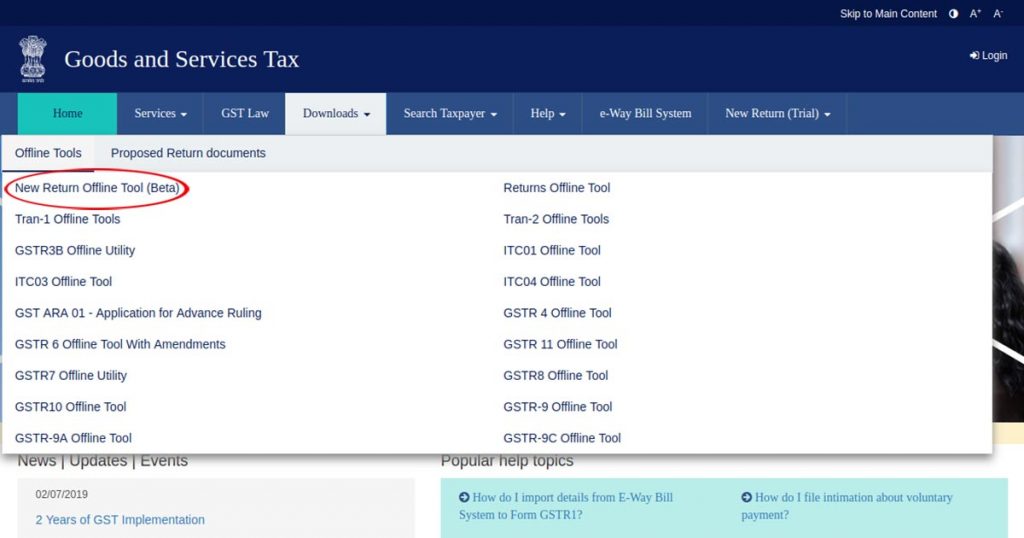

Government of India has brought in a Beta version (v0.6) of New GST Return Offline Tool to get the CA, CS and tax professional on board with the utility- A step towards accuracy and alacrity.

Beta New Return Offline Tool is just a dummy tool which has been introduced to grease the wheels of the professionals with the processing of the tool before they start working on the final version of the New Return Offline Tool of GST.

With the beta offline tool, no returns can be filed as this is just a preparatory tool so that you can fix in the loopholes and clarify the confusions beforehand only for the seamless and accurate final filing of returns.

Tax professionals and Accountants will get an idea as to how this tool works and what are the requirements for the parallel with the ground working of the tool. This will hasten the actual filing of returns and help you pave the path for preparing ANX-1, taking action in ANX-2 and reconciling ANX-2 with Purchase register with the New Return Offline Tool in an offline mode.

Important Update New Offline Tool (Beta) V0.6

Before receiving and running the downloaded file make sure that your file is not corrupted. What could you do to ensure that the file you are accessing is not corrupt?

Here is the way to know whether your file is corrupt or not:

- Check your readme document before you start installing the file.

- Double-click on GST New Returns Offline beta v0.6 to install the offline tool.

About the New Offline Tool (Beta) Introduced on 27 March 2020

- Date format has been modified in the ANX-1 Excel/CSV template to DD/MM/YY.

- The simplified version of the Error Excel File format.

- The tool facilitates downloading error excel files in case important fields are not entered in the Excel/CSV template.

- The tool facilitates downloading error excel files in case no records are there for duplicate values in the Excel/CSV template.

- The tool offers ‘View draft return functionality’ in ANX-1 and ANX-2.

- The facility to delete the data from all the tables or delete data from selected tables are given.

New GST Filing Offline Tool Installation Process & Precautions

So, to get set, first of all, you will have to install the tool by clicking on Download. But before starting with the installation process, make sure to have a look at the Readme document. And then Double-click on GST New Return Offline Tool for installing the offline tool.

After that, you will need to extract the zip file which contains – New Return GST Offline tool (Application), ANX-1 Excel Template, ANX-1 section-wise CSV files, Purchase Register Excel Template, Readme and User Manual.

Now you can run the GST New Return Offline Tool.exe file.

Read Also: Compare Old vs New GST Returns Filing System

But before extracting the downloaded file and running it, you must make sure that the file is not corrupted. To confirm the authenticity of the file, please click here.

System Compatibility

System compatibility is very important. It is like soaping the ways for seamless operations. If the system is not prepped with enough installations or utilities, it may bar the working of new downloads. For the efficient and smooth use of the New Return Offline tool, your system must be ready with the following installations:

- Windows 7 or above – OS

- The tool is not operational on Linux and Mac.

- Make sure you are using either Google Chrome or Firefox 45+ – Browser

- MS – Excel 2007 or above versions.

- For the below versions, the tool will open a default browser. Before installing the offline tool make sure that you have a 200 B storage space free in your local machine.

New GST returns