What is the Income Tax Return (ITR) 1 Form?

ITR 1 Form is filed by the taxpayers and the individuals being a residents (other than Not Ordinarily Resident) having a total Income up to INR 50 lakhs, having Income from Salaries, One House Property, Other Sources (Interest etc), and Agricultural Income up to INR 5 thousand. (Not for an Individual who is either a Director in a company or has invested in Unlisted Equity Shares). Also, to note down, from now onwards, as mentioned by the tax department, furnishing PAN and Aadhaar card details on the official website of the Income Tax Department is mandatory.

The income tax department has notified ITR forms for taxpayers based on their source of income in order to create a simple tax compliance structure. Therefore, you are required to furnish the return as per the source of your income.

- What is the ITR 1 Form

- Eligibility To File ITR 1 Online

- Not Eligible for ITR 1 Filing Online

- Penalty if Miss ITR Filing

- Modifications in ITR 1 Sahaj Form

- Due Date for ITR 1

- File ITR 1 Via Gen IT Software

- Guide to File ITR 1 Online

- Medium To Online Furnish ITR 1

- File ITR 1 Online or Electronically

- File ITR 1 SAHAJ Form Offline

- ITR-1 SAHAJ Form Important Terms

- General Queries on ITR 1 Form

File ITR 1 Form Via Gen IT Software, Get Demo!

Latest Update in ITR-1 Sahaj Form

- The ITR-1 Excel-based utility (version 1.7), which includes e-filing under section 139(8A), is now available for taxpayers. Download Now

Read Also: Gen IT Software – Fastest & Easy Income Tax Return E-Filing Software

Eligibility To File ITR 1 Online For AY 2025-26

ITR-1 is filed by taxpayers whose income is up to Rs 50 lakhs from the following sources:

- If the income is from one house property (the case where losses of previous years are carried forward are not included in this ITR)

- If the source of income is a pension or a salary

- If the source of income is from other sources

- If the clubbed income of the minor or wife is shown, then ITR-1 can be filed only in case their source of income is mentioned in the above points.

- Long-term capital gain under section 112A can file ITR-1 if the gains are within the threshold limit, i.e. 1,25,0000 .there is no loss to be carried forward or set off under the capital gain head.

Not Eligible for ITR 1 Filing Online for AY 2025-26

- Such a person will have to file a return in ITR-2 or ITR-3, as the case may be.

- The taxpayer whose income is more than Rs 50 lakhs is not eligible to furnish this form.

- Non-residents and RNOR (Residents not ordinarily residents) cannot file ITR 1.

- Taxpayers who have two or more house properties are not eligible.

- Assessees having income under the business or profession head are not eligible.

- Taxpayers who have long-term or short-term capital gains except long term capital gain under section 112A provided capital gain not exceed 1,25,000.

- Taxpayers whose income from agriculture means is greater than Rs. 5,000

- The taxpayer who claims relief for foreign taxes paid or claims double taxation relief as mentioned in section 90/90A/91.

- ITR 1 cannot be used by residents having any asset (including financial interest in any entity) located outside India or signing authority in any account located outside India.

- Where TDS has been deducted u/s 194N

- If income tax is deferred on ESOP

Penalty if Miss the Income Tax Return Filing Deadline

As per amendment in finance act 2021 an individual is liable to pay a maximum INR 5,000 penalty after missing the 31st July deadline of ITR filing. In case an individual total income does not exceed 5 lakhs then a penalty of only INR 1,000 is applicable.

| Late Income Tax Return Filing Fee Details | ||

|---|---|---|

| E- Filing Date | Total Income Below INR 5,00,000 | Total Income Above INR 5,00,000 |

| Before Revised 16th September 2025 Due Date (Non-audit) and 31st Oct 2025 (Audit cases) | INR 0 | INR 0 |

| After 16th September 2025 (Non-audit) and 31st Oct 2025 (Audit cases) | INR 1,000 | INR 5,000 |

Modification Details in ITR 1 Sahaj Form

- INR 50,000 standard deductions

- No applicability to directors of any company

- No applicability on individuals holding unlisted equity shares of any company

- No changes in computation

- ITR 1 & ITR 4 offline availability for the senior-most citizens aged more than 80 years

- Section-wise return filing is segregated within the normal filing return and response to the notice

- Salary bifurcation will be done as the standard deduction, entertainment allowance and professional tax

- The Pensioners column has been added in the nature of employment

- Details of Employer like TAN of Employer (mandatory if tax is deducted), Name of Employer, Nature of Employer), Address of Employer, Town/City, State, PIN/ ZIP Code has been inserted under the head income from salary.

