It shall be deemed to have come in to force on November 2nd, 2018.

The Companies (Amendment) Ordinance, 2018 was being announced by the President on November 2, 2018, which was implemented from the same date.

The Companies Amendment Ordinance 2019 is being replaced with Companies (Amendment) Ordinance, 2018. The latest amendment has issued by the House of People on 4 January 2019 and still, it is pending in the Council of States.

As per the Companies (Amendment) Ordinance, 2018, it will no longer be valid from the 21st day of January 2019 and will be valid for six weeks from the date when the next session of Parliament starts giving powers to the parliament to approve or disapprove the ordinance.

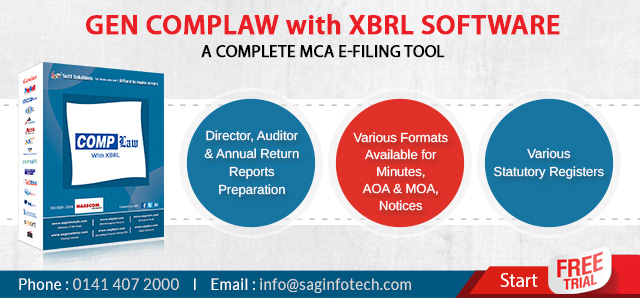

Read Also: Download Trial and Start ROC/MCA Return Filing by Gen CompLaw Software

Thus the Ministry has issued the Companies (Amendment) Ordinance, 2019 to give continued effect to the provisions of the Companies (Amendment) Ordinance, 2018 and to further amend the Companies Act, 2013.

- The companies have to issue the Commencement Certificate compulsory within 6 months of establishing the business set up or corporation. Without the certificate, companies would not be able to continue its business activities or borrow money.

- The Registration of the Companies (ROC) can be eliminated/ discarded by the Ministry whenever the companies have mentioned the fake, illegal or incomplete/improper address.

- Transformation of Public Ltd to Pvt Ltd is now shifted from NCLT to Regional Directorate

- Now the companies have to face penalty on an issue of shares at discount except as provided under section 54. In case of the violation of section 53, heavy penalties would be charged by the government.

- The companies must notify about the alteration of Authorised Capital within 30 days after its alteration. Otherwise, the penalty of INR 1000 for each day during which default continues INR 5 Lac, whichever is less, would be charged by the government

- The time limit for filing E-form CHG-1 with ROC has been reduced from 300 days to 60 days for the creation of charge.

- Whenever the companies have provided wrong statement or information in filing the Charge forms with ROC. They might have to go to jail for providing the wrong information.

- The companies must file the annual returns within 60 days of Annual General Meeting (AGM). In case of imposition, INR 100 per day penalty to the company directors surging up to INR 5 lakhs from the delay in ROC.

- If any company failed to file Annual Return within the prescribed time limit in that case company and its every officer shall be liable to a penalty of INR 50000. In case of continuing failure, Rs. 100 for each day during which such failure continues, subject to a maximum of INR 500000.

- The filing of resolutions under section 117 with ROC will be costlier now in respect of delaying the filing. The penalties have increased significantly. On late filing, Company will be charged Rs. One Lakh and on continue to default, INR 500 per day subject to the maximum limit of INR 25 Lakhs.

- Now the company and its officer shall be liable to pay penalty on the delayed filing of annual financial statements.

- The auditor shall liable for the penalty if he does not comply with the provisions. On non-compliance Auditor shall be liable for the penalty of INR 50000 or an amount equal to the remuneration of the auditor, whichever is less and in case of continuing failure penalty of INR 500 for each day shall be imposed, subject to the maximum Rs five lakhs.

- At a particular period of time, one individual person would not be able to become a director of more than 20 companies. If he continues to do this, he could be disqualified under the Companies Act.

- At the time of establishing a corporation, it is mandatory for them to appoint Company Secretary on the payroll. In the new amendment, violating the legal rules is costlier now and penalties have increased significantly.

- ROC can eliminate the registered users if it does not pay the initial share capital within 6 months after the establishment of the company.

Good work CS VIJAY JI