Form 26AS which is a tax credit statement is one of the most crucial documents where the filing of taxes is concerned.

What is the 26AS (Annual Statement) Form?

Form 26AS is an annual statement that entails the details related to the

- Tax Deducted at Source (TDS)

- Information regarding the refunds you have received during a financial year

- Information regarding the tax collected by your collectors

- Advance Tax Paid

- Self-Assessment Tax Payment

- Regular Assessment tax that you have deposited

- Information related to high-value transactions related to shares, mutual funds and so on

Why is Tax Credits Form 26AS Important?

Below mentioned are the reasons why Form 26AS is pertinent:

- You shall be able to check whether the deductor has filled the TDS statement correctly or if the collector of tax has precisely filled the details of the Tax Collected at Source(TCS)

- You can verify whether the tax deducted and collected on behalf of you has been deposited in the government treasure or not

- You can check the tax credits and the calculation of the income tax before filing ITR

Online Download & Import 26AS via Gen Income Tax E-filing Software

Now you can download and view import Form 26AS by Gen Income Tax software in a hassle-free and convenient manner.

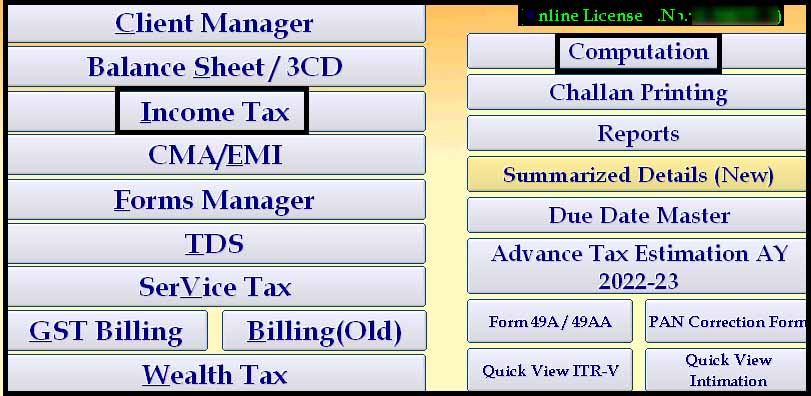

Step 1: Open the software of Gen Income Tax

Step 2: Then go to income tax – Computation – Select the client

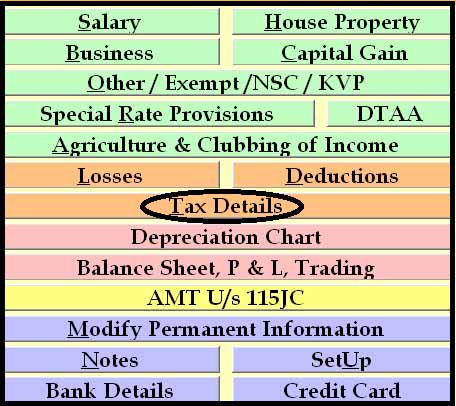

Step 3: Now click on Tax Details

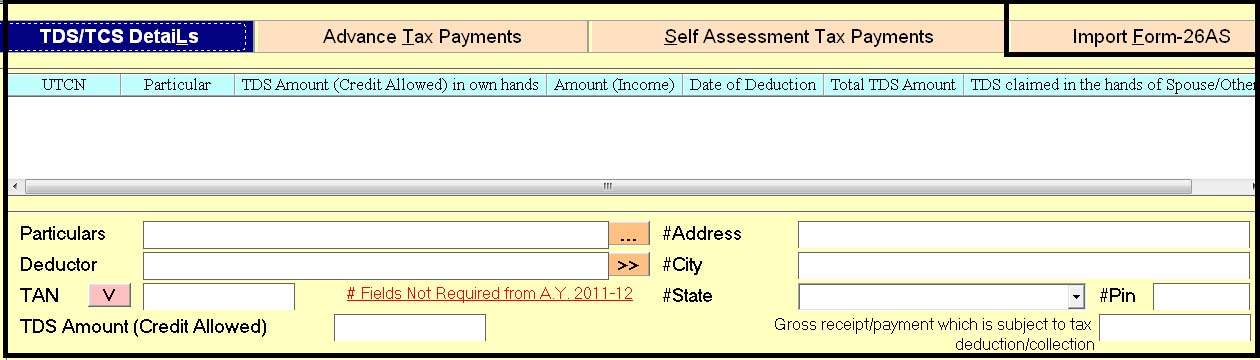

Step 4: Then go to import from 26AS – Import

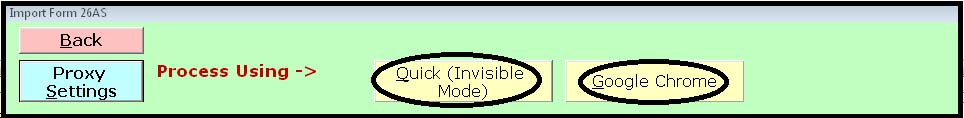

Step 5: Now select quick invisible mode or Google Chrome

How to View & Download 26AS Form on the New 2.0 Portal

Complete details about how to download and view Form 26AS through the new income tax filing portal so following the steps:

- Step 1: Open the government’s official website: https://www.incometax.gov.in/iec/foportal/

- Step 2: Log in to the new ITR E-filing Portal 2.0

- Step 3: After that go to the ‘My Account’ menu, then click the ‘View Form 26AS (Tax Credit)’ URL.

- Step 4: Learn the disclaimer, and click ‘Confirm’ & the user will be redirected to the government TDS-CPC official Portal.

- Step 5: In the TDS-CPC government portal, Agree with the acceptance of usage. Click to ‘Proceed’.

