The Delhi High Court in a ruling has reinstated the GST registration of an assessee even after the non-compliance with section 39 of the CGST act and the failure to file the returns.

The taxpayer, Rainbow Products has filed the present petition an order on 19.12.2023, whereby the GST registration of the taxpayer was cancelled, and an order on 27.05.2024, whereby the taxpayer’s application for condonation of delay in filing an application for revocation of the impugned cancellation order was denied.

The taxpayer who was enrolled with the GST council, for the successive period of 6 months, defaulted in filing its returns.

An SCN has been issued via the proper officer on 13.11.2023 directing the taxpayer to show cause as to why its GST registration not be cancelled based on the failure to provide the returns u/s 39 of the Central Goods and Services Tax Act, 2017 for a continuous period of six months.

The taxpayer was asked to answer to the cited Show Cause Notice (SCN) within 30 days from the SCN date and was asked to appear before the Proper officer dated 11.12.2023. The GST registration of the taxpayer was also suspended on the identical date 13.11.2023.

An application for the revocation of the impugned cancellation order has been made via the taxpayer. The taxpayer had a dispute with its accountant and hence it was not able to file the application for the revocation of the impugned cancellation order cancelling the GST registration of the taxpayer.

He also agreed to file the GST return and pay any outstanding dues within a week of the respondents restoring their GST registration. However, the Proper Officer rejected the application of the taxpayer because it was filed after the specified ninety-day period.

The taxpayer does not dispute that he has failed to comply with the provisions of Section 39 of the CGST Act by not filing the required returns. However, he has explained this and has assured that all outstanding returns will be filed and any dues will be paid.

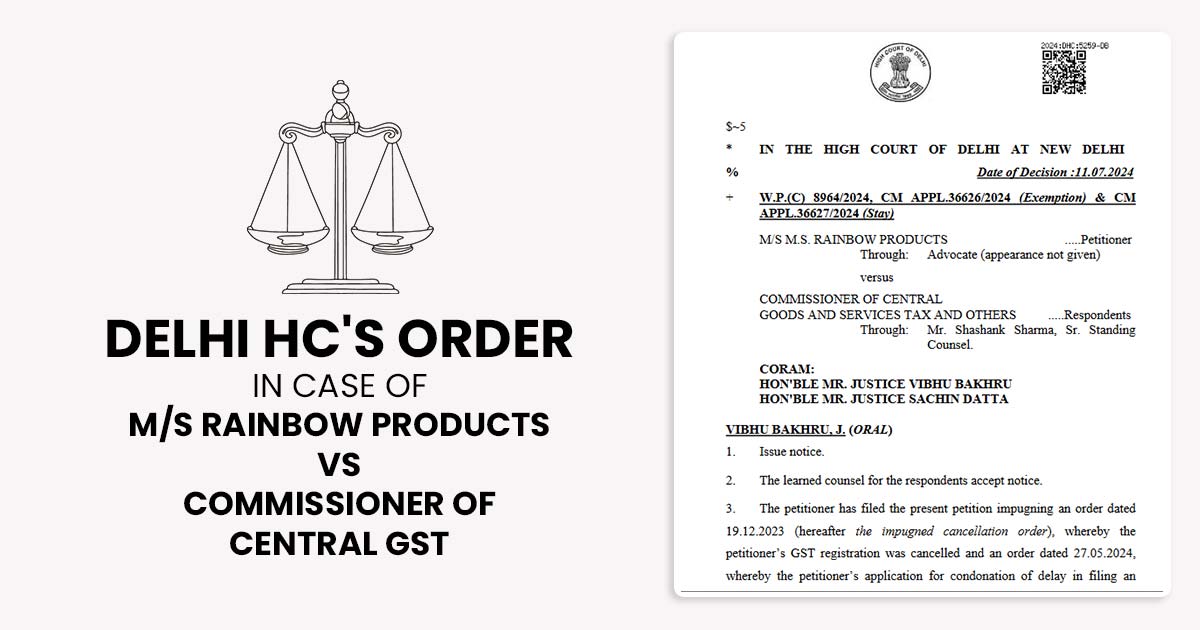

The division bench Justice Vibhu Bakhru and Justice Sachin Datta considered it fair to permit the present petition and asked the respondents to restore the GST Registration of the applicant however, this was within the condition that the applicant immediately within one week of the petitioner’s GST Registration being restored, file the returns and pay all outstanding dues including with interest.

It shall not preclude the respondent council from taking any other measure for non-compliance with the legal provisions or recovering any outstanding amount. As per that the petition was disposed of.

| Case Title | M/s Rainbow Products Vs Commissioner of Central GST |

| Case No. | W.P.(C) 8964/2024 |

| Date | 11.07.2024 |

| Counsel For Appellant | Advocate (appearance not given) |

| Counsel For Respondent | Mr. Shashank Sharma, Sr. Standing Counsel |

| Delhi High Court | Read Order |