All the registered taxpayers paying tax under the provisions of section 10 of the CGST Act 2017 or availing benefits of Notification No. 2/2019-Central Tax (Rate) dated 07th March 2019 have been categorised under the ‘special category of persons’ by the CBDT. A special procedure has been laid out by the CBDT via Notification No. 21/2019 – Central Tax dated 23rd April 2019 for such persons to file their tax returns, registered under the composition scheme.

Such specified persons are required to furnish their return statement with the help of Form GST CMP-08 quarterly (on or before the 18th of the month following the quarter of any given fiscal year). GST CMP 08 form due date is 18th April 2026 for the 4th Quarter, January to March 2026.

- What is CMP 08?

- Who Should File the GST CMP 08 Form?

- Interest GST CMP 08

- GST CMP 08 Due Date

- Penalty for Missing GST CMP 08

- How to File CMP 08

- General Queries on GST CMP 08

What is the GST CMP 08 Form?

Form GST CMP-08 is a special return form/statement that is used by the ‘specified persons’ to fill in the summary/details of their self-assessed liability or self-assessed tax for any given quarter.

Apart from this, such specified persons are also required to file their annual returns with the help of Form GSTR-4 on or before April 30 following the end of a particular fiscal year.

Who Should File the GST CMP 08 Form?

A taxpayer who opted composition scheme is required to file GST CMP 08 for depositing payment quarterly.

Interest Applicability on Late Payment of GST CMP 08

In case we take an example, a missed taxpayer accumulates 100018/1001/365 = Rs. 0.49 for a single day, under which the fluctuation is based on the final payable tax & total days missed.

GST CMP 08 Due Date

| Period (Quarterly) | Due Dates |

|---|---|

| 1st Quarter – April to June 2025 | 18th July 2025 |

| 2nd Quarter – July to September 2025 | 18th October 2025 |

| 3rd Quarter – October to December 2025 | 18th January 2026 |

| 4th Quarter – January to March 2026 | 18th April 2026 |

Penalty for Missing GST CMP 08 Return

If a particular taxpayer fails to furnish their returns on or before the due dates mentioned above, he/she must pay a late fee of INR 200 per day, i.e., INR 100/day CGST and INR 100/day SGST. One must also note that the late fee is also subject to a maximum of INR 5000 starting from the due date to the actual date of return filing by the taxpayer.

Step-by-step Guide to Fill GST CMP-08 Form

Step 1:

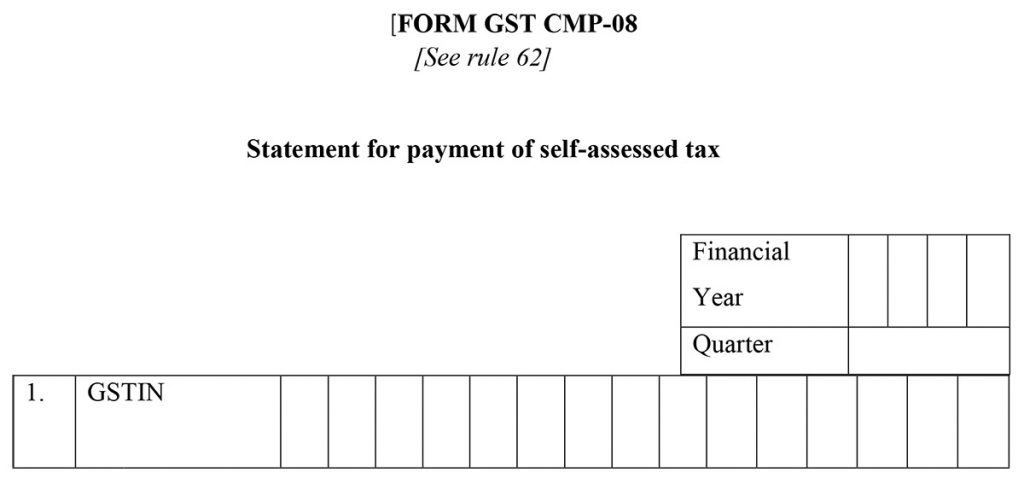

In step one, the taxpayer must enter his/her GSTIN details.

