The Delhi bench of Income Tax Appellate Tribunal ( ITAT ) in a case stated that routine support services are not to be categorized under “Fee for Technical Services” (FTS) under the India-UK Double Taxation Avoidance Agreement (DTAA), and therefore are not accountable to taxation in India.

Nord Anglia Education Ltd, the assessee/appellant is an international school organization incorporated and tax-resident in the United Kingdom, functioning over 80 premium schools in 31 countries.

In India, the taxpayer furnishes various management and support services to 5 schools managed by 4 different societies: Oakridge Educational Society, Orange Educational Society (Karnataka and Punjab), and Vikas Education Society.

Read Also: No Penalty Would be Imposed U/S 27(1)(C) as TDS Deducted Under DTAA

In the assessment year, the taxpayer had a service agreement with its Indian group entity, PBIL to furnish centralized administrative services like marketing, human resources, finance, IT support, and facilities management.

For such services, the taxpayer has obtained the payment of Rs 28,64,22,509 from PBIL.

The receipts for routine services furnished to PBIL were not proposed to tax in India, laying on Section 90(2) of the tax statute and Article 13(4)(c) of the India-UK DTAA, since these services did not make available any technical knowledge to PBIL.

Therefore the income from cross charges was claimed as waived.

The Assessing Officer (AO) during the assessment proceedings, opined that the payments received by the taxpayer from PBIL for routine support services must be categorized as FTS under the India-UK DTAA, making them taxable in India u/s 9 of the Income Tax Act and Article 13 of the India-UK DTAA.

The argument of the AO was based on the assumption that the services provided by the assessee, including marketing and human resources, entailed the sharing of technical knowledge or expertise, thereby meeting the ‘make available’ requirement in the DTAA.

The AO issued a draft assessment order, offering an addition of Rs 28,64,22,509 to the income of the taxpayer.

The taxpayer objected to this draft order, arguing that the services furnished were routine, non-technical in nature, and did not result in any technology or skill being made available to PBIL, therefore losing the make avail test under the DTAA.

Taxpayers’ objections were presented to the Dispute Resolution Panel (DRP), which examined the evidence produced by the taxpayer.

Even after the submission of the taxpayer that the services do not have the technical services under the DTAA, the DRP carried the position of the AO, drawing the interference that the services improve the skill base of the employees of PBIL.

The AO on June 27, 2023, issued the final assessment order, incorporating the DRP’s recommendations and ministering the payments obtained via the taxpayer from PBIL as FTS, taxable in India. Under Section 270A of ITA, the penalty proceedings were started against the taxpayer for under-reporting their income.

The taxpayer dissatisfied with the final assessment order appealed to the ITAT. The taxpayer before the tribunal repeated its position that the services furnished to PBIL were routine administrative support services that do not pose the transfer of technical skills and hence must not be levied to tax as FTS under the DTAA.

The taxpayer quotes the matter of Global Schools Holdings Pte. Ltd. vs. ACIT, in which the identical services were not regarded as FTS.

The bench of Mr. Saktijit Dey and Dr. B. R. R. Kumar after analyzing the matter and the taxpayers’ submission determined that the AO and DRP had wrongly categorized the type of services furnished by the taxpayer.

No conclusive proof was there to show that the services furnished resulted in any enduring benefit to PBIL or that they fulfilled the ‘make available’ test under the DTAA.

According to the Tribunal, standard assistance services like those offered by the taxpayer usually do not meet the criteria for technical services under the Double Taxation Avoidance Agreement unless they have the transfer of technical knowledge or skills that allow the recipient to conduct the services independently in the future.

The Tribunal on the grounds of its observations concluded that the payments obtained via the taxpayer from the PBIL must not be categorized as Fees for Technical Services (FTS) under the India-UK DTAA and, thus, are not taxable in India.

In favour of the taxpayer the tribunal permitted the plea by setting aside the final assessment order of the AO and nullifying the penalty proceedings initiated u/s 270A of ITA.

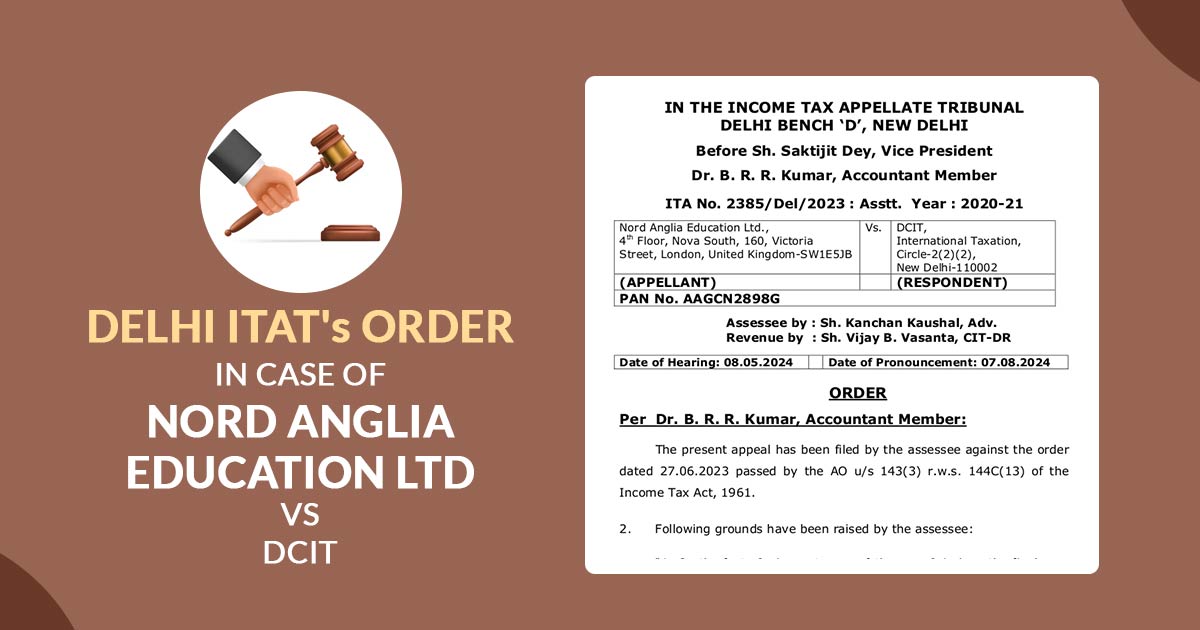

| Case Title | Nord Anglia Education Ltd. Vs DCIT |

| Citation | ITA No. 2385/Del/2023 |

| Date | 08.08.2024 |

| Counsel For Appellant | Sh. Kanchan Kaushal, Adv. |

| Counsel For Respondent | Sh. Vijay B. Vasanta, CIT-DR |

| Delhi ITAT | Read Order |