What is an Invoice Management System (IMS)?

Businesses use the IMS system to monitor and manage their input purchases, inventory, and inward supplies efficiently. It ensures that the raw materials, consumables, and services purchased for production or business procedures are being tracked effectively.

The Invoice Management System (IMS) in this case assists in ensuring the easier flow of production by keeping precise records of inputs, their availability, and procurement status.

Define the ITC (Input Tax Credit) Register

Businesses use the ITC register, which is a record-keeping tool to track the input tax credits under the GST system. ITC authorises the businesses to offset the tax filed on the inputs(purchases) against the tax liability on their outputs (sales).

The same system assists the businesses in lessening the tax payments legally, ensuring they merely file the tax on the value added at each phase.

For ensuring accuracy, compliance, and reconciliation in GST filings, comparing IMS (Invoice Management System) data with the ITC Register (Input Tax Credit Register) is significant. Here’s why this comparison is essential:

Why Should You Compare ITC Register Data with IMS Data?

Assuring Accurate Input Tax Credit (ITC) Claims

- ITC register records the input tax credit available based on the invoices purchased.

- IMS data included the information on invoices uploaded via the suppliers in the GST portal (GSTR-2A/2B).

- Comparing both ensures that ITC is claimed merely on valid and eligible invoices under the Goods and Services Tax (GST) law.

Avoiding ITC Reversal and Finding Mismatches

If an invoice appears in the ITC register, though not in the IMS data, then it may show that-

- The supplier hasn’t uploaded the invoice in GSTR-1.

- The information on the invoice is wrong (GSTIN mismatch, amount mismatch, etc.).

- For ITC, the invoice is not eligible.

- Mismatches can lead to ITC reversals, interest, and penalties if incorrect credit is availed.

GST Compliance and Audit

- Based on GSTR-2A/2B data (IMS Data), GST authorities verify ITC claims.

- Regular reconciliation ensures discrepancies are solved before GSTR-3B filing, lessening compliance risks.

- It supports keeping a clean audit trail for the tax authorities.

Identifying Missing or Duplicate GST Invoices

- If any supplier invoices are missing from the ITC Register, then IMS data assists in checking.

- It prevents claiming ITC on duplicate invoices, avoiding excess credit utilisation.

New: Enhanced Cash Flow and ITC Optimisation

- Discovering discrepancies early ensures that the businesses can claim the ITC appropriately and within time to enhance cash flow.

- It supports following up with the suppliers for corrections and timely compliance.

Difference Between IMS and ITC Register

| IMS (Input Management System) | ITC (Input Tax Credit) Register |

|---|---|

| A system used to manage and track input purchases, inventory, and related documents. | Not mandatory, but helps in efficient inventory and purchase management. |

| Helps businesses track and manage raw materials, purchases, and inward supplies. | Ensures proper tracking of eligible ITC claims and compliance with GST regulations. |

| Covers all types of inputs, including goods and services procured. | Focuses only on tax-related input credits available and adjustments. |

| Used by businesses to optimise procurement and stock management. | Mandatory for businesses claiming ITC under GST. |

| Not mandatory, but it helps in efficient inventory and purchase management. | Used for tax reconciliation and GST return filing. |

Both the IMS and the ITC registers are significant for the businesses, though they serve distinct objectives. IMS ensures facilitated inventory management, and the ITC register assists businesses in reducing tax liability and adhering to GST regulations.

