What is GSTR 9?

GSTR 9 is filed mentioning the complete information of the transactions done by the taxpayer in a particular Financial year. The form is a consolidated annual form and has details of the inward and outward supplies made/received by the taxpayer in the previous year under tax heads like CGST, SGST, IGST and HSN codes.

Form GSTR 9 is the combination of monthly/quarterly (GSTR-1, GSTR-2B, GSTR-3B) returns filed in the relevant financial year. The GSTR 9 due date for FY 2024-25 is 31st December 2025. SAG Infotech has enabled the annual return filing of GSTR-9 for FY 2025-26 in the Gen GST software.

Taxpayers Eligible of Filing GSTR 9

- Individuals registered under GST are the ones eligible for filing GSTR 9.

- NRI who is taxable in India

- Individuals from whose accounts TDS is deducted u/s 51 of the CGST Act. Input service distributors

- Filing GSTR-9 is optional for businesses with turnover up to Rs. 2 Crore in FY 2023-24.

The above list is in-line with the decision taken in the 37th GST Council Meeting.

Contents of GSTR 9

Form GSTR 9 is segregated into 6 parts and 19 sections. Every part seeks details that are available in returns filed before and the books of accounts.

- The form is broadly segregated into two sections one comprises of cases that are subject to tax and one that is not subject to tax.

- Under purchase head the entire inward supplies and the ITC availed on that is mentioned.

- These purchases are further segregated into inputs, input services, and capital goods. Also, the information if ITC that is subject to reverse due to ineligibility is also entered here.

Penalty for Late Filing Annual Return or Non-filing of GSTR 9

The assessee under the penalty provisions for the GSTR-9 annual return form, is mandated to file a penalty of Rs 200 per day with Rs. 100 being for SGST and Rs. 100 for CGST. For the turnover of more than Rs 20 crore, the penalty is 0.50% of turnover in the state/UT (0.25% each under the CGST and SGST Acts).

- A penalty of Rs. 100 per day, with Rs. 50 for SGST and Rs. 50 for CGST is mandated to file by the taxpayer. For turnover of more than Rs 5 crore but less than Rs 20 crore, the penalty is 0.04% of the turnover in the state/UT (0.02% each under the CGST and SGST Acts).

- Rs 50 per day, with Rs. 25 for SGST and Rs. 25 for CGST is mandated to be paid by the assessee. For the turnover of upto Rs 5 crore, the penalty is 0.04% of turnover in the state/UT (0.02% each under the CGST and SGST Acts).

- The taxpayer From the FY 2022-23 onwards, is mandated to file a penalty of Rs 50 per day with Rs 25 for SGST and Rs. 25 for CGST, in case of turnover up to Rs. 5 crore. The late fee will be Rs 100, comprising of Rs 50 for SGST and Rs. 50 for CGST.

As per the act it is within a maximum of 0.25% of the turnover of the taxpayer in the relevant state or union territory.

There are No Late Fees Mentioned Under IGST.

GSTR 9 has 6 different segregations and 19 tables for entering different category details. The format is thus suggested by CBIC and once submitted there is no facility for revising the form on the GST portal.

How to File GSTR 9 Via Gen GST Software?

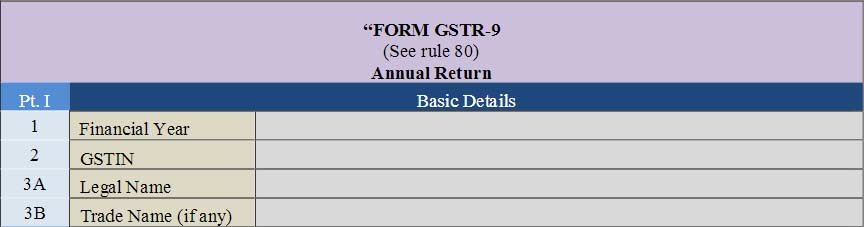

Part A – FY in which returns are filed, taxpayer’s GSTIN, 3A taxpayer’s legal name, 3B taxpayer’s trade name.

Part B – Entry of Inward/outward supplies, taxes paid, previous financial year’s transactions, and other relevant details.

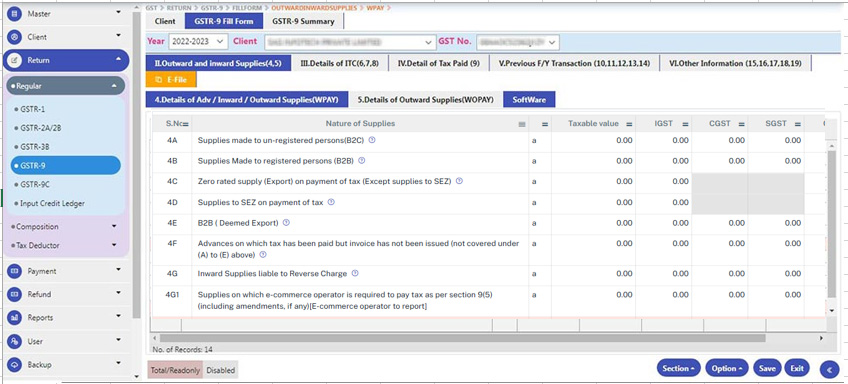

4. Details of advances, Inward and outward supplies made or received on which tax is payable

The section is concerned with the details uploaded in Form GSTR 1 and GSTR 3B for the relevant financial year. The comprehensive of all the supplies made (B2B, B2C, exports excluding SEZ, SEZ payments, advance supplies, inward supplies, and so on.)

