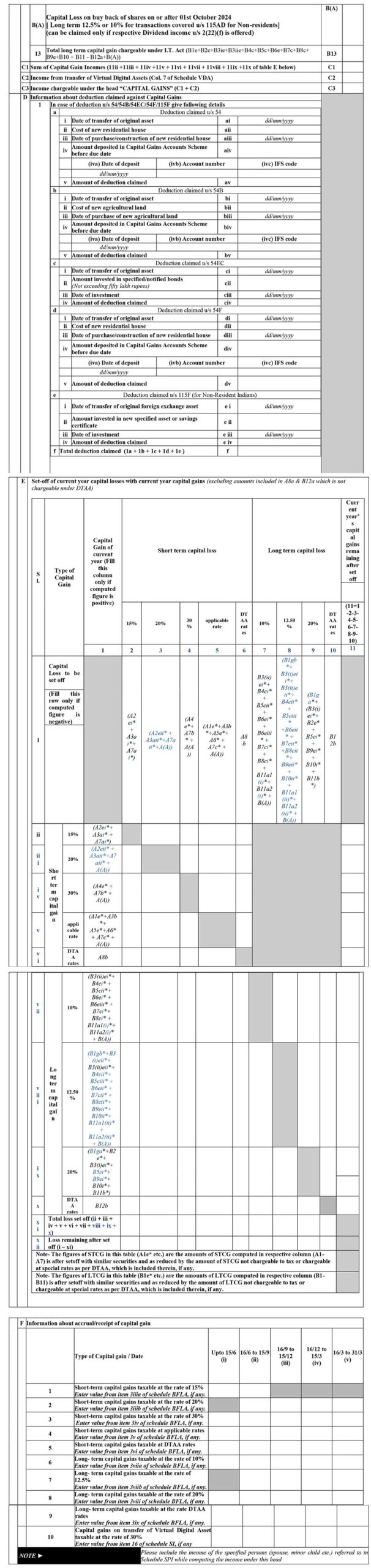

Schedule OS:

- Income from other sources: The information regarding income from other sources is enclosed:

- Gross income chargeable to tax at normal applicable rates (1a+ 1b+ 1c+ 1d + 1e)

- Income chargeable at special rates (2ai+2aii+ 2b+ 2c+ 2d + 2e +2f elements related to Sl. No.1)

- Deductions under section 57

- Amounts not deductible u/s 58

- Profits chargeable to tax u/s 59

- Income claimed for relief from taxation u/s 89A

- Net Income from other sources chargeable at normal applicable rates (1(after reducing income related to 6 DTAA portion) – 3 + 4 + 5-5a )

- Income from other sources (other than from owning race horses)

- Income from the activity of owning and maintaining race horses

- Income under the head “Income from other sources” (7 + 8e)

- Information about accrual/receipt of income from Other Sources

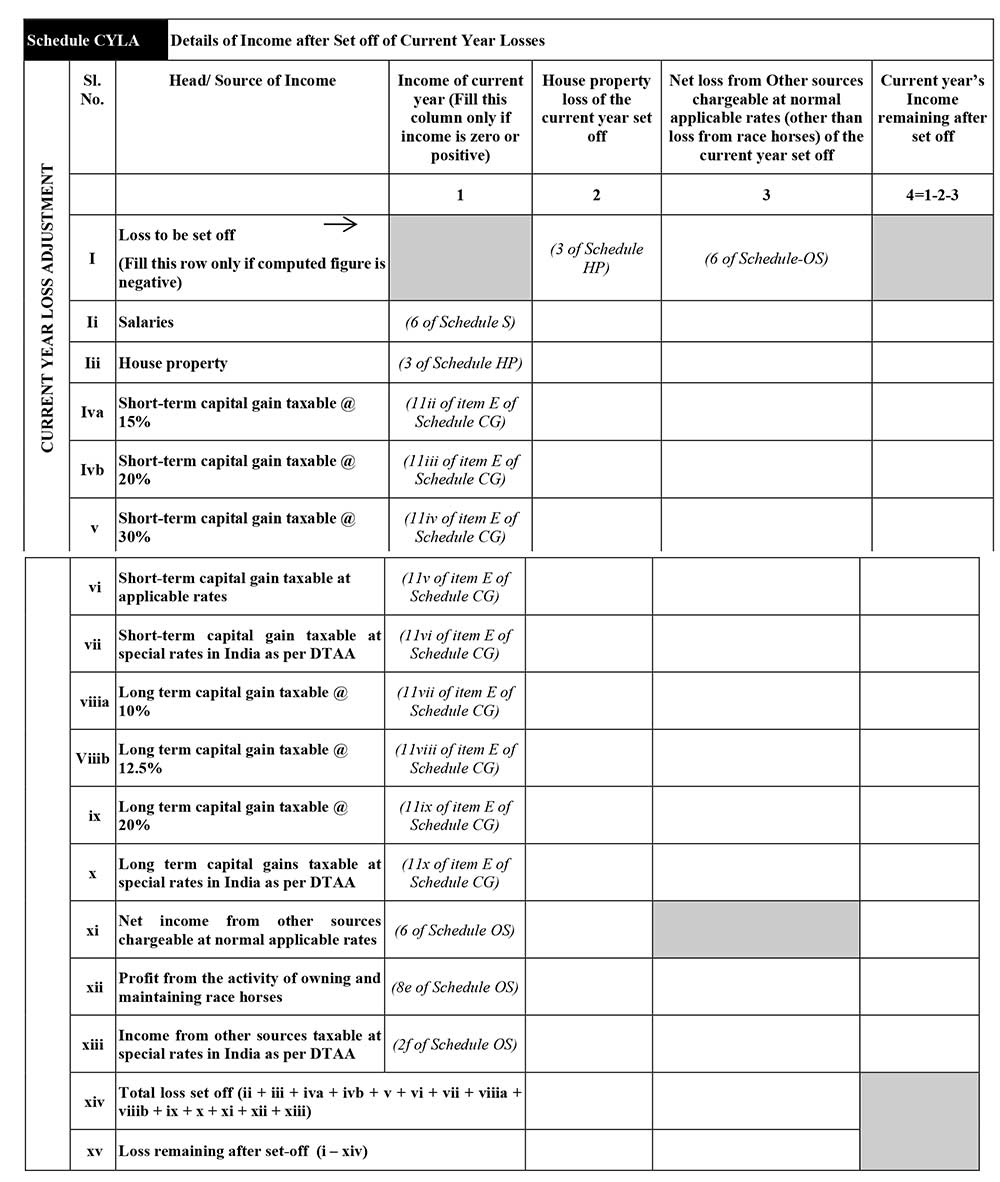

Schedule CYLA:

Details of Income after Set off of Current Year Losses

- Head/ Source of Income

- Income of the current year

- House property loss of the current year set off

- Net loss from Other sources chargeable at normal applicable rates (other than loss from race horses) of the current year set off

