The Income Tax Appellate Tribunal (ITAT) of Delhi in a decision, quashed a reassessment notice issued u/s 148 of the Income Tax Act, 1961 (ITA) to the assessee/ appellant, Natraj Products Pvt. Ltd. for the AY 2010-11, mentioning mechanical approval granted by the Principal Commissioner of Income Tax (PCIT).

The reassessment was on the grounds of alleged accommodation entries of Rs 60 lakh, however, the ITAT discovered that the approval granted for reopening the matter did not have the application of mind and was issued without fulfilling the strict needs of the law.

The matter started when the Assessing Officer (AO) again opened the assessment of taxpayers after obtaining the data from the investigation Wing in March 2013. The investigation shows that the Surender Kumar Jain Group has furnished the accommodation entries to distinct firms, along with the taxpayer in the FY 2009-10.

A notice has been furnished by the AO based on this information u/s 148 of the tax legislature on March 25, 2017, just before the expiry of the limitation period. The reassessment notice increased the company’s income by ₹60 lakhs under Section 68 of the Income Tax Act, with an additional ₹1.2 lakh considered as potential commission expenses u/s 69C, resulting in a total reassessment of ₹62.62 lakhs.

The same decision has been appealed via taxpayer before the Commissioner of Income Tax (Appeals) who kept the measures of AO both on jurisdiction and merit. The taxpayer company dissatisfied appealed before the ITAT contesting the reassessment proceedings’ legality on a distinct basis.

The objection was that the reassessment was on the grounds of the borrowed satisfaction from the Investigation Wing without the AO performing any independent verification or inquiry into the alleged accommodation entries.

The bench of Mr Pradip Kumar Kedia and Mr Yogesh Kumar US post analyzing the case discovered merit in the taxpayer’s company’s claims, for the approval allotted via the PCIT u/s 151 of the tax legislature, which empowers the issuance of a notice u/s 148 of it.

ITAT notices that the process of approval was undergone mechanically, without effective scrutiny or due consideration of the facts. It remarked discrepancies in the duration of the alleged entries and the said assessment year with the AO citing the transactions from the FY 2008-09 which shall be pertinent to a distinct assessment year than 2010-11.

It was cited by ITAT that AO does not do anything on the data of 4 years, executing the proceedings merely on the grounds of the limitation duration, showing an absence of urgency or independent inquiry.

AO and PCIT are being criticized by the tribunal as they were not able to effectively compute the case before initiating the reassessment. It emphasized that the approval u/s 151 of ITA must be allotted merely after effective consideration and not only under mere formality.

The ITAT eventually ruled that the reassessment proceedings were not valid because of improper jurisdiction under section 147 of the tax legislation, thereby nullifying the reassessment order.

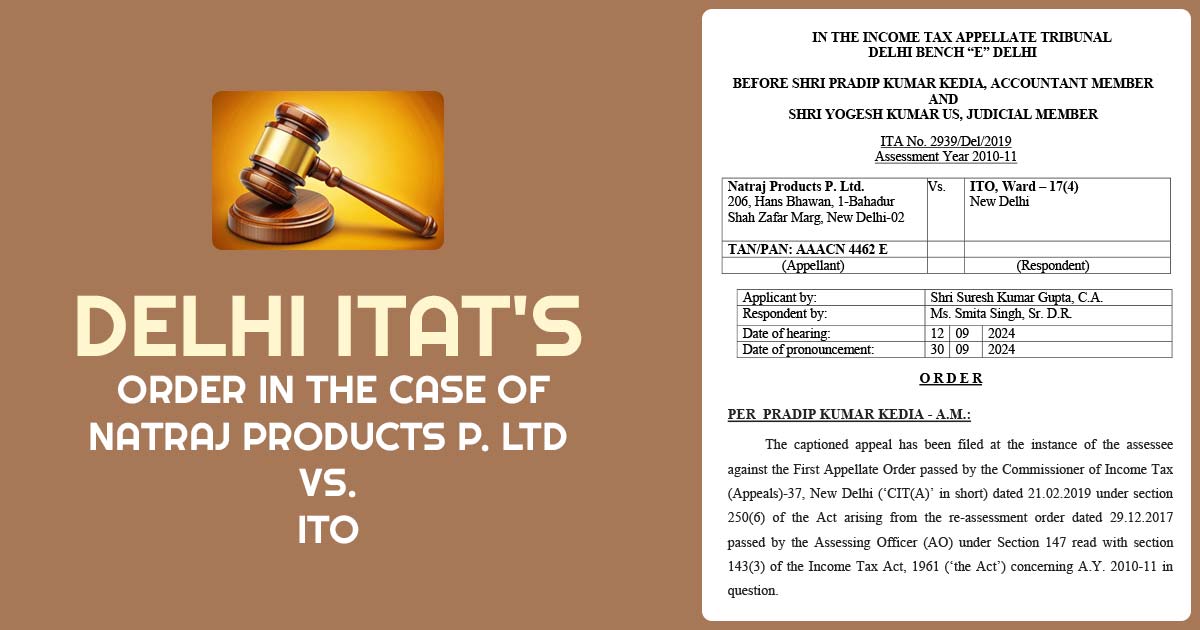

| Case Title | Natraj Products P. Ltd Vs. ITO |

| Citation | ITA No. 2939/Del/2019 |

| Date | 30.09.2024 |

| Assessee by | Shri Suresh Kumar Gupta, C.A. |

| Revenue by | Ms. Smita Singh, Sr. D.R. |

| Delhi ITAT | Read Order |