The Delhi High Court has directed the GST (Goods and Services Tax) department not to prejudice the taxpayer’s business, which is engaged in the manufacturing of mild steel products, by attaching its entire bank account pending adjudication of ₹15.09 crores in tax evasion proceedings.

It was noted by the division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta that 1 year has passed since the provisional attachment order was passed, though no Show Cause Notice (SCN) was furnished.

The whole amount alleged shall not be subjected to be paid quickly, and hence, “the Petitioner’s business cannot be prejudiced by complete attachment of bank accounts.”

The applicant had assailed the provisional attachment of its bank account, said to have a balance of around ₹2.75 crores.

Officials of the Directorate General of Goods and Services Tax Intelligence, under investigation at the Petitioner’s premises, allegedly discovered excess stock when tallied with books maintained by the Company.

U/s 67 of the Central Goods and Services Tax 2017, DGGI proposed to start the action against the applicant and ordered the seizure of goods and provisionally attached the bank account of the applicant.

The applicant in its appeal asking for the release of the bank account furnished that an influential amount surpassing Rs 100 crores as GST and Rs 4.06 crores as income tax has been filed via it in the last 3 fiscal years.

Concerning the seizure, the tax evasion assessment was performed based on an eye estimation by DGGI. To date, no proceedings have been begun.

Respondents, Directorate General of Goods and Services Tax Intelligence, will process the SCN in any case; there is a 3-year time duration to issue the SCN by the department.

The HC, more than 16 months have passed since the issuance of the Panchnama, and 1 year has passed since the passing of the provisional attachment order.

The Delhi High Court mentioned, while acknowledging the period and the financial position of the Petitioner,

“The Petitioner is a running concern and as per the accounts which have been placed on record, it is conducting business and paying substantial amounts of taxes…Under such circumstances, it would be sufficient at this stage, if 10% of the amount can be secured by way of minimum balance in the bank account of the Petitioner.”

Read Also: Delhi HC: Bank Account Freeze Order Under GST Can Give Only Commissioner Not Superintendent

Therefore, the court asked the applicant to maintain a credit balance of Rs 1.5 crores and operate the bank account.

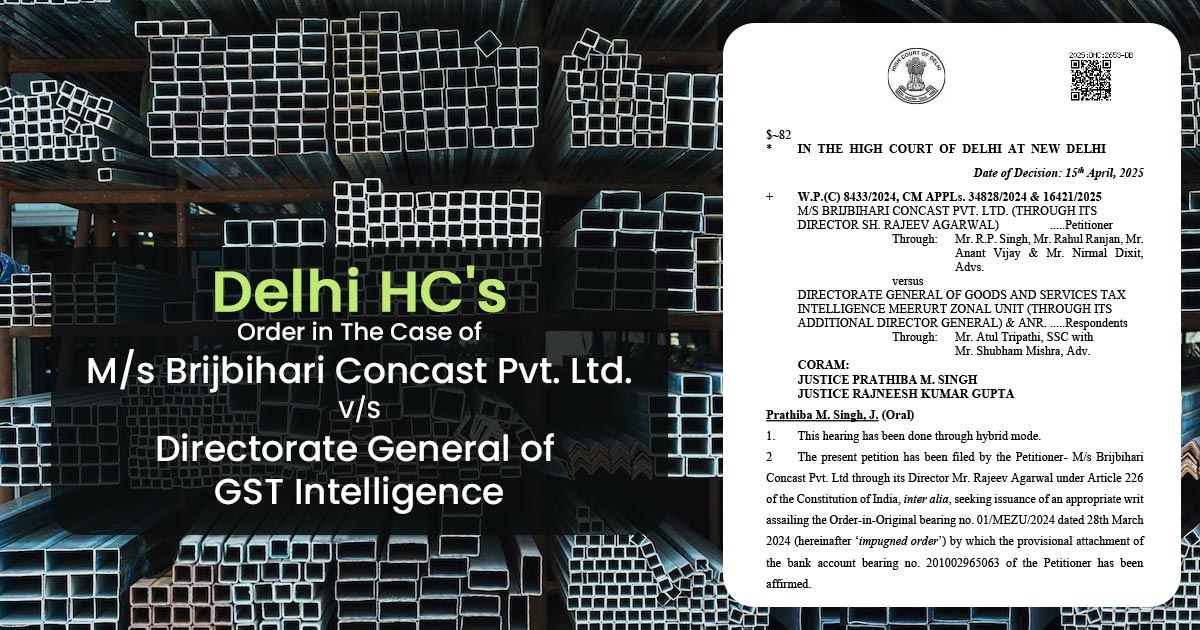

| Case Title | M/s Brijbihari Concast Pvt. Ltd. Vs. Directorate General of GST Intelligence |

| Case No. | W.P.(C) 8433/2024, CM APPLs. 34828/2024 & 16421/2025 |

| Counsel For Petitioners | Mr. R.P. Singh, Mr. Rahul Ranjan, Mr. Anant Vijay & Mr. Nirmal Dixit |

| Counsel For Respondent | Mr. Atul Tripathi, Mr. Shubham Mishra |

| Delhi High Court | Read Order |