An Intro About Form 10E

Section 89(1) of the Income Tax Act 1961 requires you to submit Form 10E in order to claim tax relief. A delayed salary received in the form of arrears is eligible for tax relief under Section 89(1) of the Act. Your Form 16 includes a line for any arrears received.

It is on this form that Government servants or employees working in companies, universities, cooperative societies, institutions, associations, local authorities, or bodies are required to submit particulars of income received under Section 192(2A).

Best Time for Submitting Form 10E

It is necessary to file form 10E before filing your ITR.

Essential Points to Know About 10E Form

You need to keep these facts in mind when filling out Form 10E:

- In order to claim tax relief, taxpayers must file Form 10E according to Sections 89(1) and 192(2A).

- Form 10E is completely filled out online through the official portal, so you cannot follow links that say download Form 10E.

- The tax relief you claimed in the previous financial year will be disallowed if you have not filled out Form 10E.

- If you file your income tax return online, you will not need to submit a copy of Form 10E. In any case, keeping a copy with you is good practice.

- In the case of VRS compensation, if the compensation is tax-exempt under Section 10(10C), you will not qualify for the deduction under Section 89(1).

Need of Gen Income Tax Software for Form 10E Filing

There are a lot of complicated and detailed steps involved in the process of filing an income tax return. In this regard, a lot of people have difficulty filing income tax and seek advice from tax experts such as Chartered Accountants. During income tax compliance, there are a lot of mistakes people commit. It is important to carefully read the guidelines of the Income Tax Department of India before filing income tax, as a small mistake can cause major problems.

The best income tax return software for CAs and professionals can eliminate all these conditions and guidelines of income tax. A number of e-filing tools and software are currently available on the market for income tax filing.

Gen Income Tax is a very user-friendly and helpful income tax software. In addition to calculating the necessary details for individuals, Gen-IT also guides them through the step-by-step process of filling out their individual tax returns.

Some of the Best Key Features of Gen I-T e-Filing Software:

- Return filing facility for multiple forms ITR1 to ITR7.

- The facility to upload the online Challan and e-file directly through the online system.

- Verification of PANs online.

- Using web services to upload your e-return – It is a quick and easy way to upload your ITR without having to enter a captcha every time.

- Forms and reports related to MIS.

- Calculation of orders under Sections 143(3), 148, 143(1), and 153A.

- Online e-file different Form 10CCBC, 10CCBD, 10CCC, 10B, 29B, 29C, 10CCBBA, and 56FF etc.

Easy Procedure to e-File Form 10E Using Gen IT Software

Step 1:- First Install the Gen I-T Return Filing Software on your PC and laptop.