- Supplying the goods and/or services to the customer or unregistered persons (B2C transactions).

- Supplying the goods and/or services to another business or registered persons (B2B transactions).

- Exports or zero-rated supplies on payment of tax (except SEZ supplies).

- Supply on payment of tax to SEZ.

- Deemed Exports (B2B transactions)

- Advance supplies for which invoice has not been issued but taxes are paid (advances not mentioned in the above points).

- Supplies on which tax is to be paid on reverse charge.

- Supplies on which e-commerce operator is required to pay tax as per section 9(5) (including amendments, if any)[E-commerce operator to report]

- Sub-Total of points A to G1.

- Credit Notes issued for transactions mentioned in points (B) to (E) above.

- Debit Notes issued for transactions mentioned in point B to E above.

- Supplies/Tax declared through amendments (+)

- Supplies/Tax reduced through amendments (-)

- Sub-Total of points I to L

- Advances and supplies on which tax is levied (point H + point M)

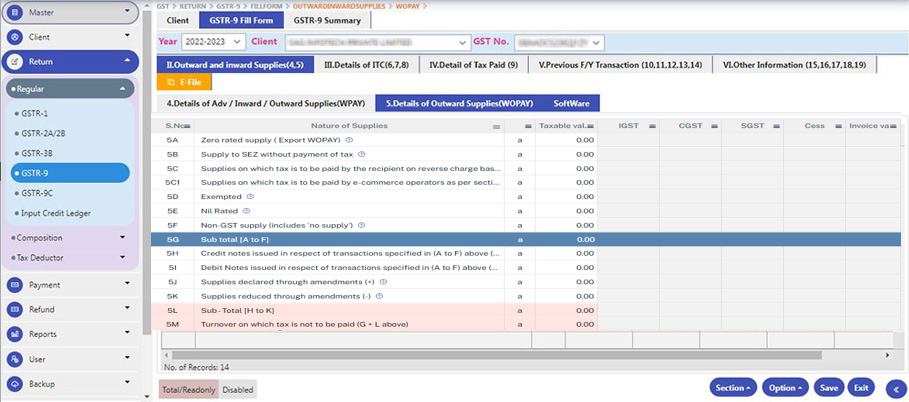

5. Details of outward supplies of the FY during which tax was not payable.

- The section is concerned with the information that is already uploaded in GSTR 1. The filer can refer to GSTR 1 to get the correct information.

- Export or zero-rated supply without tax payment.

- Supply to SEZ without tax payment.

- Supplies on which tax is paid by the recipient on reverse charge

- Supplies on which tax is to be paid by e-commerce operators as per section 9

- Exempted

- Nil Rated

- Nil supply (non-GST Supplies)

- Sub-Total of point A to F

- Credit Notes issued for overall transactions mentioned in points A to F above (-)

- Debit Notes issued for transactions mentioned points in A to F above (+)

- Supplies declared through amendments (+)

- Supplies reduced through amendments (-)

- Sub-Total of points H to K

- The aggregate of turnover on which tax is not levied (5G + 5L)

- The aggregate turnover, including Advance supplies (4N + 5M – 4G-4G1)

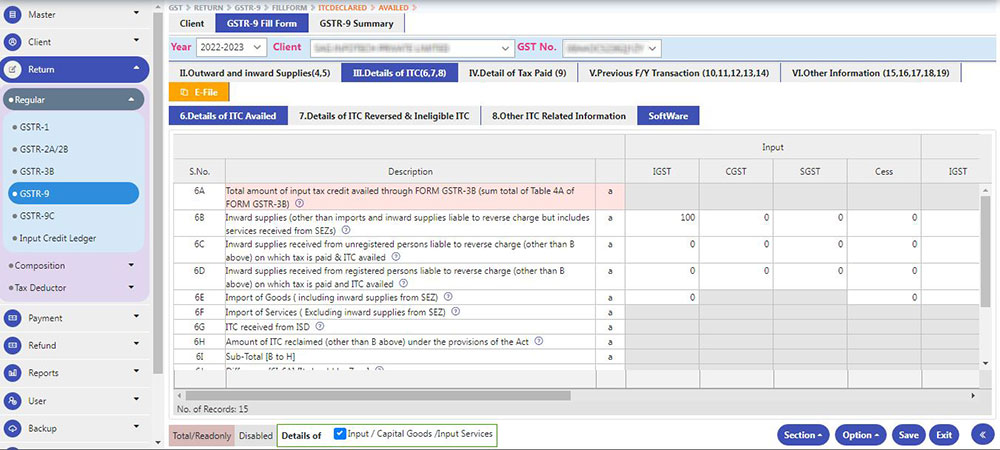

6. Details of Input Tax Credit

The section is concerned with the entire input tax credits (ITC) claimed by a business annually. The details under the section are similar to the information uploaded in your GSTR-3B and ITC Register.

