The supply of Residential Flat Construction services involves the Transfer of Undivided Shares of Land can draw an 8% Goods and Services Tax, ruled by the Chennai Authority for Advance Ruling. A copy of the challan on 22.04.2023 has been furnished by the petitioner for the application fee payment of Rs 5000 under Rules of CGST Rules 2017 and SGST 2017.

Prime Expant Infra, the petitioner is a partnership firm registered under the Indian Partnership Act, of 1932 and is in the business of providing construction services in respect of Commercial or Residential buildings and Civil structures.

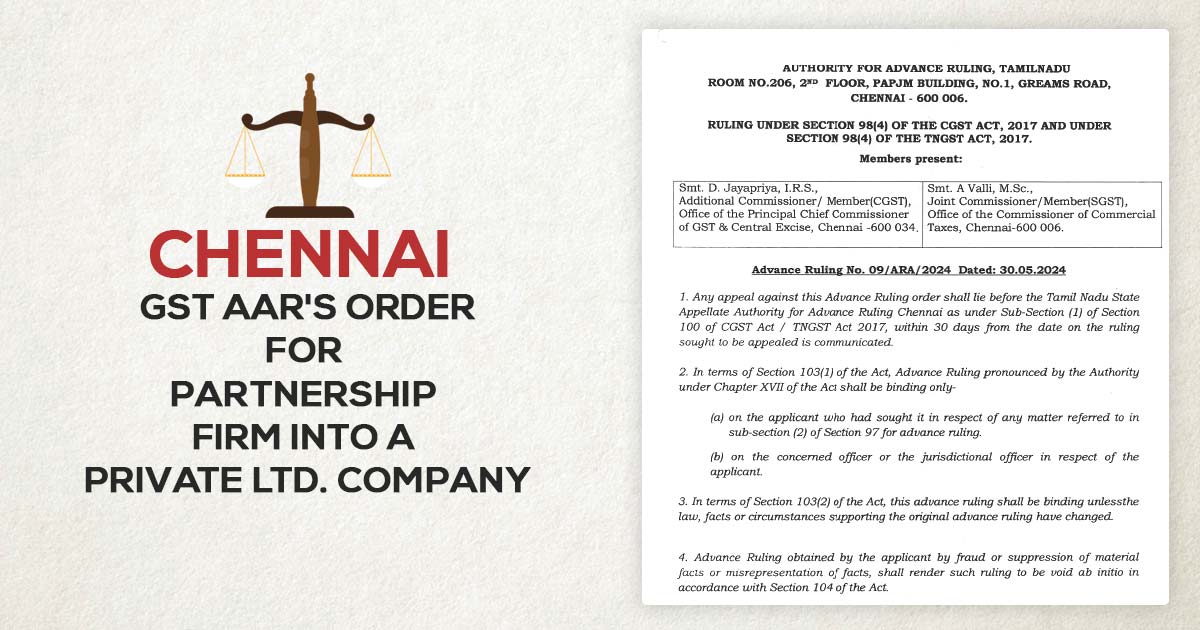

Thereafter the applicant converted the Partnership Firm into a Private Ltd Company w.e.f 22nd August 2022. As a continuation, an Advance Ruling Application has been made by the petitioner under the GSTIN 33AANCP1700C1Z0. (Private Company).

The petitioner initiated the construction of Tower ‘Block A7’ in February 2019. The articulated project comprises residential units measuring approximately 42. Sq.m unit. The said project also has commercial units, where the area of the unit is less than 15% of the total area of the project and the project is a RREP Project.

As per the notification in April 2019, the petitioner has furnished the opportunity to choose either the new rate or the old rate without claiming the ITC or with the claim of the ITC respectively.

It was regarded by the petitioner that his project is an RREP project and the applicable rate to them will be 8% for the matter of the output obligation as per the notification on 28.06.2017 but which was revised via the notification on 29.03.2019.

Concerning the condition that the services must be “construction service” counting beneath any of the schemes as mentioned in the notification, the petitioner furnished. It indeed provided that as per the notification the term affordable housing is mentioned under the social and commercial infrastructure.

Read Also:- TN AAR: School Transportation Fees Eligible for Exemption from GST

It was furnished by the petitioner that the commencement certificate of the project attached and marked as Annexure “A-4” which showed that the project was initiated before 31.03.2019 and the Chartered Engineers certificate to establish that the first requirement has been fulfilled i.e beginning of the project before 31.03.2019.

Subsequently, the petitioner furnished that the Chartered Engineers certificate on 15.04.2019 certified the percentage of work completed dated 31.03.2019 indicating the project was not finished. Consequently, the second requirement of non-issuance of the completion certificate on or before 31.03.2020 is also fulfilled.

It was furnished by the petitioner that the last condition is that the project to be ongoing must have been partly or wholly booked on or before 31st March 2019 and the same was indeed fulfilled in the matter of the project under consideration.

The petitioner was allowed to be heard dated 08.01.2024, Ms Kushboo Vora, CA, and Mr R Subramanian, CA appeared for the personal hearing as the Authorized Representatives for the applicant. They repeated the submissions and made additional submissions to the authority.

Also Read:- TN AAR: Services by Authorize Branch to Head Office & Vice Versa Are Liable Under GST

The members inquired as to whether the ARs comply with the prerequisites of the notification for which they said that the conditions do not have been satisfied and the pertinent documents have been furnished and agreed to provide any additional information when needed.

The AAR Bench, Smt.D. Jayapriya, IRS, Additional Commissioner (CGST) Smt. A Valli, Msc, Joint Commissioner (SGST) marked “the sub item “da “of item ” v” mentioned in item “ie” of SL No 3 of Notification No. 11/2017- Central Tax (Rate) dated 28.06.2017 as amended applies to the applicant and the rates as cited against the said item “ie” which is 12% (CGST 6% + SGST 6%) shall apply to the petitioner, in respect of the supply of construction services of residential flats qualifying the scheme mentioned in sub item “da” of item “v”.

In the matter of the supply of services that comprises of the transfer of land or undivided share of land the supply value will be lessened by one-third making the effective rate of 8% (CGST 4% + SGST 4)”.

| Applicant Name | Partnership Firm into a Private Ltd. Company |

| GSTIN of the applicant | 33AANCP1700C1Z0 |

| Date | 30.05.2024 |

| Applicant | Prime Expat Infra Private Limited |

| Chennai GST AAR | Read Order |