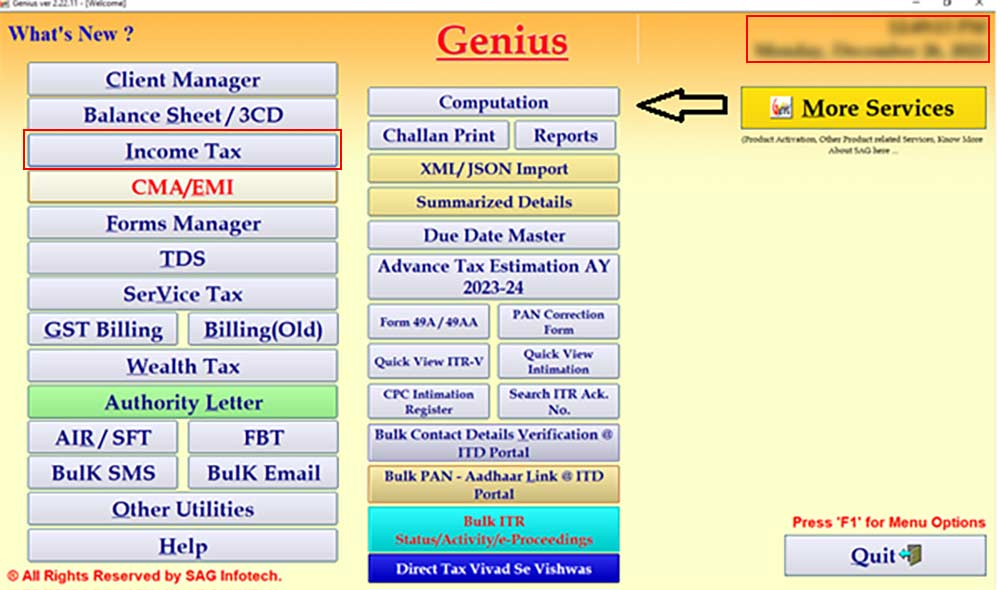

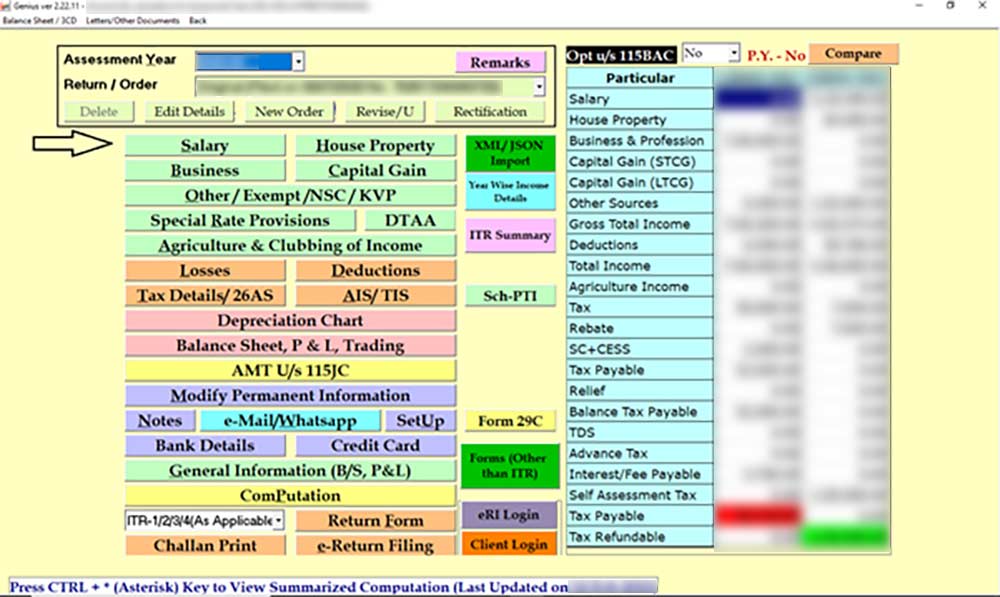

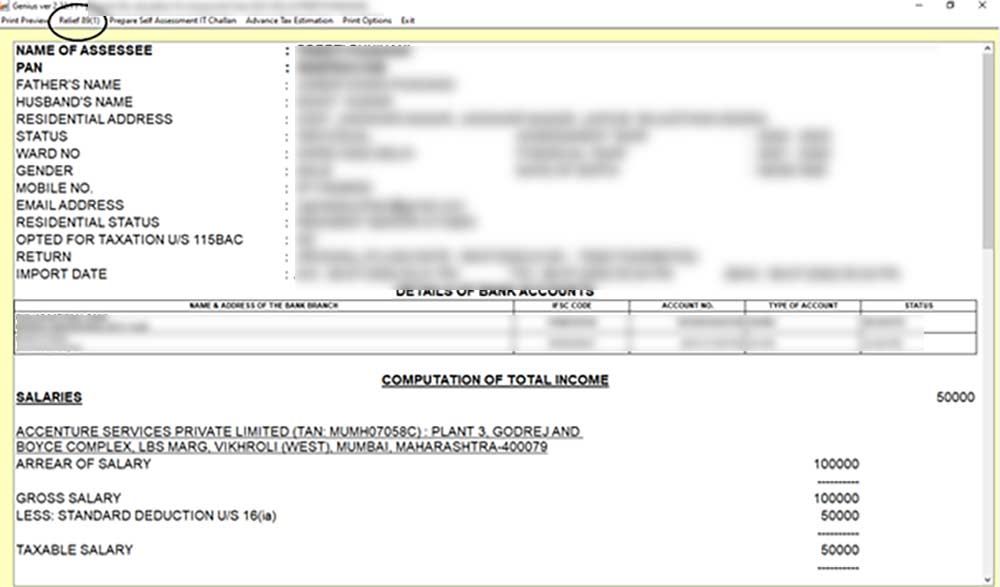

Step 2:- After that Open the