The Indian government has notified the PDF format for the ITR forms and Form 49(A). As per the Indian government rules, each individual taxpayer must file tax returns on time to avoid any legal penalty. Similarly, for allotment of a permanent account number, Indian citizens/companies/entities are required to fill Form 49A.

The current article aims to familiarise the readers with the structure and PDF format for both the ITR-7 Form (AY 2025-26) and Form 49A for AY 2025-26.

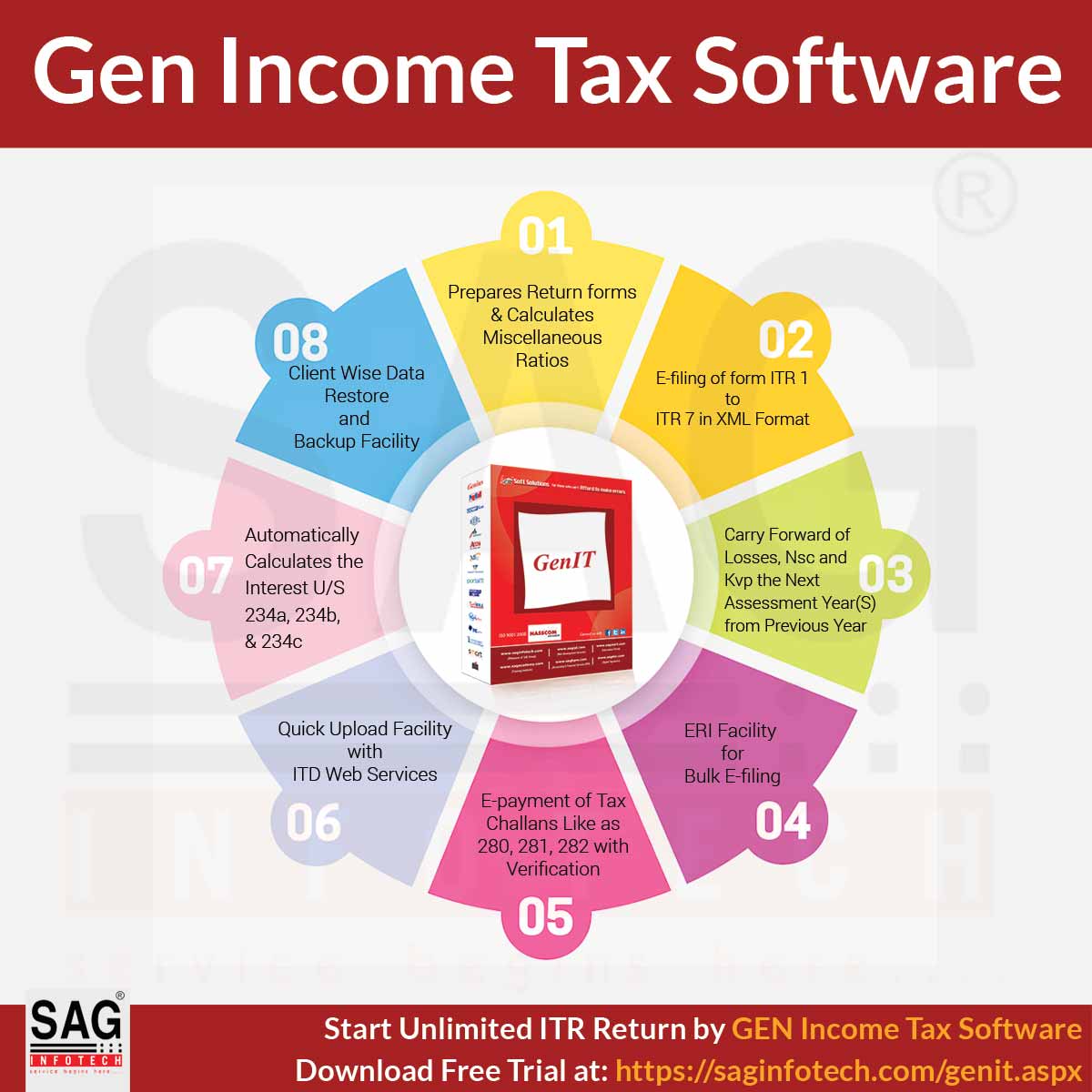

Read Also: Free Download Income Tax Return E-Filing Software

PDF Format of ITR 7 Form for AY 2025-26

The filing of the ITR-7 Form is mandatory for individuals/companies, who fall under section 139(4A) or section 139 (4B) or section 139 (4C) or section 139 4(D). The noticeable thing is that the individuals are not required to attach any document (the TDS certificate is exempted too) with this return form.

If found, the same will be returned to the person who filled out the form. Online and offline filing options are available for the form. Below is the easy-to-understand PDF format for the ITR-7 Form for AY 2025-26.

PDF Format of ITR-V Form for AY 2025-26

PDF Format of Acknowledgement Form for AY 2025-26

Meaning of Form 49A with PDF Format

Form 49A is meant to be filled out by Indian citizens for the allotment of the Permanent Account Number (PAN) in India. It is one of the most important documents for both the government and the taxpayers of India. PAN-related information helps the government to keep track of the taxes paid by the citizens, including companies.

For individuals, a PAN card assists in the filing of income tax returns, requesting refunds, and TDS certificates, and checking income tax refund status. Below is the PDF format for Form 49A.

Want my itr pdf file

Nice

ITR Status