The Delhi High Court in a ruling limited the retrospective cancellation of the GST registration because of the absence of justification in the impugned order.

In the same matter, the writ petitioner, Star Enterprises had enrolled his business with the GST authorities. The proper officer issued a show cause notice on 21.12.2021, and the writ petitioner was called upon to show cause why its registration was not cancelled.

A reference has been made by the show cause notice before the provision to file the returns u/s 39 of the Central Goods and Services Tax Act as well as the details of outward supplies furnished by the petitioner in Form GSTR-1.

There was no claim of the show cause notice that the above-said needs were broken or that there was a discrepancy in the returns of the applicant.

The applicant was directed to respond to the show cause notice within 30 days and asked to appear before the related proper officer dated 23.12.2021. The impugned order cancelled the GST registration of the applicant.

The impugned order just cited that the applicant did not show up on the scheduled hearing date and that is pertinent to the SCN, without furnishing any explanation to cancel the GST registration of the applicant.

The GST registration of the petitioner had been cancelled retrospectively from 17.07.2021.

Read Order: Step By Step Guide: GST Registration Online for New User on GST Portal

On behalf of the applicant, the council appeared to argue that the applicant is not aggrieved by the cancellation of his GST registration since he has discontinued his business.

The proper officer had cancelled his GST registration retrospectively is the problem that the applicant has raised.

The bench of Justice Vibhu Bakhru and Justice Sachin Datta disposed of the petition and carried that the cancellation order will take effect from the date of the Show cause notice, which is 21.12.2021, not retrospectively, which is on 17.07.2021.

Must Read: How to Effortlessly Check Validity of GST SCN & Orders

The Delhi High Court asked for the cancellation of the GST registration to be prospective since the impugned order does not show the cancellation cause.

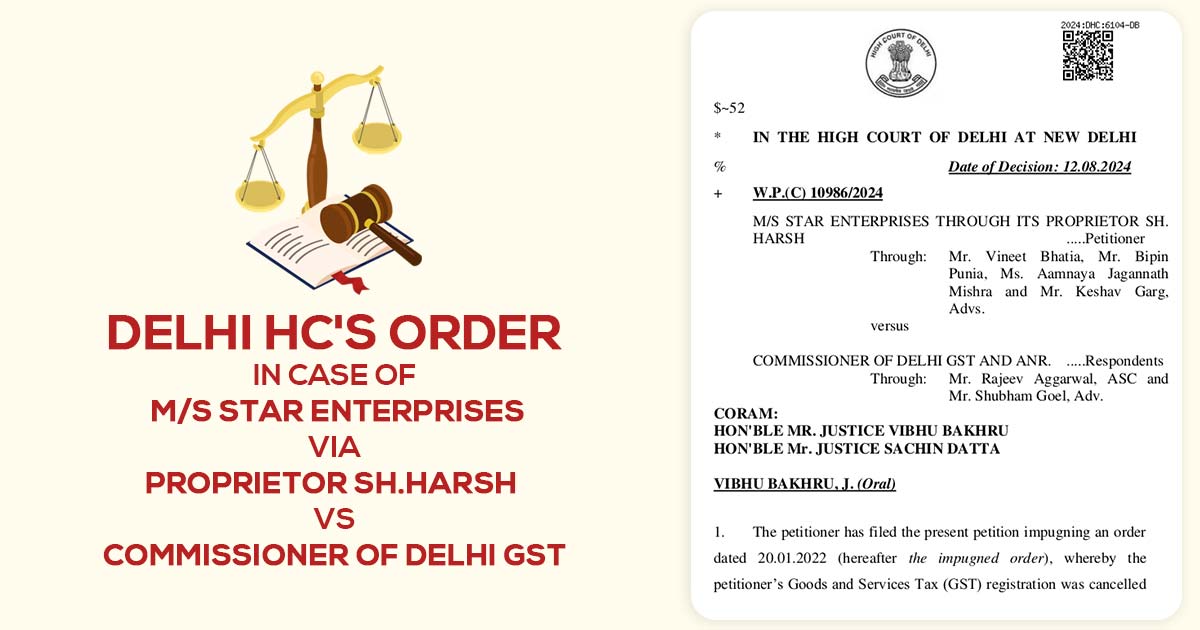

| Case Title | M/S Star Enterprises Via Proprietor SH.Harsh vs Commissioner of Delhi GST |

| Citation | W.P.(C) 10986/2024 |

| Date | 12.08.2024 |

| Counsel For Appellant | Mr. Vineet Bhatia Mr. Bipin Punia Ms. Aamnaya Jagannath Mishra Mr Keshav Garg |

| Counsel For Respondent | Mr. Rajeev Aggarwal, ASC Mr. Shubham Goel |

| Delhi High Court | Read Order |