Software and Go to ⏩ the Computation tab.

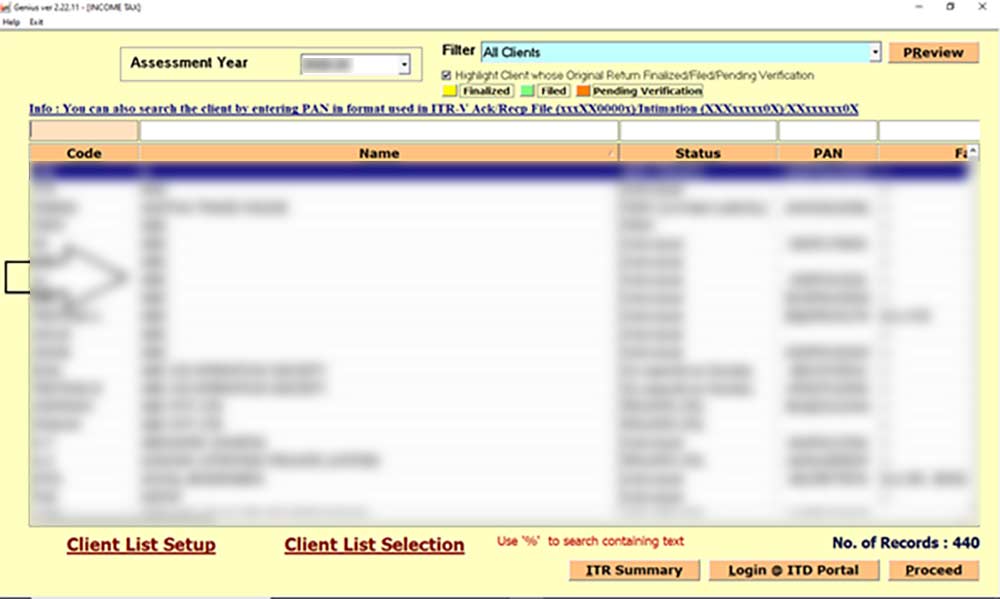

Step 3:- Now Select the Client for which you want to fill out Form 10-E.