Steps to Compare IMS Data with the ITC Register Using GenGST

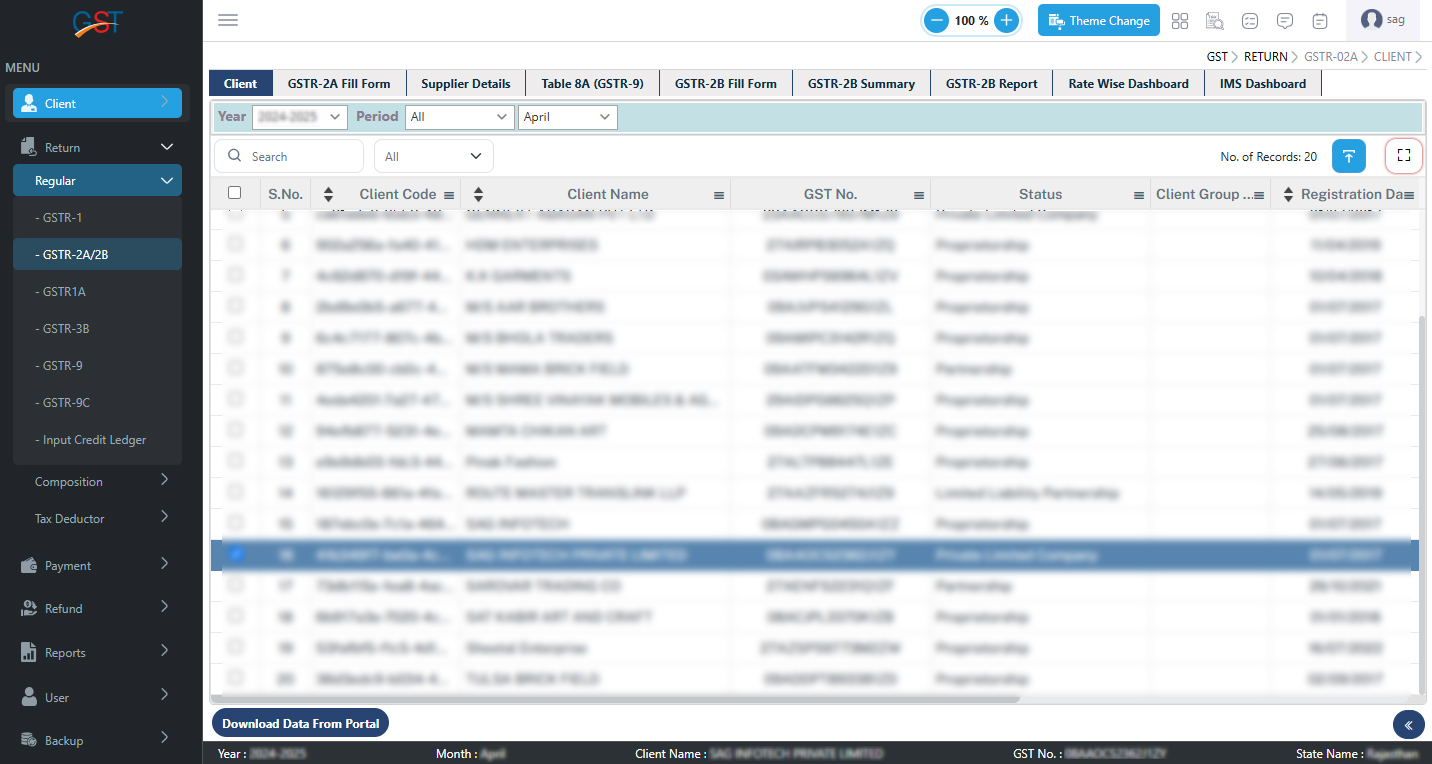

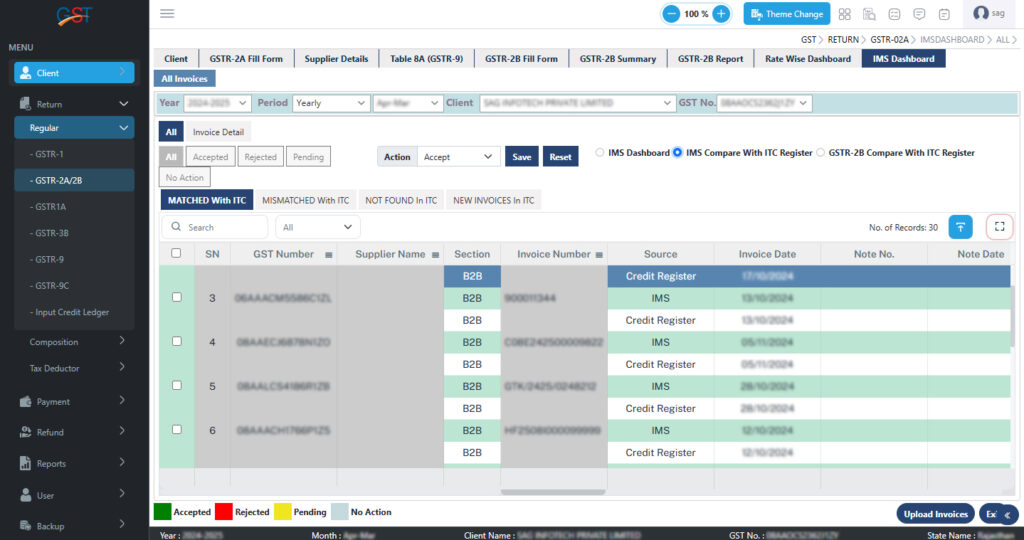

