The Delhi High Court released a notice to the Centre on 1st December 2017 in consideration of a Plea by Honda Siel Power Products Limited, questioning the constitutional validity of setting down a higher rate of GST on kerosene and petrol engines as compared to diesel engines.

The litigation team of PDS Legal which comprises Partner Tarun Gulati as head, and other members, Senior Associate Anupam Mishra and Senior Principal Associate Sparsh Bhargava came forth on behalf of the petitioner. It was presented that the diversification in GST tax rate was random and breach of Articles 14, 19(1)(g) and 21 of the Indian Constitution.

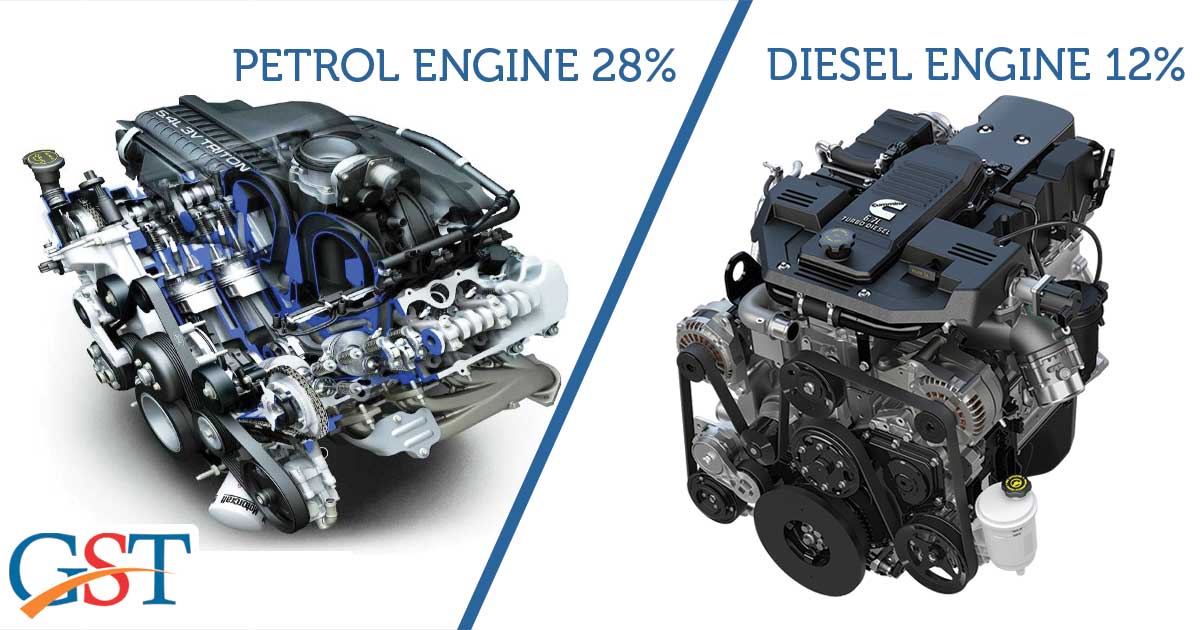

A petitioner asserted on differential GST rates and said, “The classification of fixed speed diesel engines of power not exceeding 15 HP at a lower tax rate slab of 12% while keeping the petrol/kerosene engine manufactured by the petitioner at a tax rate slab of 28% is completely discriminatory and violative of Article 14 of the Constitution since both these products are commercial substitutes of each other and are used for the purposes of providing power output to power-driven products such as water pumps, lawnmowers, backpack sprayers, tillers etc.”

Read Also: GST Impact on Automobile and Spare Parts Industry in India

The petitioner company further argued on expert bodies’ study which shows that emissions from diesel engines in the automobiles are deleterious and is the reason for intense pollution issue as well. On the contrary, the products from Honda Siel are cleaner fuel, as reported. Therefore, it is not relevant for categorizing the products of the petitioner company at a higher GST rate while discounting diesel engines to promote.

The Delhi High Court, Division bench comprising justice S Ravindra Bhat and Sanjeev Sachdeva, in the meantime of directing notice to the Centre, informed the supreme body of GST, the GST Council to contemplate the pending request about the different GST rate issue from the petitioner company.

The further proceeding of hearing on the differential GST rate issue will take place on 1.02.2018.