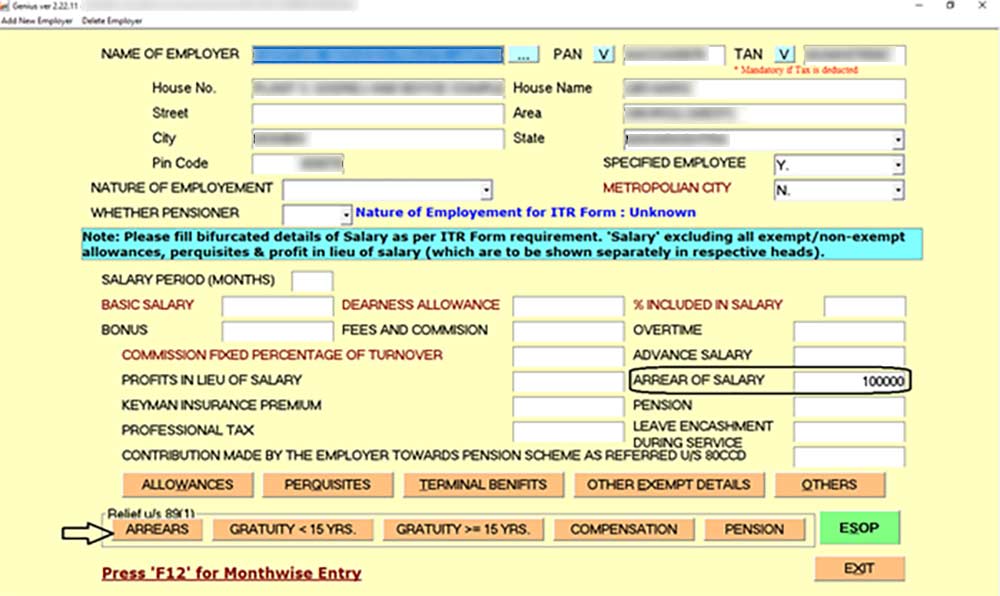

Step 4:- Go to ⏩ Salary Tab.

Step 5:- Fill in the Gross Arrear amount received in Arrear of Salary and Go to ⏩ the Arrears tab to fill in the details.

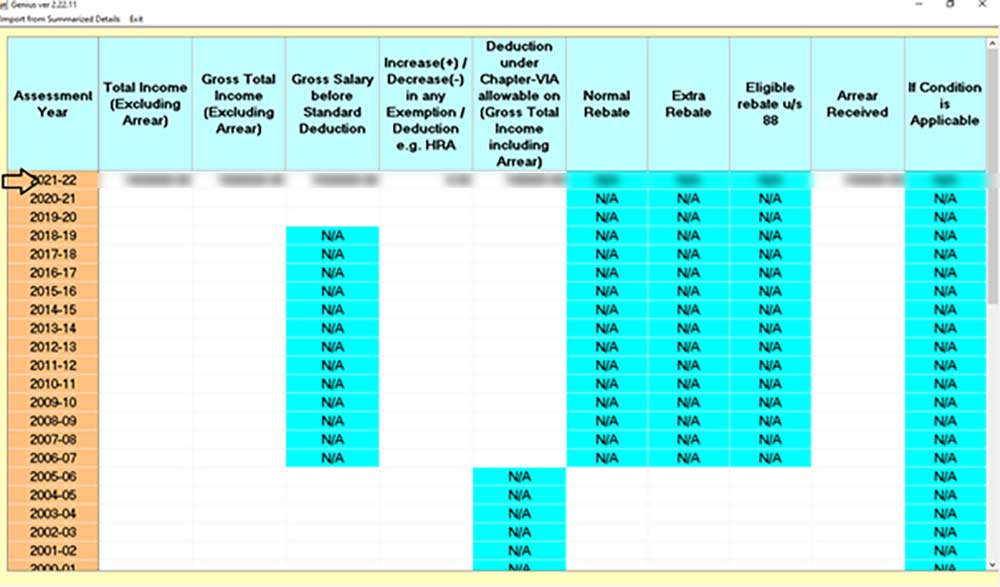

Step 6:- In the Next step, fill in the details of Income, Deductions, Gross Salary, etc., along with the arrear amount received for the year in which you have received the Arrear Amount.