- Deletion of details of Return of Income filed in response to notice u/s 153A and 153C.

- A new deduction of 80CCC, 80CCD(1), 80CCD(1B), 80CCD(2),

80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80GG, 80GGC, 80U has been added in the deductions column.

- A new deduction of 80CCC, 80CCD(1), 80CCD(1B), 80CCD(2),

- The point of the amount of rent which cannot be realized has been inserted under the head house property.

- The individual income from one house property, salaries and other sources summing up to 50 lakhs, this condition retains its place even after changes

FY 2024-25 Due Date for Filing ITR 1 Online

- FY 2024-25 (AY 2025-26) – 31st July 2025 | 16th September 2025 (Revised)

- FY 2023-24 (AY 2024-25) – 31st July 2024

- FY 2022-23 (AY 2023-24) – 31st July 2023

- Every year, ITR 1 has to be filed on or before 31st July of the following year. After that, a late fee under section 234F is levied

- Applicable Due Dates of Income Tax Return Filing

Guide to File Income Tax Return (ITR) 1 Online:

ITR 1 is divided into 7 sections where:

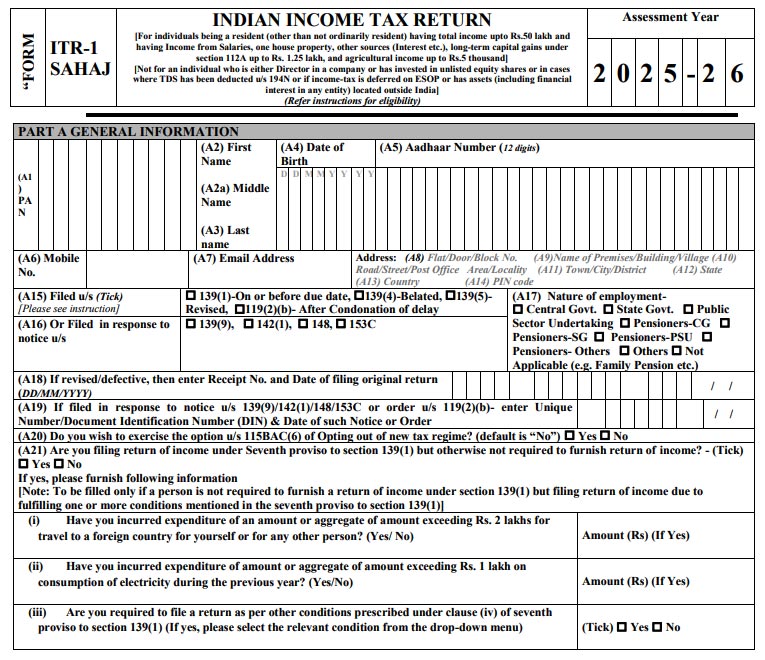

Part A – General Information

This tab includes details of the following general fields:

- PAN

- Name

- First

- Middle

- Last Name

- Date of Birth

- Aadhaar number

- Mobile. No

- E-mail Address

- Address

- Filed u/s

- 139(1)-On or before the due date

- 139(4)-Belated

- 139(5)-Revised

- 119(2)(b)- After Condonation of delay

- Or Filed in response to notice u/s 139(9), 142(1), 148 and 153(C)

- Nature of employment

- Central Govt.

- State Govt.

- Public Sector Undertaking

- Pensioners-CG

- Pensioners-SG

- Pensioners-PSU

- Pensioners-Others

- Others

- Not Applicable(e.g. Family Pension etc.)