Step 2:

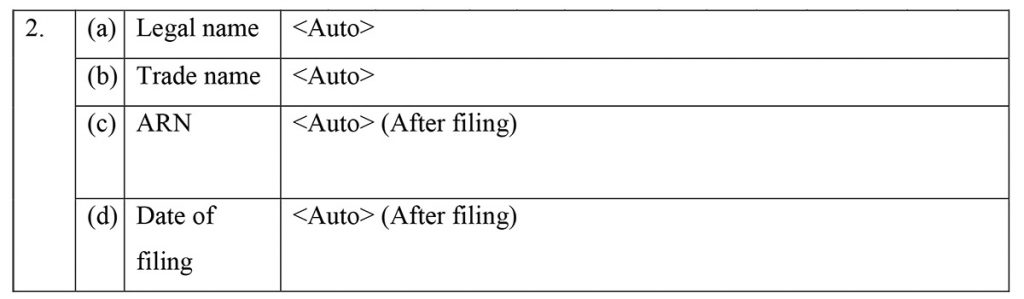

After entering the GSTN number, the taxpayer must fill in basic details like legal name, trade name, ARN, and filing date.

Step 3:

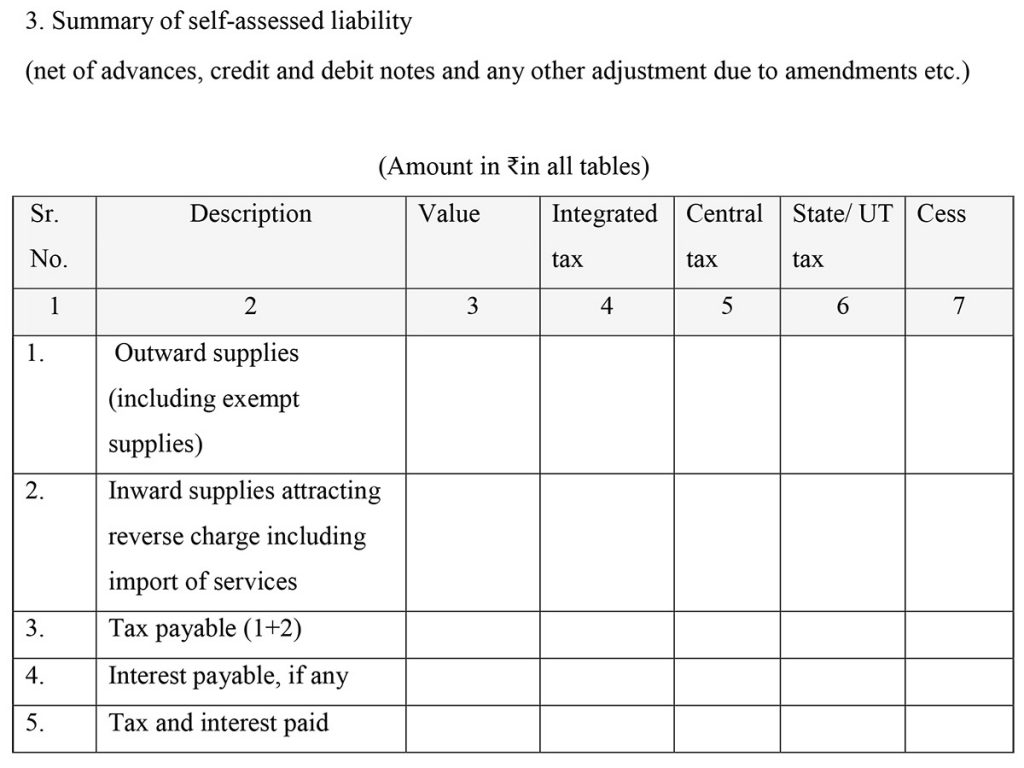

The third column of the form contains details/summary of the self-assessed tax liability. The taxpayer must provide details like outward supplies, inward suppliers, tax payable, and interest paid (if any) in this particular section.