- The aggregate of ITC availed in Form GSTR 3B

- Inward supplies excluding imports or inward supplies that are liable for a reverse charge including services from SEZ

- Imports or inward supplies from the unregistered person and is liable for a reverse charge (excluding point B) on which tax is paid and ITC is available

- Inward supplies from the registered person and is liable for a reverse charge (excluding point B) on which tax is paid and ITC is available

- Goods imports (including SEZ inward supplies)

- Service imports (excluding SEZ inward supplies)

- ITC claimed from the Input service distributor

- Amount of ITC reclaimed (excluding point B above) as per the norms of the Act

- Sub-Total of the points B to H

- The difference of the points (I – A) above

- Transition Credit through TRAN-1

- Transition Credit through TRAN-2

- Any other ITC availed (excluding the ones mentioned above)

- Sub-Total of the points K to M

- The aggregate of the availed ITC points (I + N)

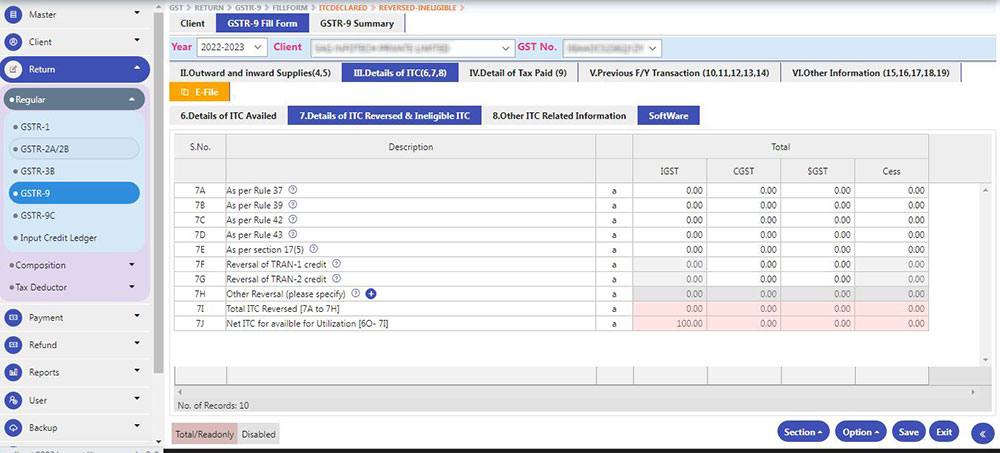

7. Details of Reversed ITC

The section is concerned with the entry of the reversed ITC under various rules of central GST and State GST Act 2017. For filling the section one can refer to table 4(B) of Form GSTR 3B.

- Rule 37 – Details of the reversed ITC due to ineligibility or reversal needed u/s 37 of CGST/SGST rules. Table 4(B) of GSTR 3B can be referred.

- Rule 39 – Details of the reversed ITC due to ineligibility or reversal needed u/s 39 of CGST/SGST rules. Table 4(B) of GSTR 3B can be referred.

- Rule 42 – Details of the reversed ITC due to ineligibility or reversal needed u/s 42 of CGST/SGST rules. Table 4(B) of GSTR 3B can be referred.

- Rule 43 – Details of the reversed ITC due to ineligibility or reversal needed u/s 43 of CGST/SGST rules. Table 4(B) of GSTR 3B can be referred.

- Rule 17(5) – The column is meant for Input Tax Credit reversed u/s 17(5) of CGST/SGST Act along with the information of ineligible transition credit claimed through FORM GST TRAN-1 or FORM GST TRAN-2 and then subsequently reversed. Table 4(B) of GSTR 3B can be referred.

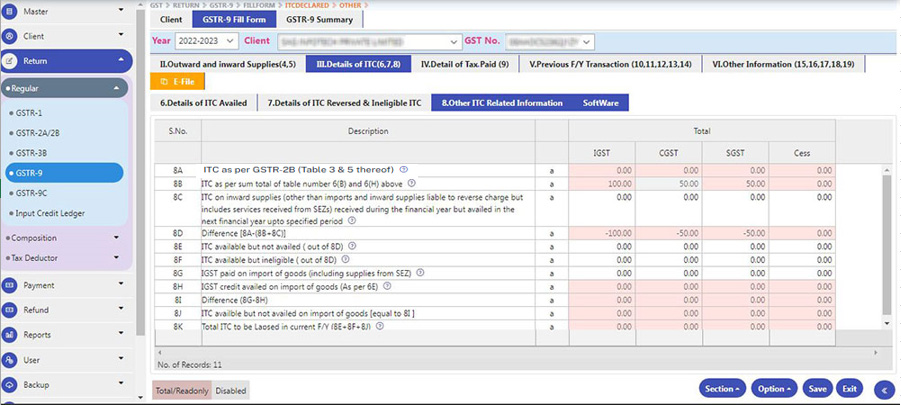

8. Other ITC Related Information During the Financial Year

Note: Table number 8A will be auto-filled based on the details auto-populated in Form GSTR-2A and from FY 2023-24 It will be auto populated from GSTR 2B and the same is non-editable.

Tables under this section will be pre-loaded referring to the details in Form GSTR 2B. Details in the section cannot be edited. The details of the credit available for inward supplies, inward supplies liable for a reverse charge (including services received from SEZ) in the relevant financial year and is reflected in Table 3 and 5 only.

- ITC as per GSTR 2A (table 3 and 5 only).

- Details of the ITC derived after adding 6B and 6H above.

- ITC on inward supplies (excluding the imports) the ITC that is liable for a reverse charge (including services from SEZ).