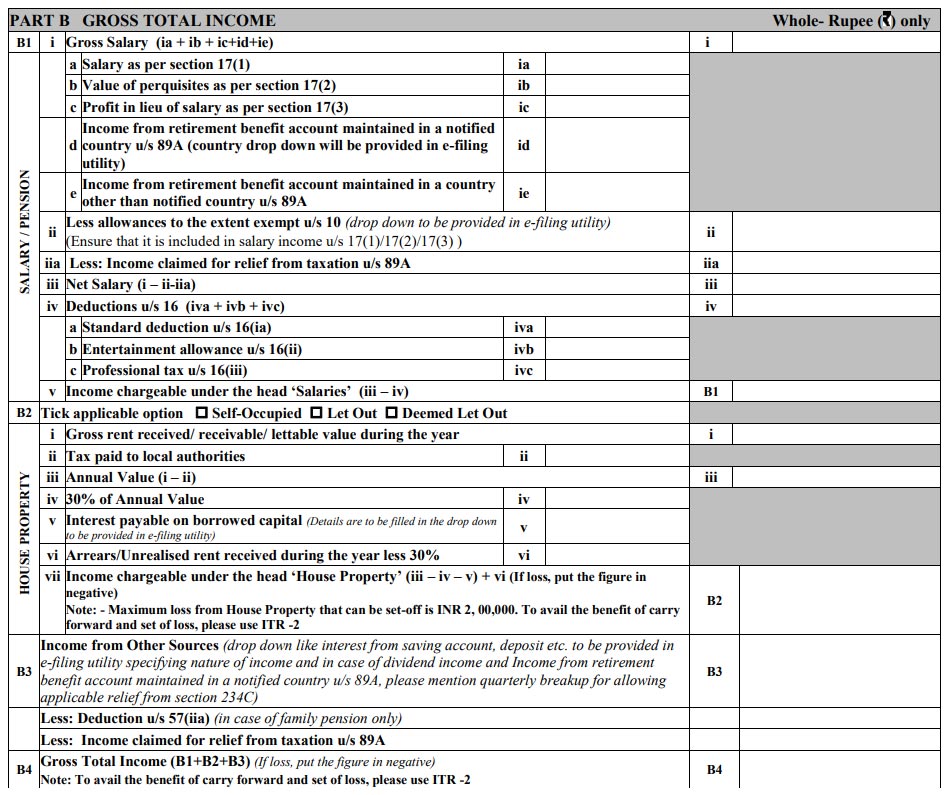

Part B – Gross total income

This tab includes details related to gross total income:

Part B1: Salary/Pension

- Details of Employer like TAN, Name, Nature& Address of Employer

- Salary details

- All the allowances which are exempted

- All the value of perquisites

- Net salary

- Deduction in u/s 16

- Income chargeable under the head ‘salaries’

Part B2: House Property

- Gross Rent received

- Tax paid to local authorities

- Annual value

- 30% of the annual value

- Interest payable on borrowed capital

- Arrears/unrealized rent less than 30%

- Income chargeable under head ‘house property’

Part B3: Income from Other Sources

- Less Deductions u/s 57 (iia)

- Less Income Claimed for relief from taxation u/a 89A

Part B4 – Gross total income (B1 + B2 + B3)

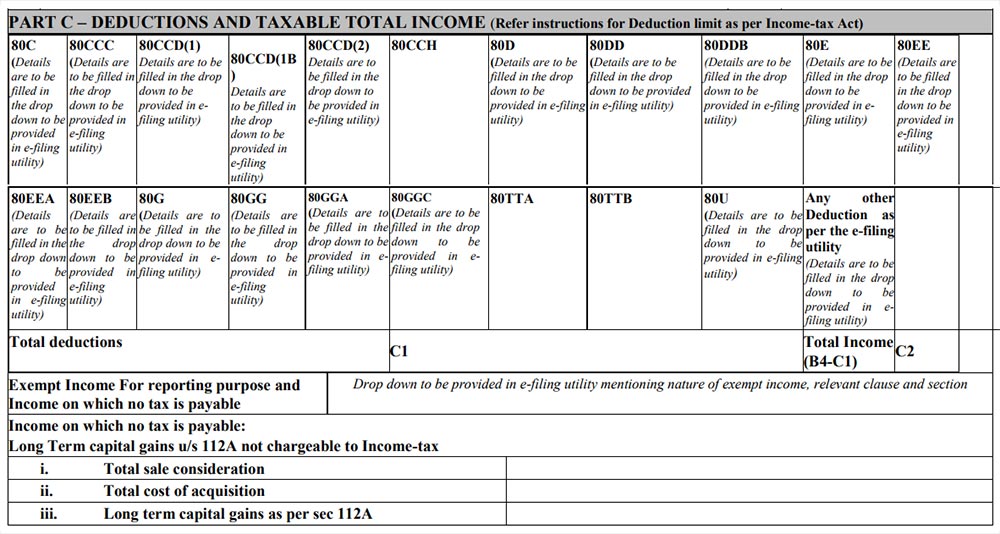

Part C – Deductions u/c VI-A and Taxable total income

This tab includes all the deductions and the taxable total income

Here, the deduction limit will be as per the Income Tax Act

- 80C, 80CCC, 80CCD(1), 80CCD(1B), 80CCD(2), 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80GG, 80GGC, 80U

