The claim for deduction under section 80JJAA of the Income Tax Act,1961 permitted by the Ahmedabad Bench of the Income Tax Appellate Tribunal ( ITAT) even after a 29-day delay in Form 10DA, deeming the delay as procedural.

The taxpayer, Analytix Business Solution (I) Pvt. Ltd, had claimed a tax deduction of ₹92.60 lakh u/s 80JJAA, which was rejected by the Centralised Processing Centre (CPC) in processing under section 143(1) due to late filing of Form 10DA. The form was submitted 29 days after the deadline. The CIT(A) kept the rejection, remarking that the timely form filing was obligatory to claim the deduction.

It was marked by the ITAT that the taxpayer before the Commissioner of Income Tax(Appeals)[CIT(A)] claimed that the late Form 10DA filing was just procedural and must not have consequence in the refusal of the deduction u/s Section 80JJAA.

Read Also: ITAT Ahmedabad Upholds ₹45.5 Lakh Addition for Bogus Agricultural Income

It relied on various decisions, along with those by the ITAT Delhi in Sai Computers Ltd., the Madras High Court in Craftsman Automation Pvt. Ltd., and the Allahabad High Court in Surya Merchants Ltd., all keeping that these filing conditions were directory, not obligatory.

Taxpayer, the deduction of ₹92.60 lakh was accurately shown in the tax audit report and return of income, and that Form 10DA was filed before the return was processed, though 29 days late. It is mentioned that the delay was not intended and must not affect the claim.

The taxpayer in the hearing referred to the ITAT rulings in Sunrise Industries (India) Ltd. and G4S Secure Solutions (India) Pvt. Ltd., which supported its case.

CIT(A) had not acknowledged or addressed these submissions and case laws, and kept the disallowance without distinguishing them, the tribunal mentioned. The department cannot be directed to any opposite decision from the jurisdictional High Court or the Supreme Court, it mentioned.

It was ruled by the two-member bench, including T.R.Senthil Kumar (Judicial Member) and Annapurna Gupta (Accountant Member), that the CIT(A) was unexplained in validating the disallowance of ₹92.60 lakh deduction under section 80JJAA.

Late filing of Form 10DA was merely procedural and does not affect the eligibility of the taxpayer for the deduction. For permitting the claim, the appellate tribunal directed CPC/AO. As per that, the appeal was permitted.

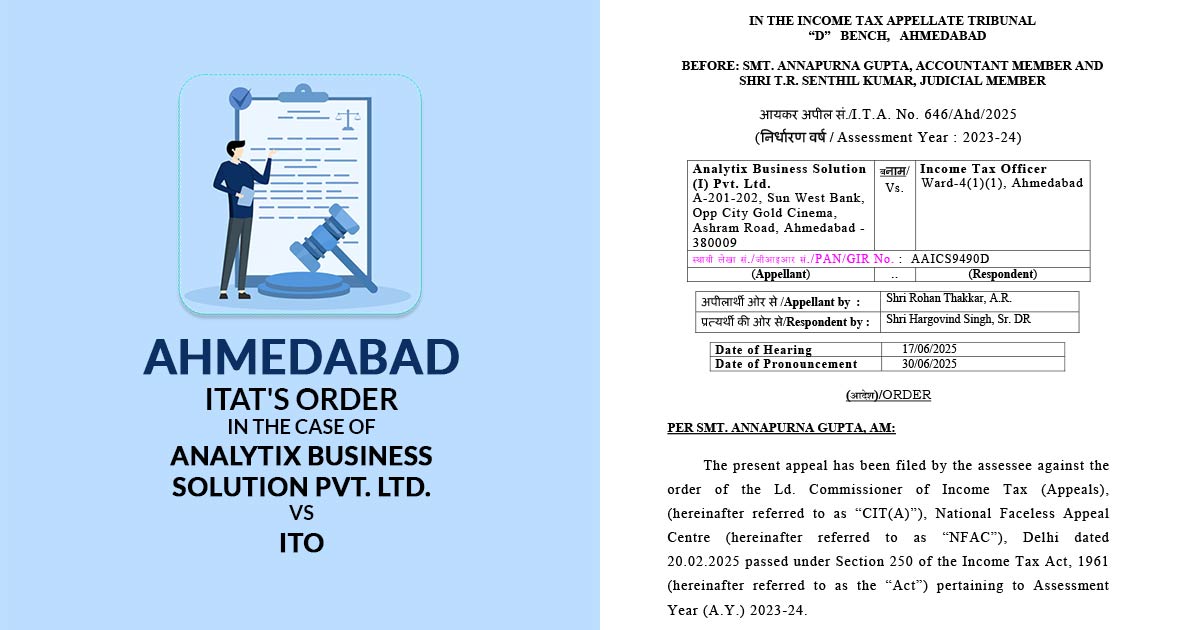

| Case Title | Analytix Business Solution Pvt. Ltd. vs. ITO |

| Case No. | I.T.A. No. 646/Ahd/2025 |

| Appellant by | Shri Rohan Thakkar |

| Respondent by | Shri Hargovind Singh |

| Ahmedabad ITAT | Read Order |