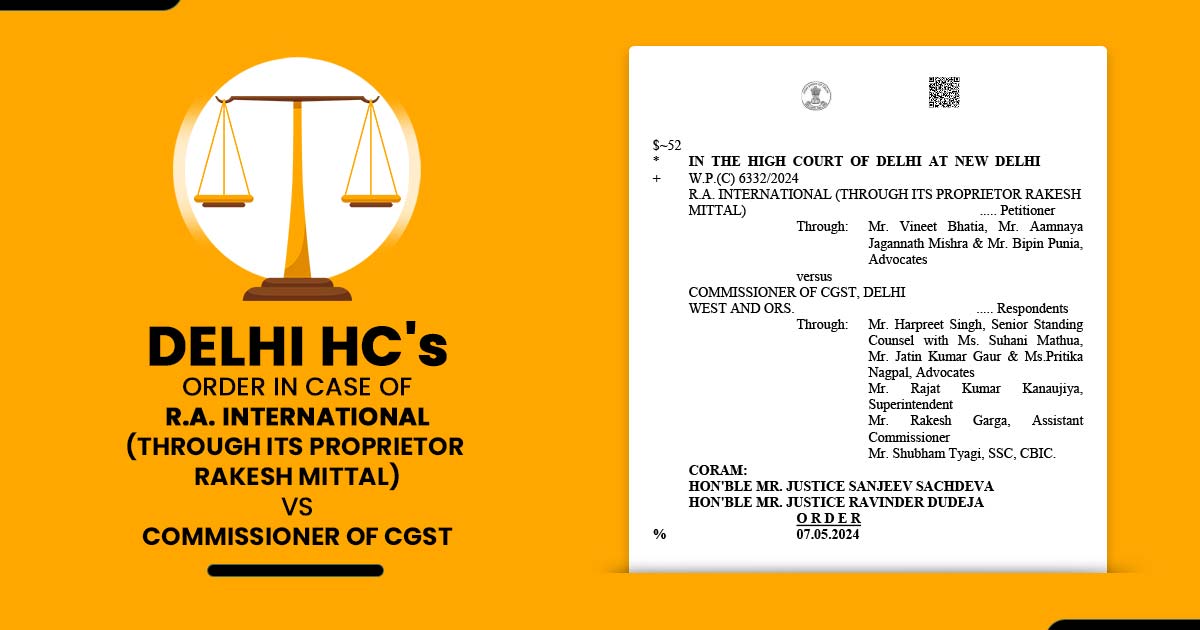

News Introduction: In the case of R.A. International (Through Its Proprietor Rakesh Mittal) vs. Commissioner of CGST, the Delhi High Court addressed procedural issues of the issuance of Show Cause Notices for GST registration cancellations. The court’s order to a GSTN officer to furnish a detailed affidavit on the operation of the GST portal highlights the role of technological infrastructure in ensuring fair and transparent administrative processes.

Analyses in Depth

The applicant, R.A. International, contested the Show Cause Notice (SCN) on April 22, 2024, which directed the suspension of its GST registration effective from the exact date. U/S 29(2)(e) of the Central Goods & Services Tax Act, 2017 (CGST Act), the SCN was issued mentioning “fraud, willful misstatement, or suppression of facts” as the foundations for cancellation. The notice does not have reasons, and the name and designation of the issuing officer were skipped because of technical issues in the GST portal.

Commentary By the Sourt

In its Judgment, the Delhi High Court Emphasized many Procedural Lapses in the Issuance of the SCN.

- Insufficiency of Detailed Reasons: SCN is not able to furnish particular causes for the offered cancellation just listing a generic foundation from a dropdown menu on the portal. It does not have the information that violates the need for clarity and transparency in administrative actions.

- Suspension Date Automatically: SCNs (Show Cause Notices) cited that the GST registration shall be suspended from the notice date. But the same date was generated via the portal, leaving nothing for the Proper Officer to practice discretion or apply their ruling.

- Details about the Missing Officer: The lack of the issuing officer’s name and designation compounded the problem consequently, raising the question of the accountability and legitimacy of the notice.

Directions of the Court

The court under such observations considered the same vital to receive a complete learning of the GST portal’s operationality. The court asked a senior competent officer from the GSTN network to furnish an affidavit that addresses the below-stated facts-

- The grounds are shown in the SCN and how they are generated.

- Options available to the Proper Officer for adding other reasons.

- The inclusion of the issuing officer’s name, designation, and signature in the SCN.

- Once the SCN is uploaded to the portal the information is accessible to the taxpayer.

- The method and criteria for determining the suspension date of the GST registration.

Within one week, the affidavit was to be filed with the subsequent hearing scheduled for May 22, 2024.

| Case Title | R.A. International Through Its Proprietor Rakesh Mittal vs Commissioner of CGST |

| Case No.: | W.P.(C) 6332/2024 |

| Date | 07.05.2024 |

| Counsel For Petitioner | Mr. Vineet Bhatia, Mr. Aamnaya Jagannath Mishra & Mr. Bipin Punia, Advocates |

| Counsel For Respondent | Mr. Harpreet Singh, Senior Standing Counsel with Ms. Suhani Mathua, Mr. Jatin Kumar Gaur & Ms.Pritika Nagpal, Advocates, Mr. Rajat Kumar Kanaujiya, Superintendent Mr. Rakesh Garga, Assistant Commissioner Mr. Shubham Tyagi, SSC, CBIC |

| Delhi High Court | Read Order |