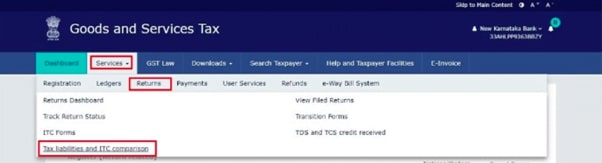

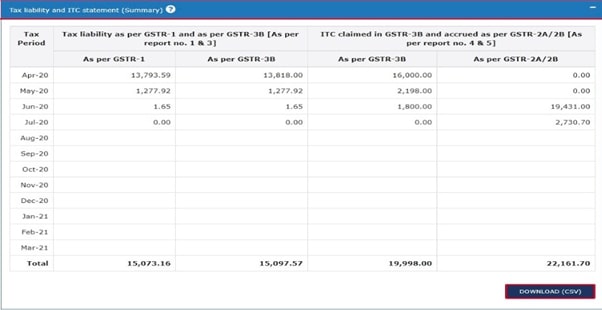

The taxpayers claim the ITC and apart from that the liability also is declared and this is a comparison between the GST liability and the ITC. The taxpayers can have a look over the ITC comparison and the tax liability in the returns tab which gives the option to have knowledge of the month-wise tax liability mentioned in Form GSTR 3B and GSTR 1.

Latest Update on Tax Liabilities Comparison

- Tax liabilities comparison report as per GST return form GSTR 1 return/IFF (Invoice Furnishing Facility), GST return 2B/2A and paid as per GST return form 3B is available beneath Services > Returns > ‘Tax liabilities and ITC comparison’. Read more

Further, the ITC claimed can be compared with Form GSTR-2A/GSTR-2B in the form GSTR 3B and the accrued ITC. Talking about GSTR 3B and GSTR 2A, the GSTR 3B form is a summary of output and input tax credit (ITC) from which the net tax liability is calculated and thus paid. It is however important to go through Form GSTR 2B before GSTR 3B filing as it shows the supplier uploaded invoice. This ensures that the claimed ITC on the invoices is not in the GSTR 2B.

Easy Process to Comparison Between GSTR 3B & GSTR 2A/2B

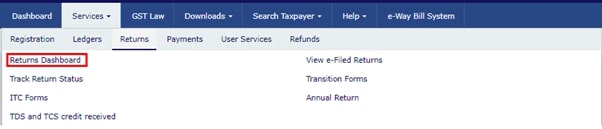

Step 1: Log in to the GST portal through the account credentials and click on the returns dashboard or visit the services > Returns > Returns Dashboard.

Step 2: Opt for the financial year and the concerned return filing tenure from the drop-down list and to compare the GSTR 2A and GSTR-3B, one can click on the view button just under the Comparison of liability declared and ITC claimed.

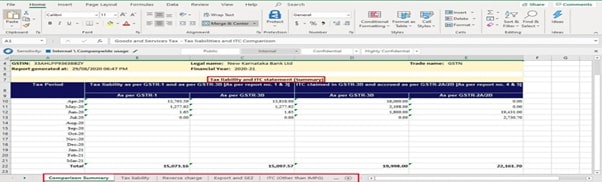

Step 3: The comparison page and the tax liability is then displayed. Also one can select the financial year and select year for the comparison report and then click the search button.

Step 4: Further the liability statement and credit page will be displayed. The comparison of data will be done within the two returns tax liability being declared in the GSTR 3B & 1 while the claimed ITC in GSTR 3B and available ITC as per GSTR 2A/2B.

Step 5: Pick the reports to analyze the data being compared. After clicking the given tabs to get the reports.

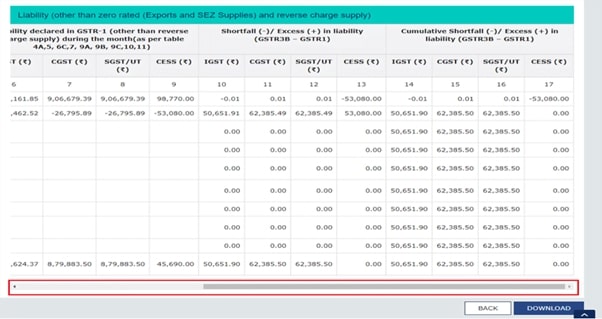

Reverse Charge Liability on Outward

The comparison of tables of tax liability within the GSTR 3B and 1 for supplies done outward. Remember that the data does not include zero rates supplies and inward liable supplies for reverse charge.

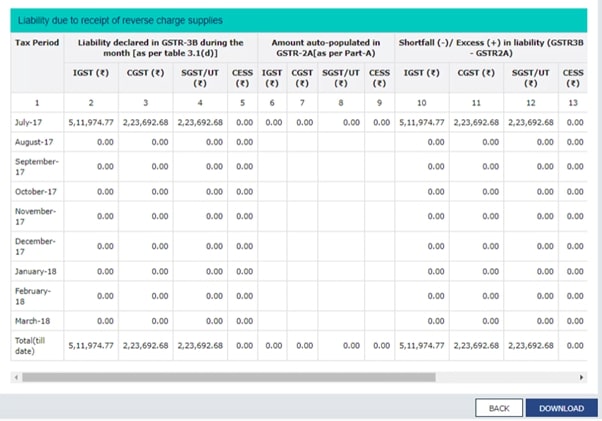

Reverse Charge Liability on Inward

The comparison of tables of tax liability within the GSTR 3B and 1 for supplies done inward which are also liable to reverse charge as per comparison of tables.

Export & SEZ Supplies Liability

The table will be comparing the GSTR 3B and 1 liability on the outward supplies that are zero-rated i.e., exports and SEZ supplies.

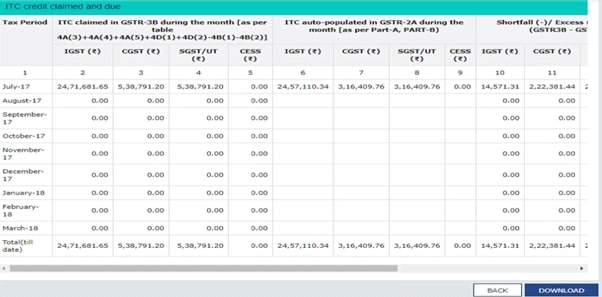

Due & Claimed GST ITC Credit

The table given would help in comparing the taken ITC form GSTR 3B with submitted tax data by the suppliers as per the GSTR 1. Also, the table gives the comparison of data given by the ISD distributors and GSTR 6.