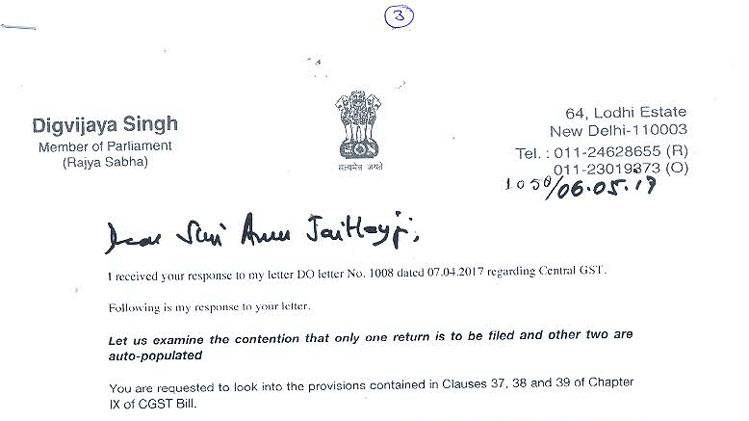

The nation is working day and night to implement goods and services tax and is making sure that every step must be smooth and hassle free. In between the opposition Congress questioned about the ease of doing business after the GST. The minister from Congress Mr. Digvijay Singh sent a letter to the union finance minister regarding the GST and its implementation. He asked that what will be the consequences and the feasibility of the business after the implementation of GST?

The congress minister reiterated the provisions by the GST council and asked the union finance minister Arun Jaitley that how the GST will bring ease of doing business after a mandatory and complex three returns per month along with a consolidated return at the end of the year taking the toll up to 37 returns per year. He also mentioned that in the current tax scenario, the business units make away with 4 returns per year but GST would be implementing a compliance tight taxation scheme with multiple returns every month.

The forms are included in the GST tax scheme and these forms will be filled up every month giving every detail of the transactions. After the implementation of the GST, traders will have to give sales purchase details on 10th of every month. After which it will have to provide details of every sale and purchase transaction based on the returns on 15th of every month. Finally, at the end of the month on the 20th day, it will have to provide consolidated data including those of purchases it made during the month.

Read Also: What is Voluntary Registration Under GST

On this issue, the union minister Arun Jaitley provide some answers and said that traders will only have to provide purchase (outward supply) data on 10th of every month after which the bills will be validated by the trader and the information regarding the credit will be available auto populated to him. As per the standard provisions, it is mentioned that every trader has to file up their sales and purchase details on the due dates of 10th, 15th and 20th of every month.