The controversial problem of retrospective cancellation of GST registration for the case of Shree Bankey Bihari Trading Company vs. Principal Commissioner of the Department of Trade and Taxes and Another has been addressed by the Delhi High Court. The ruling of the court mentioned that the restrictions on these cancellations especially concentrate on the effective date starting from the SCN issuance.

The applicant, M/s Shree Bankey Bihari Trading Company, contested the retrospective cancellation of its GST registration under the Central Goods and Service Tax Act, 2017. Effective from 31st July 2017, the retrospective cancellation, was because the applicant did not furnish the returns for a continuous duration of 6 months.

The SCN issued on 19th September 2019 initiated the proceedings, but it does not hold the particular causes and does not notify the applicant of the retrospective cancellation feasibility.

The cancellation was been confirmed by the order on 4th October 2019 quoting the non-submission of a response to the SCN. However, the rationale order was discovered opposing and does not hold substantive reasoning for the retrospective measure opted.

The court remarked that the absence of the dues against the applicant and nil demand emphasized the arbitrary nature of the retrospective cancellation.

When looking at the legal framework, the court referred to Section 29(2) of the Act. It highlighted that cancelling a registration, particularly with retrospective effect, is required to be justified objectively via the proper officer.

The court highlighted that the reason for such cancellation cannot be purely subjective and must adhere to particular criteria. It was noted that simply failing to file GST returns does not automatically justify retrospective cancellation, specifically without due process and fair reasons being provided to the taxpayer.

Also, the ruling concerned the implications of the retrospective cancellation on the taxpayer’s claim of ITC and the importance of the fair application of the natural justice principles.

It shows that the decisions that affect the assessee’s substantial rights like retrospective cancellation that impacts the former transactions and adherence, should be kept via clear and effective causes.

Hence, the impugned order has been amended by the Delhi HC to align with the principles of natural justice and fairness. It restricts the cancellation of the GST registration to the SCN issuance date, 19th September 2019, acknowledging the decision of the applicant to cease the activities of the business.

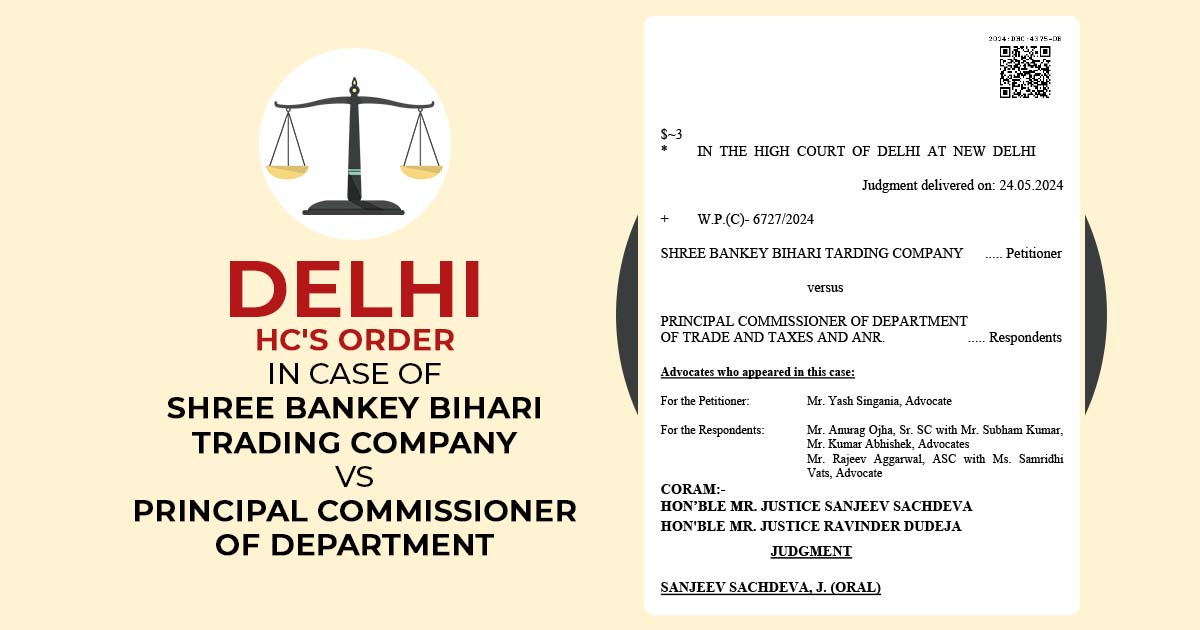

| Case Title | Shree Bankey Bihari Trading Company Vs Principal Commissioner of Department of Trade And Taxes And Anr. |

| Citation | W.P.(C)- 6727/2024 |

| Date | 24.05.2024 |

| For the Petitioner: | Mr. Yash Singania, Advocate |

| For the Respondents: | Mr. Anurag Ojha, Sr. SC with Mr. Subham Kumar, Mr. Kumar Abhishek, Advocates Mr. Rajeev Aggarwal, ASC with Ms. Samridhi Vats, Advocate |

| Delhi High Court | Read Order |