Step 4:

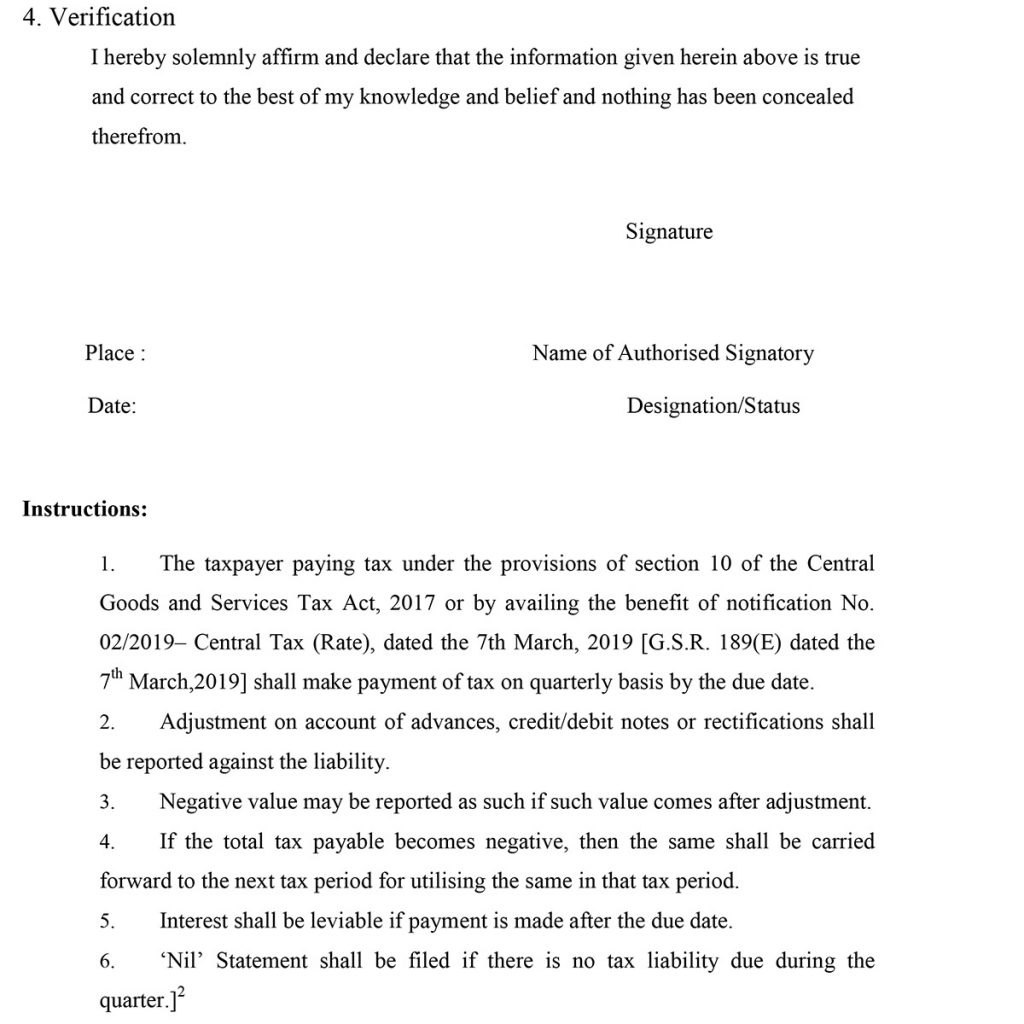

At last, the taxpayer must self-verify all the entered details by signing the Form along with other information like the place, date, etc.

Points to Remember

- Taxpayers can file ‘NIL’ returns if the total tax liability is zero for the given quarter.

- The taxpayers have to pay interest and penalties in case of missing the due date of return filing.

- Tax Liabilities also include adjustments on account of advances, credit/debit notes or rectifications.

General Queries on GST CMP 08

Q.1 What is Form GST CMP-08?

The Form GST CMP-08 is used to declare the details or information or summary of self-assessed tax which is payable for the given quarter by taxpayers registered as composition taxable individual or taxpayer who has opted for composition levy.

Q.2 – Who needs to fill and submit Form GST CMP-08?

The Form GST CMP-08 need to be filled by Taxpayers who have opted for composition levy through Form GST CMP-02, or Taxpayers who are registered as composition taxable person through Form GST REG-01.

Q.3 – By when a person needs to file Form GST CMP-08?

Form GST CMP-08 is a statement that needs to be furnished by a composition dealer at the end of each quarter. The due date for filing the Form GST CMP-08 is 18th of the month following the quarter for which tax payment needs to be made by the composition dealer. The due dates can be extended by Government through notification. So Taxpayer also needs to keep eyes on notification and updates.

