A second chance has been furnished to the applicant by the Delhi High Court to prove the payment of the inward supplies, concerning the GST income tax credit (ITC) refund on the export of zero-rated supplies claimed.

The applicant, Rajiv Sharma HUF Proprietor of M/s Sagar Scooter Syndicate via its Karta Rajiv Sharma, a Hindu Undivided Family (HUF), is in the business of trading and export of automotive spare parts, automobile components, and other allied products in the name and style of its proprietorship concern, ‘M/s Sagar Scooter Syndicate’.

The applicant is registered under the Central Goods and Services Tax Act, 2017 (CGST Act) and has been allocated the Goods and Services Tax Identification No. (GSTIN) :07AAPHR6437P1Z6.

The applicant has filed the present petition impugning an order on 24.04.2023, whereby the appeal of the applicant u/s 107 of the CGST Act against an Order-in-Original on 01.11.2022 was dismissed.

The applicant has the remedy of an appeal under section 112 of CGST Act 2017 however the applicant could not claim the cited remedy since the appellate tribunal has not been formed. In that case, it is good to entertain the petition.

The applicant has made an application in the effective format, asking for a refund of the collected ITC for November 2021 for Rs 12,82,643. It was claimed by the applicant that the export of the goods was performed without the tax payment and was qualified for the refund of the collected ITC concerning the zero-rated supply u/s 16 of the Integrated Goods and Services Tax Act, 2017 (IGST Act).

The Adjudicating Authority issued an SCN dated 10.10.2022 in FORM GST RFD-08 offering to reject the petitioner’s application for a refund. The applicant answered to the SCN.

The adjudicating authority accepted the applicant’s elaboration. Though rejected the application for the refund was on the basis that the applicant was unable to furnish the bank realization certificates (BRC), and the bank statements and ledger accounts of suppliers were discovered incomplete.

The applicant appealed to the appellate authority over the impugned refund rejection order under section 107 of the CGST Act. The contention of the applicant of the applicant that providing BRCs is not required to claim a refund of collected ITC. as the applicant shall need to re-deposit the amount to be granted as a refund as of the non-receipts of the sale proceeds in 9 months. The refund was an empty formality, the appellate authority ruled.

It was indeed kept by the appellate authority that the determinations of the adjudicating authority, the ledger account of the suppliers furnished via the applicant was not finished and therefore the applicant is unable to establish that it was allowed to claim the ITC advantage as per section 16(2)(c) of CGST Act.

It was indeed impugned by the applicant that the provision of Rule 96B of the CGST Rules on the foundation that it is ultra vires the provisions of the CGST Act and the IGST Act.

The petitioner argues that a taxpayer does not need to receive the sale proceeds of exported goods within the period specified under FEMA to claim a tax refund under Section 16 of the IGST Act. However, the petitioner’s legal counsel has chosen not to challenge the validity of Rule 96B of the CGST Rules and has limited the current petition to challenging the disputed order on its merits.

The petitioner’s application for a refund was rejected for four reasons. First, there is a discrepancy in certain invoices. Second, the petitioner needed to provide GST E-Way bills for both inward and outward supplies. Third, the petitioner was required to provide the BRC’s. Fourth, the petitioner was asked to provide bank statements and ledger accounts of suppliers for further verification. The refund was not granted as the proper officer was satisfied in this regard.

In this case, the Proper Officer has not issued any deficiency memo. Therefore, it should be assumed that all the required documents for processing the refund claim, as per Rule 89(2) of the CGST Rules, were filed along with the refund application.

In the mentioned context, the request from the proper officer to submit BRCs, bank statements, and ledger accounts of the suppliers for additional assessment did not strictly comply with Rule 92(3) of the CGST Rules. There were no valid reasons for the proper officer to conclude that the petitioner’s refund application should be rejected based on these grounds.

In Show Cause Notice (SCN) the proper officer had positioned four reasons for the rejection of the petitioner’s application for refund. But two reasons are fulfilled so only two issues demand additional examination.