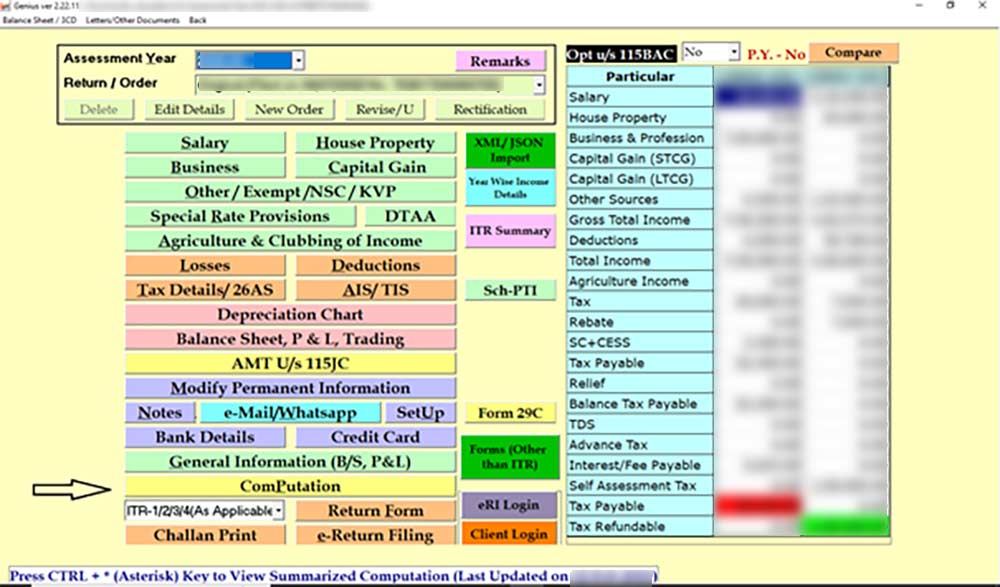

Step 7:- After that, go to ⏩ Computation to upload Form 10E.

Step 8:- Go to ⏩ Relief u/s 89(1) to upload the Form 10E.

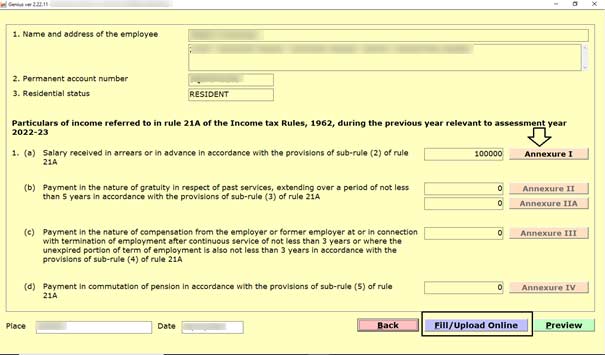

Step 9:- Go to Annexure I to fill in the details, otherwise go to ⏩ Fill/Upload Offline to Upload the Form.

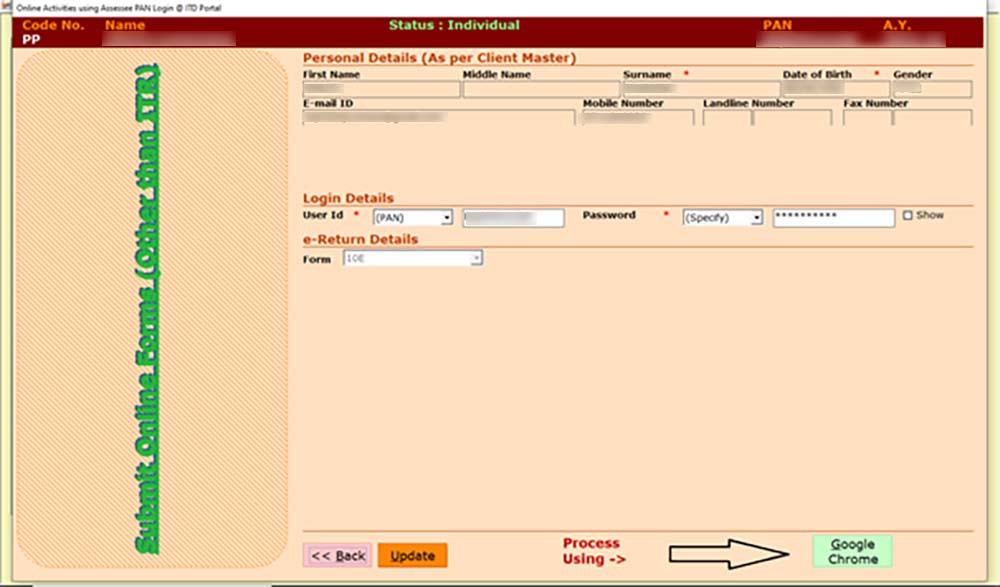

Step 10:- Click on Google Chrome to upload the Form.