The Delhi High Court looked into a case involving Metalax Industries and the GST officers. The court examined whether the tax actions taken by state authorities for the financial years 2017-18 and 2018-19 were valid.

The applicants contested the proceedings based on Section 6(2)(b) of the CGST Act, 2017, claiming that once an investigation has been started via the Directorate General of GST Intelligence (DGGI), the State GST authorities can not perform the parallel proceedings.

The court directed to its previous rulings in DLF Home Developers Limited vs. Sales Tax Officer, where it mentioned that the simultaneous investigations via various tax authorities on the identical problem were not allowable.

Provided that DGGI had issued a show cause notice (SCN) earlier covering the pertinent period and tax demands, therefore the court discovered the merit in the claim of the applicant that state GST can not provide separate orders for the identical case.

Therefore the Delhi High Court has quashed the show cause notice furnished via the state GST department and the related tax demands. However, it is been mentioned that the final adjudication on the case shall be discovered via the current DGGI investigation.

It was reaffirmed by the ruling that State GST authorities can analyze and opt for the required measures based on the consequence of the proceedings of DGGI though cannot aim independently for the parallel assessments for the identical problem and period.

The decision of the court shows the requirement for clear jurisdictional demarcations between tax authorities to prevent duplication of proceedings and taxpayer hardship.

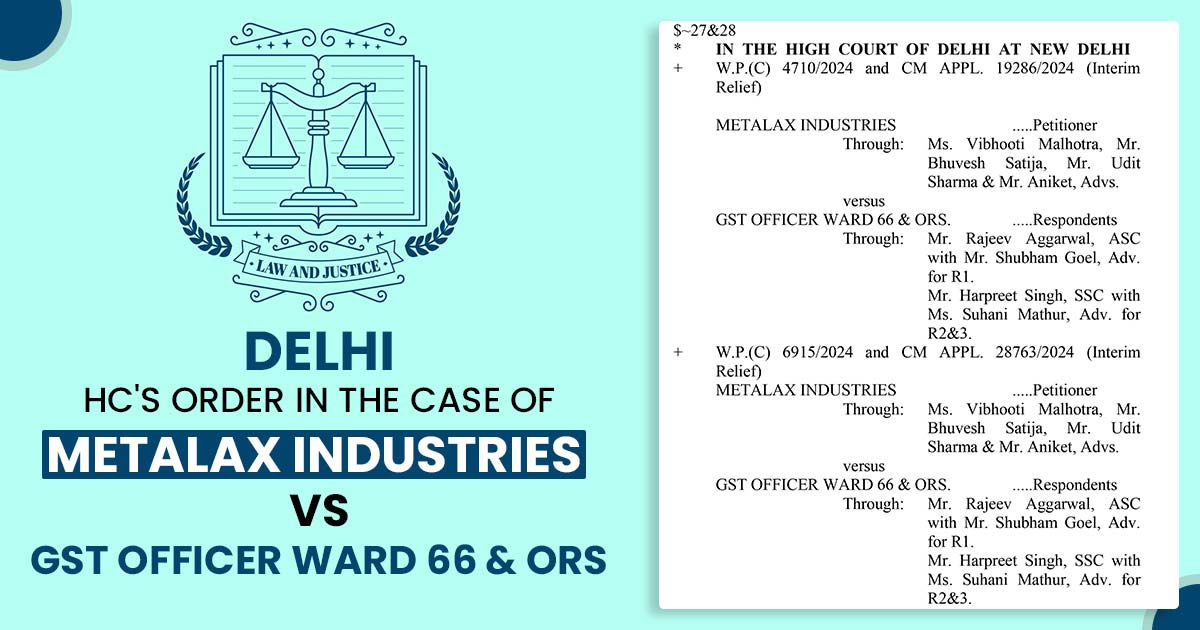

| Case Title | Metalax Industries Vs GST Officer Ward 66 & Ors |

| Citation | W.P.(C) 4710/2024 and CM APPL. 19286/2024 (Interim Relief) |

| Date | 26.11.2026 |

| For the Petitioner | Ms. Vibhooti Malhotra, Mr. Bhuvesh Satija, Mr. Udit Sharma, and Mr. Aniket |

| For the Respondent | Mr Rajeev Aggarwal, Mr Shubham Goel, Mr Harpreet Singh, and Ms Suhani Mathur |

| Delhi High Court | Read Order |