- Current year’s Income remaining after set off

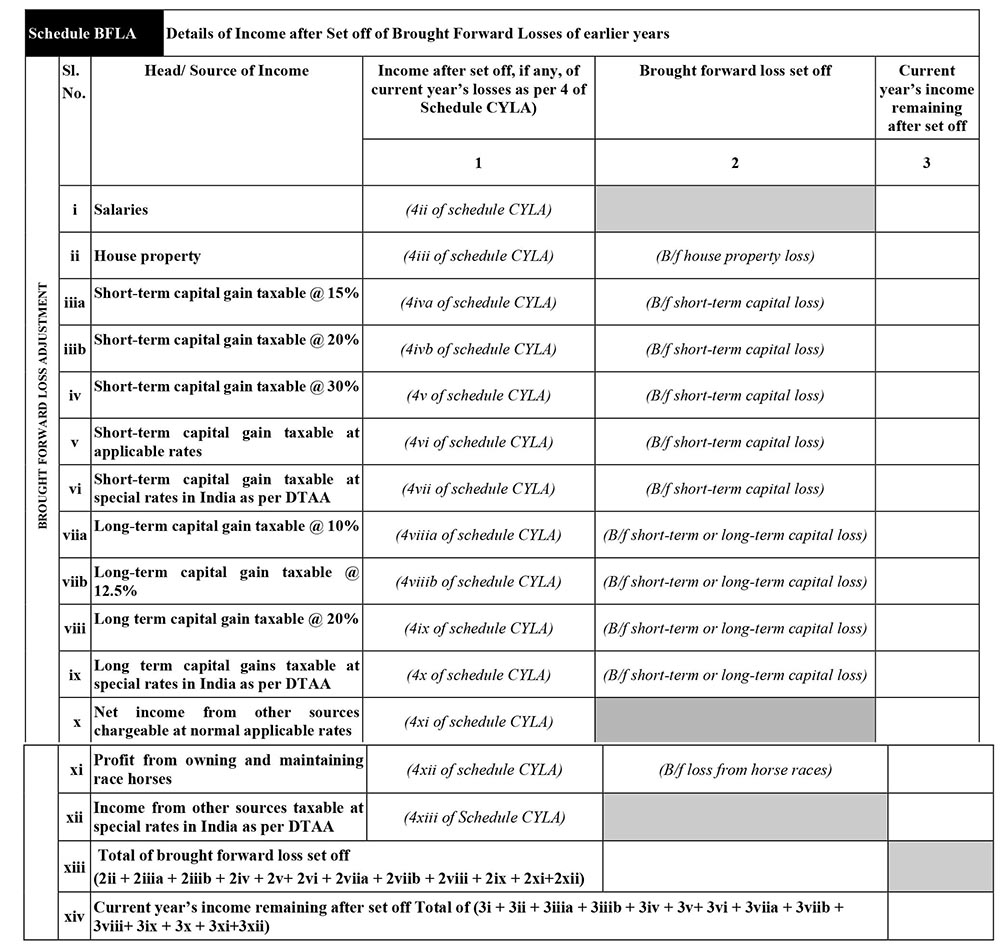

Schedule BFLA:

Details of Income after Set off of Brought Forward Losses of earlier years

- Head/ Source of Income

- Income after set off, if any, of current year’s losses as per 4 of Schedule CYLA)

- Brought forward loss set off

- Current year’s income remaining after set off

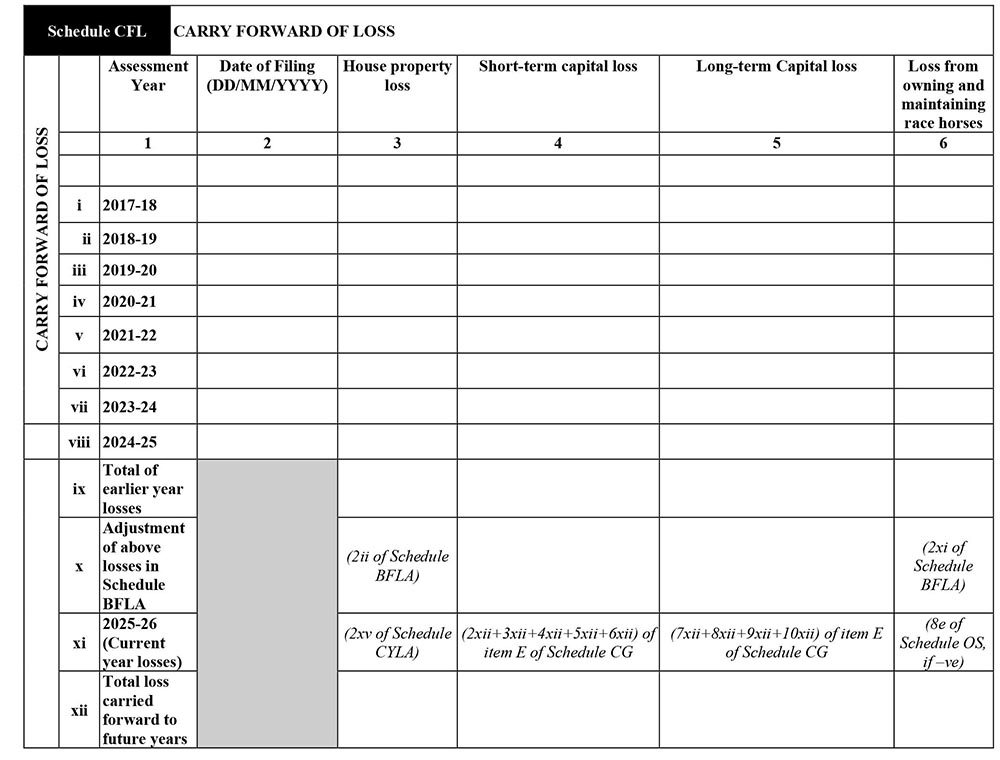

Schedule CFL: Carry Forward of Loss

- Assessment Year

- Date of Filing

- House property loss

- Short-term capital loss

- Long-term Capital loss

- Loss from owning and maintaining race horses

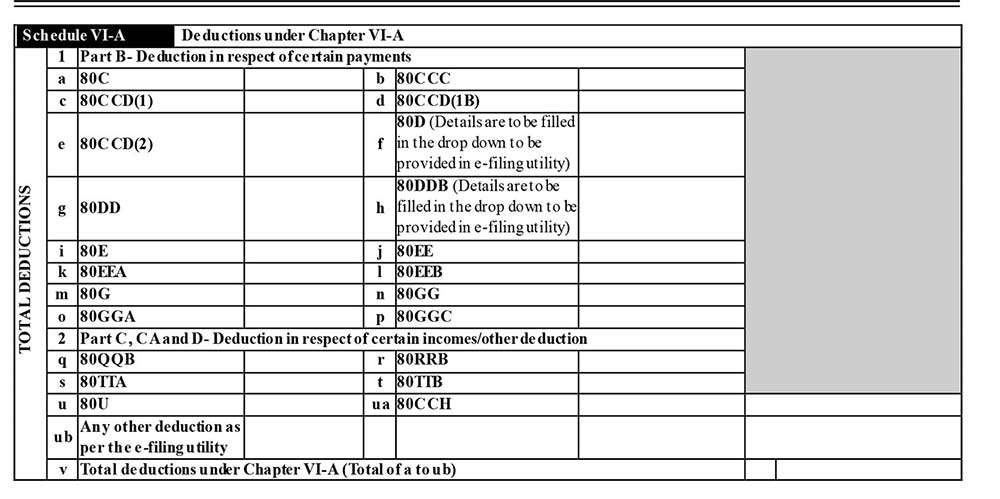

Schedule VI-A: Deductions under Chapter VI-A

Details under this title are enclosed with the following details of the taxpayer to furnish:

1. Part B- Deduction in respect of certain payments

2. Part C, CA and D- Deduction in respect of certain incomes/other deduction

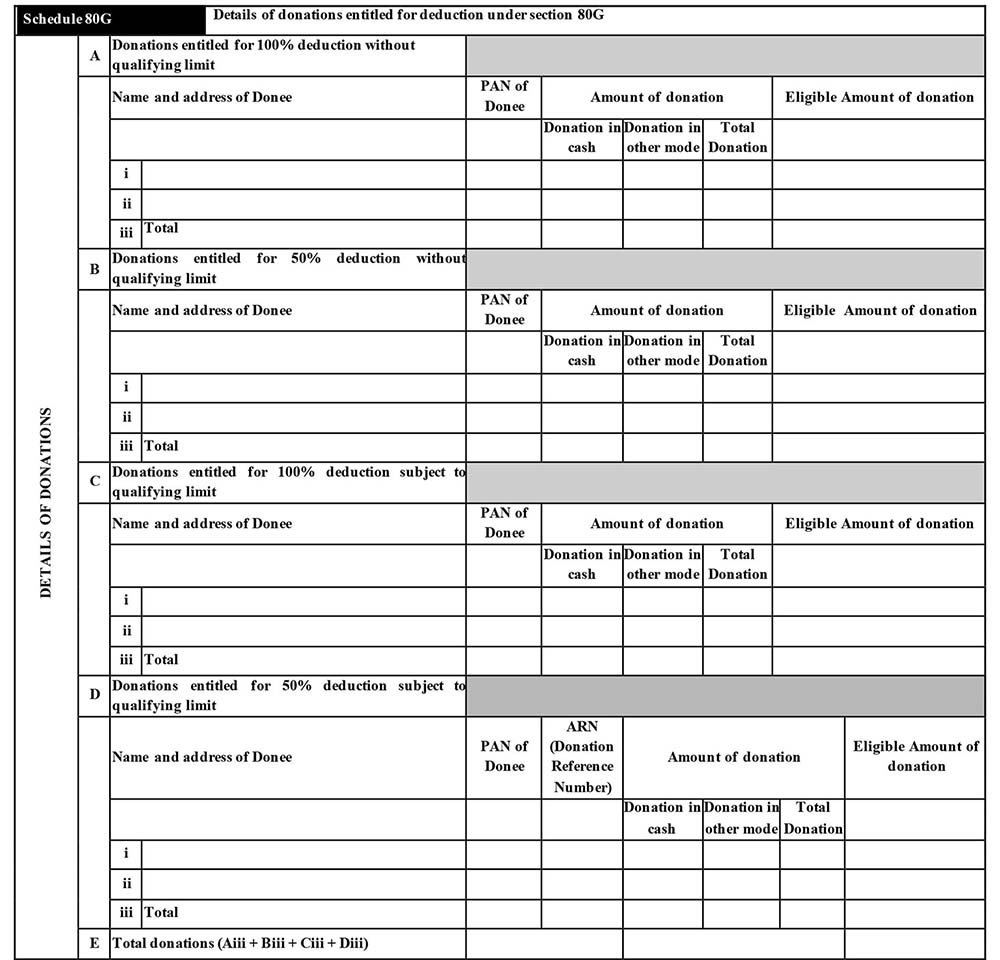

Schedule 80G: Details of donations entitled for deduction under section 80G

- Donations entitled for 100% deduction without qualifying limit

- Donations entitled for 50% deduction without qualifying limit

- Donations entitled for 100% deduction subject to qualifying limit

- Donations entitled for 50% deduction subject to qualifying limit

- Total donations

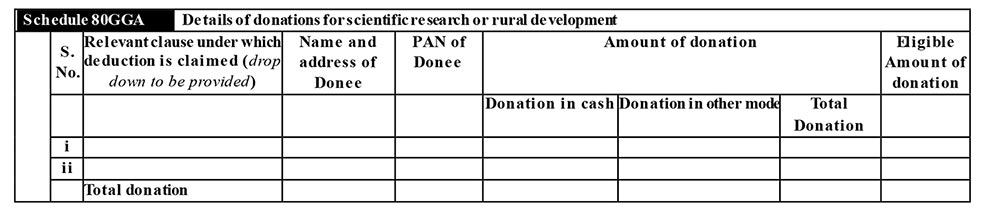

Schedule 80GGA: Details of donations for scientific research or rural development

- Relevant clause under which deduction is claimed

- Claimed Name and address of donee

- PAN of Donee

- Amount of donation

- Eligible Amount of donation

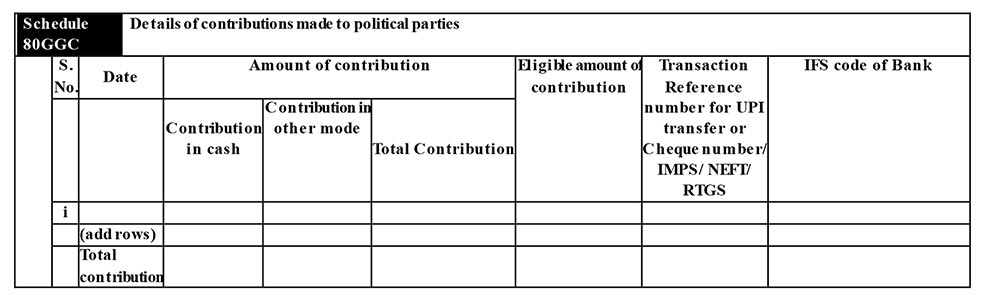

Schedule 80GGC: Details of contributions made to political parties.

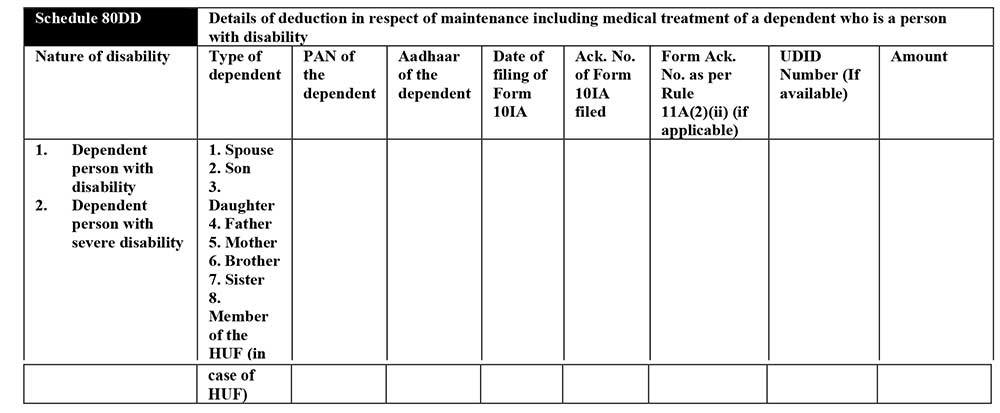

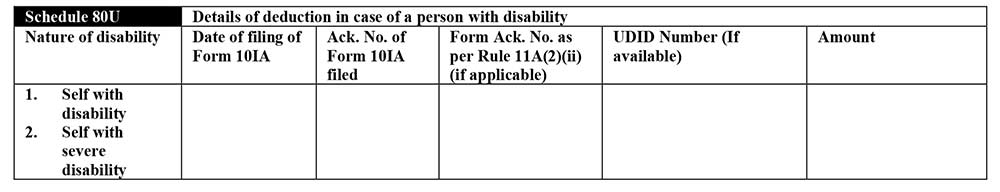

Schedule 80DD: Details of deduction in respect of maintenance including medical treatment of a dependent who is a person with disability.

Schedule 80U: Details of deduction in case of a person with disability

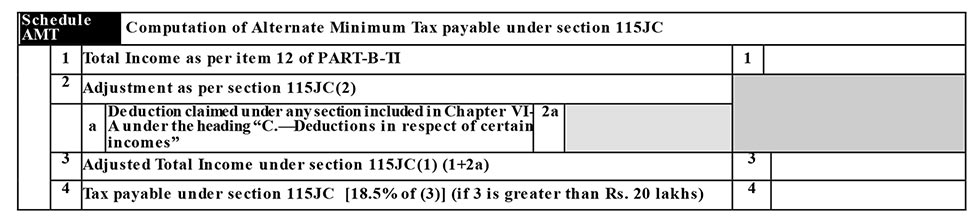

Schedule AMT: Computation of Alternate Minimum Tax payable under section 115JC

- Total Income as per item 12 of PART-B-TI

- Adjustment as per section 115JC(2)

- Adjusted Total Income under section 115JC(1) (1+2a)

- Tax payable under section 115JC [18.5% of (3)] (if 3 is greater than Rs. 20 lakhs)

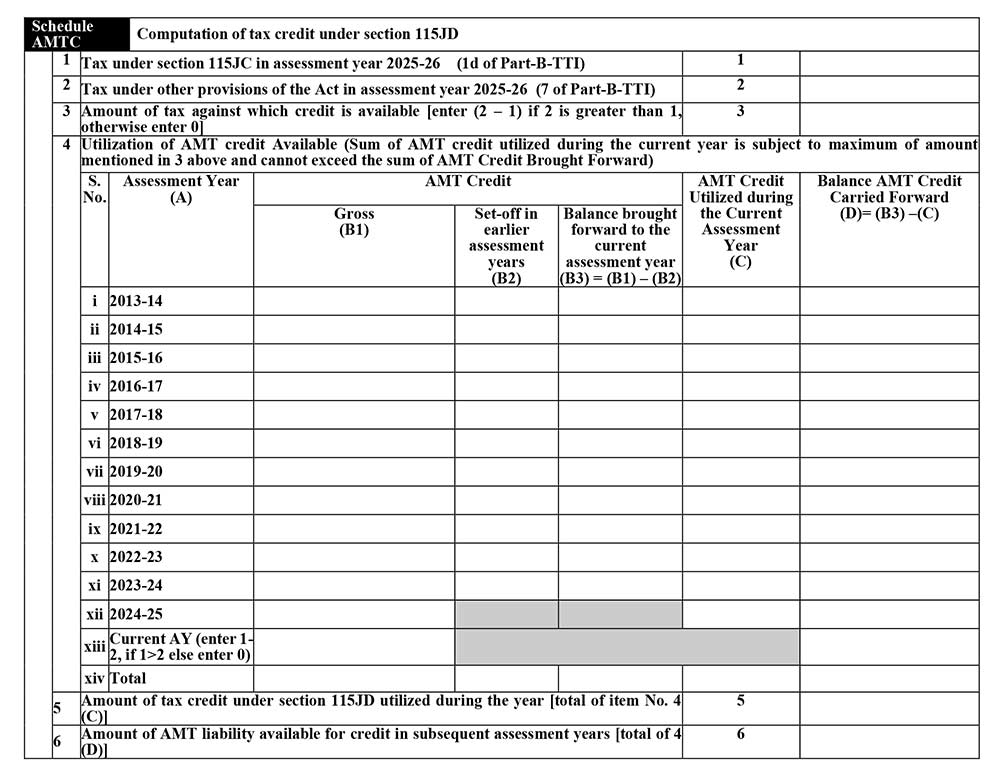

Schedule AMTC: Computation of tax credit under section 115JD

- The tax under section 115JC in the assessment year 2024-25 (1d of Part-B-TTI)