- Conclusion of (8A – (8B + 8C))

- Eligible ITC that is not availed

- Ineligible ITC – ITC is available in GSTR 3B but is ineligible (can input the negative value in the table).

- IGST on import of Goods (including SEZ supplies).

- IGST credit on the input of goods (refer point 6E).

- The difference between 8G -8H.

- ITC on the input of goods is available but not available.

- Aggregate ITC to have lapsed in current FY (8E + 8F + 8J)

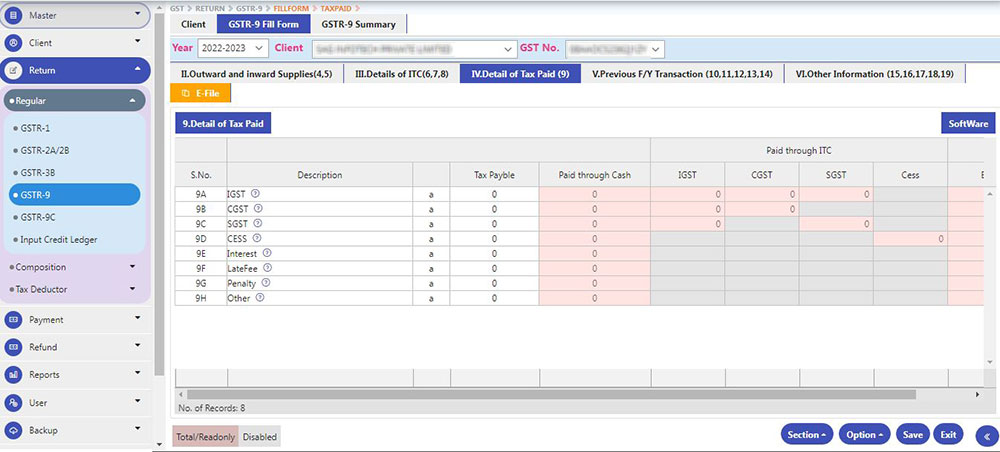

9. Information About Tax Outgo

The section seeks details of the taxes paid during the financial year. The returns for the same are filed. Details include interest, penalty, taxes, etc that went out of the taxpayers’ account.

Paid tax details in accordance with the returns filed during the financial year.

- Details of actual tax outgo (including late payments, interests, etc.) through cash or ITC.

- Tax paid and mentioned under table 6.1 of GSTR 3B can be referred to while filing the form.

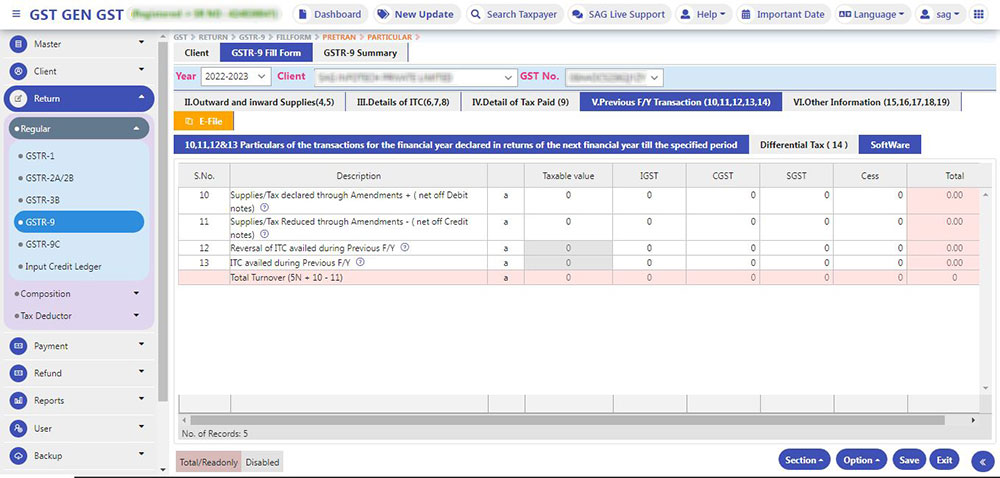

- Transactions of the previous financial year reported in the next financial year.

10. Supplies/taxes declared through amendments (+ debit notes)

“Details related to the additions or any changes in the supply that is revealed in the previous financial year’s returns. Such amendments are presented in Table 9A, 9B and 9C of Form GSTR-1 of April to September of the current financial year or date of filing of Annual Return for the previous financial year, whichever is earlier shall be declared here”.

11. Supplies/taxes reduced through amendments (- credit notes)

Details related to the additions or any changes in the supply that is revealed in the previous financial year’s returns. Such amendments are presented in Table GSTR 9A, GSTR 9B and GSTR 9C of Form GSTR-1 of April to September of the current financial year or date of filing of Annual Return for the previous financial year, whichever is earlier shall be declared here.

12. Reversal of ITC availed during previous Financial Year

The aggregate value of the reversal of ITC which was availed in the previous financial year but reversed in returns filed for the months of April to September of the current financial year or date of filing of Annual Return for the previous financial year, whichever is earlier shall be declared here.

The section focuses on the total value of ITC reversal that was claimed in the previous financial year and was reversed in the returns for April to September of the current financial year. Whichever is earlier.

One can refer to Table 4(B) of FORM GSTR-3B to fill in the section.