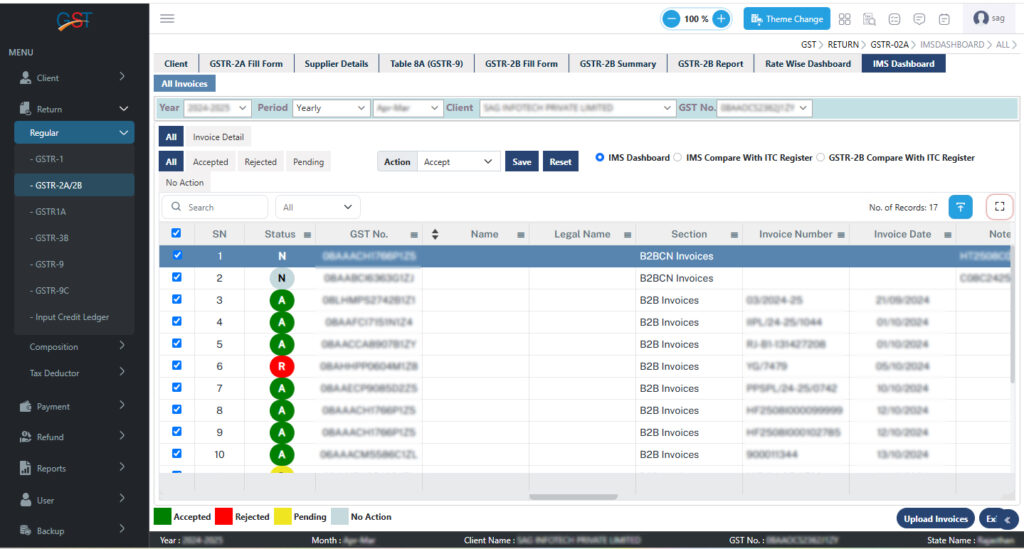

Step 1:- To use this, kindly select the client first, then go to Return -> Regular -> GSTR-2A/2B -> IMS Dashboard

