Despite a circular issued by the CBIC concerning the scope of ‘intermediary services’ under the Service Tax and GST Regime, the Union of India continues to contest decisions favouring the taxpayer before the Supreme Court.

In one of the first appeals on the intermediary issue, the Chandigarh Bench of the Tribunal, in a final order on February 27, 2018, explained that an entity furnishing the main service on a principal-to-principal basis does not authorize as an ‘intermediary’ and its services comprise the export of services.

Before the High Court of Punjab & Haryana, the same decision was contested. The HC on December 15, 2023, dismissed the petition on the grounds of non-maintainability, observing that the problem related to the taxability but permitted the council to approach the Apex court.

The department even after the circular of the CBIC stating the scope of intermediary services has filed a civil appeal to the Apex court nearly 5 years and 11 months post the decision of the Tribunal.

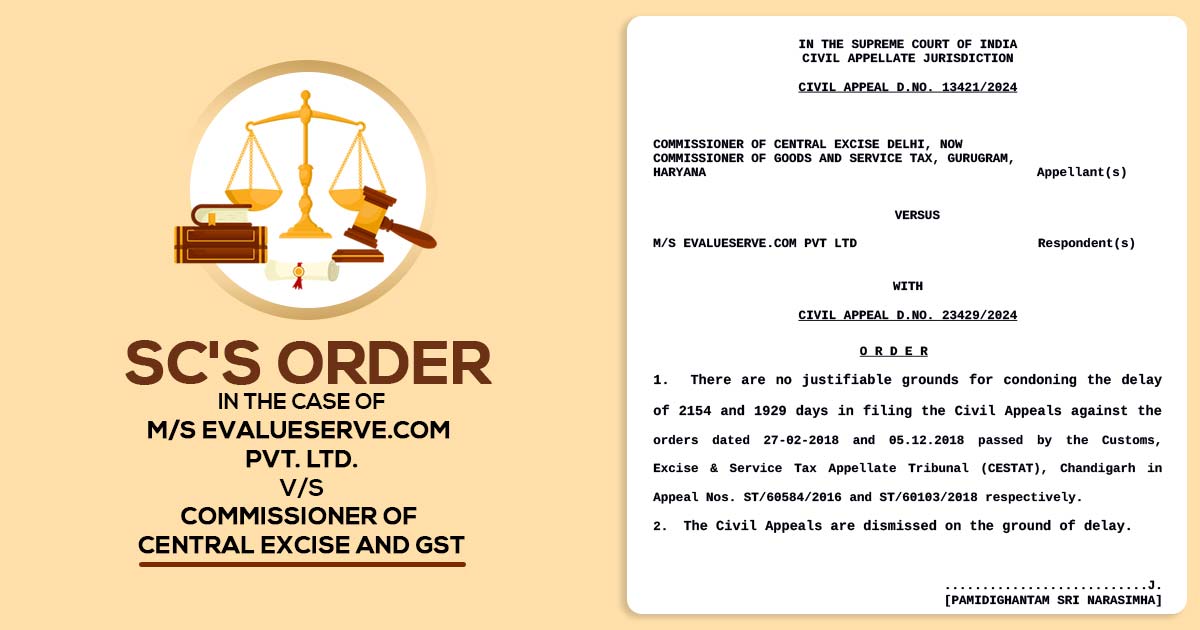

The Supreme Court on July 10, 2024, dismissed the civil appeal of the department hopefully bringing finality to the issue. The very decision is anticipated to conclude the long-standing saga of intermediary services that poses numerous implications for ITES and likewise placed companies.

Read Also:- PB & HR HC Grants Relief to Holding Companies for Facing GST Notice of Corporate Guarantees

Petitioner(s) Counsel: N.Venkataraman, A.S.G.; Gurmeet Singh Makker, AOR; Mukesh Kumar Maroria, AOR; V.C.Bharathi, Adv; Padmesh Mishra, Adv; Navanjay Mahapatra, Adv; Aditya Shankar Dixit, Adv; Dr. Arun Kumar Yadav, Dy. Govt, Adv;

Respondent(s) Counsel: Senior Advocate, Mr. Tarun Gulati. The Indirect Tax practice team of Kochhar & Co., led by Ms. Reena Khair, Senior Partner, included Ms. Shreya Dahiya and Ms. Vrinda Bagaria, Principal Associates, and Mr. Subham Jaiswal, Senior Associate, who appeared in the matter. Mr. Vaibhav Joshi, Partner, Kochhar & co. was the AOR in the matter.

| Case Title | M/s Evalueserve.com Pvt. Ltd. V/S Commissioner of Central Excise and GST |

| Case No.: | CIVIL APPEAL D.NO. 13421/2024 |

| Date | 10.07.2024 |

| Counsel For Petitioner | Mr N. Venkataraman, A.S.G., Mr Gurmeet Singh Makker, AOR, Mr Mukesh Kumar Maroria, AOR, Mr V.C. Bharathi, Adv., Mr Padmesh Mishra, Adv., Mr Navanjay Mahapatra, Adv., Mr Aditya Shankar Dixit, Adv., Dr Arun Kumar Yadav, Dy. Govt, Adv. |

| Counsel For Respondent | Mr Tarun Gulati, Sr. Adv., Ms Reena Asthana Khair, Adv., Ms Shreya Dahiya, Adv., Ms Vrinda Bagaria, Adv., Mr Subham Jaiswal, Adv., Mr. Vaibhav Joshi, AOR |

| Supreme Court | Read Order |