13. ITC claimed for previous Financial Year

The information related to availment of ITC in the previous financial year but the ITC for the same was also availed in the returns for April to September of the prevailing financial year or on the date of filing Annual Returns the Annual Returns of the previous financial year.

One can refer to Table 4(A) of FORM GSTR-3B to fill in the section.

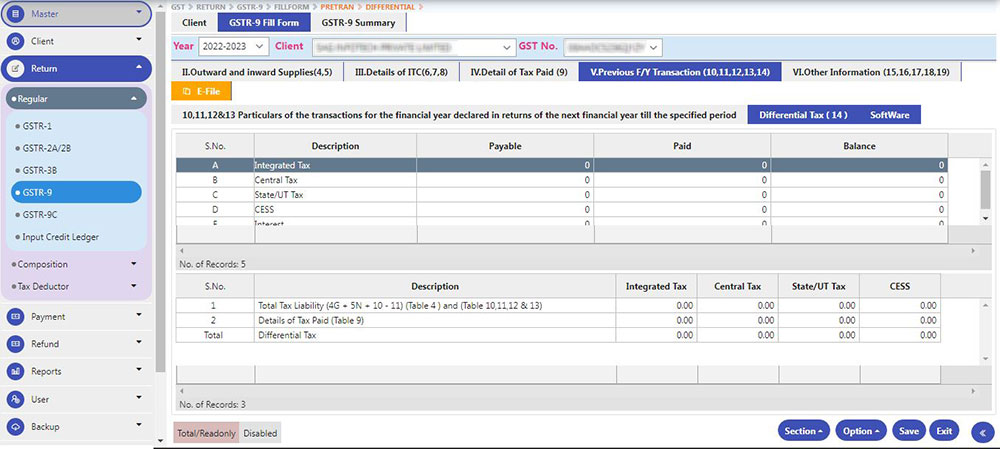

14. Differential tax paid but reported in the next financial year

The section focuses on the details of ‘Differential Tax’ related to the payment of transactions for the previous financial year but is revealed in the returns of April to September of the prevailing financial year.

Results are taken out based on the difference between Table (4G + 5N + 10 – 11) and Table 9. One can easily find the formula by clicking on that particular tax.

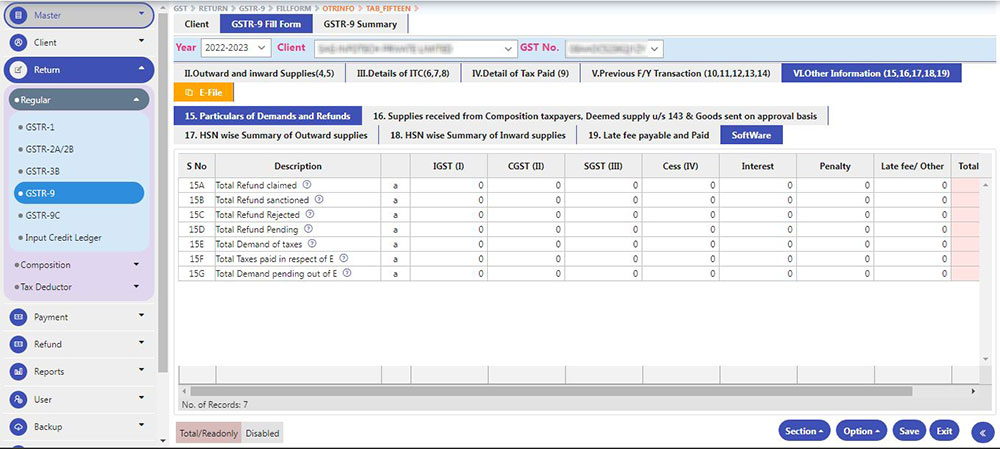

15. Information about demands and refunds

Information related to the total value of refunds that are claimed, rejected, sanctioned, and/or pending shall be declared here.

The section ‘Refund Claimed’ will contain information of refunds that are claimed, sanctioned, rejected and pending.

‘Refund Sanctioned’ means the total value of the refund sanction orders.

‘Refund Pending’ means the total value of refund applications for which acceptance is already received and will exclude provisional refunds received.

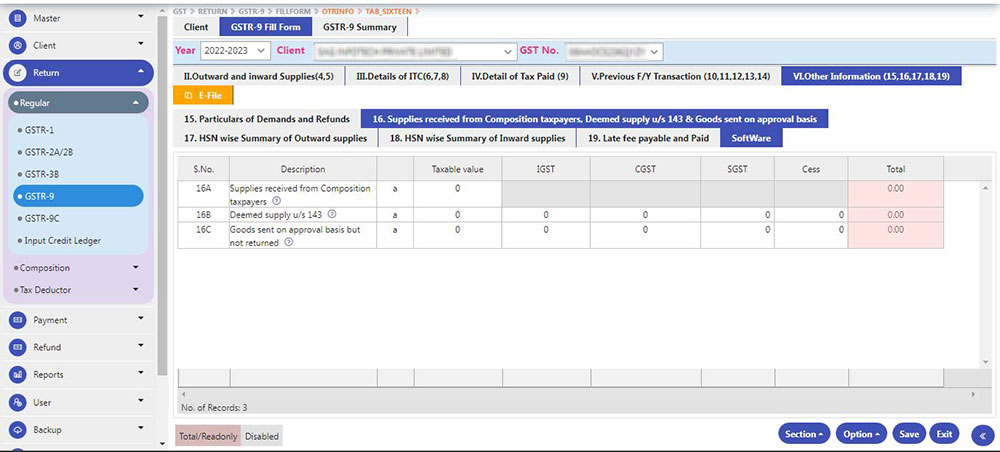

16. Supplies from Composition Taxpayers, Deemed Supply u/s 143 and Goods sent on approval basis

The section deals with the information:

- Supplies from Composition Taxpayers – The total value of supplies received from the taxpayers. One can refer to table 5 of form GSTR 35.