- The tax under other provisions of the Act in the assessment year 2024-25 (7 of Part-B-TTI)

- Amount of tax against which credit is available [enter (2 – 1) if 2 is greater than 1, otherwise enter 0]

- The utilisation of AMT credit Available

- Amount of tax credit under section 115JD utilised during the year [total of item No. 4 (C)]

- Amount of AMT liability available for credit in subsequent assessment years [total of 4 (D)]

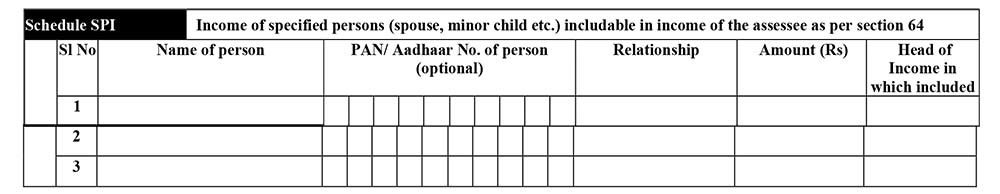

Schedule SPI: Income of specified persons (spouse, minor child etc.) includable in income of the assessee as per section 64

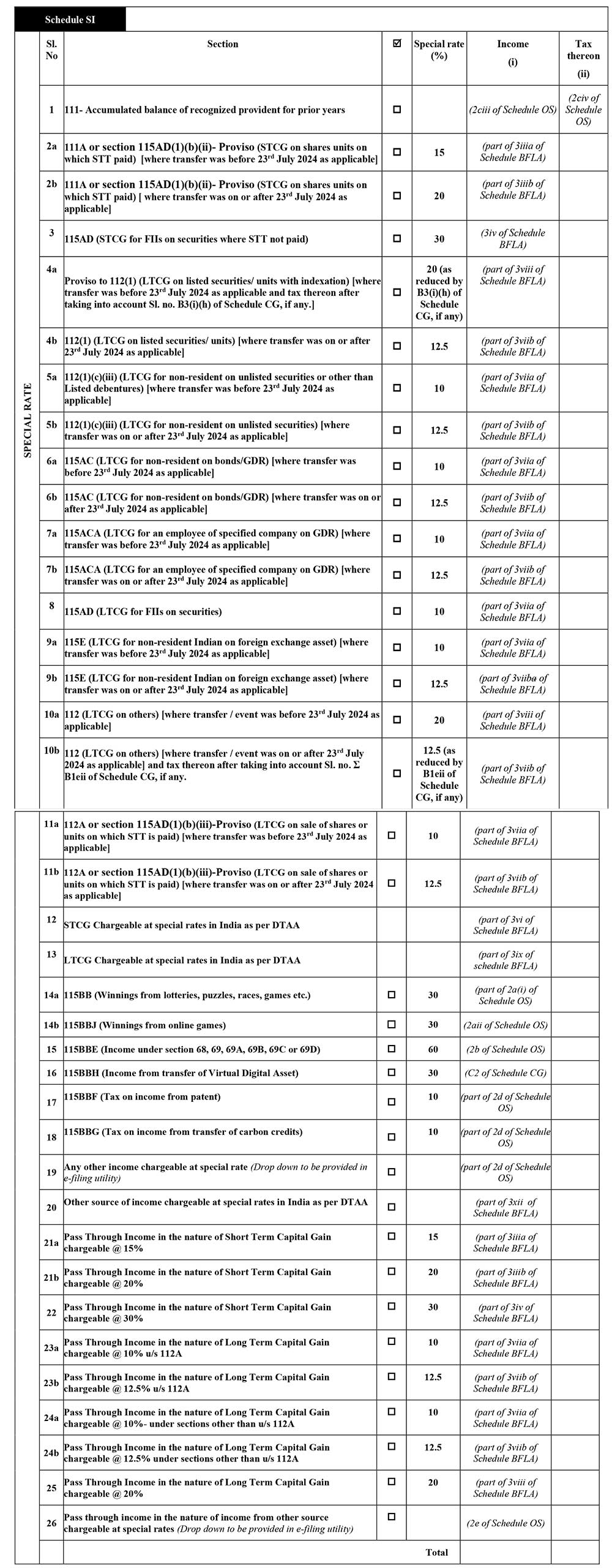

Schedule SI: Income chargeable to tax at special rates

1 111- Accumulated balance of recognised provident for prior years

2 111A or section 115AD(1)(b)(ii)- Proviso (STCG on shares units on which STT paid)

3 115AD (STCG for FIIs on securities where STT not paid)

4 112 proviso (LTCG on listed securities/ units without indexation)

5 112(1)(c)(iii) (LTCG for non-resident on unlisted securities)

6 115AC (LTCG for non-resident on bonds/GDR)

7 115ACA (LTCG for an employee of specified company on GDR)

8 115AD (LTCG for FIIs on securities)

9 115E (LTCG for non-resident Indian on specified asset)

10 112 (LTCG on others)

11 112A or section 115AD(1)(b)(iii)-Proviso (LTCG on sale of shares or units on which STT is paid) 10 (part of 3vi of schedule BFLA)

12 STCG Chargeable at special rates in India as per DTAA

13 LTCG Chargeable at special rates in India as per DTAA

14 115BB (Winnings from lotteries, puzzles, races, games etc.)

15 115BBE (Income under section 68, 69, 69A, 69B, 69C or 69D)

16 115BBF (Tax on income from patent)

17 115BBG (Tax on income from transfer of carbon credits)

18 Any other income chargeable at special rate (Drop down to be provided in efiling utility)

19 Other source of income chargeable at special rates in India as per DTAA

20 Pass Through Income in the nature of Short Term Capital Gain chargeable @ 15%

21 Pass Through Income in the nature of Short Term Capital Gain chargeable @ 30%

22 Pass Through Income in the nature of Long Term Capital Gain chargeable @ 10% u/s 112A

23 Pass Through Income in the nature of Long Term Capital Gain chargeable @ 10%- under sections other than u/s 112A

24 Pass Through Income in the nature of Long Term Capital Gain chargeable @ 20%

25 Pass through income in the nature of income from other source chargeable at special rates (Drop down to be provided in e-filing utility)

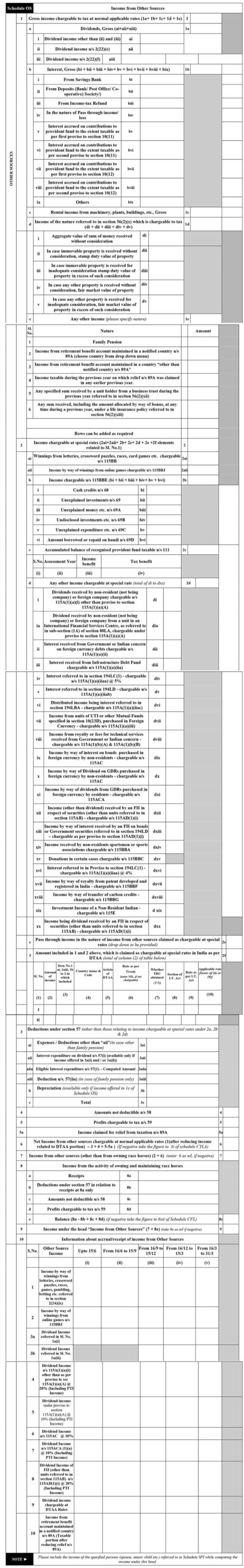

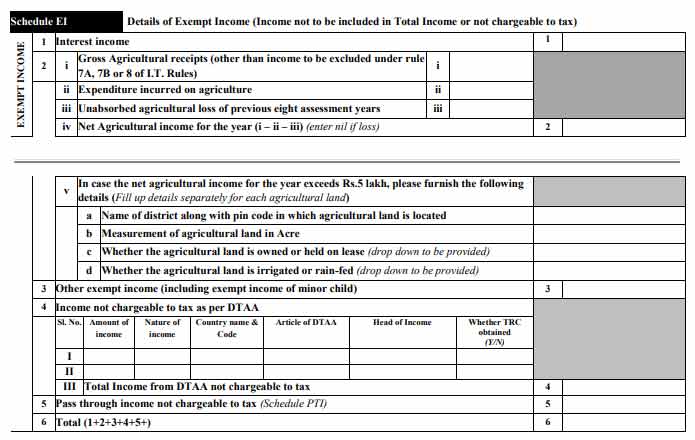

Schedule EI: Details of Exempt Income (Income not to be included in Total Income or not chargeable to tax)

