What is GSTR-4?

GSTR-4 is a GST return which is to be filed by the composition dealer. A dealer who opts for the composition plan is expected to furnish only 1 return which is GSTR 4 once in the year by the 30th of June following a financial year, unlike the normal taxpayer.

When is the GSTR-4 Due Date?

GSTR 4 is to be filed annually. The due date for filing the GSTR 4 follows the appropriate financial year. For this case, the GSTR 4 for FY 2024-25 is due by 30th June 2025.

Who should file GSTR-4?

The GSTR-4 has been filed for the taxpayer who has opted for the composition levy. This covers the composition scheme for the service providers through the CGST (Rate) notification number 2/2019 date 7th March 2020 with influence from FY 2019-20.

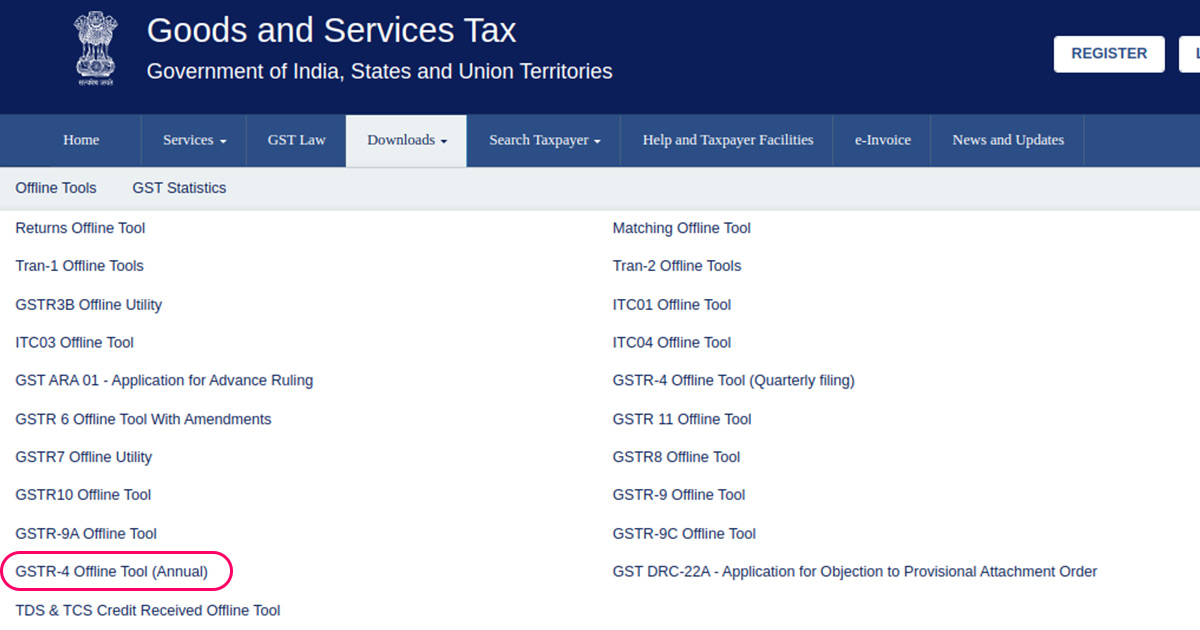

Download unzip and open the GSTR-4 offline utility (excel macro) to prepare your GSTR-4 return in offline mode. Download here

Download GSTR 4 V2.3 Offline Tool Zip File Contains

- GSTR 4 (Annual) Offline Utility (Excel Macro)

- FAQs and User Manual Returns Offline Tool GSTR 4 V2.3

- Readme

- Release Notes

Important!

- Before unzipping and opening the GSTR-4 offline tool, ensure that the file is not corrupted. How do I know that My file is corrupted? Click here to know more.

- Go through the Readme document as well as the Readme section in offline utility.

- Double-click on GSTR 4 Offline Utility V2.3 to run the offline utility.

System Requirement

To use the tool efficiently, ensure that you have the following installed on your system:

- Operating system > Windows 7 or above. The tool does not work on Linux and Mac.

- An Uncompress file software like- Winzip or Winrar.

- Microsoft Excel 2007 & above.