- Deemed supply under Section 143 – The total value of deemed supplies from the primary party to the job worker. One can refer to sub-section (3) and sub-section (4) of Section 143 of the CGST.

- Goods sent for approval and were not received back – The information of the goods that were sent for approval but didn’t return to the primary supplier shall be entered under this section.

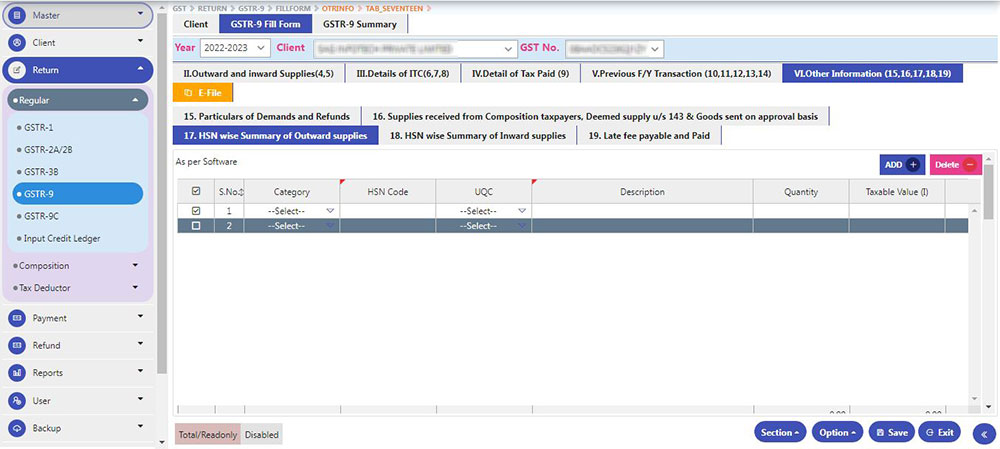

17. Summarizing Outward Supplies (HSN wise)The section focuses on the outward supplies made against a particular HSN code

- Reporting the outward supplies as per the HSN code is optional for the businesses earning below Rs. 1.50 Cr annually.

- Business up to Rs. 1.50 Cr in the preceding financial year – HSN code of 2 digits

- Business above Rs. 1.50 Cr but below Rs. 5 Cr – HSN code of 4 digits

- Above 5 Cr. – UQC details furnished for the supply of goods.

Here one can refer Table 12 of Form GSTR – 1 for filling the details in the section.

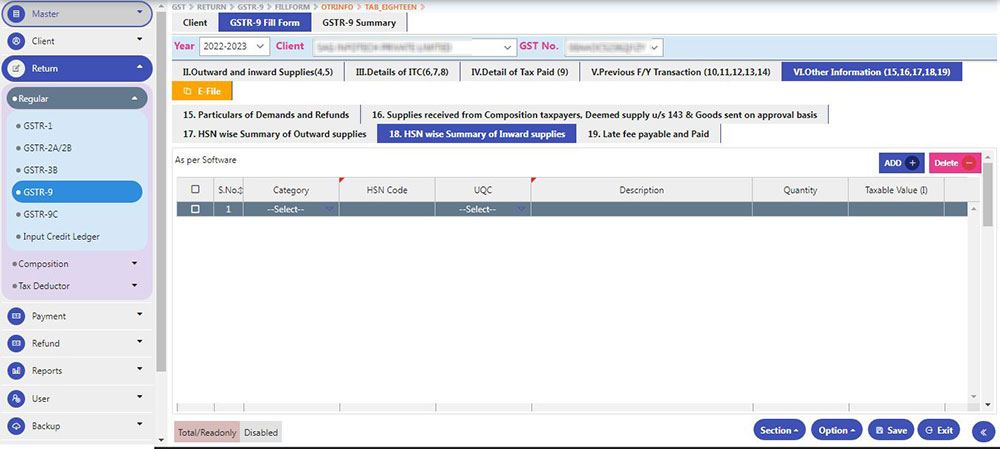

18. Summarizing Inward Supplies (HSN wise)

The section focuses only on the inward supplies that are received against a particular HSN code.

- Reporting the inward supplies as per the HSN code is optional for the businesses earning less than Rs. 1.50 Cr.

- The business of Rs. 1.50 Cr in the preceding year – HSN code of 2 digits.

- Business above Rs. 1.50 Cr but below 5 Cr in the preceding financial year – HSN code of 4 digits.

- Above 5 Cr. – UQC details furnished for the supply of goods.