- Value of Total deduction

- Total income (B4 – C1)

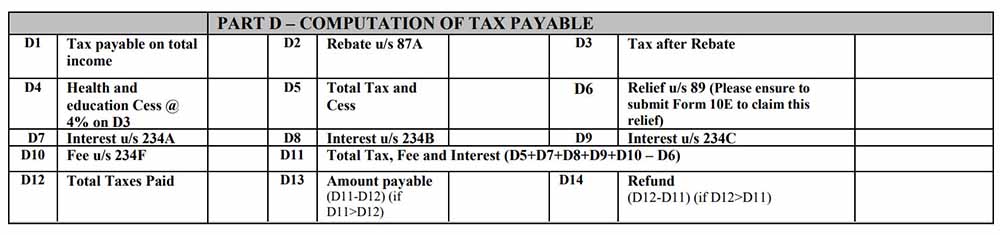

Part D – Computation of tax payable

This tab includes all the valuation of tax payable

- D1 Tax payable on total income

- D2 Rebate u/s 87A

- D3 Tax after rebate

- D4 Cess on D3

- D5 Total tax and cess

- D6 Relief u/s 89(1)

- D7 Interest u/s 234A

- D8 Interest u/s 234B

- D9 Interest u/s 234C

- D10 Fee u/s 234F

- D11 Total tax, fee, and interest

- D12 Total tax paid

- D13 Amount payable

- D14 Refund

- Exempt income

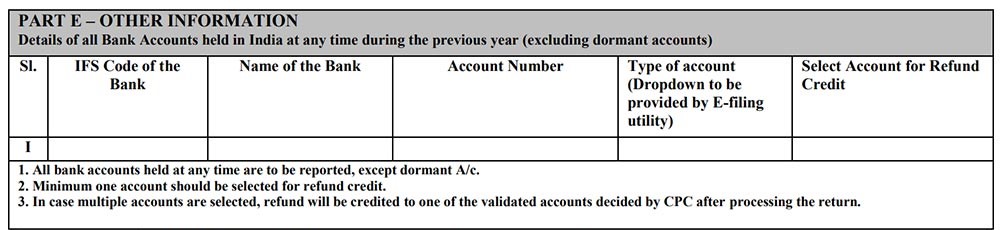

Part E – Other Information

This tab includes banking details

- IFSC Code of the bank

- Name of the bank

- Account Number

- Select Amount for Refund Credit

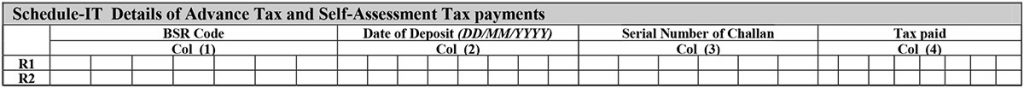

Schedule-IT: IT Details of advance tax and self-assessment tax payments

- BSR code

- Date of deposit

- Serial number of challan

- Tax Paid

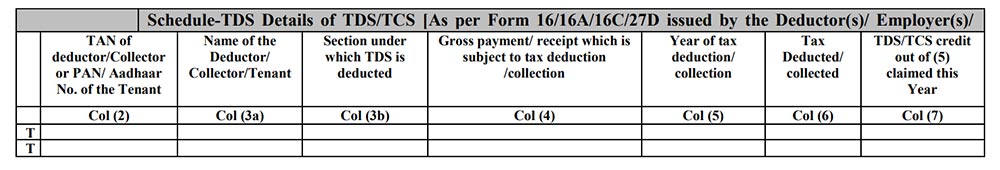

Schedule-TDS: TDS details of TDS/TCS

- TAN of deductor/ PAN of tenant

- Name of deductor

- Gross payment

- Year of tax deduction

- Tax deducted

- TDS/TCS credit

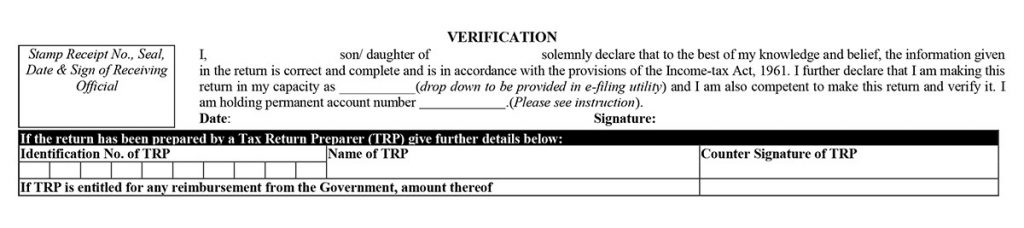

Verification

The taxpayer has to verify and self-attest the form at the last by signing the verification content after entering all the details such as name, parent name and PAN details.

Medium To Online Furnish Income Tax Return 1 (ITR)

An ITR-1 form can be furnished either in online or offline mode. In online mode, either XML needs to be uploaded or the client can directly login to the income tax portal and select the submission mode as “prepare and submit online”. In the case of online filing, some data can be imported from the latest ITR or form 26AS.

Also, super senior citizens (Age of 80 years or more) are exempted from the online filing of ITR.

Offline here means to furnish the return form in paper format.

File ITR 1 Online or Electronically:

- While furnishing ITR-1 online, feed the details and e-verify the return using EVC via Bank

Account/Net Banking/Demat Account/Aadhar OTP or - Feed the details using an electronic medium and send a physical copy of ITR V to the Centralized Processing Centre (CPC), Bengaluru through speed post or normal post.

When you furnish the ITR-1 return form using electronic medium, the receipt will be seen in the inbox of the registered email ID. It can also be downloaded from the official income tax website manually. After downloading the acknowledgement, you need to sign the form and then send it to the CPC office, in Bangalore before completing 30 days from the e-filing date. On the other side, it is not required to send the ITR V to the CPC if the EVC/OTP option is used.

File ITR 1 SAHAJ Form Offline