- 1 Interest income

- 2

- I Gross Agricultural receipts (other than income to be excluded under rule 7A, 7B or 8 of I.T. Rules)

- II Expenditure incurred on agriculture ii

- III Unabsorbed agricultural loss of previous eight assessment years iii

- IV Net Agricultural income for the year (i – ii – iii) (enter nil if loss) 3

- V In case the net agricultural income for the year exceeds Rs.5 lakh, please furnish the following details (Fill up details separately for each agricultural land)

- a Name of the district along with pin code in which agricultural land is located

- b Measurement of agricultural land in Acre

- c Whether the agricultural land is owned or held on lease (drop down to be provided)

- d Whether the agricultural land is irrigated or rain-fed (drop down to be provided)

- 3 Other exempt income (including exempt income of minor child)

- 4 Income not chargeable to tax as per DTAA

- Sl. No. Amount of income

- Nature of income

- Country name & Code

- Article of DTAA

- Head of Income

- Whether TRC obtained

- (Y/N) I, II, III Total Income from DTAA not chargeable to tax

- 5 Pass through income not chargeable to tax (Schedule PTI)

- 6 Total (1+2+3+4+5+6)

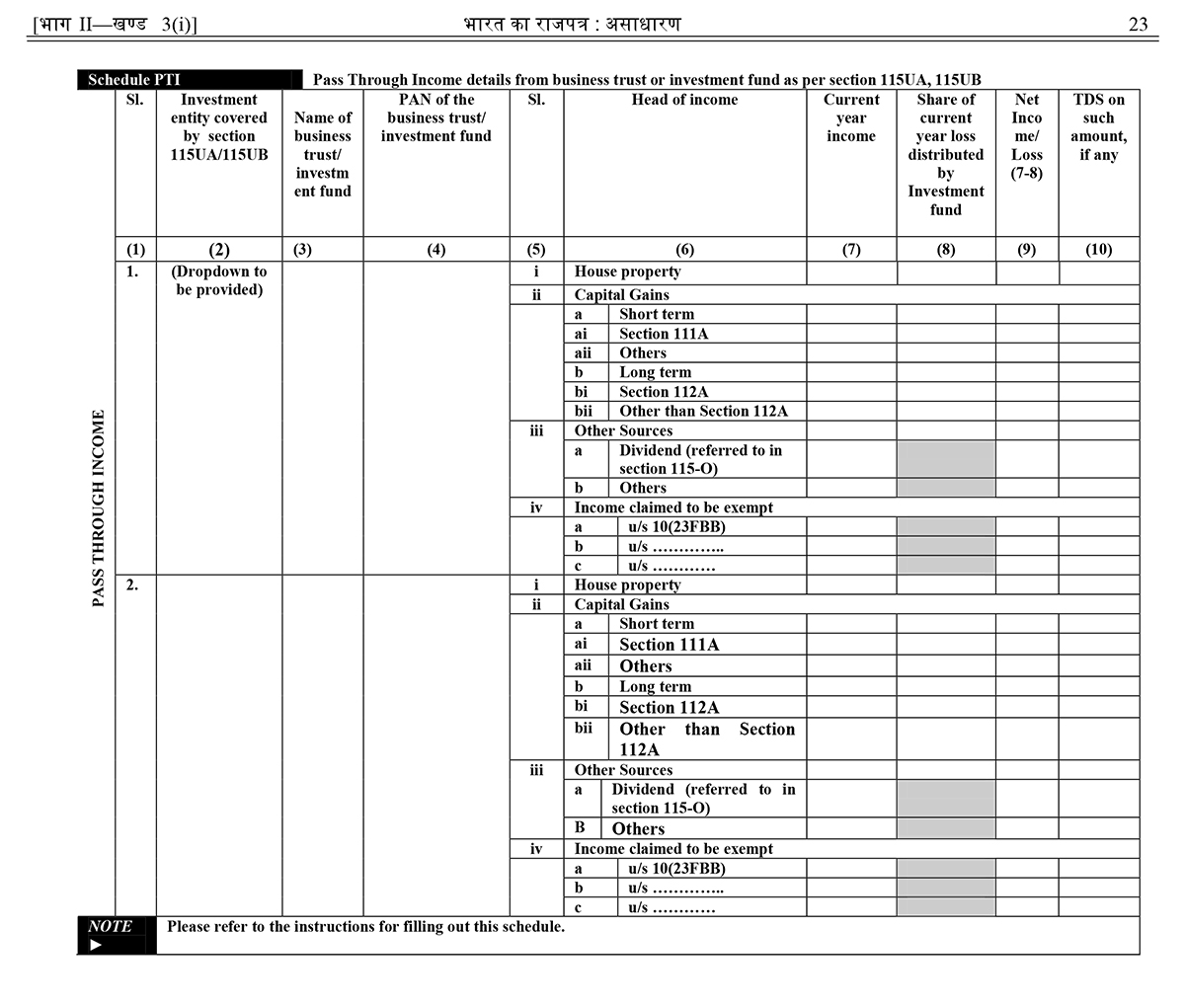

Schedule PTI: Pass Through Income details from business trust or investment fund as per section 115U, 115UA and 115UB

- Investment entity covered by section 115U/115UA/115UB

- Name of business trust/ investment fund

- PAN of the business trust/ investment fund

- SI.

- Current Year Income

- Share of current year loss distributed by Investment fund

- Net Income/Loss (7-8)

- TDS on such amount, if any

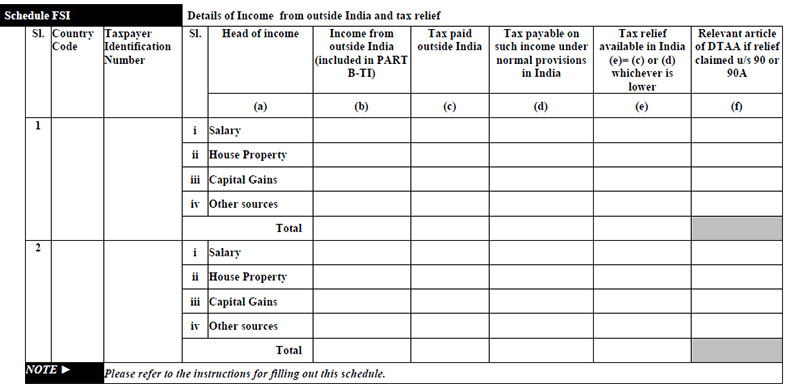

Schedule FSI: Details of Income from outside India and tax relief

- Country Code

- Taxpayer Identification Number

- Head of income

- Income from outside India (included in PART B-TI)

- Tax paid outside India

- Tax payable on such income under normal provisions in India

- Tax relief available in India (e)= (c) or (d) whichever is lower

- Relevant article of DTAA if relief claimed u/s 90 or 90A

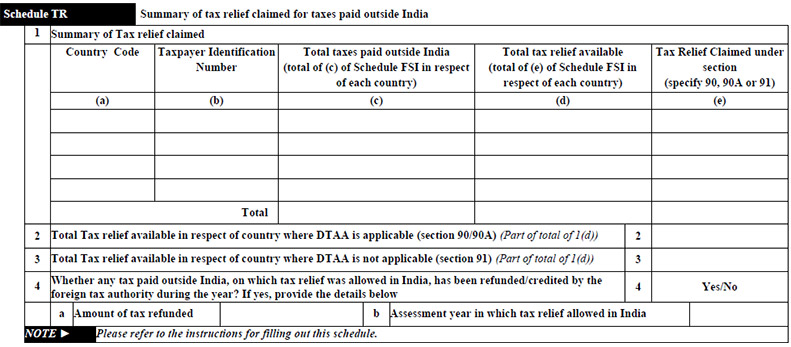

Schedule TR: Summary of tax relief claimed for taxes paid outside India

- 1 Summary of Tax relief claimed

- 2 Total Tax relief available in respect of country where DTAA is applicable (section 90/90A)

- 3 Total Tax relief available in respect of country where DTAA is not applicable (section 91)

- 4 Whether any tax paid outside India, on which tax relief was allowed in India, has been refunded/credited by the foreign tax authority during the year?

