In the matter of Pilani Industrial Corporation Limited Vs ACIT, heard by the Income Tax Appellate Tribunal (ITAT) Delhi, the issue is of cash deposits at the time of the demonetization period.

The petitioner, Pilani Industrial Corporation Limited, argued against the assessment order of the Assessing Officer (AO) for the treatment of cash deposits amounting to Rs. 65,49,189 u/s 69A of the Income Tax Act, alleging failure to designate the source of the deposits.

At the time of the assessment proceedings, the appellant elaborated that the cash deposits were a consequence of the normal business receipts, specifically from the functionality of the petrol pump.

They furnish detailed submissions demonstrating the breakdown of their turnover, stressing the surged sales volume and per unit price at the time of the pertinent assessment year compared with the earlier one.

Read Also: ITAT: More IT Addition Not Permissible Without Books of Account U/S 68

They emphasized the government notification permitting the particular banknotes for purchasing petrol, diesel, and gas during the demonetization period.

But both the Assessing Officer (AO) and the commissioner of the Income Tax (Appeals) kept the disallowance, arguing that the cash deposits remained unexplained. AO laid on the numbers given via the appellant and declared the deposits as unexplained without denying the books of account.

Closure: The ITAT Delhi, referencing the precedent designated via the Supreme Court in Lalchand Bhagat Ambica Ram vs. CIT, underscored the significance of genuine entries in books of account.

It carried that treating cash deposits as unexplained exclusively based on entries in the books without rejecting them is lawfully prohibited. Consequently, the ITAT set aside the assessment order and the appellate order, authorizing the petition of the appellant.

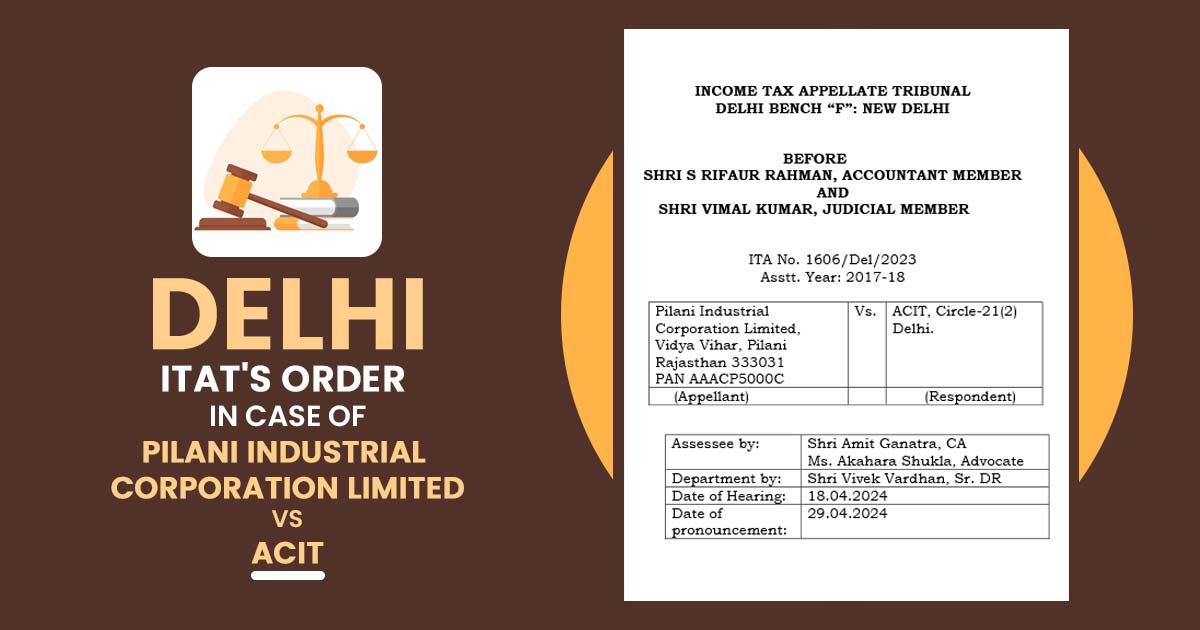

| Case Title | Pilani Industrial Corporation Limited & ACIT, Circle-21(2) |

| Citation | ITA No. 1606/Del/2023 |

| Date | 29.04.2024 |

| Assessee by | Shri Amit Ganatra, CA Ms. Akahara Shukla, Advocate |

| Department by | Shri Vivek Vardhan, Sr. DR |

| Delhi High Court | Read Order |