- If the age of the person is 80 or more years during the respective tax period or in the previous year.

Important Terms To Understand In ITR-1 SAHAJ Form for AY 2025-26

Notice Number: Notice Number is required to be mentioned when the taxpayer furnishes the return in answer to the notice issued by the Income Tax Department.

Revised Return: There is an option of re-file, so if you have made certain mistakes, you can rectify them again. For FY 2024-25, the taxpayer can furnish the revised return on or before 31 December 2025.

Advance Tax: If the tax on other income is above Rs. 10,000 in a year, the assessee is required to calculate and deposit the advance tax. This advance tax is to be paid on a quarterly basis such as in, June, December, September and March.

Annexure-less Return: Annexure-less return which means it doesn’t require affixing any documents with the ITR-1 Form.

Let’s Go Through ITR-1 Return Filing FAQ’s

Q.1 What documents one needs to submit while filing tax returns?

No document is needed to be submitted while filing income tax returns. However, one should keep basic documents like Form 16, shreds of investment evidence, and so on ready with him/herself. Because in some cases when the income tax department sends notice, these documents are required to be presented before the tax authorities on a later date.

Q.2 – What are the heads under which Pension and family pension are taxable?

Income from salary’ is the head for levying a tax on pension whereas family pension is taxable under the head ‘Income from other sources.

Q.3 – Who is eligible to file return via paper form rather than e-filing an ITR?

YEvery income tax assessee has to mandatorily e-file income tax returns. However, there are some exceptions to the standard rule wherein they can submit paper ITR forms and they do not have to file the ITRs online. They are as follows:

- At present, Super senior citizens who are above 80 years of age.

Q.4 – What amount will attract tax if the value of the gift is more than Rs. 50,000?

When the value of the gifts received from friends on any event except the wedding during a year is Rs 50,000 then the whole amount will attract tax under the head ‘Income from Other Sources’ head.

Note: Gifts are taxed on the total value of all the gifts received in the year and not on the value of the individual gifts.

Q.5 – How bank accounts are reported in ITR-1?

Details of savings and current accounts which are held during any time of the previous year must be reported in Part E of the ITR form which seeks – other information. The account number must comply with the Bank’s Core Banking Solution (CBS) system. However, one need not provide details of dormant accounts which is not working since 3 years.

Q.6 – Can ITR-1 be filed in case of exempt agricultural income?

