The 26AS Form under income tax comprises an Annual Information Statement or AIS that consists of a complete profile of the assessee in a specific year.

An annual information statement or AIS comprises a view of details for the assessee shown in Form 26AS. In the making of AIS, detailed processing is needed to show complete and precise details to the assessee.

What Do You Mean by Annual Information Statement?

Annual Information Statement (AIS) comprises a view of information for the assessee shown inside Form 26AS. The assessee would furnish feedback on the details shown in AIS. AIS mentioned both the reported value and the modified value, which is after recognising the assessee feedback beneath every section, that is, TDS, SFT, and other details.

The purpose of AIS comprises: Displaying the complete details to assess with the utility to take the online feedback, promote voluntary compliance and enable seamless prefilling of returns to deter non-compliance.

Benefits of New AIS

Specifications of the new AIS comprise:

- Inclusion of new information (interest, dividend, securities transactions, mutual fund transactions, foreign remittance information, and others)

- Utilisation of Data Analytics to populate PAN in non-PAN data for inclusion in AIS.

- Deduplication of details & generation of an easier Taxpayer Information Summary (TIS) for simple furnishing of return (pre-filling will be enabled in a phased manner).

- The assessee would be enabled to submit the online feedback on the basis of the information shown in the new AIS, along with the download details in PDF, JSON, and CSV formats.

- The new AIS Utility will enable taxpayers to view AIS & upload feedback in an offline manner.

- AIS Mobile Application would enable the assessee to view new AIS & upload feedback on mobile.

Format of Password to Open AIS Consolidated Feedback (PDF) File

AIS Consolidated Feedback (PDF) undergoes password protection. To open the file, you are required to enter the combination of the PAN (in upper case) and the date of birth, if you are an individual assessee or the date of incorporation/formation for the non-individual taxpayer, in the format DDMMYYYY (without any space). For example, if the PAN is AAAAA1234A and the date of birth is 21st January 1991, then your password will be AAAAA1234A21011991.

In the Gen Income Tax Filing Software Following Options are Available

On furnishing the ITR via Gen Returns e-filing Software, you would see your AIS or TIS inside the PDF format, and you would be enabled to import the data from AIS or TIS and transfer it to the concerned authority.

- You can download and see your AIS/TIS in PDF Format with one tap

- You can Import Data from AIS/TIS and transfer it to the concerned authority.