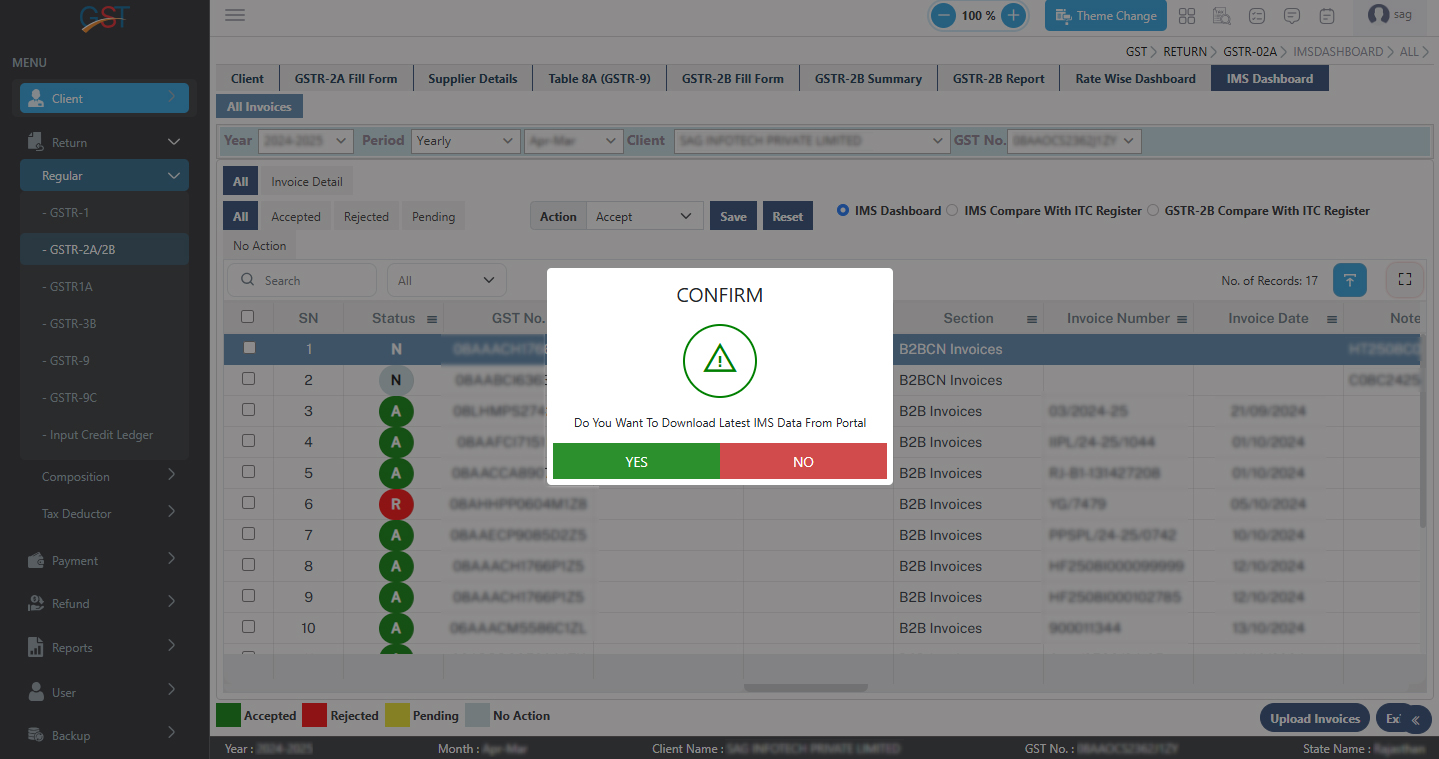

Step 2:– After clicking on IMS Dashboard, it will ask you to download the Latest IMS data from the portal