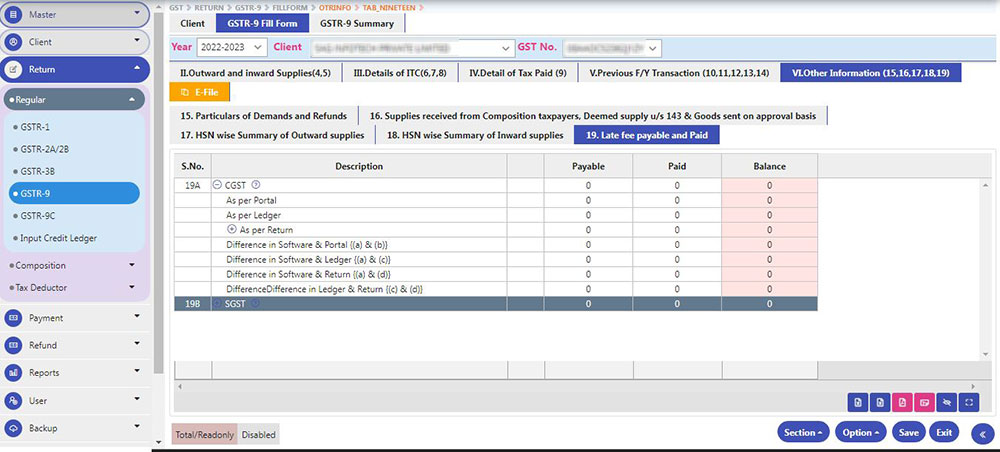

19. Late Fees (Paid or Payable)

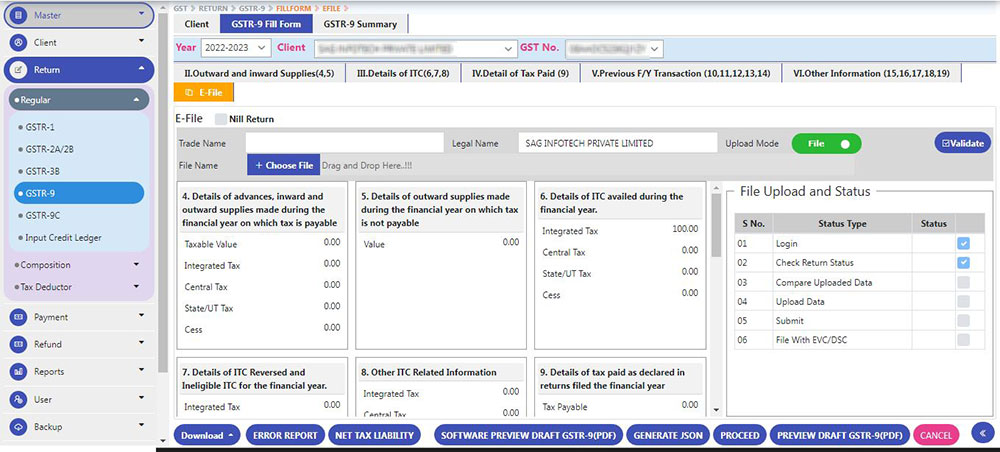

E-File

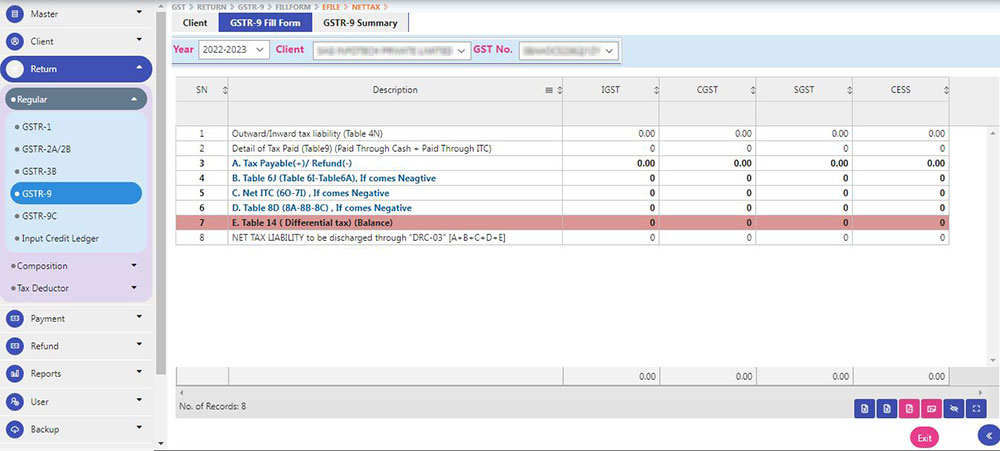

After filling in all details it will land on the E file page where the user can view a summary of GSTR 9 At the bottom, we have given an error report which can be used to view errors in JSON files if any

Next, we have given Net Tax Liability, which helps in Fetching the Actual liability which needs to be paid through DRC-03

Note:- this is given only for reference purposes only( actual calculation may differ from this)

Under the section on can pay off all his/her penalties. Declaration Box and Authorized signatory fields will be available if there is enough cash balance.

Select the declaration box > Select Authorized sign cash Balance > late fees can only be paid via cash > select Create Challan option > If there is not enough cash in the Cash Ledger then the system will auto-fill the deficient amounts > once the dues are clear > file the return with EVC/DSC.

FAQs solving queries related to GSTR 9

Q.1 Who needs to file GSTR 9 (annual returns)?