- Step 6: Now click ‘View Tax Credit (Form 26AS)’

- Step 7: Choose the AY (Assessment Year) & ‘View type’ (HTML, Text or PDF)

- Step 8: Click on ‘View and Download’ in PDF format.

Why Purchase Only Gen Income Tax Software?

The Gen Income Tax Software is the first choice of Chartered Accountants because it computes Self Assessment and Advances Tax and Interest calculation as per sections 234A, 234B and 234C. It has many appealing features like auto return form, XML generation, PAN Application, Arrear Relief Calculation, 26AS Import, PAN Application and correction and so on. So go now the SAG Infotech website and fill out the query form for a free trial demo of Gen Income Tax Software. After installation, you can easily view & import the 26AS (Tax Credits) form from this software

General Queries About 26AS Form

Q.1 – What Comes within the Domain of Form 26 AS?

Ans. The aforesaid form entails all the information related to the details of the tax collected by collectors, advance tax that has been paid by you, self-assessment Tax payments, assessment tax that has been deposited by you and the details of the refund that has been received.

Q.2 – Which Forms Related to TDS are Required to be Submitted

Ans. In Part A1 of this form, you shall have information about your income where TDS has not been deducted while you have submitted Form 15G/Form 15H.

Q.3 – Why Form 26 AS is Worthy of Attention

This form is an annual credit statement (consolidated) that is issued with regard to your PAN. It is critical that you compare Form 16 that has been received from your employer with the Form 26 AS.

Q.4 – What steps to follow if the amount of advance tax has been Paid in Bank Account; however, It is not reflected in Part C of Form 26AS

Ans. The reason attributed to this aspect is that the bank has made an error in its data entry. So an Individual shall have to take up this issue with individual’s bank and rectify the amount.

Q.5 – Can an Individual amend the name and address (mentioned in PAN) in Form 26AS

Ans. Yes, He can if the given details of PAN holder are incorrect. It is essential for an individual to submit an application through the ‘Request for the new PAN Card or/and changes or the correction in the PAN data option’ on the official website of the tax department.

26as

Pls show the output form of 26 AS in excel. So software purchase decision can be taken.