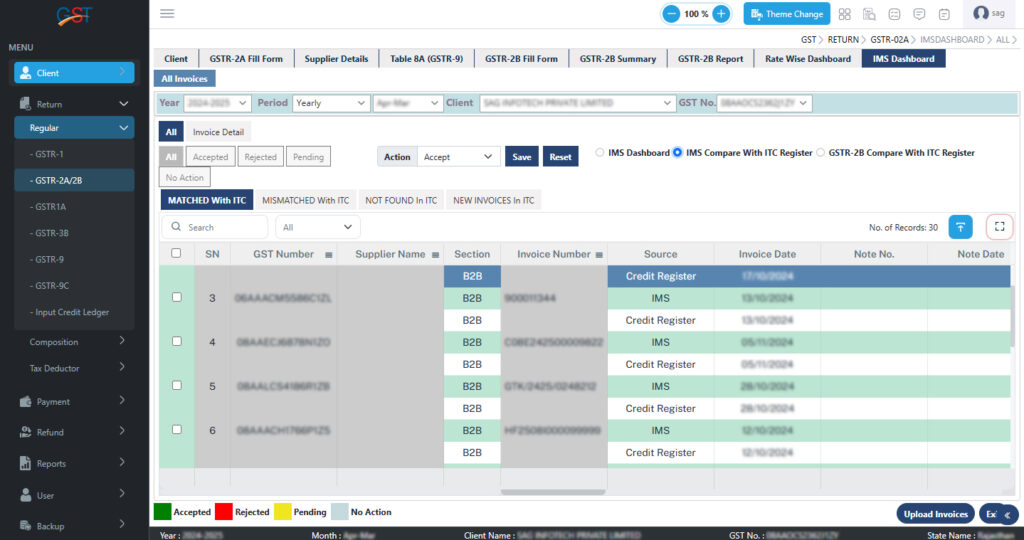

Step 3:– We have also provided the feature of comparing IMS entries with the ITC Register (BooksITC). So that one can accept Matched Entries at one click, to view this, kindly click on its Radio Button

Step 4:– We have also provided a match with ITC where the IMS entry exactly matches with Book ITC.

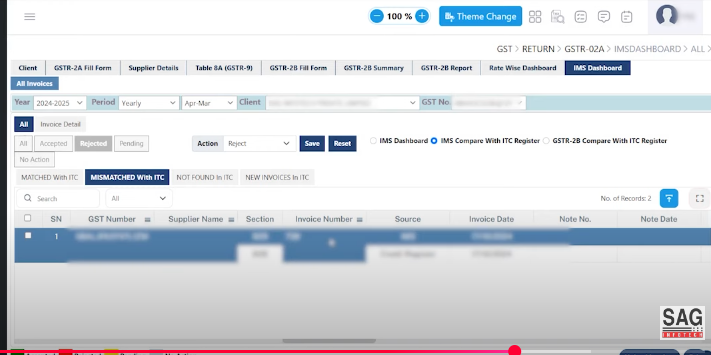

Step 5:– We have also provided Mismatched with ITC where the IMS entry differs from Book ITC.

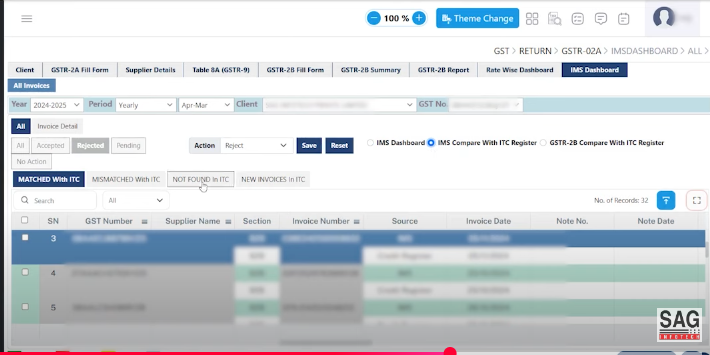

Step 6:– Not found in ITC, in which an extra new entry is found in the IMS Dashboard.

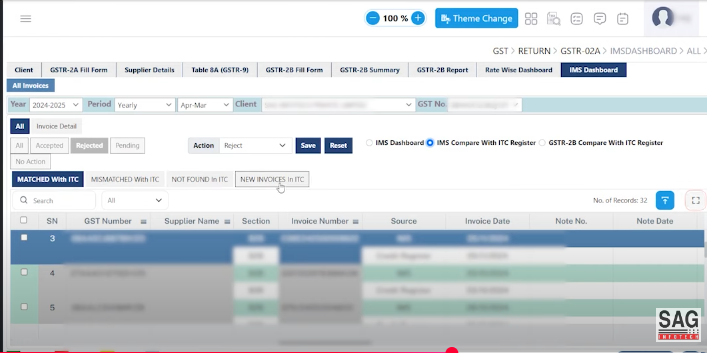

Step 7:– New Invoice in ITC in which Book ITC is not available in the IMS Dashboard. Users can take action accordingly, as per the required tab.