Yes, one can file ITR-1 when the agricultural income is not more than Rs 5000. But when it exceeds Rs 5000, one needs to file ITR 2.

Q.7 – Is it necessary to file an ITR if the annual income does not exceed Rs 250,000?

No, it is not necessary to file an ITR if the annual income is less than Rs 250,000. But in this case, a ‘Nil Return’ should be filed to upkeep a record which is an employment proof required while applying for a passport or loan.

Q.8 – Does dividend income from Mutual Funds need to be included in it?

Yes, dividend income from mutual funds should be included under the head ‘Exempt Income(others)’ as it is an exempt income u/s 10(35).

Q.9 – Can I file ITR-1 if I have a House Property loan?

Yes, you can file ITR-1 if you have a house property loan.

Q.10 – Should I file ITR-2 or ITR-1, if my maximum exempt income is more than Rs. 5,000? What much amount of income will be considered as exempt income?

ITR-2 has to be filed if the amount of aggregate exempted income is more than Rs. 5,000. Some incomes are tax exempt as per Section 10 of the Income Tax Act. A few examples of exempt income are as follows:

- Income from Agriculture

- Long term capital gain on listed shares and securities (Section 10(38)

- Gratuity, Pension and Leave encashment are exempt u/s 10 of the Income Tax Act.

- Maturity amount of LIC (Section 10 (10D)

Q.11 – Can I file ITR-1 if I have a Rental Income?

Yes, you can file ITR-1 if you have a rental income. Refer our guide for the step-by-step process.

Q.12 – Should Interest Income be mentioned under the head ‘Income from Other Sources ‘ while filing ITR-1 when TDS has already been subtracted?

Yes, Interest Income should always be mentioned under the head ‘Income from Other Sources’ even when tax has already been subtracted by the bank.

Q.13 – Do I still need to furnish my Bank Account details in the ITR if there is no refund due to me?

Yes, furnishing the bank details in the ITR is mandatory, regardless of refund is due or not. It is mandatory because many taxpayers pay more taxes than their tax liability. So, to enable the Income Tax Department to send refunds on time, bank account details need to be furnished.

Q.14 – How can I download the Income Tax Return Form?

Income tax return forms are available on the official website of the Income Tax Department. Simple steps to download forms are as follows:

- Go to the Income Tax Department website

- Click the option ‘Form/Downloads’ on the homepage.

- Choose the option of ‘Income Tax Returns’ from the drop-down menu.

- Now you will be redirected to the ‘Income Tax Return’ webpage. Now download the form which is appropriate according to your source of income and A.Y.

Q.15 – What is the meaning of ITR XML file?

ITR XML is a kind of file format which is generated when you file the important data of your ITR in an offline utility.

dear sir

is it necessary to have proofs of income while filing ITR online? i mean if i mention FD interest 10000/ , just my statement for this is enough or to attach some proof

thank you

No, proof required to attach while filing ITR online.

Retired from State Govt. Service in FY 2023-24. Received Salary, Pension, Earned Leave Encashment, Retirement Gratuity, Commuted Value of Pension.

I understand that Salary and Pension are to be shown in Salary u/s 17(1).

How do I show Leave Encashment, Gratuity and CVP in ITR1?

Salary u/s 17(1), 17(2) and 17(3)?

Terminal benefits fall under section 17(3)

Pls advise where in ITR 1 income of spouse can be disclosed as additional information whilst such income is included in the income of the main taxpayer (husband)?

1) What is the exemption limit of Leave Encashment for Central Government Pensioners for AY 2023-24 ? Is it Rs 300000/- or actual received ?

2) Pension income plus other income for the previous year is less than Rs 500000 but adding retirement benefits increases it much beyond that. Total Income after exemption u/s 10 again is below 500000. Portal is denying tax rebate u/s 87A.

Sir,

Where to show the Sum received as GPF and GISS of a retired Govt. Employee in ITR1 efiling?

As Deduction from Salary income u/s 10

OR

Exempt income (For Reporting purpose)?

It will be shown as exempt income (For Reporting Purposes)

Sir,

I understand that the Annual Annuity earned from PMVVY is taxable. But what about the taxability on Maturity Amount? Is it entirely Tax Exempt U/S 10(10D)?

if your income is above 2.5 lakh and you have to pay a zero(suppose you get rebate) tax then weather you are called taxpayer or not?