As per Section 16(3) of the IGST Act, the applicant is entitled to a refund of unused ITC on the export of goods. The expressions ‘export of goods’ and ‘export of services’ are described under Sections 2(5) and 2(6) of the IGST Act respectively.

However, under a circular, the petitioner’s claim for a refund of ITC cannot be rejected by the proper officer on the foundations of the non-furnishing of BRCs.

The Division Bench, consisting of Justice Vibhu Bakhru and Justice Sachin Datta, noted that the court believes the case should be sent back to the adjudicating authority to make a new decision on the specific issue of whether the petitioner has paid suppliers for inward supplies related to their claim for a refund of accumulated ITC.

Thus the bench set aside the impugned order and the impugned refund rejection order and remanded the case to the adjudicating authority to analyze the limited question.

The applicant is furnished with the liberty to file the required documents along with the bank statements and ledger accounts of the suppliers kept in its books of account, if not filed. The adjudicating authority passes the order post furnishing the applicant a chance for a hearing. The applicant is disposed of in the above-mentioned terms.

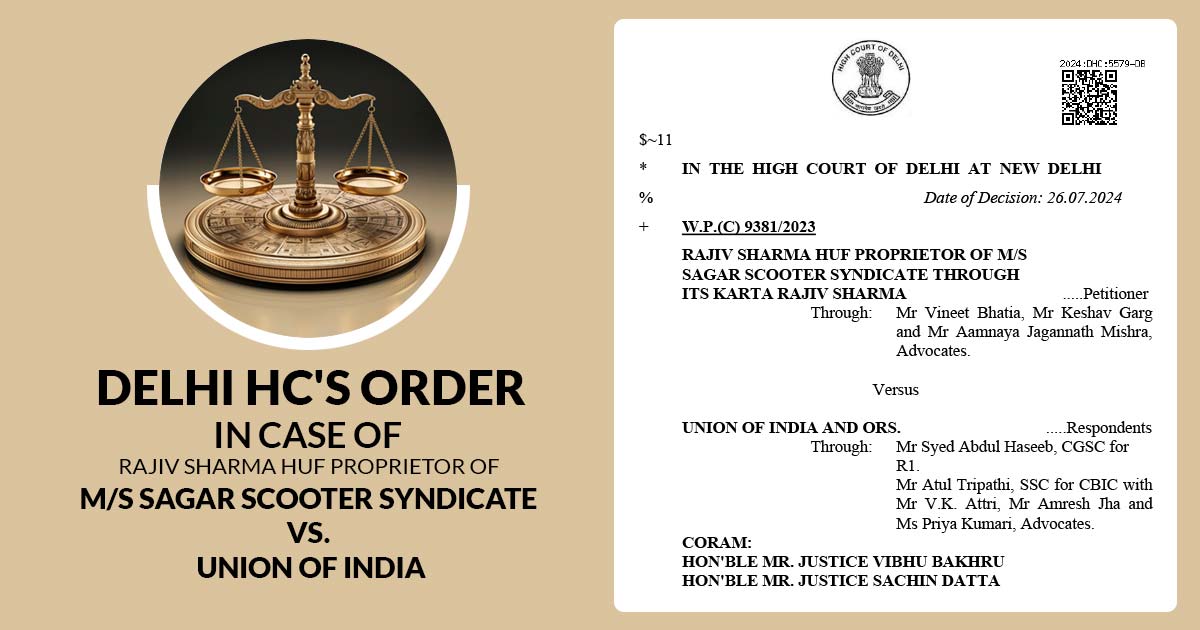

| Case Title | Rajiv Sharma HUF Proprietor of M/S Sagar Scooter Syndicate Vs. Union of India |

| Citation | W.P.(C) 9381/2023 |

| Date | 26.07.2024 |

| For the Petitioner | Mr Vineet Bhatia, Mr Keshav Garg and Mr Aamnaya Jagannath Mishra |

| For Respondents | Mr Syed Abdul Haseeb, Mr Atul Tripathi, Mr V.K. Attri, Mr Amresh Jha and Ms Priya Kumari |

| Delhi High Court | Read Order |