Step 8:– After selecting the Required action, one can select all records and click on the Upload invoice button.

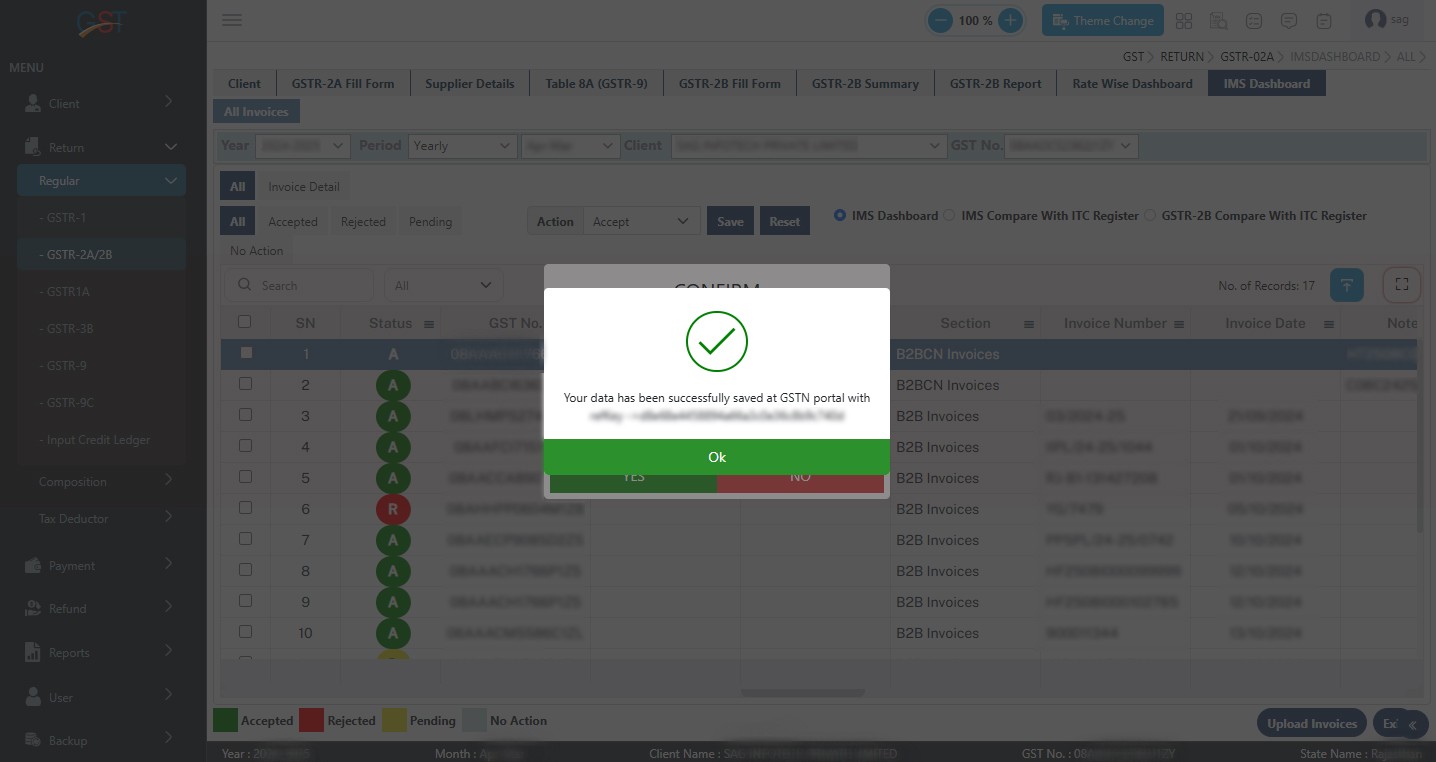

Step 9:– After that, the user needs to click on the Upload Invoice button to upload the latest JSON file to the GST portal. The following message will then be displayed: ‘Your data has been successfully saved on the GSTN portal,’ as shown below.