- You can compare AIS/TIS Data with the 26AS form

How to Download and View Your AIS/TIS via Gen IT Software

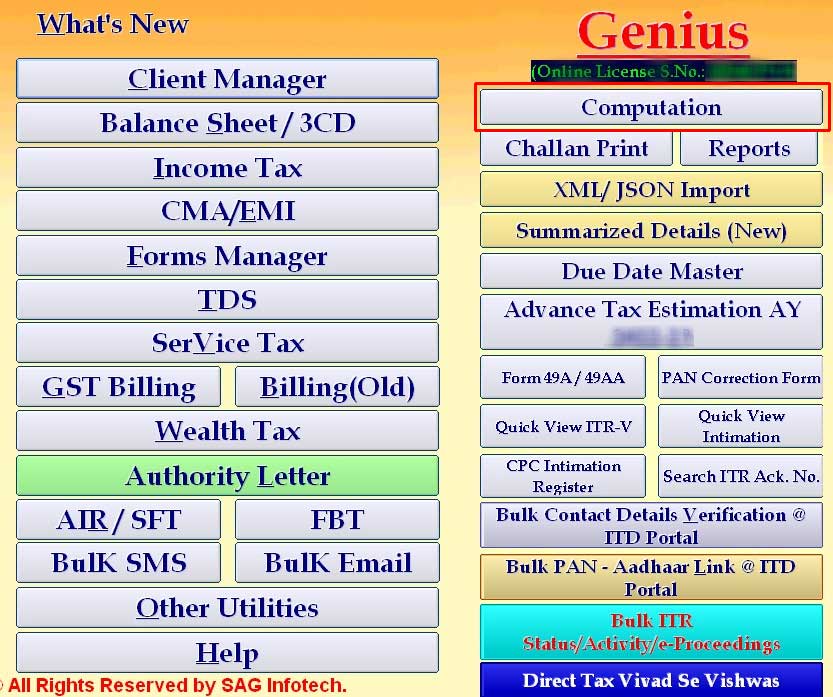

Step 1: Open the Genius software

Step 2: After that, click Income tax

Step 3: Now, Click on Computation

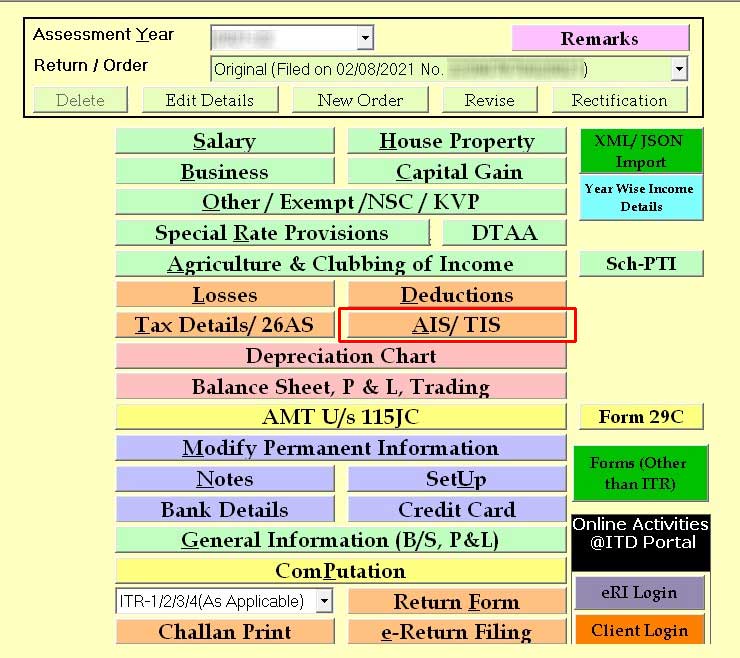

Step 4: Then, Select the Client

Step 5: After that, click on AIS/TIS

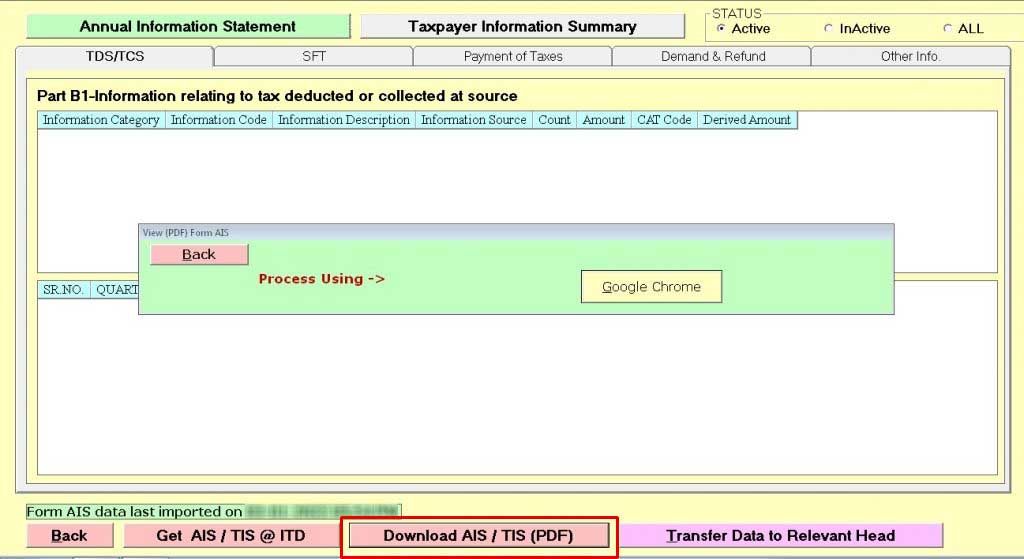

Step 6: Now, Download AIS/TIS (PDF)