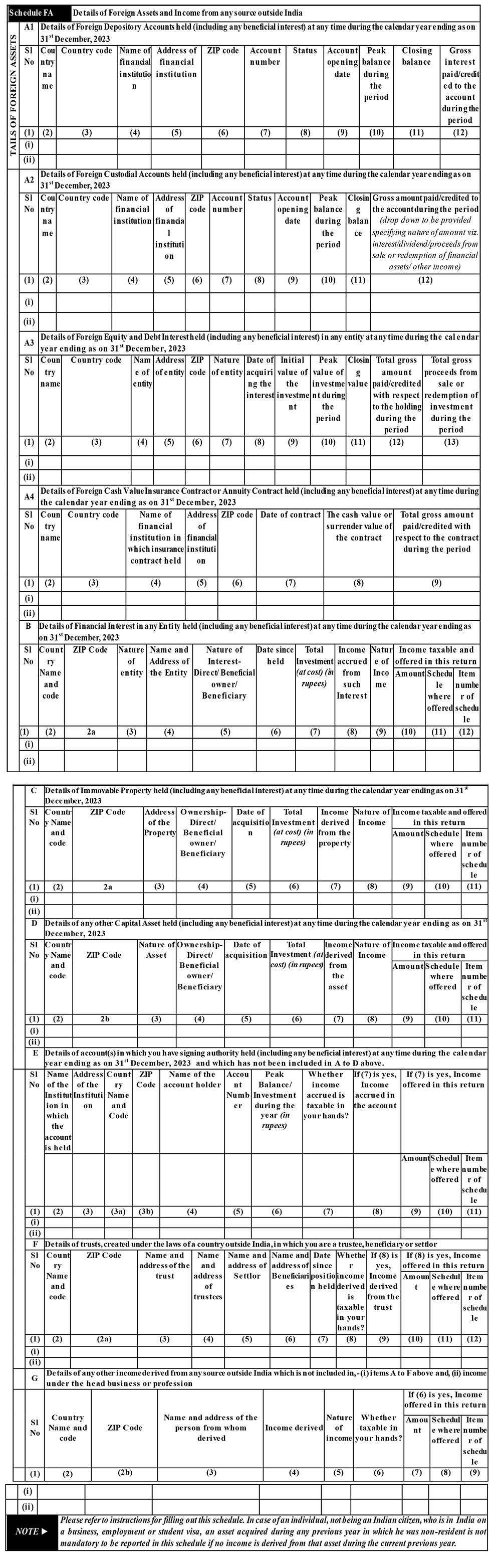

Schedule FA: Details of Foreign Assets and Income from any source outside India

- A1 Details of Foreign Depository Accounts held (including any beneficial interest) at any time during the calendar year ending as on 31st December 2024

- A2 Details of Foreign Custodial Accounts held (including any beneficial interest) at any time during the calendar year ending as on 31st December 2024

- A3 Details of Foreign Equity and Debt Interest held (including any beneficial interest) in any entity at any time during the calendar year ending as on 31st December 2024

- A4 Details of Foreign Cash Value Insurance Contract or Annuity Contract held (including any beneficial interest) at any time during the calendar year ending as on 31st December 2024

- B Details of Financial Interest in any Entity held (including any beneficial interest) at any time during the calendar year ending as on 31st December 2024

- C Details of Immovable Property held (including any beneficial interest) at any time during the calendar year ending as on 31st December, 2024

- D Details of any other Capital Asset held (including any beneficial interest) at any time during the calendar year ending as on 31st December, 2024

- E Details of account(s) in which you have signing authority held (including any beneficial interest) at any time during the calendar year ending as on 31st December, 2024 and which has not been included in A to D above

- F Details of trusts, created under the laws of a country outside India, in which you are a trustee, beneficiary or settlor

- G Details of any other income derived from any source outside India which is not included in (i) items A to F above and, (ii) income under the head business or profession

Note: Please refer to instructions for filling out this schedule. In case of an individual, not being an Indian citizen, who is in India on a business, employment or student visa, an asset acquired during any previous year in which he was non-resident is not mandatory to be reported in this schedule if no income is derived from that asset during the current previous year.

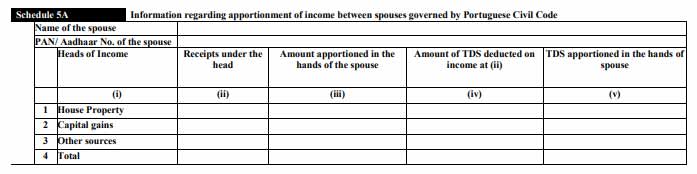

Schedule 5A: Information regarding apportionment of income between spouses governed by Portuguese Civil Code

- Name of the spouse

- PAN of the spouse

- Heads of Income

- Income received under the head

- Amount apportioned in the hands of the spouse

- Amount of TDS deducted on income at (ii)

- TDS apportioned in the hands of the spouse

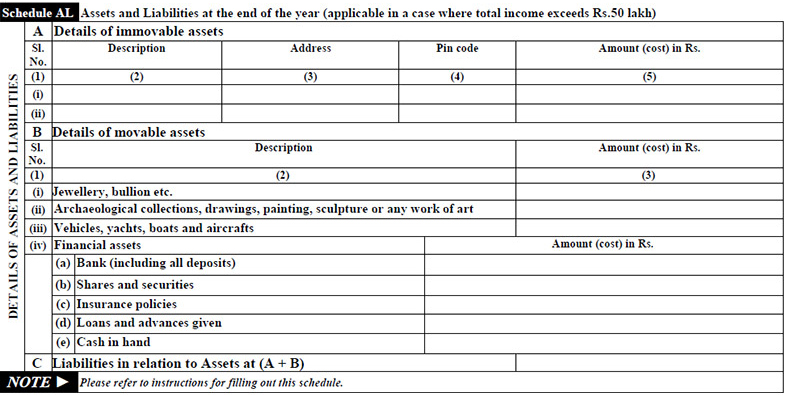

Schedule AL: Assets and Liabilities at the end of the year (applicable in a case where total income exceeds Rs. 1 Crore)

- A Details of immovable assets

- B Details of movable assets

- C Liabilities in relation to Assets at (A + B)

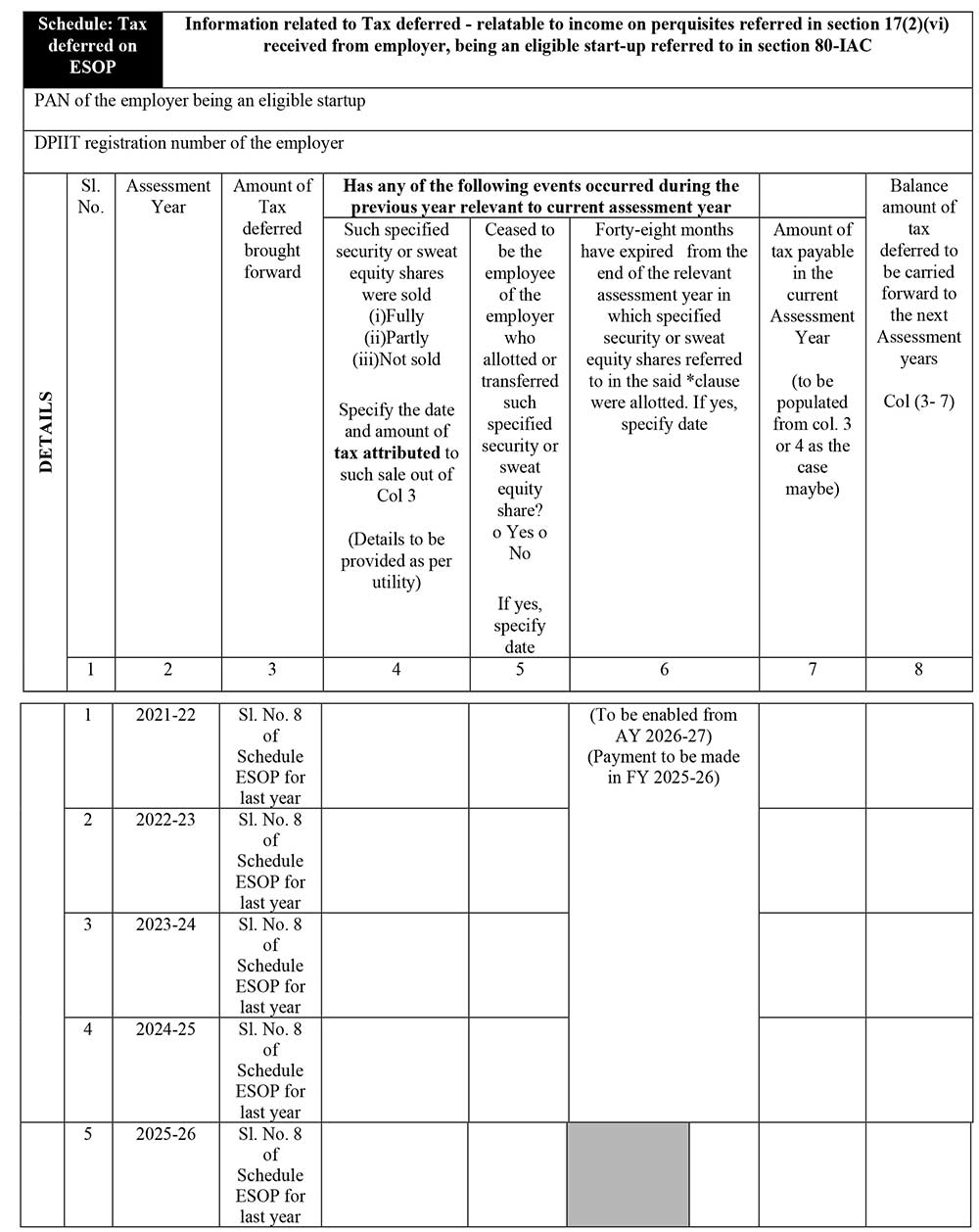

Schedule Tax-deferred on ESOP: Information related to Tax deferred – relatable to income on perquisites referred in section 17(2)(vi) received from

