The income tax deduction is allowable on expenditures incurred on warranty claims, the Delhi Bench of Income Tax Appellate Tribunal (ITAT) ruled.

The bench of Kul Bharat (Judicial Member) and M. Balaganesh (Accountant Member) has laid on the Supreme Court’s decision in the matter of Rotork Controls India (P) Ltd., where it was carried that if the particulars show that defects existed in some of the items manufactured and sold, the provision made for warranty for the army of sophisticated goods would be authorized to deduction u/s 37 of the Income Tax Act.

The bench remarked that the taxpayer has shown that defects emerged and were improved at the time of the warranty duration. Therefore CIT(A) is mistaken in holding that the decision rate of the Supreme Court in the matter of Rotork Controls India (P) Ltd. is not subjected to be applied.

The petitioner is in the business of sales, trading, marketing, production, and assembly of products and parts for warehousing automation, where the products are highly sophisticated. It is incumbent on the taxpayer to furnish warranty cover on such products for a specific period, ordinarily one year. The taxpayer is under obligation to repair or substitute the products if they were discovered impaired in the warranty period.

Read Also: ITAT Delhi: No Tax Deduction Permits U/S 54 Without Basic Facilities

The commitment generates an obligation when the product is sold. The obligation shall start when the risk and rewards of the products are transferred to the buyer under the terms and conditions agreed upon. According to the mercantile system of accounting, the profit is to be achieved after considering all the accrued receipts and expenses.

An income return is been furnished by the taxpayer in electronic mode, declaring a loss. The matter was chosen for investigation. The taxpayer attended the proceedings in answer to the legal notices issued via the assessing authority. By disallowing the provisions for warranty expenses the AO incurred an addition.

The taxpayer carried the case in appeal to CIT(Appeals), who kept the addition incurred for disallowance of expenses asserted for provision incurred for warranty expenses.

The taxpayer argued that CIT(A) did not recognize that the provision made in the relevant assessment year was actually used during the remainder of the warranty period, demonstrating that it was calculated reasonably and reliably. The warranty clause is an essential part of the sales agreement or purchase order and charges an obligation in the year of the sale, and the taxpayer is obligated to honour the claims during the remaining warranty period. If the provision for the remaining period is not allowed in the relevant assessment year, the actual expenses made on warranty claims in the following assessment year must be permitted.

Recommended: Tax Implication Guide on Income of Bloggers Under I-T Act

The tribunal remarked that according to established law, warranty expenses can be authorized if the taxpayer can demonstrate that they have been calculated based on past experience and scientific principles. In this case, there is no past data available, and the claim is solely based on an estimation. However, the assessee has used a formula to make the claim and has continued to use the same formula in subsequent years, and consequently, the claim based on the formula has been allowed in those subsequent years.

The tribunal asked the Assessing Officer (AO) to permit the claim of the taxpayer post verifying the claim of the taxpayer that it made the expenses at the time of the unexpired warranty period.

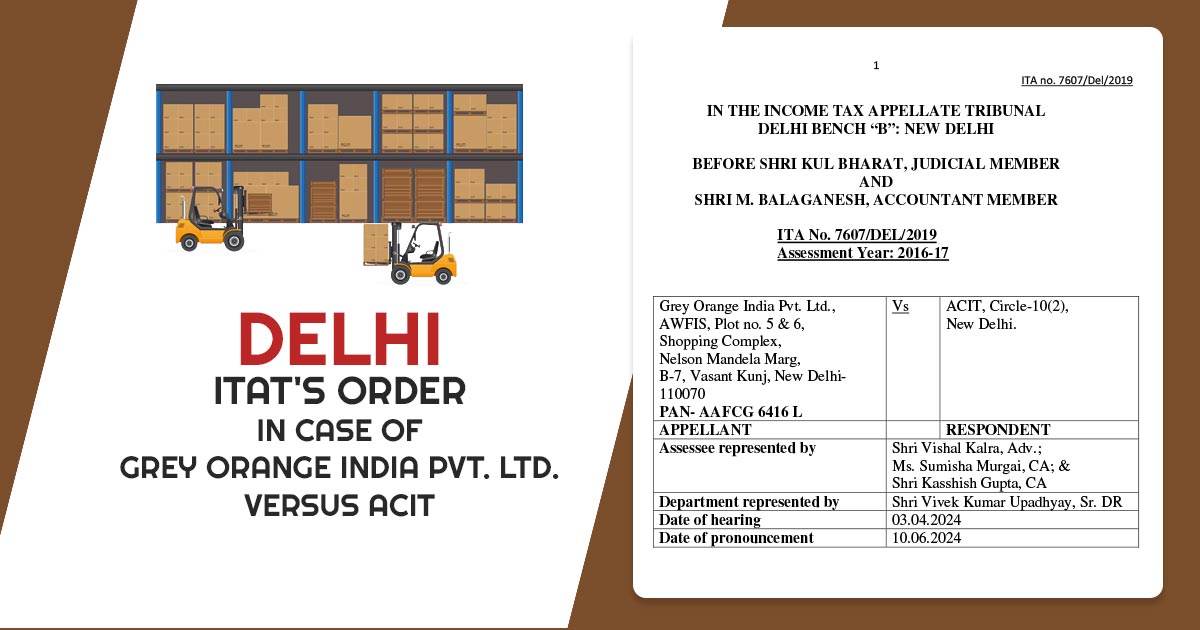

| Applicant Name | Grey Orange India Pvt. Ltd. Versus ACIT |

| Case No. | ITA No. 7607/DEL/2019 |

| Date | 10.06.2024 |

| Appellant by | Shri Vishal Kalra, Ms Sumisha Murgai, Shri Kasshish Gupta |

| Respondent by | Shri Vivek Kumar Upadhyay |

| Delhi ITAT | Read Order |