Form 26AS has all the required details of tax deducted by the deductor, i.e. bank, employer, etc. Therefore, all the deductions of TDS, which are shown in Form 16A/Form 16, can be cross-verified by means of Form 26AS. It is to be noted that the amount of TDS should match the Form 26AS and the Form 16/16A.

The income-tax department introduced a new e-filing portal, which is www.incometax.gov.in, on 7th June 2021. Meanwhile, the intention behind making this is to provide taxpayers with convenience and advance with an absolute experience to taxpayers.

This latest website has multiple interesting attributes like interactivity and uploads, or uncertain actions will be featured in an individual dashboard for follow-up action by the taxpayers. There will be free income tax software available for filing ITR-1 and ITR-4.

Apart from the information of 26AS, which is a tax passbook, here is the procedure for downloading Form 26A, which is also shown under the advance portal –

- Details linked to tax withdrawn at source;

- Details linked to tax assembled at source;

- Details linked to particular Financial Transactions (SFT);

- Details linked to the payment of taxes;

- Details linked to the request and refund.

- Details linked to the pending progress

- Details linked to accomplished proceedings, along with

- Details gained from any officer, authority, or body doing any tasks under section 90 or section 90A or details received from other individuals at the end, and it seems fit in terms of the capital.

Taxpayers have to go through the following steps in terms of downloading Form 26AS:

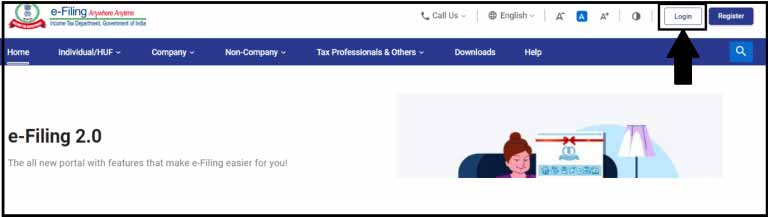

Step 1. Go to the income tax upgraded website incometax.gov.in

Step 2. Move your cursor on Login placed top right of the home page

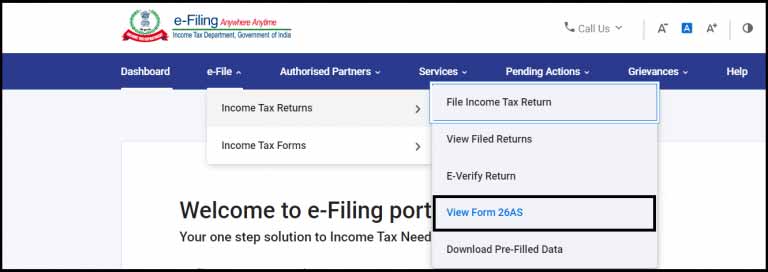

Step 3. Click on the ‘e-file’ menu > go to Income-tax returns> choose ‘view Form 26AS’

Step 4. Go through the disclaimer and click on the ‘Confirm’ button.

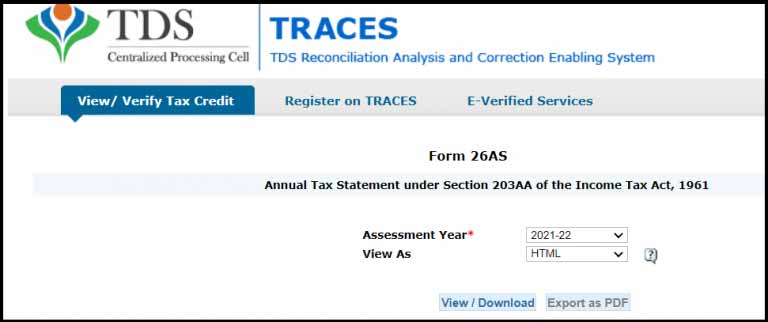

Step 5. Soon after confirming, you will be diverted to the TDS – CPC website.

Step 6. On the TDS – CPC website, conform to the acceptance and usages of Form 16/16A initiated from TRACES and select ‘proceed’;

Step 7. Tap on the ‘View Tax Credit ( Form 26AS)’ option;

Step 8. Go to the relevant assessment year where Form 26AS is needed and choose ‘View Type ‘(HTML or Text)

Step 9. Tap on ‘View /Download’ and

Step 10. You will get to see 26AS on the screen.

In case you want to download the 26AS Form in PDF, tap on Export as PDF and save the Form 26AS for future use.