employer, being an eligible start-up referred to in section 80-IAC

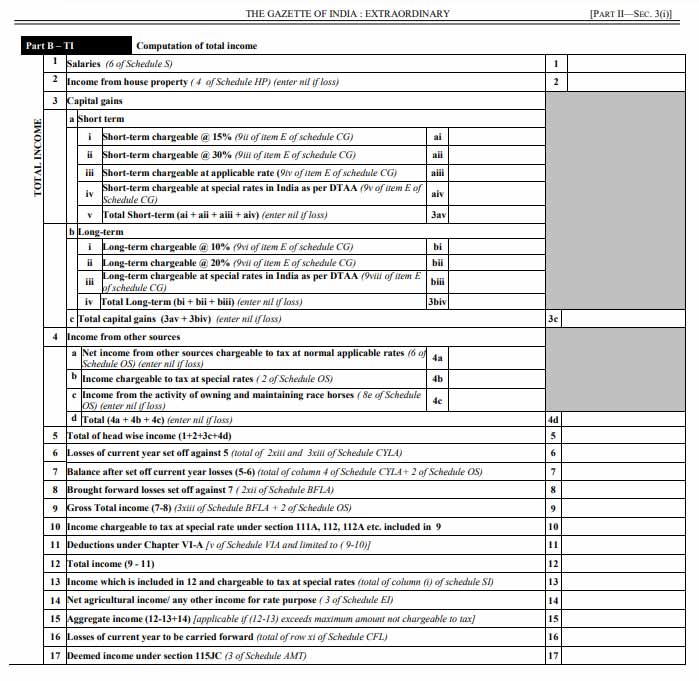

Part B-TI: Computation of Total Income

The information regarding total income is enclosed with the following details of the taxpayer to furnish with:

- Salaries

- Income from house property

- Capital gains

- Income from other sources

- Total of head wise income (1+2+3c+4d)

- Losses of current year set off against 5

- Balance after set off current year losses (5-6)

- Brought forward losses set off against 7

- Gross Total income (7-8)

- Income chargeable to tax at special rate under section 111A, 112, 112A etc. included in 9

- Deductions under Chapter VI-A

- Total income (9-11)

- Income which is included in 12 and chargeable to tax at special rates

- Net agricultural income/ any other income for rate purpose

- Aggregate income (12-13+14)

- Losses of the current year to be carried forward

- Deemed income under section 115JC

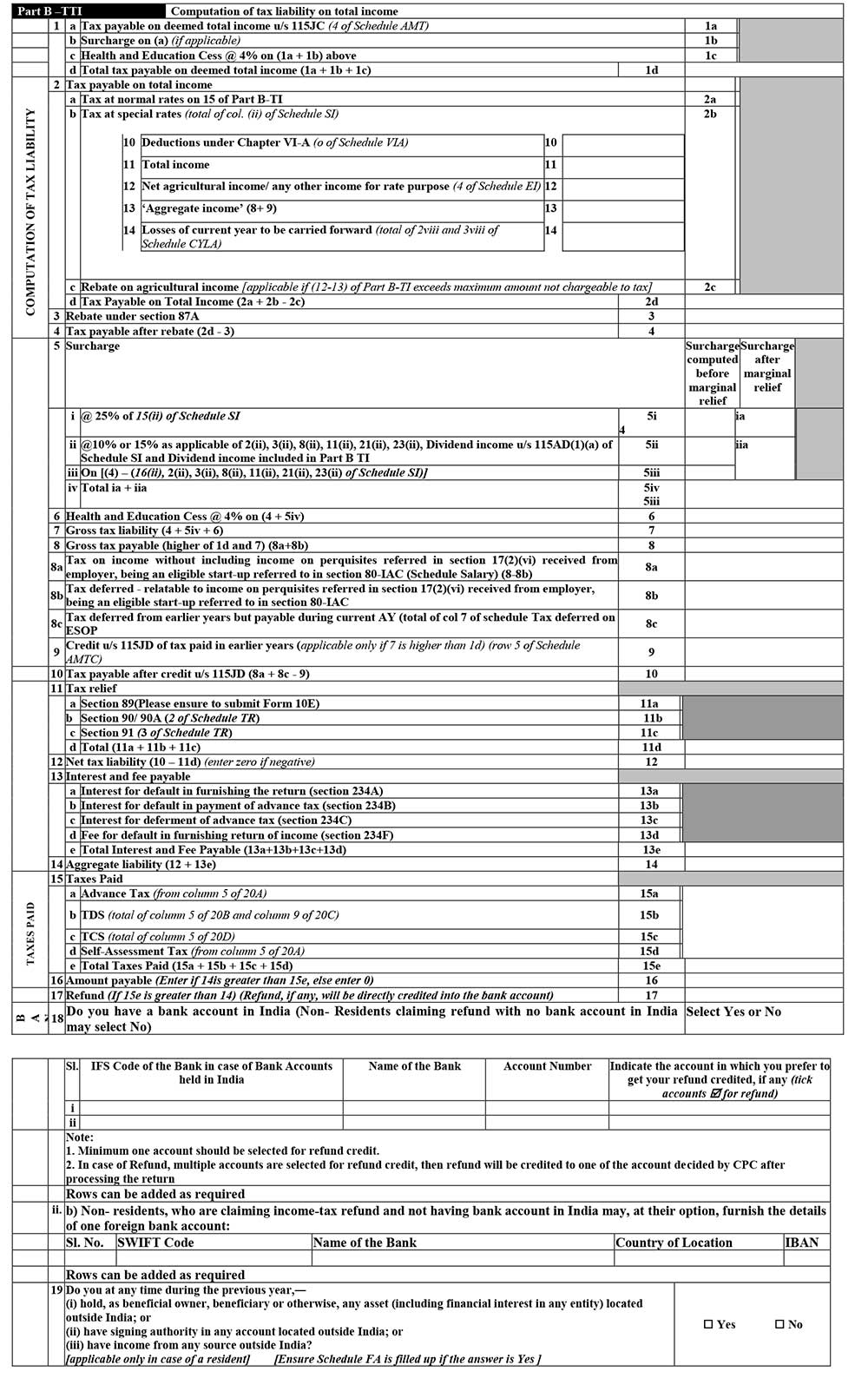

Part B-TTI: Computation of tax liability on total income

The information regarding the Computation of tax liability on total income is enclosed with the following details of the taxpayer to furnish with:

- Tax payable on deemed total income u/s 115JC

- Tax payable on total income

- Rebate under section 87A

- Tax payable after rebate (2d-3)

- Surcharge

- Health and Education Cess @ 4% on (4 + 5iv)

- Gross tax liability (4 + 5iv + 6)

- Gross tax payable (higher of 1d and 7)

- a) Tax on income without including income on perquisites referred in section 17(2)(vi) received from employer, being an eligible start-up referred to in section 80-IAC ( Schedule Salary)

- b) Tax deferred – relatable to income on perquisites referred in section 17(2)(vi) received from employer, being an eligible start-up referred to in section 80-IAC

- c) Tax deferred from earlier years but payable during current AY (total of col 7 of schedule Tax deferred on ESOP

- Credit u/s 115JD of tax paid in earlier years

- Tax payable after credit u/s 115JD (8a +8c – 9)

- Tax relief

- Net tax liability (10 – 11d)

- Interest and fee payable

- Aggregate liability (12 + 13e)

- Taxes Paid

- Amount payable (Enter if 14is greater than 15e, else enter 0)

- Refund

- Details of all Bank Accounts held in India at any time during the previous year

- Do you at any time during the previous year

- (i) hold, as beneficial owner, beneficiary or otherwise, any asset (including financial interest in any entity) located outside India; or

- (ii) have signing authority in any account located outside India; or

- (iii) have income from any source outside India?