Q.4 – Are there any pre-conditions for filing Form GST CMP-08?

Yes, there are a few Pre-conditions for filing of Form GST CMP-08, which are listed below:

- The taxpayer must be registered as Composition Taxpayer or have opted for Composition scheme and should have an active GSTIN.

- The taxpayer must have a valid User ID and password.

- In the case of a taxpayer who wishes to file it by a digital signature, they also need to have a valid & non-expired/non-revoked digital signature (DSC).

- A taxpayer must have filed all the applicable GST CMP-08 for the previous quarter(s).

Q.5 Can someone file nil Form GST CMP-08?

Yes, if a person doesn’t have any liability to discharge, then he/she can file nil Form GST CMP-08

Q.6 – From where can I access and file Form GST CMP-08?

Form GST CMP-08 can be accessed on the GST Portal. You can get it after login in the Returns Dashboard by the composition taxpayer.

Q.7 – Is filing Form GST CMP-08 mandatory?

Filing of Form GST CMP-08 for the appropriate quarter is mandatory, even in cases, where there are no self-assessed liabilities.

Q.8 – Does Form GST CMP-08 can be prepared offline with Offline tool?

No, there is no offline tool for preparing Form GST CMP-08.

Q.9 – Is there any penalty or late fee in case of filing of Form GST CMP-08 after the due date?

No, there is no late fee or penalty for delayed filing of Form GST CMP-08.

Q.10 – Can I discharge my CMP-08 liabilities through ITC?

No, Composition taxpayer cannot claim ITC. so, CMP-08 liabilities can be paid only through cash and not through ITC.

Q.11 – Do I need to file Form GST CMP-08 for all quarters?

Form GST CMP-08 need to be filed by composition taxpayer for all applicable quarters effective from 2019-20 i.e. 1st period would be Apr 2019-Jun 2019.

Q.12 – What should I do if my balance in Electronic Cash Ledger is less than the required amount to compensate the liabilities?

In this case, additional cash needs to be paid by the taxpayer. It will be shown in the Additional Cash Required column. From there you can create challan for the payment of this amount directly by clicking on the Create Challan button.

Q.13 – What is Negative Liability Adjustment?

Any negative entry made in the present quarter will be carried forward to the next quarter this adjustment is known as Negative Liability Adjustment. It will be reflected in the Adjustment of negative liability of previous tax period column of Table 4 of the next quarter GST CMP-08 filing.

For e.g. While filing GST CMP-08 Form for quarter Apr-Jun 2019, negative values from previous quarter Jan-Mar 2019 of GSTR-4 will be arranged and shown in the column of Table 4.

Q.14 – Can I preview filled details in Form GST CMP-08 before submitting?

Of course Yes, the system allow the user to view and even download the preview of Form GST CMP-08. You can preview it by clicking on Preview Draft GST CMP-08 before submitting it on the GST Portal.

Q.15 – What are the modes of signing Form GST CMP-08?

You can file Form GST CMP-08 using DSC or EVC. Here DSC stands for the digital equivalent (that is electronic format) of physical or paper certificates. Whereas the EVS stands for Electronic Verification Code that authenticates the identity of the user at the GST Portal by generating an OTP.

Q.16 – What do DSC and EVC mean?

Digital Signature Certificates or commonly known as DSCs are the electronic format of physical or paper certificates. DSCs in India are issued by authorized Certifying Authorities. Currently GST Portal accepts only PAN based Class II and III DSC. On the other hand, Electronic Verification Code or EVC authenticates the identity of the user on the GST Portal by generating an OTP. The OTP is sent to the registered phone number of Authorized Signatory filled in part A of the Registration Application.

Q.17 – What happens after Form GST CMP-08 is filed?

After Form GST CMP-08 is filed:

- The acquirer reference number or ARN will be generated on successful filing of the Form GST CMP-08

- Status of the form will be changed to Filed from Not filed

- The authorized signatory will receive an SMS and email on the successful filing of Form GST CMP-08

- After filing of Form GST CMP-08, Electronic Cash Ledger and Electronic Liability Register Part-I will get updated

- After it, the negative liability adjustment table will be refreshed with new details, if required

Q.18 – Does filed Form GST CMP-08 can be revised?

No, Form GST CMP-08 once filed, cannot be revised.