Simple Steps to Import Data from AIS/TIS by Gen IT Software

Step 1: Open the Genius software

Step 2: After that, click Income tax

Step 3: Now, Click on Computation

Step 4: Then, Select the Client

Step 5: After that, click on AIS/TIS

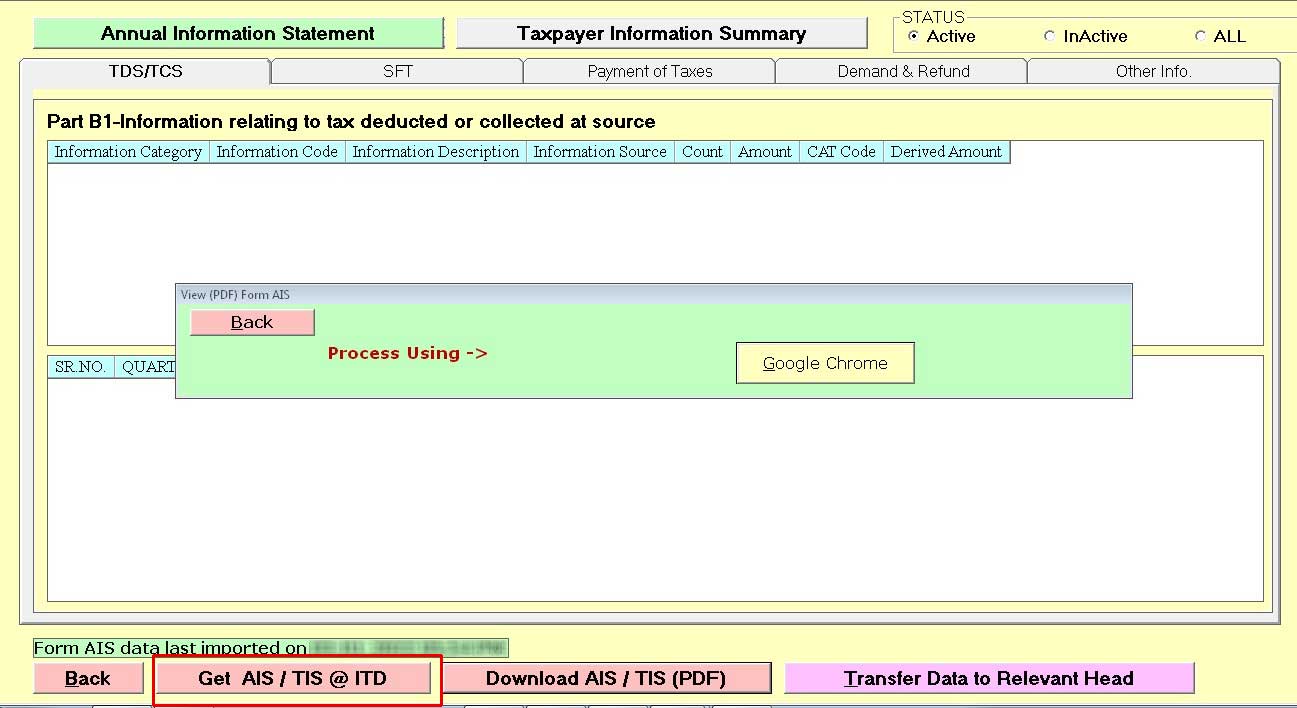

Step 6: Then, Click on Get AIS/TIS @ ITD

Step 7: Click on Option AIS/TIS

Step 8: After that, Select the Browser

Note: You can check Particular Head Wise Details, i.e. TDS/TCS, SFT, Payment of Taxes, etc.