Taxpayers registered under GST are obliged to duly file GSTR 9. The form is an annual return and is comprehensive of all the outward and inward supplies made in a particular financial year. The details of the entire supplies made or received under different tax heads like CGST, IGST and SGST are mentioned in the form.

- A composition taxpayer

- Casual taxable person

- Input service distributor

- People paying TDS u/s 51 of CGST Act

- Businesses upto 2 Crore can voluntarily file GSTR 9 for the FY 2021-22.

Q.2 – Information required in GSTR 9?

Contents of the Annual Return Form:

- The form is divided into 6 parts with 19 sections and each section seeks details that can be extracted from the previously filed returns or books of accounts.

- Basically the form seeks details of annual sales (in tax payment and non-payment cases), the total value of inward supplies, total ITC availed, purchase of inputs or input services and capital goods.

Q.3 – Which is the best software for filing GSTR9?

Gen GST is one of the reliable sources for filing GSTR 9 as it gives error-free outputs, filing is easier, certain sections come pre-loaded according to your GSTN and a lot more.

- Easy download of GSTR 1, 2A, and 3B data for all 21 months.

- Information pre-loaded in the tables of GSTR 9 (Tables 6-8, 10, 11 and 17).

- Checklist for identifying probable errors.

- In-built audit utility for invoice level at each entry.

- Direct transmission of data into ClearTax with the rapid tally plug-in.

- For table 15, the auto computation of outward sales (HSN Wise).

- Invoice-level reconciliation of GSTR-1 with books of accounts.

- Data upload from GSTR-9 to GSTN in just one click and filing with advanced Cleartax Assistant for GSTR-9.

Q.4 – What if the supplier files GSTR 1 after the recipient files GSTR 9?

The invoice details entered in GSTR 9 by the recipient will be reflected in Form GSTR 1A of the supplier and once these invoice details are approved and entered in GSTR 1 by the suppliers only then it will be considered valid and ITC can be claimed on the invoice.

Q.5 What are the eligibility parameters for creating a ‘NIL’ GSTR 9 return?

A NIL GSTR 9 return can be filed once all the parameters are fulfilled during the relevant financial year:

- Total outward supplies are NIL

- No invoice for goods and services

- No additional liability

- No credit claimed

- No refund claimed

- No demand order received

- Invoice-level reconciliation of GSTR-1 with books of accounts.

- No penalty or late fees is charged during the financial year.

Q.6 – Is it possible to make changes in the data that is auto-populated by the GSTN?

Yes, it is possible to manually edit the auto-populated sections of GSTR 9. But there are certain tables that cannot be amended:

- a) Table 6A – Aggregate value of ITC availed through GSTR 3B.

- b) Table 8A – ITC as per GSTR 2A

- c)Table 9 – Information about paid tax except for tax payable column.

Q.7 – Is GSTR 9A similar to GSTR 9C?

GSTR 9 – Annual Return Form filed by the composition taxpayers. GSTR 9C – It is the reconciliation statement between GSTR 9 and annual audited financial statements.

Q.8 –Difference between GSTR 9 and GSTR 9C?

- GSTR 9 – The annual returns filed once in a year only be the registered taxpayers.

- GSTR 9C – It is the reconciliation statement between GSTR 9 and annual audited financial statements.

Q.9 – HSN wise entry is mandatory in GSTR 9 if the turnover is below Rs. 5 Cr?

All taxpayers with an annual turnover exceeding Rs. 5 Crores must report the HSN code at six digits, and taxpayers with an annual turnover up to Rs. 5 Crores must report it at four digits.

Q.10 – What if a company files only GSTR 9 and not GSTR 9C?

GSTR 1 and GSTR 3B filed before are already registered with the tax department and if the taxpayer liable for filing GSTR 9 doesn’t file the compliance then the government will accordingly send notices to such taxpayers.

Q.11 – Is there a need to file GSTR 9 if GSTR 10 is already filed by the taxpayer?

The taxpayer is suggested to go log in to the GSTN and check GSTR 9 there. If GSTR 9 form is visible then he/she is compelled to file the form.

Q.12 – How to segregate ITC into categories like Capital goods, Input and Input Services?

Table 6B of GSTR 6 needs ITC details that are bifurcated into Capital Goods, Inputs, Input Services, Books of accounts. It is done so that ITC on the purchases attributable to each section can easily be identified. However, the ITC on goods and services are treated similarly.

Hence, such bifurcation may be dispensed within the first year as the assessee may not have maintained books in the required manner due to non-requirement in GSTR-3B.

Q.13 – Is it necessary to match input GST with 2A/2B before filing GSTR 9?

Yes, it is mandatory to reconcile GSTR 2A/2B for FY 2017-18 with the input ta credit mentioned in the books of accounts before Filing GSTR 9.

Q.14 – What is the penalty for delay or not filing GSTR 9?

Delay or non-filing of GSTR 9will attract Rs 100 per day, as mentioned in the norms. Rs. 100 per day under CGST and Rs. 100 per day under SGST. A total of Rs. 200 per day is charged till the default continues.

Thus, the total liability is Rs 200 per day of default. The penalty is subject to a maximum of 0.25% of the taxpayer’s aggregate taxable turnover in the relevant state or union territory. Late fees on IGST is not yet defined.

Gen GST – Video Tutorial of GSTR 9 Filing

Recommended: Free Download Gen GST Software for E-Filing GSTR 9 Form