As per the Delhi High Court, a Final Assessment order passed via the Income Tax Authorities u/s 143 of the Income Tax Act, 1961 is not sustainable, if it is passed in ignorance of pending objections before the Dispute Resolution Panel.

A division bench of Acting Chief Justice Vibhu Bakhru and Justice Tushar Rao Gedela said that the absence of information with the Assessing Officer (AO) regarding the pendency of the objections is of no outcome. It expressed,

“notwithstanding the lack of information with the AO, if an objection has been filed and is pending before the DRP, the Assessment Order passed in ignorance of the said objections, is required to be set-aside.”

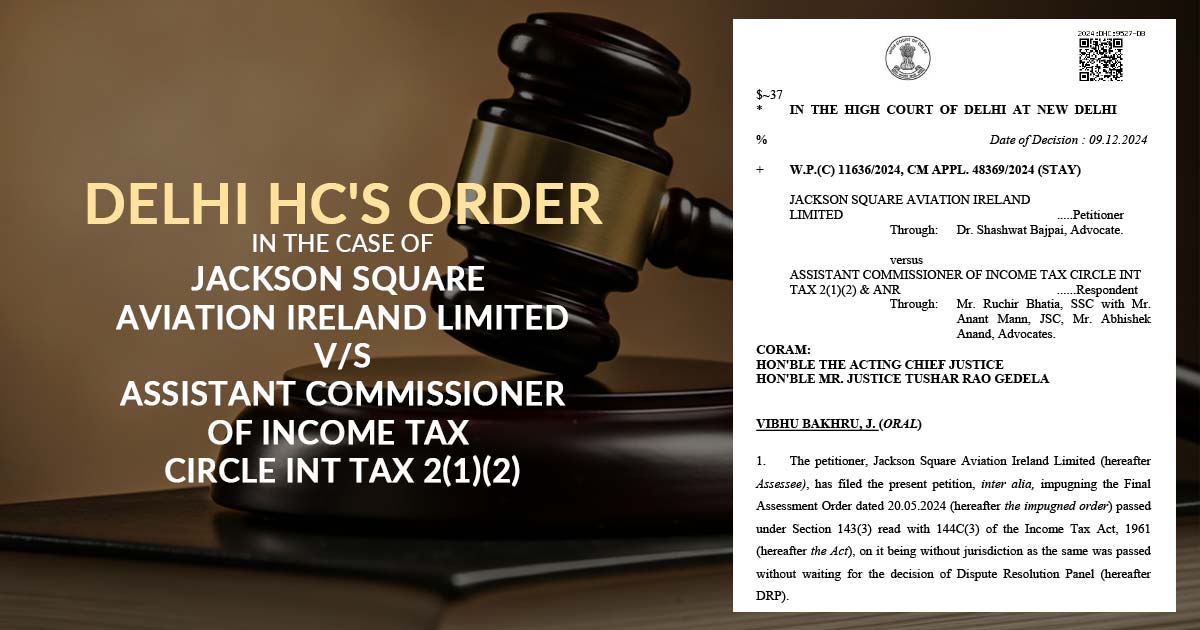

The order was passed in a writ petition submitted via Jackson Square Aviation Ireland Limited, contesting the Final Assessment Order passed u/s 143(3) read with 144C(3) of the Act for being passed without waiting for the decision of the Dispute Resolution Panel.

A Draft Assessment Order has been initially passed by AO u/s 144C(1), offering an addition to the income of the taxpayer based on treating the aircraft lease rentals obtained via it as interest income.

In Form No. 35A, the DRP taxpayer has furnished its objections. Notwithstanding it, the AO passed the impugned final Assessment Order re-computing the income.

It was claimed by the taxpayer that the AO could not have extinguished its right to obtain its objections disposed of via the DRP. It furnished that it is qualified as per Section 144C(15)(b)(i) of the Act and that the objections were duly filed to the DRP, within the said time as per Section 144C(2)(b) of the Act.

Also, it furnished that the department must await the decision of the DRP before passing the Final assessment order, even in matters where the AO has not been reported via the taxpayer as long as the objections before the DRP has furnished within time.

The Delhi High Court considering the submission of the taxpayer granted a relief and set aside the impugned final assessment order.

| Case Title | Jackson Square Aviation Ireland Limited vs. Assistant Commissioner of Income Tax Circle Int Tax 2(1)(2) |

| Citation | W.P.(C) 11636/2024, CM APPL. 48369/2024 |

| Date | 09.12.2024 |

| For the Appellant | Dr. Shashwat Bajpai |

| For the Respondent | Mr. Ruchir Bhatia, Mr. Anant Mann, and Mr. Abhishek Anand |

| Delhi High Court | Read Order |