The order cancelling the GST registration of the applicant has been quashed by the Delhi High Court and allowed the applicant to answer to the Show Cause Notice, as the mere allegation against the applicant is that it was discovered to be non-existent.

The bench of Justice Vibhu Bakhru and Justice Sachin Datta has granted liberty to the applicant to provide all documents and material in support of its assertion that it continues to be a valid tax entity.

The applicant has filed the appeal contesting an order passed via the respondent department through which the applicant’s GST registration was cancelled. The SCN under which the order was passed has been contested by the applicant.

The applicant has claimed that the SCN was issued only on the grounds of the communication obtained via the other department without the proper officer satisfying that independently. The applicant was asked to respond within 7 working days and indeed asked to appear before the proper officer dated April 24, 2023, at 04.10 p.m.

The applicant does not claim the chance to file a response or appear before the proper officer. The same order has been issued by the proper officer on the foundation that the applicant was not present at the given place of the business.

The order remarks that neither any answer in response to the impugned show cause notice was filed nor was there any explanation on behalf of the applicant on the designated date. It was argued by the applicant that SCN cannot be issued on the dictates of another authority.

It was contended by the council that a Show Cause Notice (SCN) was not issued on the dictates of another officer however because of the particular that the communication sent to the applicant was obtained back with the observation to the effect that No such firm discovered. The applicant argued that it has filed a response with the show cause notice dated April 27, 2023.

It is wrong and is founded on the reference to a response on April 27, 2023, made in the impugned order. The reference is wrong and is mentioned based on the wrong template used for these orders.

Read Also: Delhi HC Directs Officials to Submit Affidavit on GST Portal Technical Issues in Show Cause Notice

While the opening sentence of the order shows that it is in respect to the response of the applicant on 27th April 2023 in response to the impugned SCN, In fact, no response was provided via the applicant and it is cited in the following sentence in the impugned order.

It was remarked by the court that the matter of the applicant as to why its registration was not cancelled has not been regarded on merit. While disposing of the petition the court asked the applicant to provide the reply to the Show Cause notice including all the pertinent material filed via the applicant within 4 weeks from the date.

The proper officer will regard it and pass an informed decision post providing the applicant a chance to be heard.

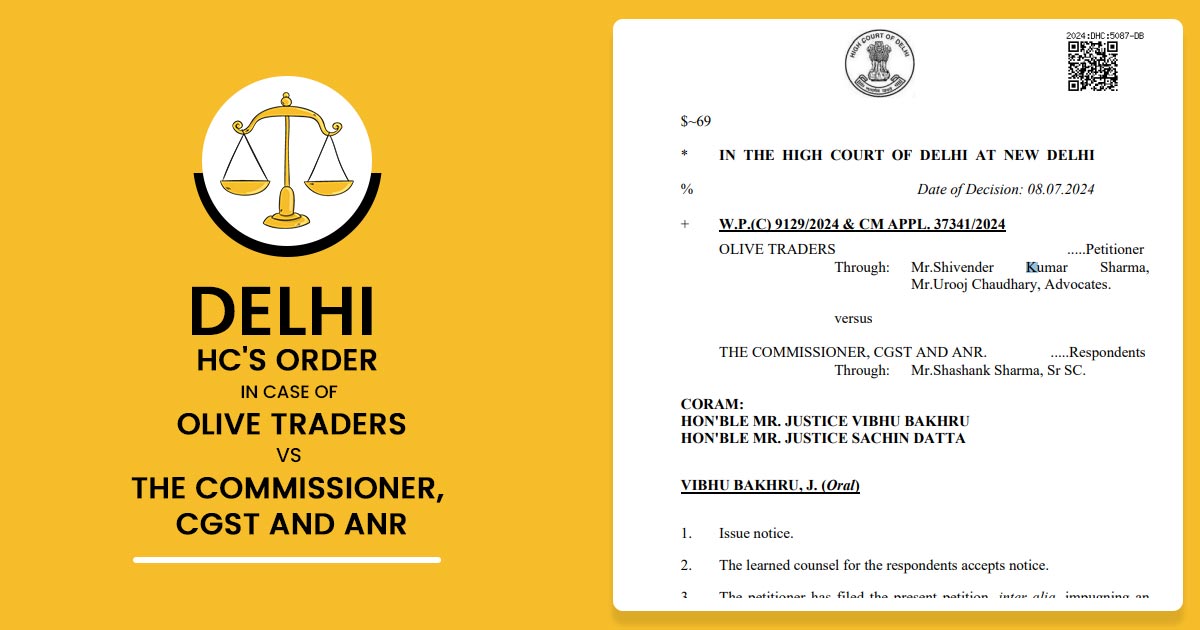

| Case Title | Olive Traders Versus The Commissioner, CGST and ANR |

| Case No | W.P.(C) 9129/2024 & CM APPL. 37341/2024 |

| Date | 08.07.2024 |

| Counsel For Appellant | Shivender Kumar Sharma |

| Counsel For Respondent | Shashank Sharma |

| Delhi High Court | Read Order |