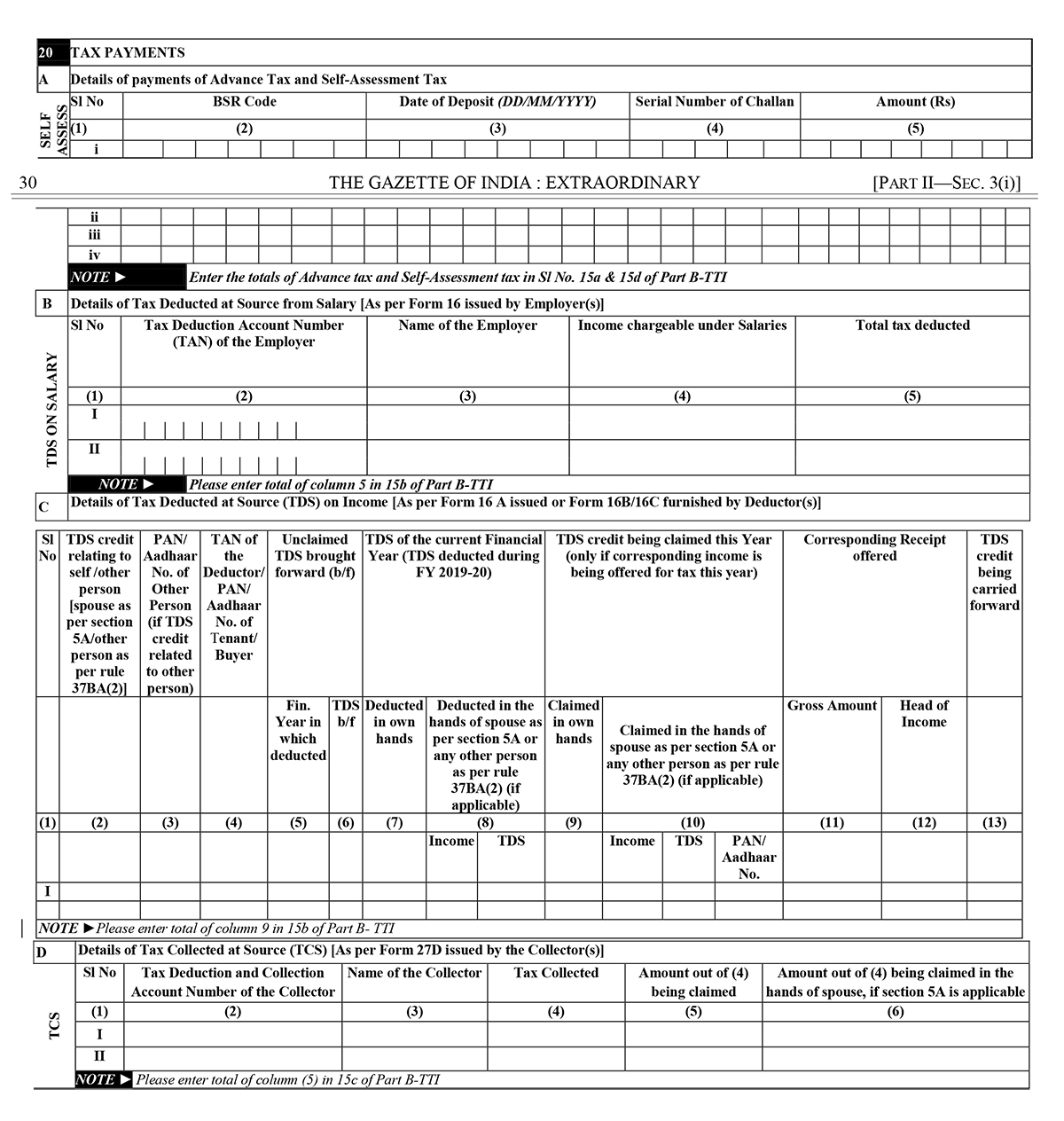

20 Tax Payments

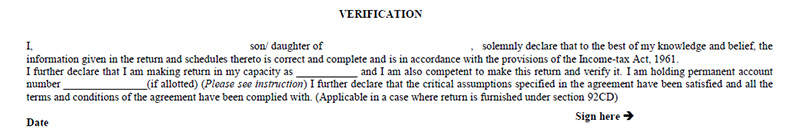

Verification: There will be verification at the end of all the General, Part B TI and Part B TTI ensuring that the details given are factually correct and self-attested by the taxpayer.

If the return has been prepared by a Tax Return Preparer (TRP) give further details below:

- Identification No. of TRP

- Name of TRP

- Counter Signature of TRP

If TRP is entitled for any reimbursement from the Government, amount thereof 21

A Details of payments of Advance Tax and Self-Assessment Tax

B Details of Tax Deducted at Source from Salary [As per Form 16 issued by Employer(s)]

Income Tax Return 2 Form Filing Mode

An ITR-2 form can be furnished either in online or offline mode. In online mode, either XML needs to be uploaded or client can directly login to income tax portal and select the submission mode as “prepare and submit online”. In the case of online filing, some data can be imported from the latest ITR or form 26AS. Super senior citizens (Age of 80 years or more) are exempted from the online filing of ITR. Offline here means to furnish the return form in paper format.

Online:

- While furnishing ITR-2 online, feed the details and e-verify return using EVC via Bank Account/Net Banking/Demat Account/Aadhar OTP or

- 2. Feed the details using electronic medium and send a physical copy of ITR V to Centralized Processing Centre (CPC), Bengaluru through speed post or normal post. When you furnish the ITR-2 return form using electronic medium, the receipt will be seen in the inbox of the registered email id. It can also be downloaded from the official income tax website manually. After downloading the acknowledgement, you need to sign the form and then send CPC office, Bangalore before completing 120 days counting from the e-filing date. On the other side, it is not required to send the ITR V to the CPC if EVC/OTP option is used

Offline:

- If the age of the person is 80 or more years during the respective tax period or in the previous year, he/she can opt for offline return filing.

ITR 2 Online User Manual Guide

Hi

I have updated my NPS employer contribution under Chapter VI A deductions however it is not coming into my taxable income as deduction. Anyone else having this issue ? if so what is the fix

Thanks for that Guide.

I’m a foreign national on a long term student visa. I’m filing online ITR2 Return with Residential Status “Resident but not Ordinarily resident”.

I do have a bank account abroad but no income derived from it since it does not give any interest on the small savings amount I have there.

Do I have to fill out Schedule FA section? I cannot find it there.

Please let me know what do I have to do? Thanks.

In case of Resident but not Ordinarily resident fill following detail in FA schedule.

1. whether you were director in a company at any time during the previous year?

2. Whether you were partner in a firm?

3. Whether you have held unlisted equity share at any time during the previous year?

Thanks for your response.

But as I mentioned I cannot even find FA schedule in the online ITR2 Form.

Itr form 2 me

Schedule special income me to tax thereon zero show ho raha hai lekin tax dendari me rashi judkar show ho rahi hai in part B TI

कहां चूक रहा हूं थोड़ी हेल्प करो डियर

I am a pensioner and sold a property. TDS was deducted by the buyer and its reflecting in AIS also. I could not find a column where it should be manually reflected ITR 2, as it was not captured automatically. Can you please guide me through the selection of schedules and where to enter the amount manually.

Income from sale of property will come under the head of income from capital gain. Taxpayer can enter the detail under this head manually.

please enter the pan under col(10) at sr. no 1 in schedule tds2 itr 2 solution a.y. 2024-25

Not seeing the – 20 Tax Payments in the ITR-2 Excel utility-

we found the option to enter self-assessment paidment is captured in the IT (worksheet) – but it’s 17A – but Part-B TTI 15 d . Tax paid is expecting – self-assessment Tax column 5of 20 A .

Can you guide me

For NRI having only income from stcg/ltcg and savings bank interest which is just about 2.55lakh and ITR2 calculated the income tax as 37.5k as per STCG/LTCG flat rates. Is this even correct? how to fix this? I tried to fill rectified ITR2 also but no luck it still shows tax liability same. Why it doesnt give basic exemption of 2.5lac and calculate tax on 5k INR? plz advice.

Income of STCG/LTGG taxable flat rate, it not included in basic exemption limit. Deduction under 80TTA And 87A available for only resident not for NRI.