Transfer Data to the Relevant Head from the Gen ITR Filing Software

Step 1: Open the software

Step 2: After that, click Income tax

Step 3: Now, Click on Computation

Step 4: Then, Select the Client

Step 5: After that, click on AIS/TIS

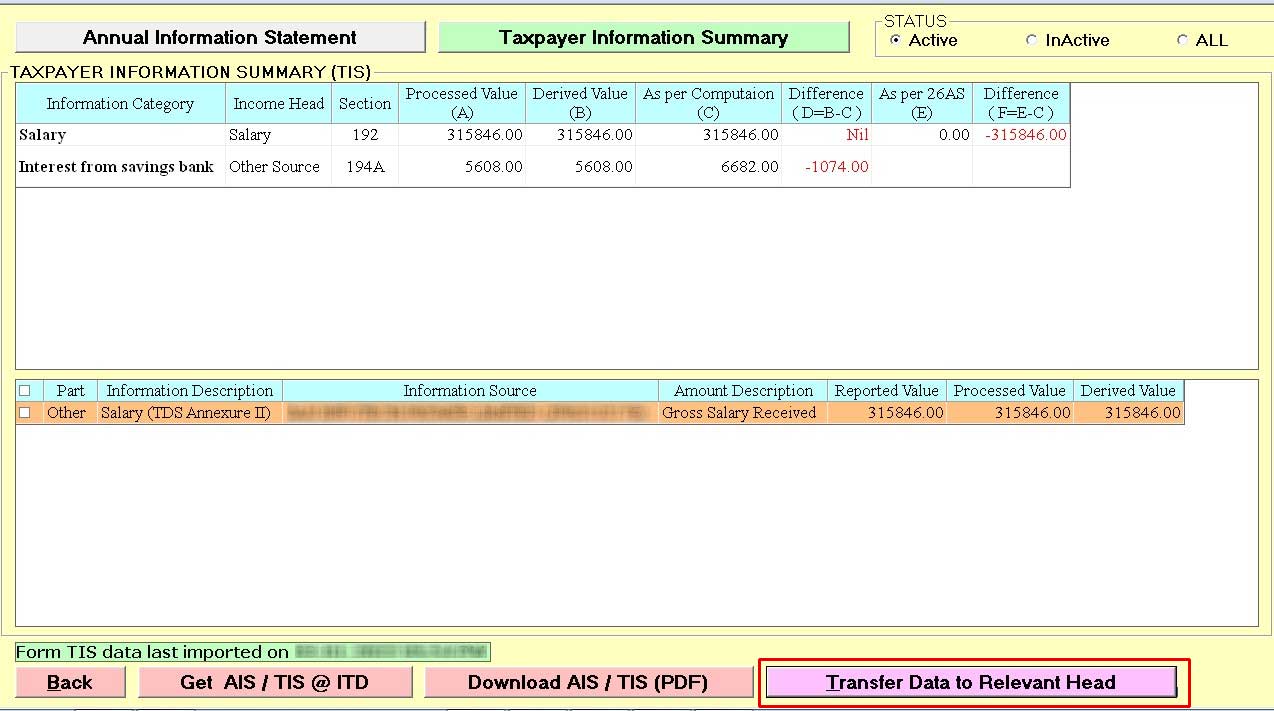

Step 6: Now, go to the Taxpayer Information Summary

Step 7: Then Select an Item

Step 8: Now, Click on “Right Click and Click on “Transfer Data to Relevant Head

Differentiate AIS/TIS Data with Computation & 26AS by Gen IT Filing Software

Step 1: Open the software

Step 2: After that, click Income tax

Step 3: Now, Click on Computation

Step 4: Then, Select the Client

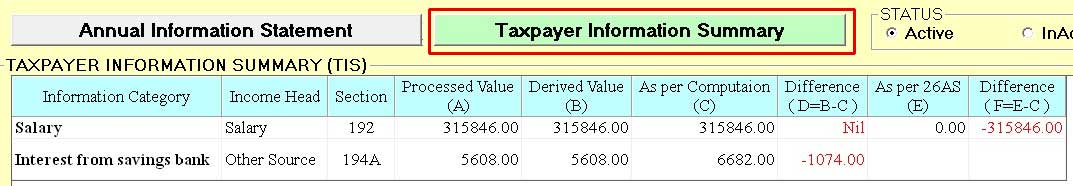

Step 5: After that, click on AIS/TIS

Step 6: Now, go to the Taxpayer Information Summary

What is the Reason to Choose Gen IT Software?

Gen IT software is one of the first solutions in the market to offer AIS/TIS features within the software itself, as per government compliance. Also, the Gen IT return e-filing software can offer a summarised head-on the first basis to the client. The Gen IT software is also a reliable software to get the complete filing features, such as return filing, document storage, master data, and more.

FAQs on AIS/TIS Feature in Gen IT Software

Q.1 – Can I Download Online AIS/TIS from Gen IT Software?

Yes, one will be able to download the online AIS/TIS from the Gen IT software easily.

Q.2 – Is Gen IT Software Shows Different Types Features in AIS?

Yes, Gen IT is able to offer multiple featureful specifications while filing AIS as per government compliance. You can check Particular Head Wise Details i.e. TDS/TCS, SFT, Payment Of Taxes Etc.

Q.3 – Can I Compare AIS/TIS Data with Form 26AS Via Gen IT Filing Software?

Yes, you can easily compare the AIS/TIS Data with Form 26AS within the Gen IT filing software as per the government compliance.

Q.4 – Do I Transfer Data to the Particular Head from AIS via Software?

Yes, one can make a quick transfer of data within the Gen IT software and also it can make ahead transfer as per the requirement of the client.

Q.5 – Is the Download Option Available for AIS in PDF Format?

Yes, the Gen IT software can quickly download the AIS in PDF format and save it on the desktop.